North Dakota Affidavit of Heirship for Motor Vehicle

Description

How to fill out Affidavit Of Heirship For Motor Vehicle?

US Legal Forms - among the largest libraries of legitimate types in the States - delivers an array of legitimate document templates you may download or print. Utilizing the site, you may get 1000s of types for enterprise and personal reasons, categorized by classes, says, or keywords and phrases.You will find the most recent models of types like the North Dakota Affidavit of Heirship for Motor Vehicle in seconds.

If you already possess a membership, log in and download North Dakota Affidavit of Heirship for Motor Vehicle from your US Legal Forms collection. The Download switch can look on each form you perspective. You have accessibility to all formerly saved types from the My Forms tab of the account.

If you wish to use US Legal Forms initially, listed here are straightforward directions to obtain began:

- Make sure you have picked the best form for your town/area. Select the Preview switch to examine the form`s information. Read the form description to ensure that you have selected the correct form.

- When the form doesn`t satisfy your requirements, utilize the Search field at the top of the monitor to find the one which does.

- Should you be content with the form, verify your choice by clicking the Buy now switch. Then, pick the rates program you like and supply your references to register for the account.

- Procedure the financial transaction. Utilize your charge card or PayPal account to perform the financial transaction.

- Select the structure and download the form on the product.

- Make alterations. Fill out, change and print and sign the saved North Dakota Affidavit of Heirship for Motor Vehicle.

Every web template you added to your bank account lacks an expiry time and is also your own eternally. So, if you wish to download or print an additional backup, just proceed to the My Forms section and then click about the form you will need.

Gain access to the North Dakota Affidavit of Heirship for Motor Vehicle with US Legal Forms, one of the most substantial collection of legitimate document templates. Use 1000s of professional and condition-distinct templates that meet up with your small business or personal requires and requirements.

Form popularity

FAQ

Under Oklahoma law, successors (usually children) can file an affidavit of heirship if the deceased individual's estate qualified as a ?small estate.? The affidavit of heirship must contain specific information if its to be used to avoid the probate process.

How to Fill Out Affidavit of Heirship | PDFRUN - YouTube YouTube Start of suggested clip End of suggested clip Read the clause above the signature. Lines. Once you have understood this clause. And have confirmedMoreRead the clause above the signature. Lines. Once you have understood this clause. And have confirmed the information contained in this affidavit. You may sign it a fix your signature.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

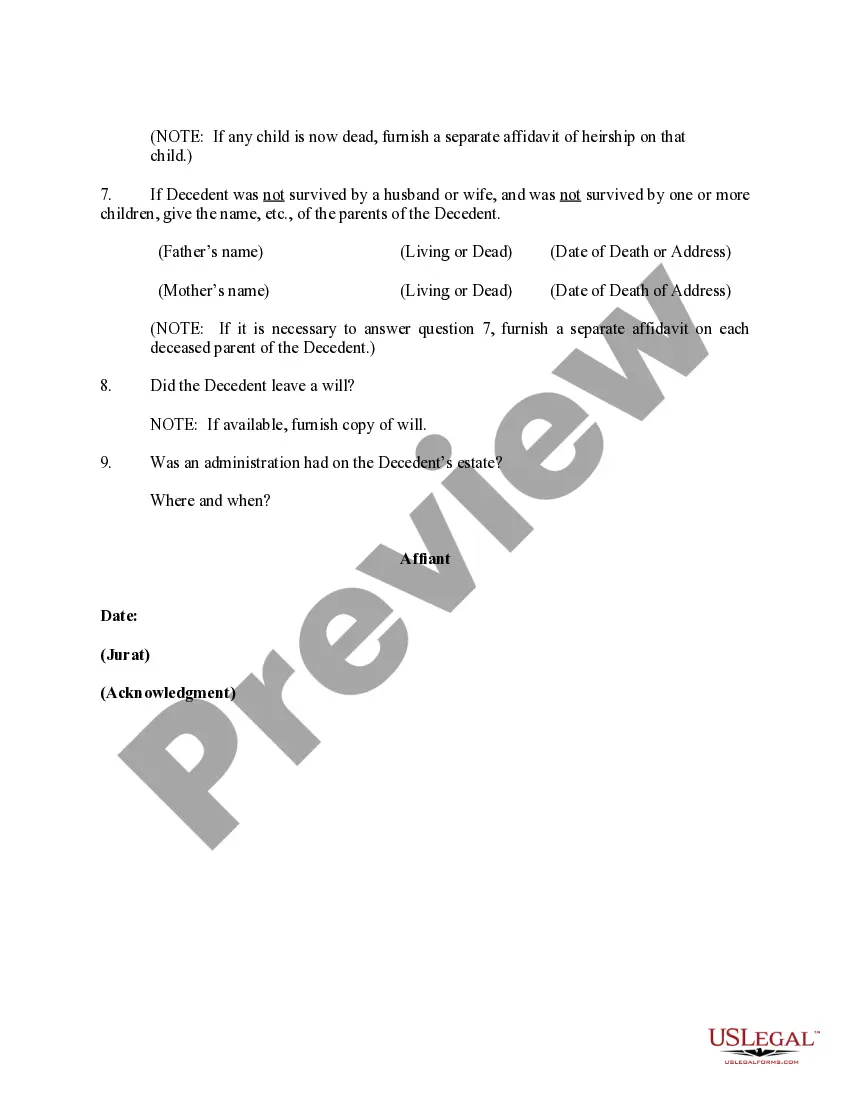

A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death. It should list all real estate owned by the deceased owner.

The total value of the probated property (minus any debts or other encumbrances on the property) is less than $50,000.00; No real property (real estate) is part of the probated estate; No probate case is started or completed in a North Dakota state district court, a court of any other state, or a tribal court; and.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

An Affidavit of Heirship or Affidavit Concerning Identity of Heirs is authorized by the Texas Estates Code. Essentially, the affidavit is a legal document that must be signed by a person with personal knowledge of the decedent's family and marital history.