North Dakota Physical Therapist Agreement - Self-Employed Independent Contractor

Description

How to fill out North Dakota Physical Therapist Agreement - Self-Employed Independent Contractor?

US Legal Forms - among the largest libraries of authorized forms in the USA - provides a wide range of authorized record templates you can down load or printing. While using internet site, you can get 1000s of forms for business and person purposes, categorized by categories, suggests, or key phrases.You can get the newest models of forms such as the North Dakota Physical Therapist Agreement - Self-Employed Independent Contractor in seconds.

If you currently have a registration, log in and down load North Dakota Physical Therapist Agreement - Self-Employed Independent Contractor in the US Legal Forms library. The Down load switch will show up on every single develop you look at. You gain access to all previously delivered electronically forms in the My Forms tab of your own account.

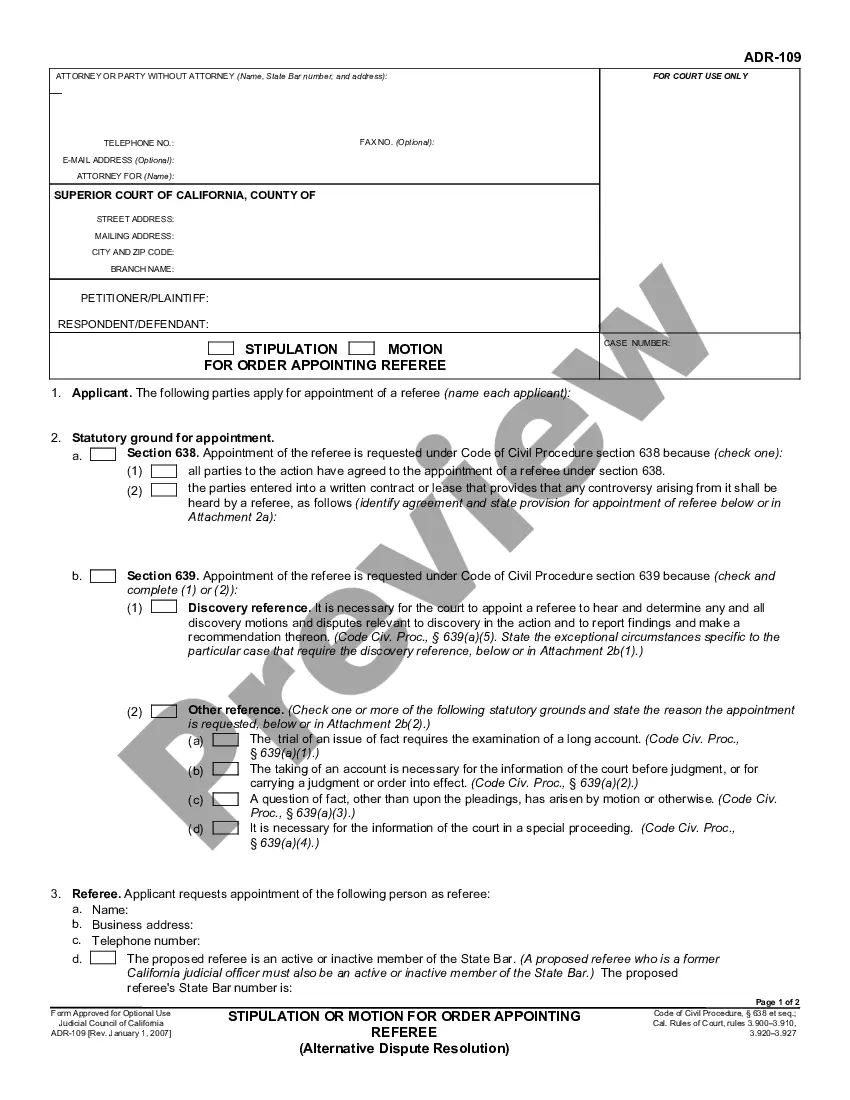

If you would like use US Legal Forms the very first time, allow me to share easy guidelines to obtain started off:

- Ensure you have picked the best develop to your area/area. Click on the Preview switch to examine the form`s information. Look at the develop description to actually have chosen the correct develop.

- In case the develop does not match your needs, use the Search field at the top of the display screen to find the one who does.

- Should you be happy with the shape, confirm your choice by clicking on the Buy now switch. Then, select the prices program you prefer and provide your qualifications to register to have an account.

- Approach the purchase. Utilize your credit card or PayPal account to accomplish the purchase.

- Pick the format and down load the shape on your gadget.

- Make modifications. Complete, modify and printing and indicator the delivered electronically North Dakota Physical Therapist Agreement - Self-Employed Independent Contractor.

Each and every template you put into your bank account does not have an expiration date which is the one you have eternally. So, if you want to down load or printing one more duplicate, just check out the My Forms portion and click on around the develop you require.

Gain access to the North Dakota Physical Therapist Agreement - Self-Employed Independent Contractor with US Legal Forms, by far the most extensive library of authorized record templates. Use 1000s of skilled and status-particular templates that meet your small business or person demands and needs.

Form popularity

FAQ

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Prop 22 was a ballot measure that passed on November 3, 2020. It declares that app-based transportation companies, such as rideshare (i.e. Uber and Lyft) and food delivery companies (i.e. Grubhub), are exempt from AB5 and its drivers are classified as independent contractors.

Like a number of other businesses, physical therapists can organize as a sole proprietor, a partnership or a professional corporation.

The Legislature has added several exceptions to AB 5, including physicians, dentists, podiatrists, veterinarians, and psychologists, but physical therapists are expressly absent from the list.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Because physical therapists and physical therapist assistants provide care directly to patients as contractors, under current law, they can no longer be independent contractors and must be employees unless they meet one of two criteria, recently passed into law under AB 2257.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A. Generally, courts have found that home healthcare employees such as registered nurses, physical therapists, occupational therapists, medical social workers and others with similar duties satisfy the duties requirements of one or more of the exemptions discussed below.