Title: Understanding North Dakota Writ of Execution: Types and Detailed Description Introduction: As part of the legal process, North Dakota Writ of Execution plays a crucial role in enforcing judgments and collecting debts. This detailed description aims to shed light on the nature and types of Writ of Execution in North Dakota. 1. North Dakota Writ of Execution: Overview A North Dakota Writ of Execution is a court order issued by the state in response to a judgment granted in favor of the plaintiff. It empowers the sheriff or an authorized officer to levy and seize property owned by the defendant to satisfy the judgment debt. 2. Types of North Dakota Writ of Execution: 2.1 General Writ of Execution: A General Writ of Execution allows the sheriff to seize and sell the defendant's non-exempt personal property, such as vehicles, equipment, jewelry, etc., to satisfy the judgment debt. The proceeds from the sale are used to fulfill the judgment, including any interest and related costs. 2.2 Real Property Writ of Execution: If the defendant fails to satisfy the judgment through personal property or other means, a Real Property Writ of Execution can be used. This type of writ empowers the sheriff to sell the defendant's real estate or land to satisfy the judgment debt. The proceeds are utilized to clear the outstanding amount, interest, and associated costs. 2.3 Earnings Writ of Execution: In cases where the defendant is employed, the court may issue an Earnings Writ of Execution. This writ allows a portion of the defendant's wages to be withheld by their employer and directed towards the judgment debt. The duration and percentage of wage garnishment are determined by North Dakota laws. 2.4 Bank Account Garnishment: To collect a judgment debt, the creditor may request a Bank Account Writ of Execution, which enables the sheriff to levy funds from the defendant's bank accounts up to the judgment amount. Certain exemptions apply, ensuring that only non-exempt funds from the defendant's accounts are used for satisfying the judgment. 3. Procedure for Obtaining a Writ of Execution: To initiate the issuance of a Writ of Execution in North Dakota, several steps need to be followed: 3.1 Judgment: A plaintiff must first obtain a judgment against the defendant in a North Dakota court. 3.2 Application for Writ: The judgment creditor should complete an application form, outlining their intent to request a specific type of Writ of Execution. 3.3 Filing and Fee: The completed application is then filed with the clerk of court, accompanied by the appropriate fee. 3.4 Issuance: Once approved, the court clerk issues the Writ of Execution, which is then forwarded to the sheriff or authorized officer for enforcement. Conclusion: North Dakota Writ of Execution serves as a critical instrument for enforcing judgments and facilitating debt recovery. Understanding the different types of writs, including General, Real Property, Earnings, and Bank Account Garnishment, allows creditors to navigate the legal process effectively. By following the required procedure, judgment creditors can ensure the enforcement of their rights and the collection of outstanding debts.

North Dakota Writ of Execution

Description

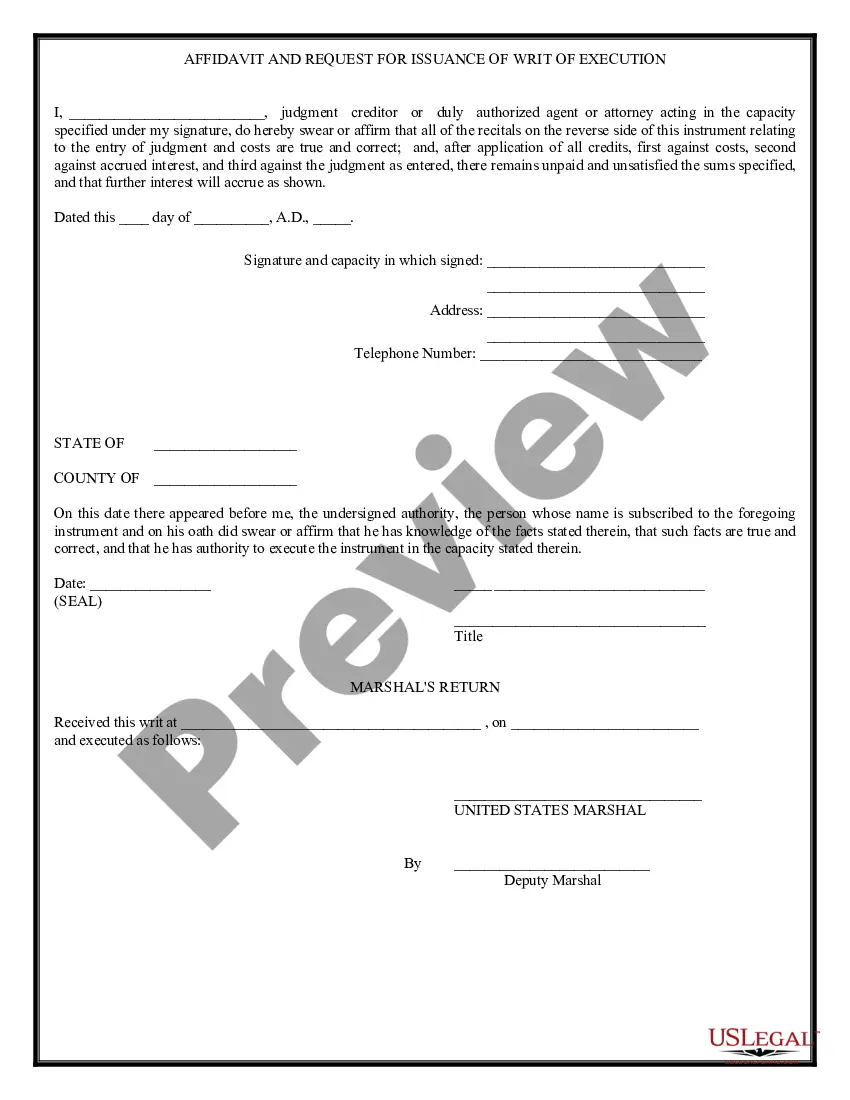

How to fill out North Dakota Writ Of Execution?

US Legal Forms - one of many greatest libraries of legitimate types in the USA - offers a variety of legitimate record templates it is possible to download or produce. Utilizing the web site, you can find 1000s of types for business and personal reasons, categorized by groups, claims, or search phrases.You can get the latest models of types much like the North Dakota Writ of Execution in seconds.

If you already have a membership, log in and download North Dakota Writ of Execution in the US Legal Forms catalogue. The Download switch will show up on each and every form you see. You gain access to all in the past delivered electronically types in the My Forms tab of the account.

If you want to use US Legal Forms for the first time, listed below are straightforward guidelines to help you started:

- Ensure you have picked the proper form to your metropolis/region. Click the Review switch to analyze the form`s information. See the form description to ensure that you have chosen the proper form.

- When the form doesn`t match your requirements, utilize the Research area near the top of the display screen to find the one who does.

- In case you are content with the form, affirm your choice by simply clicking the Acquire now switch. Then, choose the rates program you favor and offer your references to register for the account.

- Method the deal. Use your Visa or Mastercard or PayPal account to finish the deal.

- Select the format and download the form on the system.

- Make modifications. Fill out, revise and produce and indication the delivered electronically North Dakota Writ of Execution.

Every format you put into your bank account does not have an expiration date which is your own for a long time. So, if you wish to download or produce yet another duplicate, just check out the My Forms segment and click around the form you will need.

Obtain access to the North Dakota Writ of Execution with US Legal Forms, probably the most substantial catalogue of legitimate record templates. Use 1000s of skilled and condition-distinct templates that satisfy your small business or personal demands and requirements.