North Dakota Self-Employed Wait Staff Services Contract

Description

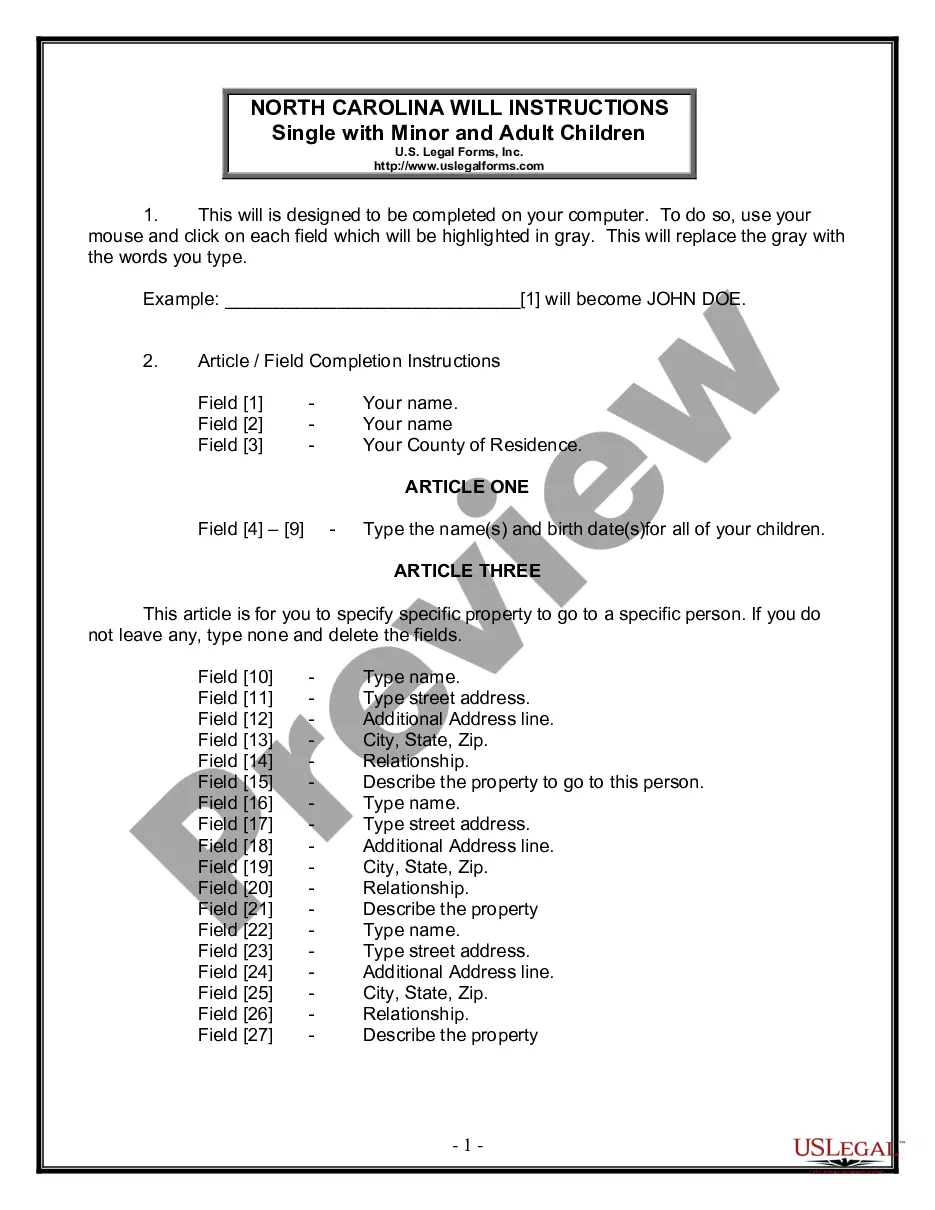

How to fill out North Dakota Self-Employed Wait Staff Services Contract?

Are you presently inside a placement in which you need papers for either company or individual purposes just about every day? There are tons of legal document themes available on the net, but locating ones you can rely isn`t simple. US Legal Forms provides 1000s of develop themes, such as the North Dakota Self-Employed Wait Staff Services Contract, which can be written to fulfill federal and state demands.

Should you be currently familiar with US Legal Forms site and also have a free account, simply log in. Following that, you are able to obtain the North Dakota Self-Employed Wait Staff Services Contract design.

Unless you come with an profile and wish to begin using US Legal Forms, abide by these steps:

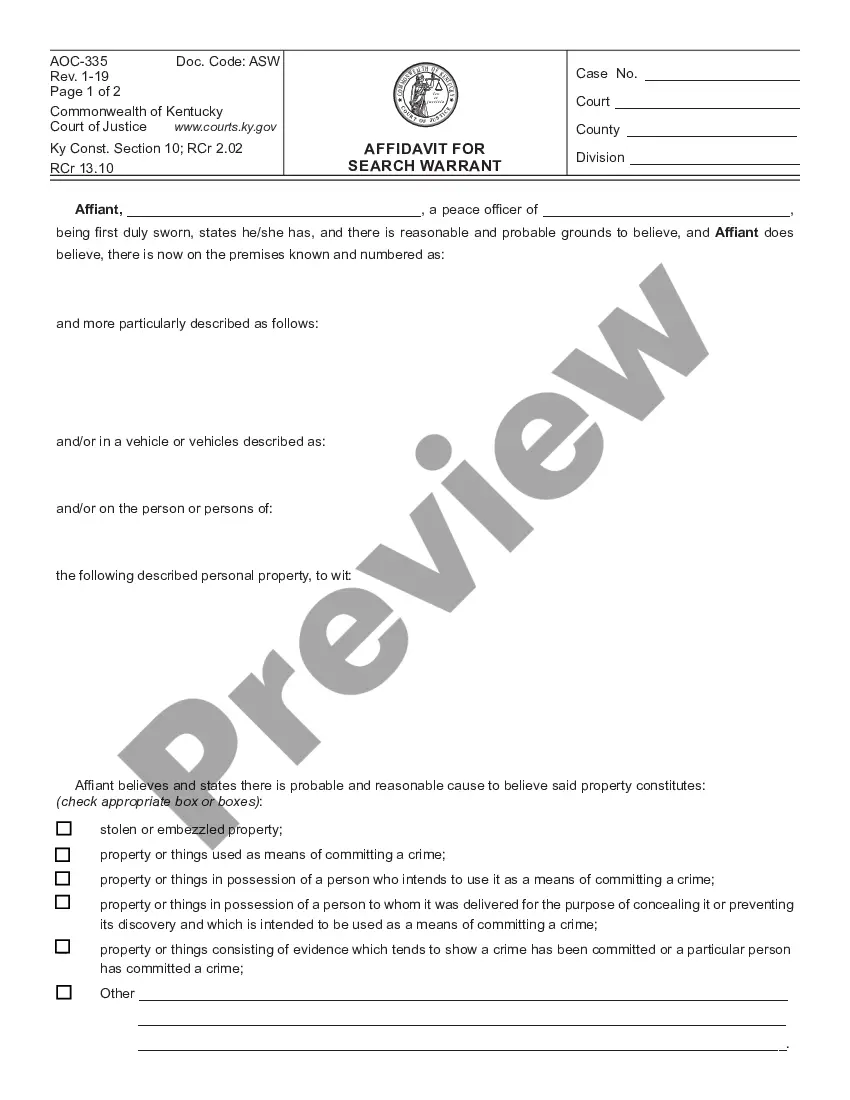

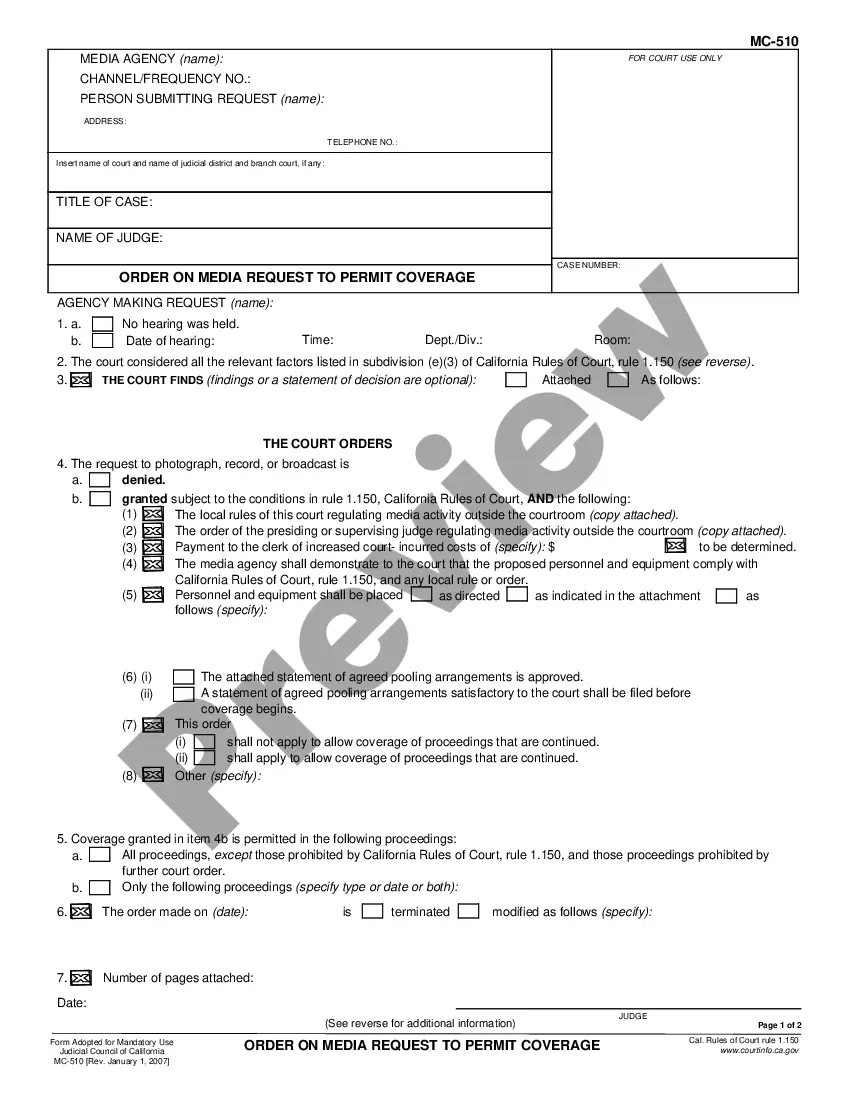

- Obtain the develop you require and ensure it is for that correct area/county.

- Make use of the Review key to review the shape.

- Look at the description to ensure that you have chosen the proper develop.

- In the event the develop isn`t what you`re seeking, use the Search industry to discover the develop that meets your needs and demands.

- Whenever you discover the correct develop, click on Get now.

- Pick the pricing prepare you want, fill out the desired information to make your money, and pay money for your order utilizing your PayPal or bank card.

- Choose a handy file structure and obtain your backup.

Get every one of the document themes you may have bought in the My Forms menu. You can obtain a more backup of North Dakota Self-Employed Wait Staff Services Contract whenever, if needed. Just click on the essential develop to obtain or print the document design.

Use US Legal Forms, by far the most considerable variety of legal varieties, to save time and avoid blunders. The services provides skillfully made legal document themes which can be used for a variety of purposes. Generate a free account on US Legal Forms and initiate producing your way of life a little easier.

Form popularity

FAQ

8. Services rendered personally. Must the worker provide the services personally, as opposed to delegating tasks to someone else? (This indicates that you are interested in the methods employed, and not just the results.)

Every person who works in insurable or pensionable employment in Canada is required to have a SIN . Employers are required by law to request your SIN within three (3) days after the day on which your employment begins.

An employer cannot pay you if you do not have a SIN. The law in Canada says that your employer has to ask you for your SIN within 3 days after you start a job.

A Contractor does not give you his SIN, he is a business. He should provide you with is business number/HST number and you should require his workers comp as well.

North Dakota is an employment-at-will state (ND Cent. Code Sec. 34-03-01). Therefore, an employer may generally terminate an employment relationship at any time and for any reason, unless an agreement or law provides otherwise.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

To ensure you're protected from start to finish, always follow these protocols before you hire.Get Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.More items...?

Being Self-Employed and Self-Employment Taxes Since you are not an employee, no Social Security/Medicare taxes are withheld from your wages. You may need to pay quarterly estimated taxes on self-employment tax and estimated income tax to avoid penalties.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

In North Dakota, as in other states, employees work at will. This means an employee can generally be fired at any time and for any reason, or for no reason at all.