North Dakota Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

How to fill out Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

Have you been inside a position in which you need to have documents for possibly company or individual functions nearly every day time? There are a lot of legal document themes available on the net, but getting types you can depend on is not easy. US Legal Forms gives a large number of form themes, much like the North Dakota Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, that happen to be composed to meet state and federal demands.

When you are currently acquainted with US Legal Forms web site and have your account, basically log in. Afterward, it is possible to download the North Dakota Declaration of Election by Lessor to Convert Royalty Interest to Working Interest template.

Unless you provide an accounts and would like to begin using US Legal Forms, adopt these measures:

- Discover the form you will need and ensure it is for that appropriate city/state.

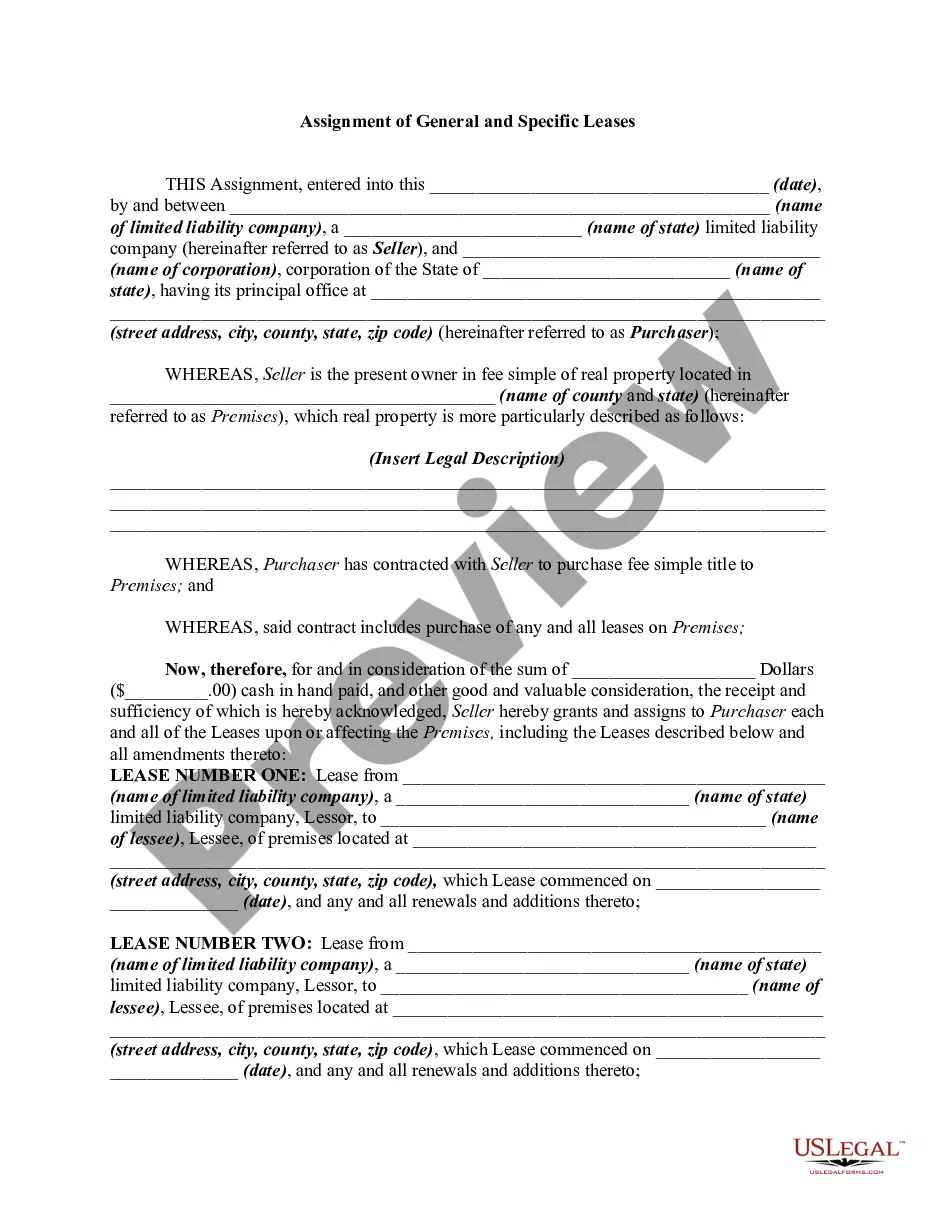

- Make use of the Review switch to check the form.

- Look at the outline to ensure that you have selected the correct form.

- In the event the form is not what you are searching for, take advantage of the Search discipline to find the form that suits you and demands.

- Once you find the appropriate form, simply click Buy now.

- Opt for the prices strategy you desire, complete the specified details to produce your money, and buy an order utilizing your PayPal or credit card.

- Pick a convenient data file file format and download your version.

Get all of the document themes you may have purchased in the My Forms menu. You may get a further version of North Dakota Declaration of Election by Lessor to Convert Royalty Interest to Working Interest at any time, if needed. Just click on the required form to download or print the document template.

Use US Legal Forms, probably the most considerable selection of legal types, to conserve efforts and steer clear of mistakes. The assistance gives expertly produced legal document themes which you can use for a range of functions. Generate your account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action. North Dakota Mineral Rights - O'Keeffe O'Brien Lyson Attorneys okeeffeattorneys.com ? north-dakota-minera... okeeffeattorneys.com ? north-dakota-minera...

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs. Royalty Interest: What it Means, How it Works - Investopedia investopedia.com ? terms ? royalty-interest investopedia.com ? terms ? royalty-interest

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well. Overriding Royalty Interest (ORRI) (US) - Westlaw westlaw.com ? Glossary ? PracticalLaw westlaw.com ? Glossary ? PracticalLaw

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.