North Dakota Waiver Special Meeting of Shareholders

Description

How to fill out Waiver Special Meeting Of Shareholders?

Are you within a situation in which you require documents for both business or person functions virtually every day? There are tons of lawful document layouts available on the Internet, but locating versions you can trust is not effortless. US Legal Forms provides a huge number of kind layouts, such as the North Dakota Waiver Special Meeting of Shareholders, which can be created to satisfy state and federal demands.

Should you be previously knowledgeable about US Legal Forms site and also have a merchant account, merely log in. Afterward, it is possible to obtain the North Dakota Waiver Special Meeting of Shareholders web template.

Should you not offer an accounts and need to start using US Legal Forms, abide by these steps:

- Find the kind you need and ensure it is for the correct town/region.

- Take advantage of the Review switch to check the form.

- Look at the description to ensure that you have chosen the proper kind.

- In case the kind is not what you`re looking for, take advantage of the Search discipline to obtain the kind that suits you and demands.

- If you get the correct kind, click on Acquire now.

- Opt for the prices program you desire, complete the specified information to generate your money, and pay money for an order utilizing your PayPal or charge card.

- Decide on a practical paper structure and obtain your backup.

Discover all the document layouts you might have bought in the My Forms menus. You can get a further backup of North Dakota Waiver Special Meeting of Shareholders any time, if required. Just go through the necessary kind to obtain or produce the document web template.

Use US Legal Forms, one of the most comprehensive assortment of lawful forms, to save lots of some time and steer clear of blunders. The services provides skillfully produced lawful document layouts that you can use for a variety of functions. Make a merchant account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

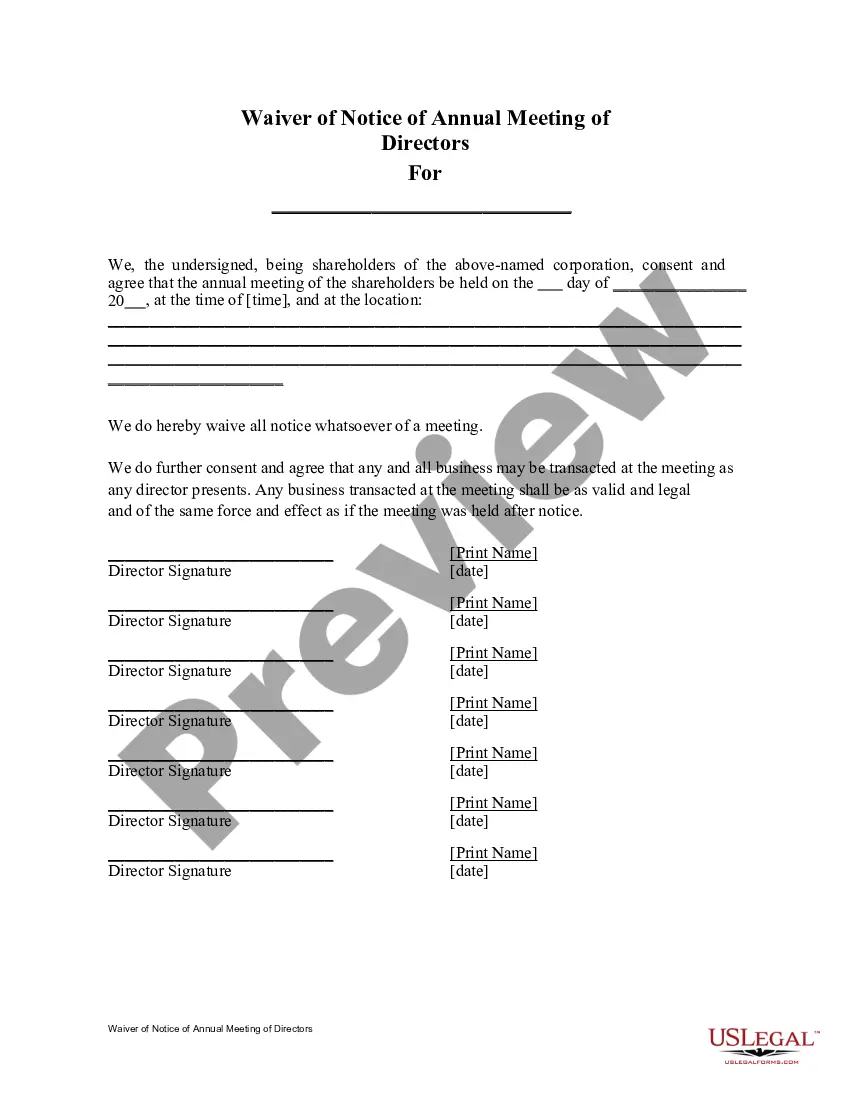

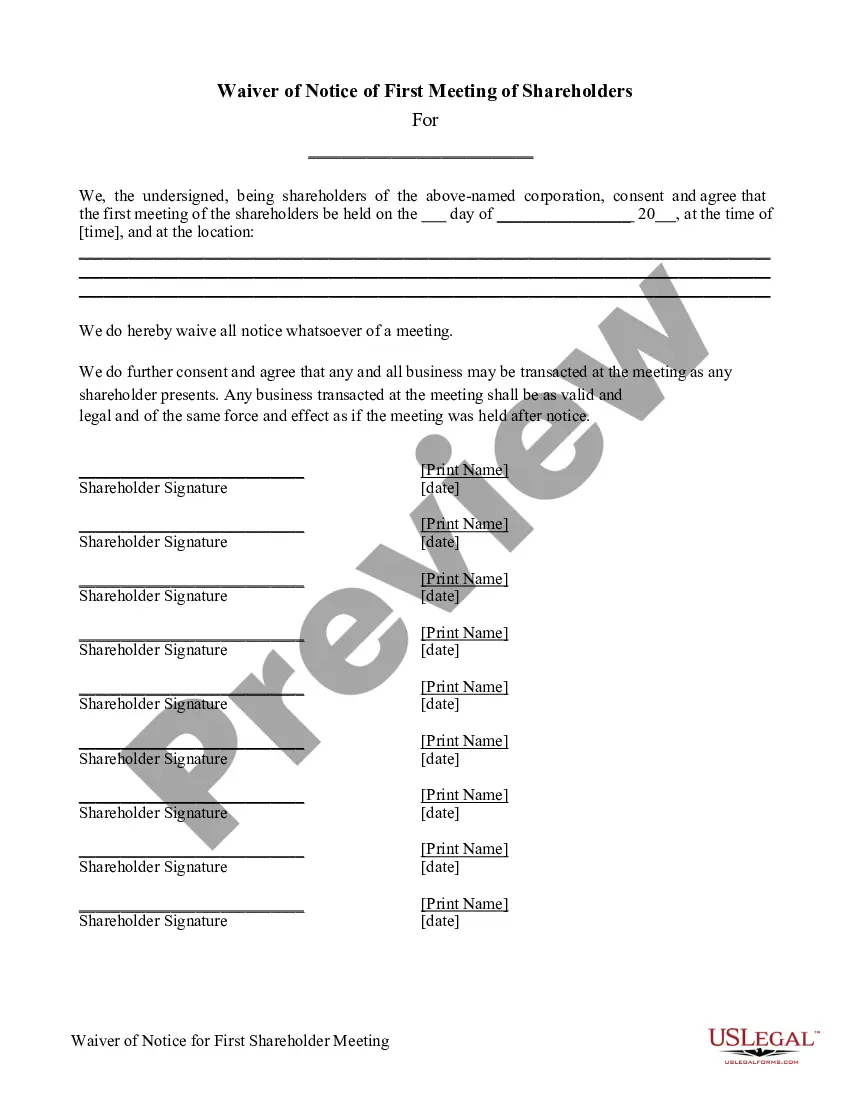

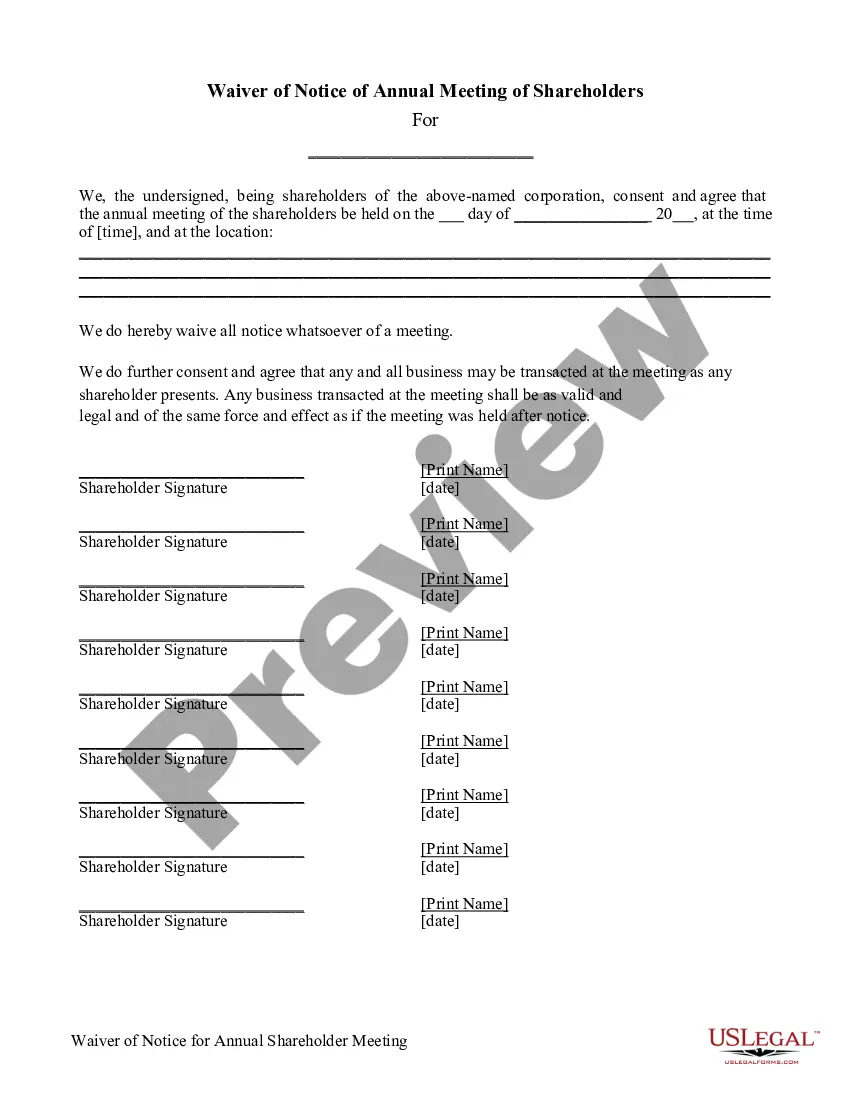

Corporations that don't consistently hold annual meetings may need to hold one without notice. The waiver of notice form is needed in order to document that all stockholders agree to the actions taken during the meeting, even though they may not have been present during it.

The notice of meeting should include a clear reference to shareholders' rights to appoint a proxy, or where the constitution so provides, to cast a direct vote. Voting forms should be drafted to ensure shareholders clearly understand how the chairperson of the meeting intends to vote undirected proxies.

A waiver of notice is a written acknowledgment from people eligible to attend a company meeting stating that they are giving up their right to receive formal notice of the meeting.

Even though the corporation is legally required to notify shareholders of the annual meeting, stockholders may opt out of receiving notification of the meeting by signing a waiver of notice form. Essentially, shareholders are telling the corporation that they no longer wish to be notified of future annual meetings.

A notice of meeting letter is a document that informs a group of people when and where their company is holding an assembly. These letters effectively communicate the meeting's information so that the recipients know when the meeting occurs.

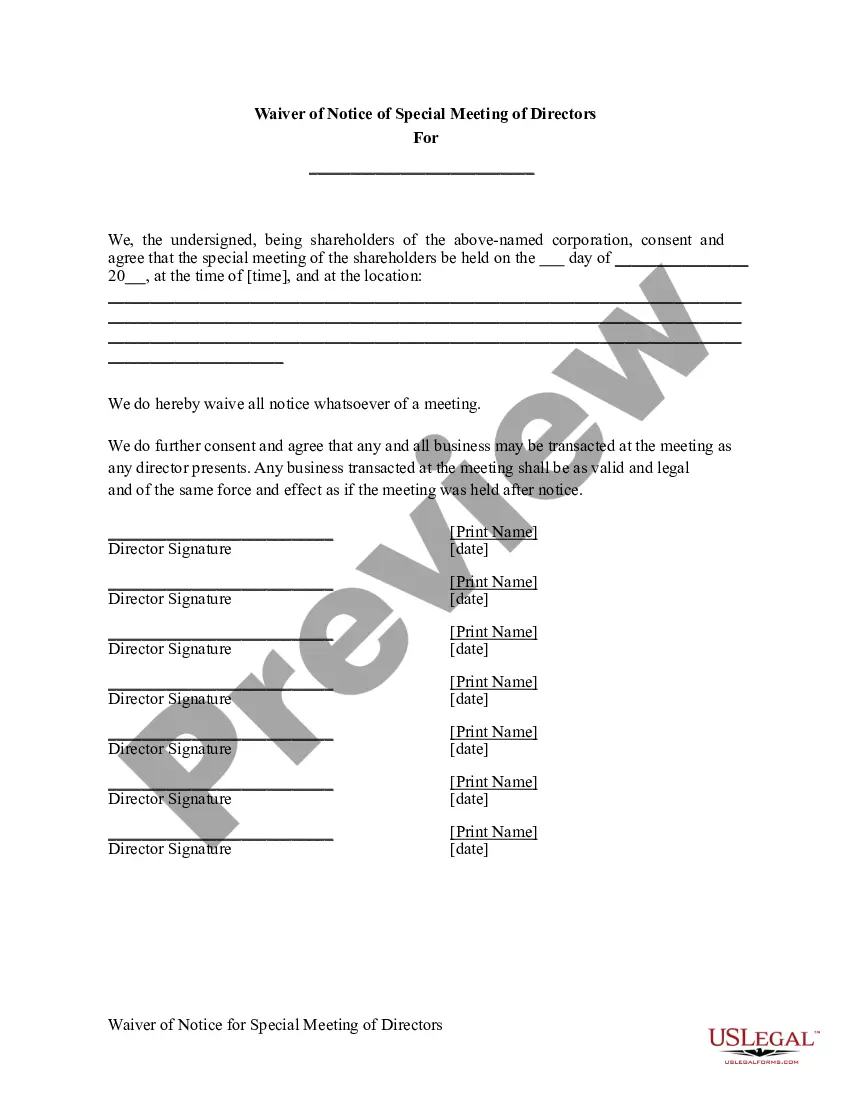

A special meeting allows shareholders to remove the current board of directors and elect a new board. The following is an explanation of the procedures for calling a special meeting of the shareholders. Enclosed are copies of documents, which you can use for your meeting.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation ...

A waiver of notice is a written acknowledgment from people eligible to attend a company meeting stating that they are giving up their right to receive formal notice of the meeting.