North Dakota Correction Assignment of Overriding Royalty Interest Correcting Lease Description

Description

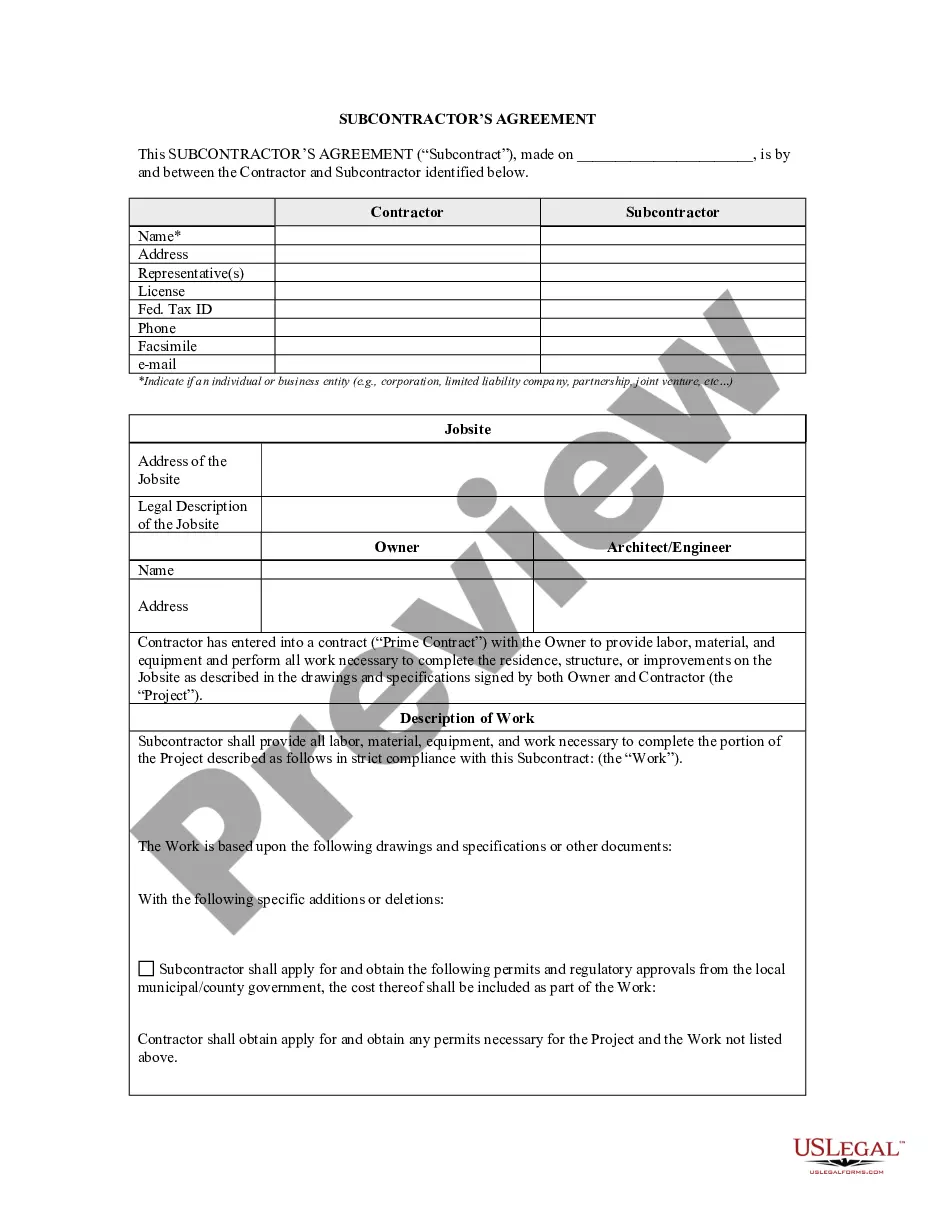

How to fill out Correction Assignment Of Overriding Royalty Interest Correcting Lease Description?

Are you presently within a situation where you need paperwork for sometimes company or personal functions just about every time? There are a variety of legal record templates available on the Internet, but getting ones you can rely on is not straightforward. US Legal Forms provides 1000s of form templates, much like the North Dakota Correction Assignment of Overriding Royalty Interest Correcting Lease Description, which are written to meet federal and state demands.

If you are already familiar with US Legal Forms internet site and possess a merchant account, merely log in. Following that, you may acquire the North Dakota Correction Assignment of Overriding Royalty Interest Correcting Lease Description template.

Unless you provide an accounts and would like to start using US Legal Forms, follow these steps:

- Obtain the form you need and ensure it is for the proper city/region.

- Take advantage of the Preview button to analyze the shape.

- Read the information to ensure that you have selected the right form.

- In case the form is not what you are trying to find, make use of the Search discipline to find the form that meets your requirements and demands.

- Once you get the proper form, just click Acquire now.

- Opt for the pricing strategy you want, complete the specified info to generate your bank account, and buy the order with your PayPal or credit card.

- Select a convenient file structure and acquire your copy.

Discover each of the record templates you might have bought in the My Forms menu. You can obtain a more copy of North Dakota Correction Assignment of Overriding Royalty Interest Correcting Lease Description any time, if required. Just go through the essential form to acquire or printing the record template.

Use US Legal Forms, one of the most considerable collection of legal types, in order to save efforts and prevent blunders. The assistance provides expertly manufactured legal record templates that you can use for a variety of functions. Create a merchant account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.