North Dakota Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

US Legal Forms - among the most significant libraries of legitimate kinds in the USA - gives a wide range of legitimate file layouts you may obtain or print. Using the web site, you will get a large number of kinds for enterprise and individual uses, categorized by types, says, or keywords.You will find the latest versions of kinds such as the North Dakota Clauses Relating to Initial Capital contributions in seconds.

If you currently have a membership, log in and obtain North Dakota Clauses Relating to Initial Capital contributions in the US Legal Forms library. The Down load button will show up on each and every form you look at. You have access to all earlier saved kinds within the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, here are basic guidelines to help you get started out:

- Ensure you have selected the proper form to your area/area. Select the Preview button to analyze the form`s content material. See the form explanation to ensure that you have selected the right form.

- When the form doesn`t fit your demands, use the Research area near the top of the screen to obtain the one that does.

- In case you are pleased with the shape, affirm your selection by simply clicking the Buy now button. Then, choose the costs program you like and provide your qualifications to sign up for the account.

- Process the purchase. Utilize your charge card or PayPal account to finish the purchase.

- Pick the formatting and obtain the shape on the device.

- Make changes. Complete, modify and print and signal the saved North Dakota Clauses Relating to Initial Capital contributions.

Each format you added to your account does not have an expiry time and is also your own property eternally. So, if you wish to obtain or print one more duplicate, just check out the My Forms area and click about the form you want.

Gain access to the North Dakota Clauses Relating to Initial Capital contributions with US Legal Forms, probably the most comprehensive library of legitimate file layouts. Use a large number of specialist and state-certain layouts that meet your small business or individual requires and demands.

Form popularity

FAQ

A ?marriage tax penalty? occurs when tax-bracket thresholds, deductions and credits are not double the amount allowed for single filers. Both higher- and lower-income households can face such a penalty. It can happen at both the federal and state level, depending on where you live.

For married persons filing jointly, both of whom are full-year residents, the credit is $700. In the case of married persons filing jointly, where one spouse is a full-year resident of North Dakota and the other spouse is a nonresident of North Dakota for part or all of the year, a $350 credit is allowed.

North Dakota Family Member Care Tax Credit This Tax Credit is a percentage of the taxpayer's earned income. The amount of credit is determined by eligible expenses incurred for caring for a family member. The caregiver can offset up to $4,000 in expenses with the credit, which is a percentage of income.

EARNED INCOME TAX CREDIT (EITC) Latest Legislative Action: In 2021, Gov. Doug Burgum signed H.B.1515, creating a temporary, nonrefundable EITC of $350 for individuals and $700 for couples filing jointly.

A marriage penalty is when a household's overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples.

While the marriage penalty has been reduced or even eliminated for many couples, if you have higher income or take advantage of certain credits or deductions, the penalty will still be present.

When two individuals get married and decide to file jointly, their standard deductions combine, and their Married Filing Jointly standard deduction becomes $25,900 for 2022's taxes. So, the standard deduction for a married couple is not ?higher?; it is the combination of the two single individuals' standard deductions.

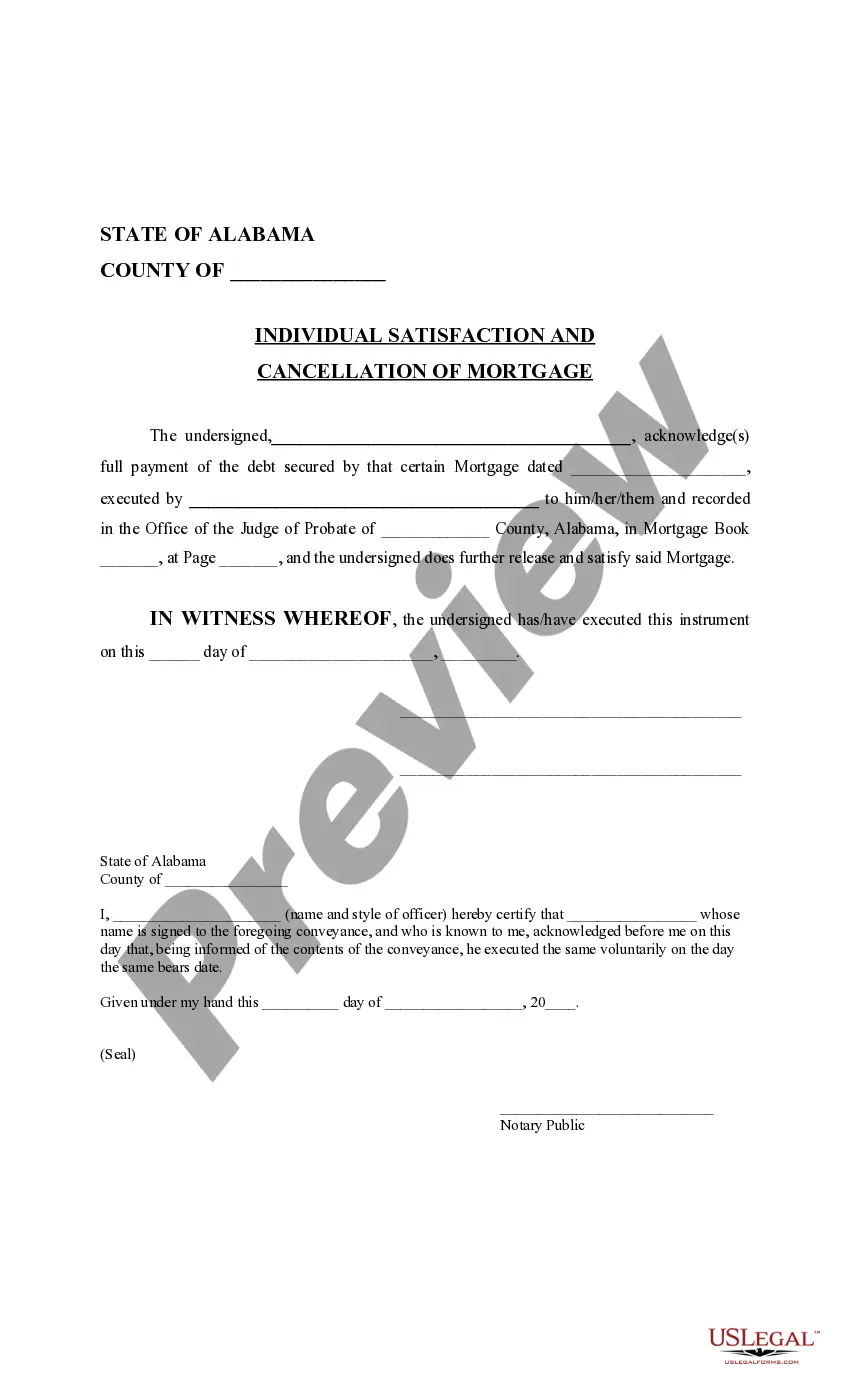

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions?these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on.