This form is used when the owners adopt, ratify, and confirm the Lease in all of its terms and provisions, and lease, demise, and let to the Lessee named in the Lease, all of the owner's interest in the Lands as fully and completely as if each of the undersigned had originally been named as a lessor in the Lease and had executed, acknowledged, and delivered the Lease to the Lessee.

North Dakota Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights

Description

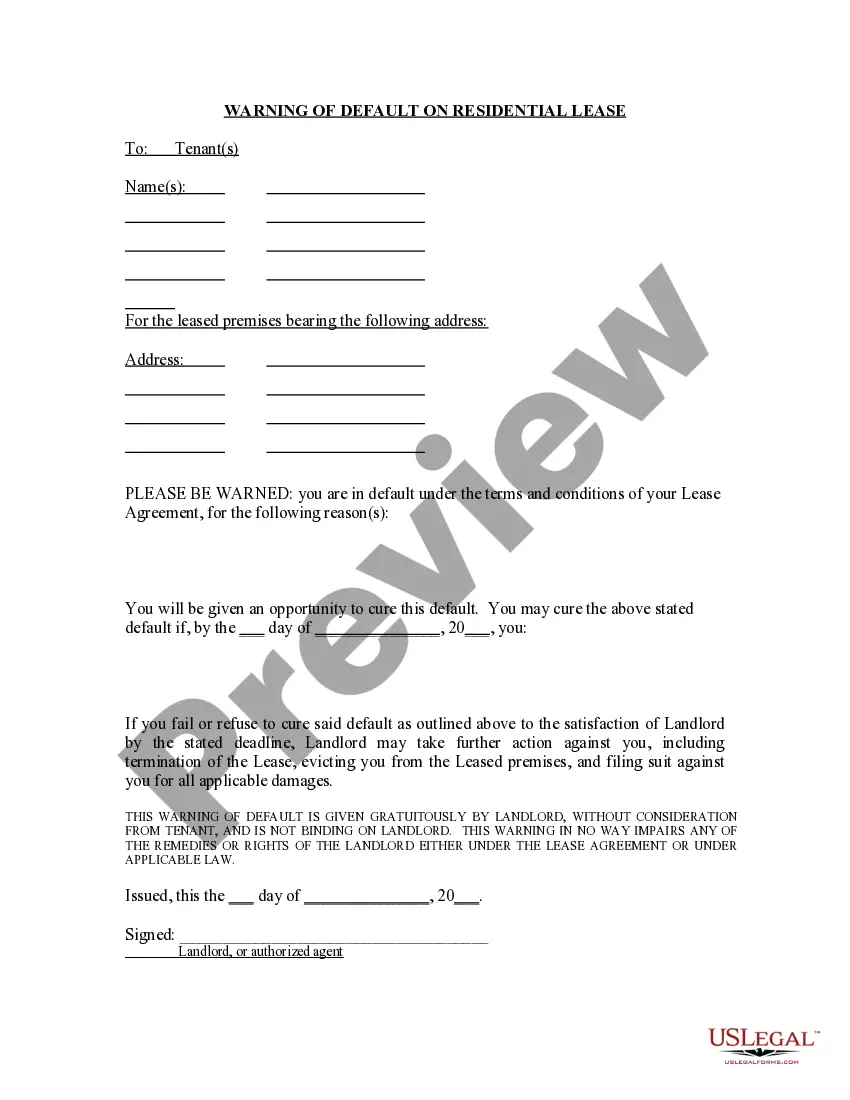

How to fill out Ratification And Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights?

Finding the right legitimate document template could be a have a problem. Obviously, there are a variety of themes available on the net, but how can you get the legitimate type you need? Make use of the US Legal Forms site. The service offers a large number of themes, for example the North Dakota Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights, that can be used for organization and private requires. All of the types are checked by specialists and meet federal and state requirements.

When you are already signed up, log in to the bank account and click the Down load option to obtain the North Dakota Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights. Utilize your bank account to search from the legitimate types you may have ordered formerly. Visit the My Forms tab of the bank account and obtain another version from the document you need.

When you are a brand new consumer of US Legal Forms, listed here are straightforward recommendations for you to comply with:

- First, ensure you have chosen the correct type for your town/region. You are able to look over the form while using Review option and look at the form explanation to ensure this is basically the right one for you.

- When the type is not going to meet your preferences, use the Seach field to discover the proper type.

- Once you are sure that the form is acceptable, select the Get now option to obtain the type.

- Choose the costs prepare you want and enter in the essential information and facts. Design your bank account and pay money for the transaction making use of your PayPal bank account or credit card.

- Select the document file format and down load the legitimate document template to the system.

- Complete, edit and printing and indication the acquired North Dakota Ratification and Bonus Receipt For Party Not Signing Lease, Or Who Does Not Own Executive Rights.

US Legal Forms is definitely the most significant collection of legitimate types in which you will find a variety of document themes. Make use of the service to down load professionally-manufactured paperwork that comply with express requirements.