North Dakota Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out North Dakota Translator And Interpreter Agreement - Self-Employed Independent Contractor?

Have you been in the placement in which you need to have paperwork for either company or personal purposes virtually every day? There are a variety of legal record layouts available on the net, but finding versions you can rely on is not simple. US Legal Forms provides thousands of form layouts, much like the North Dakota Translator And Interpreter Agreement - Self-Employed Independent Contractor, that are composed in order to meet federal and state specifications.

Should you be presently informed about US Legal Forms internet site and have a free account, simply log in. Next, you can acquire the North Dakota Translator And Interpreter Agreement - Self-Employed Independent Contractor format.

Should you not offer an profile and need to start using US Legal Forms, follow these steps:

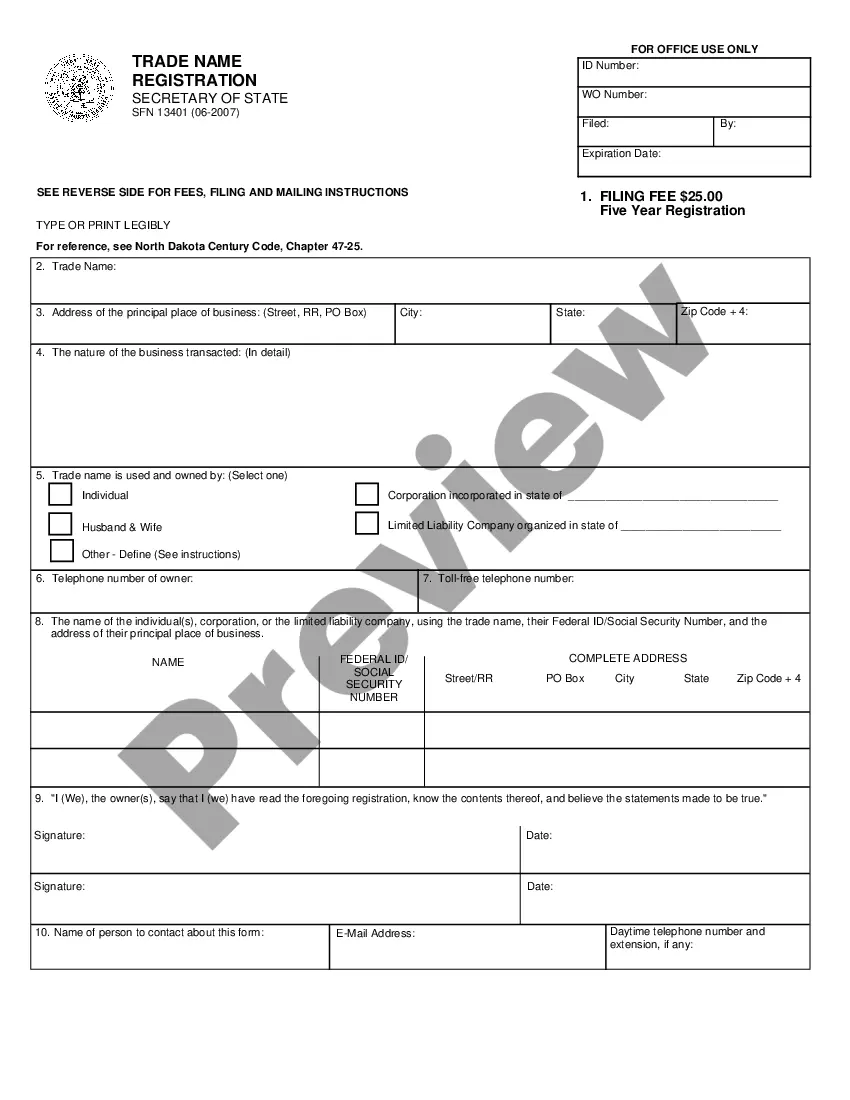

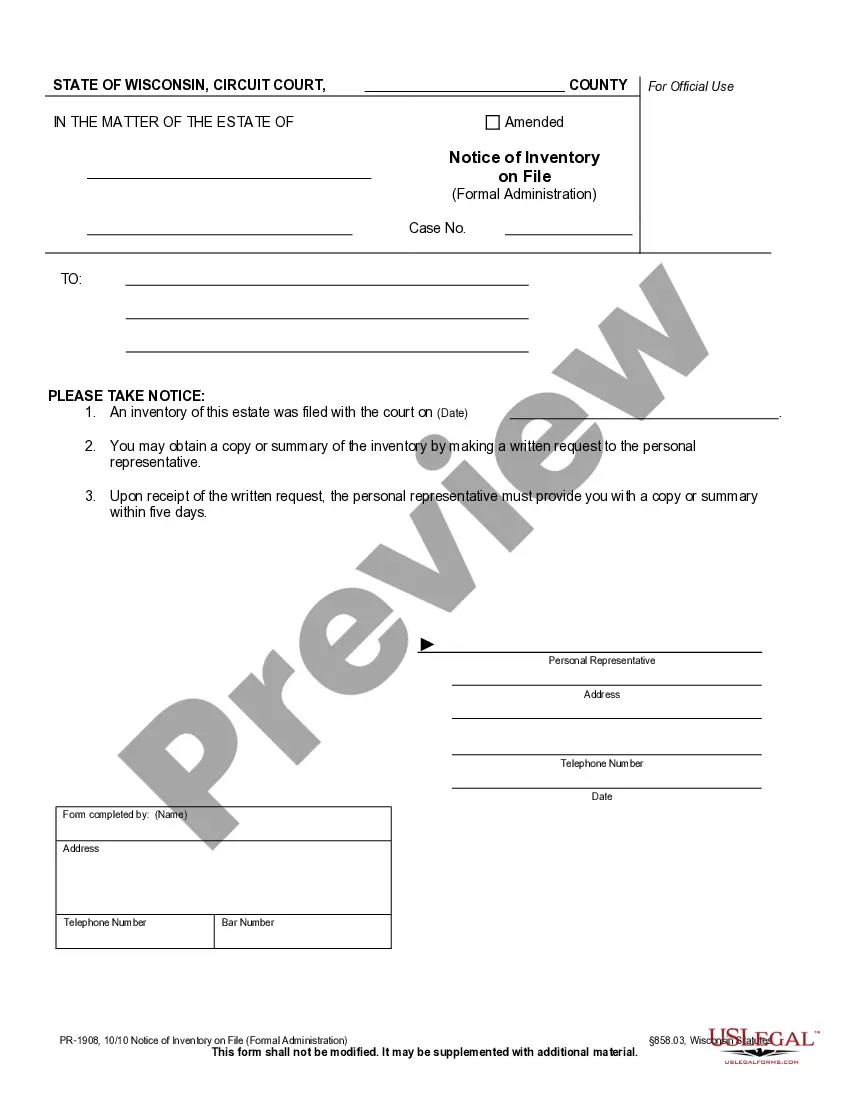

- Find the form you will need and make sure it is to the right town/county.

- Take advantage of the Review key to examine the shape.

- Read the explanation to actually have selected the appropriate form.

- In the event the form is not what you are trying to find, make use of the Lookup industry to get the form that meets your needs and specifications.

- When you find the right form, just click Buy now.

- Pick the pricing strategy you desire, complete the desired information to produce your account, and purchase the order using your PayPal or charge card.

- Decide on a hassle-free data file format and acquire your backup.

Get each of the record layouts you possess purchased in the My Forms food list. You can aquire a further backup of North Dakota Translator And Interpreter Agreement - Self-Employed Independent Contractor whenever, if needed. Just select the necessary form to acquire or print the record format.

Use US Legal Forms, one of the most extensive assortment of legal forms, to save efforts and prevent mistakes. The services provides skillfully made legal record layouts which can be used for an array of purposes. Produce a free account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

Freelance interpreters and translators run their own business. They choose their own hours and negotiate their own wages. All language professionals who contract with language service companies are required to fill out a 1099 tax form so that their wages are reported to the government (no exceptions!).

Freelance interpreters or translators work on a self-employed basis converting written texts from one language to another or providing verbal translations in live situations, such as conferences, performances, or meetings.

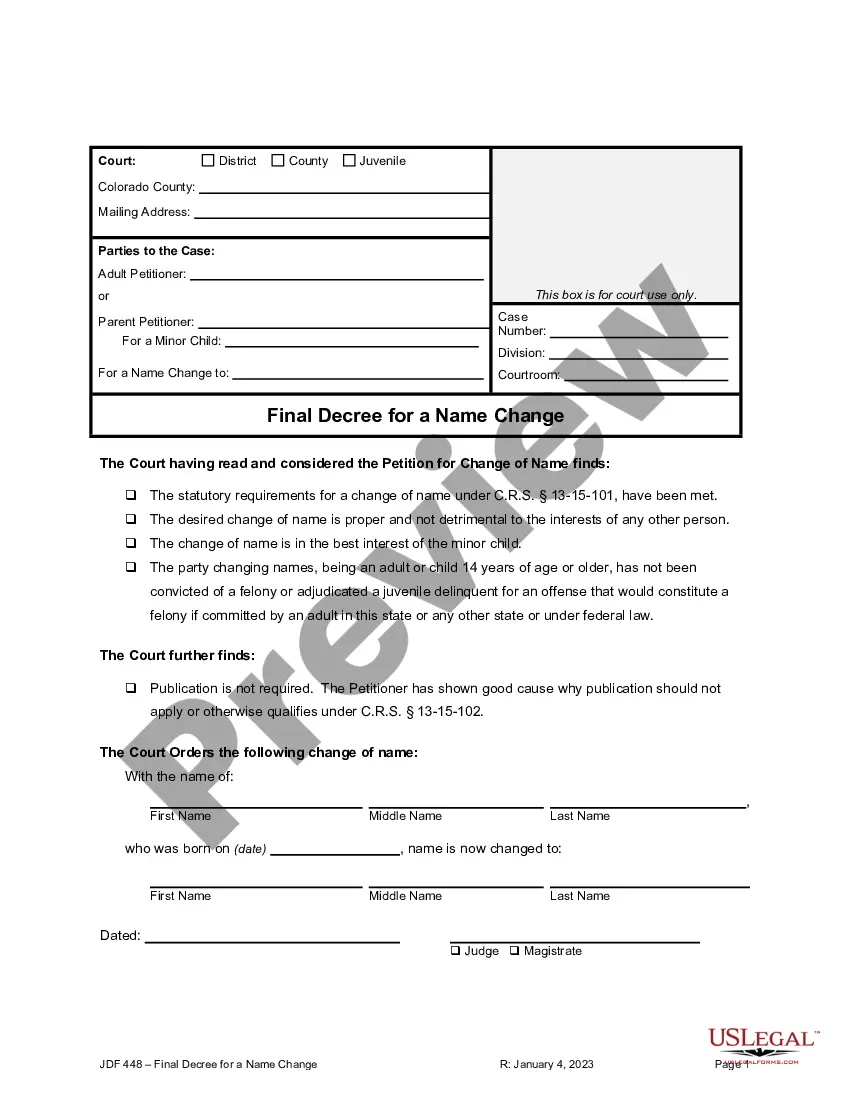

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

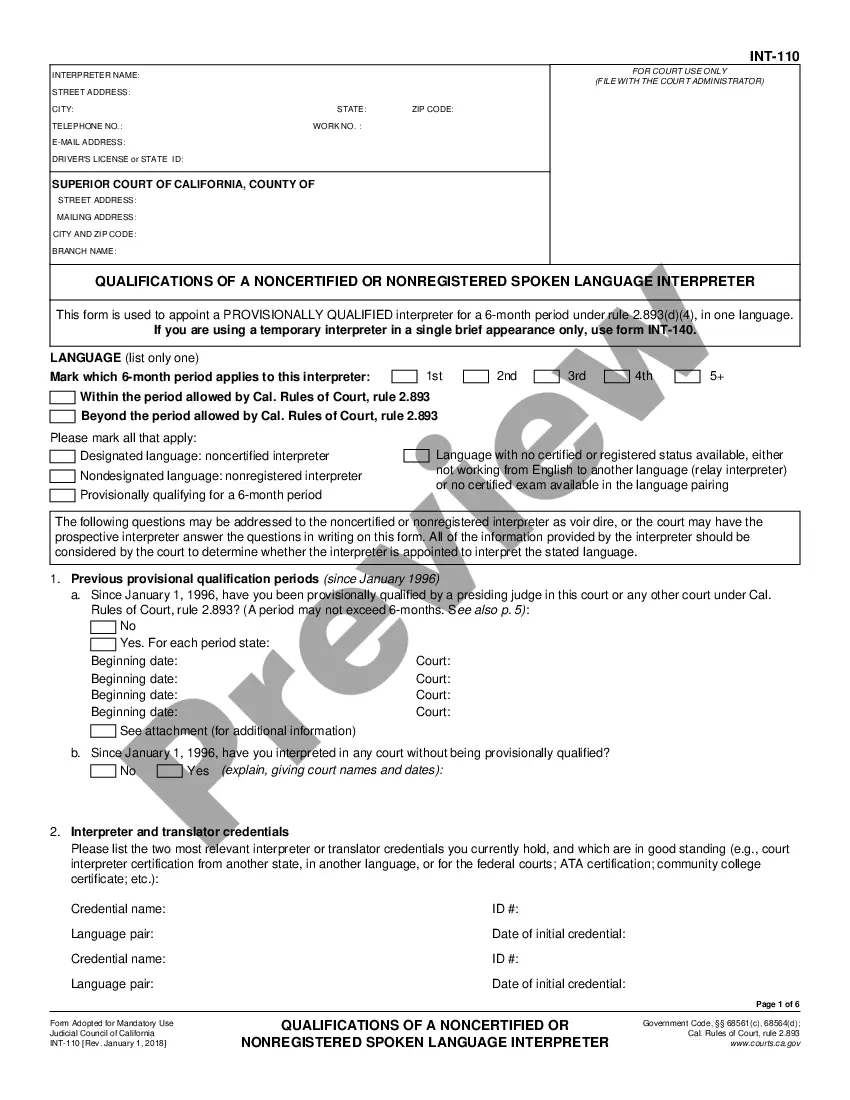

Interpreters and translators in California have been granted an exemption from AB 5. It's been almost 9 months since the controversial AB 5 bill went into effect, which reclassified independent interpreters and translators in California as employees, and no longer as independent contractors.

Freelance interpreters or translators work on a self-employed basis converting written texts from one language to another or providing verbal translations in live situations, such as conferences, performances, or meetings.

The role of a professional interpreter is to enable communication between two or more parties who speak different languages. To this end, professional interpreters can only interpret the words being spoken.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

Fact #1: A large percentage of all interpreters and translators are independent contractors. There are many reasons that language professionals choose to work as independent contractors. Many prefer the flexibility of making their own schedule and being able to choose their assignments.

Highly skilled and experienced interpreters who travel to interpret at conferences are often contractors, working directly for the conference or through an LSP. They typically have a contract to provide services at a specific conference (i.e., a short-term commitment with a clearly-stated end date).