North Dakota Self-Employed Ceiling Installation Contract

Description

How to fill out North Dakota Self-Employed Ceiling Installation Contract?

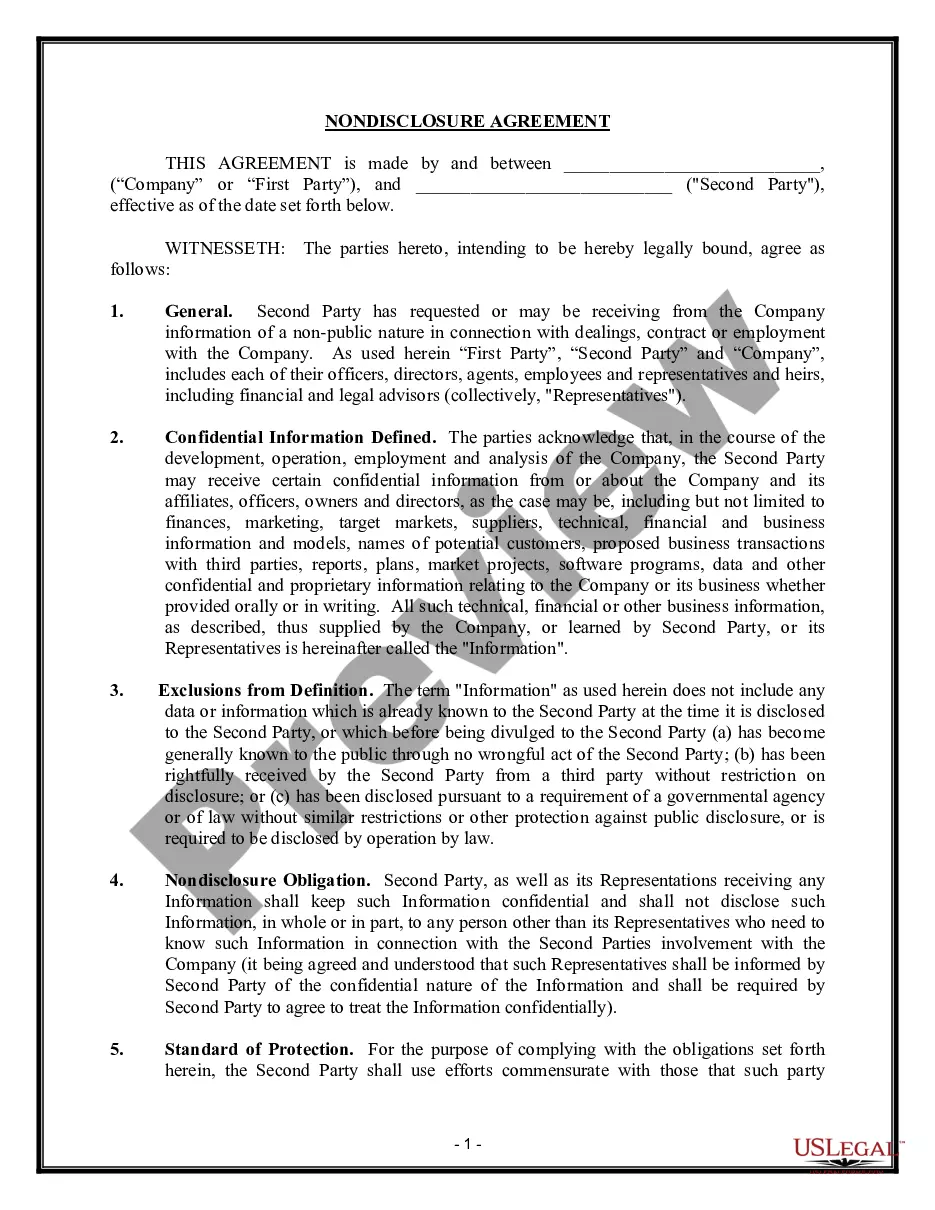

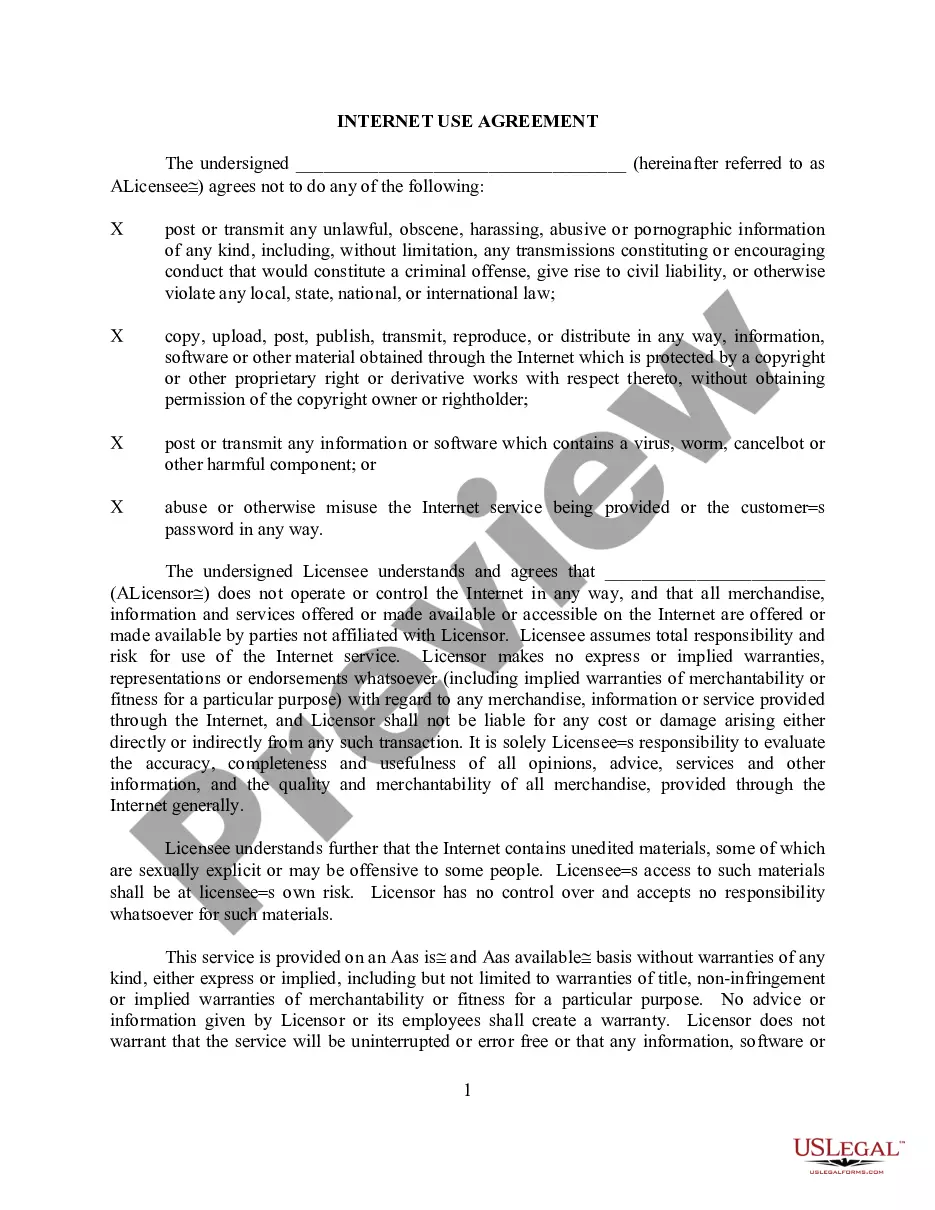

US Legal Forms - one of many most significant libraries of legal varieties in the USA - delivers an array of legal record layouts you are able to acquire or produce. Making use of the web site, you can get a large number of varieties for enterprise and individual purposes, categorized by categories, claims, or keywords and phrases.You can get the most up-to-date models of varieties much like the North Dakota Self-Employed Ceiling Installation Contract in seconds.

If you currently have a membership, log in and acquire North Dakota Self-Employed Ceiling Installation Contract from your US Legal Forms library. The Obtain key can look on each develop you perspective. You have accessibility to all formerly acquired varieties inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms for the first time, here are simple guidelines to obtain began:

- Ensure you have picked the right develop to your metropolis/region. Click the Review key to examine the form`s content material. Look at the develop explanation to actually have selected the proper develop.

- In case the develop does not fit your needs, make use of the Research field near the top of the display to find the one which does.

- When you are content with the form, affirm your choice by clicking the Get now key. Then, pick the rates strategy you prefer and supply your accreditations to sign up on an bank account.

- Method the financial transaction. Make use of credit card or PayPal bank account to finish the financial transaction.

- Find the format and acquire the form on your own device.

- Make alterations. Fill up, modify and produce and sign the acquired North Dakota Self-Employed Ceiling Installation Contract.

Every single design you added to your bank account lacks an expiration particular date and is yours for a long time. So, if you want to acquire or produce another version, just check out the My Forms area and then click about the develop you will need.

Obtain access to the North Dakota Self-Employed Ceiling Installation Contract with US Legal Forms, probably the most substantial library of legal record layouts. Use a large number of specialist and condition-particular layouts that fulfill your business or individual demands and needs.

Form popularity

FAQ

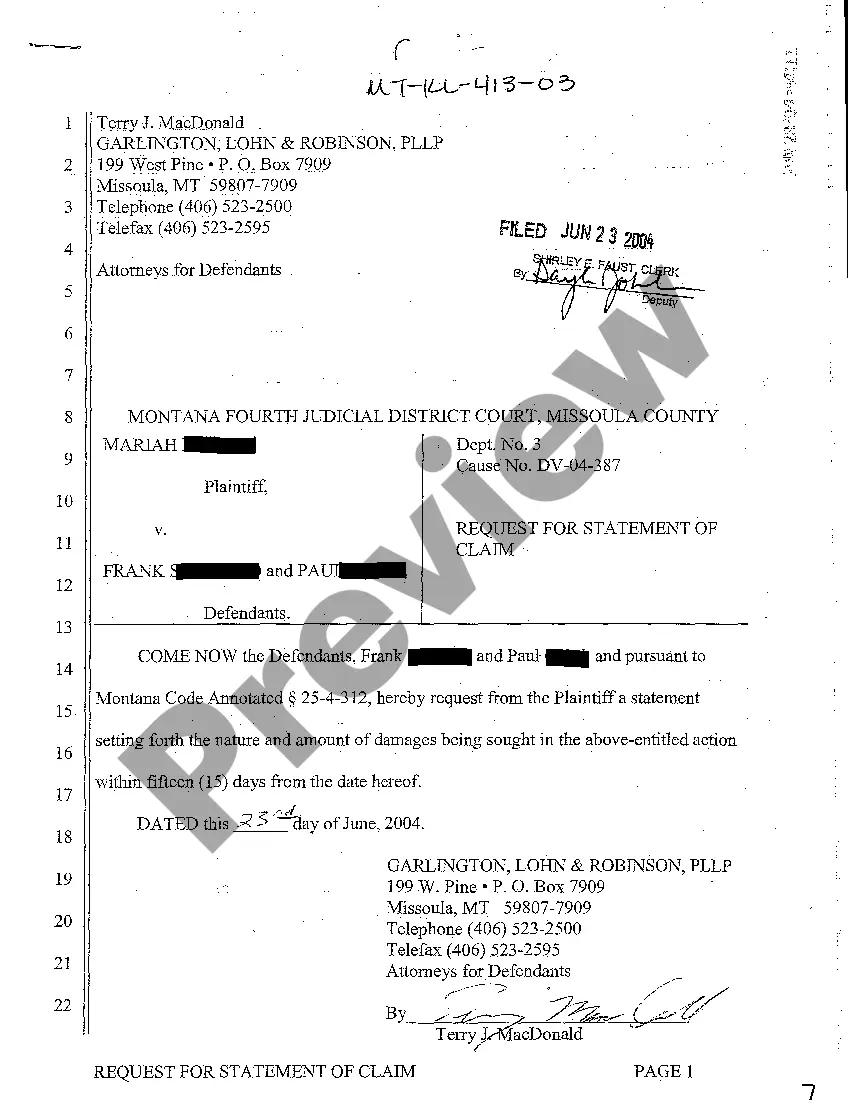

Anyone who plans on doing the contractor work as described by the Montana Department of Labor and Industry will need to register and apply for a Construction Contractors or an Independent Contractors license.

No person may engage in the business nor act in the capacity of a contractor within this state when the cost, value, or price per job exceeds the sum of $4,000 without first having a license.

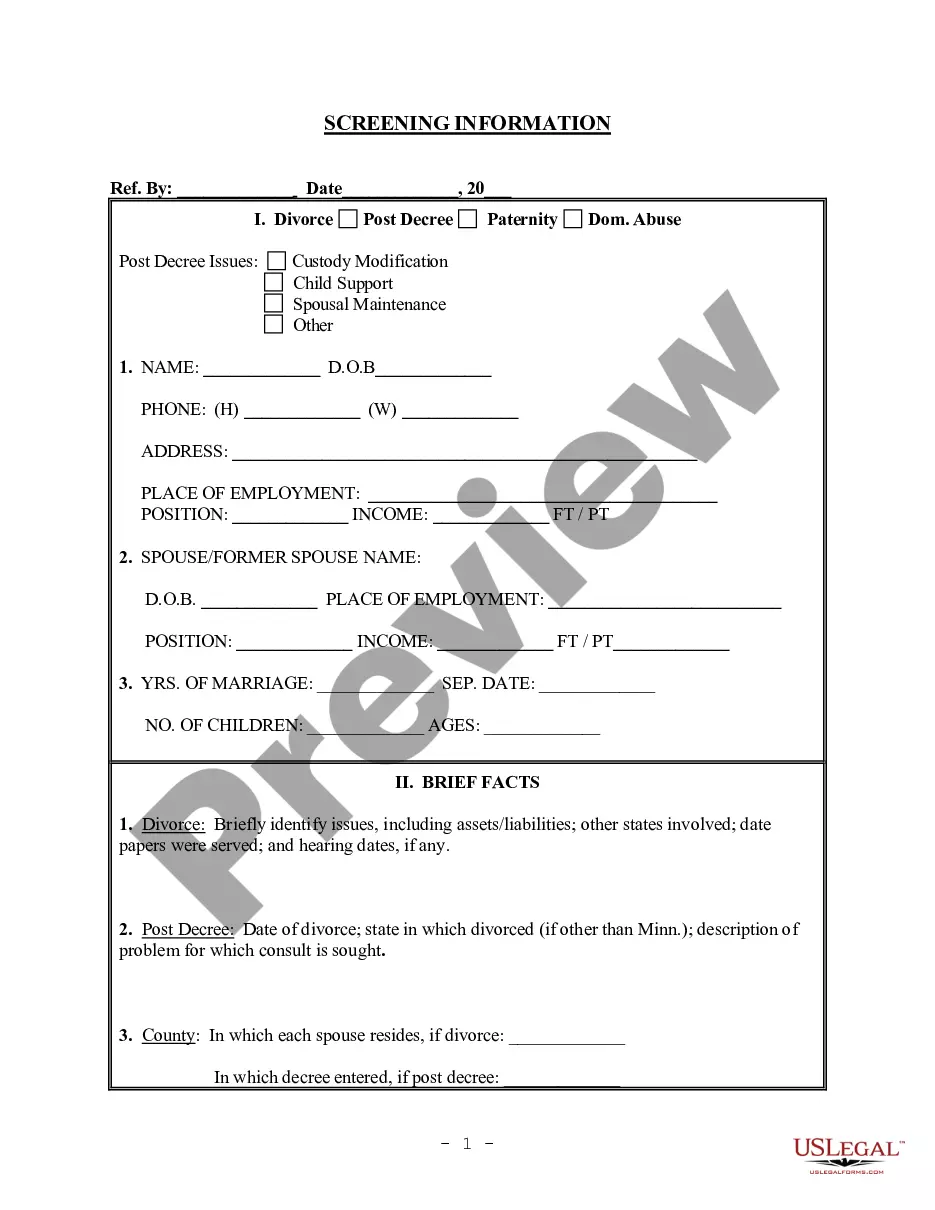

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

The good news here: If you're interested in becoming a general contractor, handyman, or any other type of builder, the state of Texas doesn't require you to get a contractor license. That's right: Unlike in other states, there's no need to take an exam or submit paperwork to be a contractor!

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

First up: Get your tax forms in orderStep 1: Ask your independent contractor to fill out Form W-9.Step 2: Fill out two 1099-NEC forms (Copy A and B)Ask your independent contractor for invoices.Add your freelancer to payroll.Keep records like a boss.Tools to check out:

In North Dakota, a contractor's license is required for anyone who intends to do construction work amounting to over $4,000 for materials and labor. If you attempt to cheat the system and work without one, you could get hit with massive fines and jeopardize your ability to work in the future.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring.

Generally speaking, subcontractors do require licenses in North Carolina. This includes plumbers, electricians, HVAC contractors, and roofers. Even interior construction contractors need to carry trade licenses to work in North Carolina.