North Dakota Quitclaim Deed for Mineral / Royalty Interest

Description

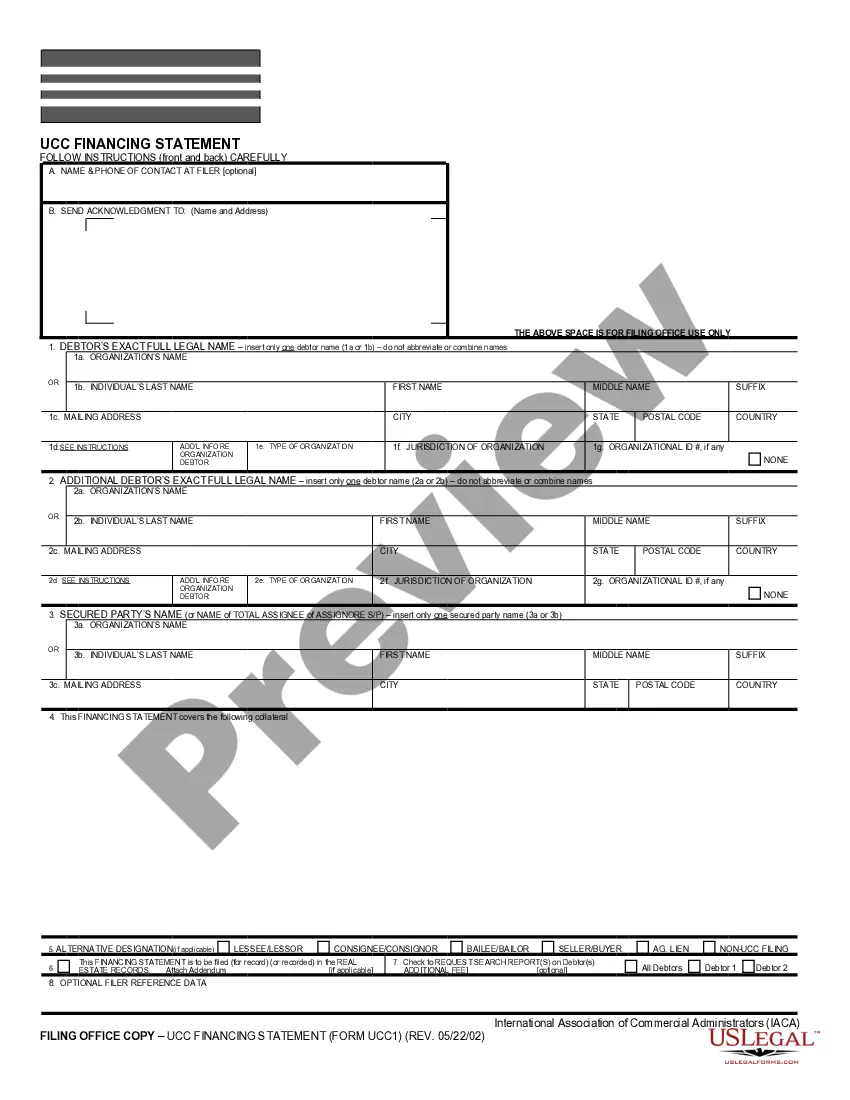

How to fill out Quitclaim Deed For Mineral / Royalty Interest?

US Legal Forms - one of many most significant libraries of legitimate forms in the States - delivers a variety of legitimate papers layouts it is possible to download or printing. Using the internet site, you can get 1000s of forms for business and specific uses, sorted by categories, suggests, or keywords.You will find the latest types of forms like the North Dakota Quitclaim Deed for Mineral / Royalty Interest in seconds.

If you currently have a membership, log in and download North Dakota Quitclaim Deed for Mineral / Royalty Interest through the US Legal Forms collection. The Down load option can look on each type you look at. You have accessibility to all earlier acquired forms inside the My Forms tab of your accounts.

If you want to use US Legal Forms initially, here are straightforward directions to help you started out:

- Ensure you have chosen the correct type to your town/region. Go through the Preview option to analyze the form`s content material. Read the type description to actually have chosen the right type.

- In case the type does not satisfy your demands, utilize the Search field at the top of the display screen to find the the one that does.

- Should you be content with the shape, validate your selection by clicking the Acquire now option. Then, choose the pricing strategy you prefer and supply your credentials to sign up on an accounts.

- Approach the deal. Make use of Visa or Mastercard or PayPal accounts to complete the deal.

- Select the file format and download the shape on your product.

- Make adjustments. Fill out, change and printing and indicator the acquired North Dakota Quitclaim Deed for Mineral / Royalty Interest.

Each design you included with your money does not have an expiry time and it is the one you have permanently. So, if you want to download or printing one more duplicate, just check out the My Forms area and click on about the type you need.

Obtain access to the North Dakota Quitclaim Deed for Mineral / Royalty Interest with US Legal Forms, probably the most extensive collection of legitimate papers layouts. Use 1000s of specialist and condition-certain layouts that fulfill your business or specific requires and demands.

Form popularity

FAQ

To estimate mineral rights value in North Dakota you need to multiple your total lease bonus by 2x to 3x. Generally speaking the mineral rights value in North Dakota for leased mineral rights will be between 2x to 3x the lease bonus.

Minerals include gold, silver, coal, oil, and gas. If you want to transfer the rights to these minerals to another party, you can do so in a variety of ways: by deed, will, or lease. Before you transfer mineral rights, you should confirm that you own the rights that you seek to transfer.

Mineral interests last indefinitely as long as they are not abandoned. Minerals are considered abandoned when they have not been used or claimed for twenty or more years. Minerals are ?used? when some type of activity such as production, leasing, or conveying occurs under North Dakota law.

How do I transfer mineral rights in North Dakota? To convey or transfer ownership of mineral rights to a new owner, the current owner of the rights has to engage a title insurance company or an attorney at a district court to perform a search of the property title.

Laws & Requirements Signing Requirements § 47-19-03: A grantor must sign a quitclaim deed in North Dakota before a notary public and have it notarized. Recording Requirements § 47-19-07: A quitclaim deed in North Dakota is filed with the County Recorder's Office in the county where the property is located.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

The mineral rights value in North Dakota is typically be between a few hundred per acre and a couple thousands per acre for non-producing/non-leased mineral rights. A lot will depend on which county you are in. If you have mineral rights in McKenzie County North Dakota you are going to see more demand than other areas.