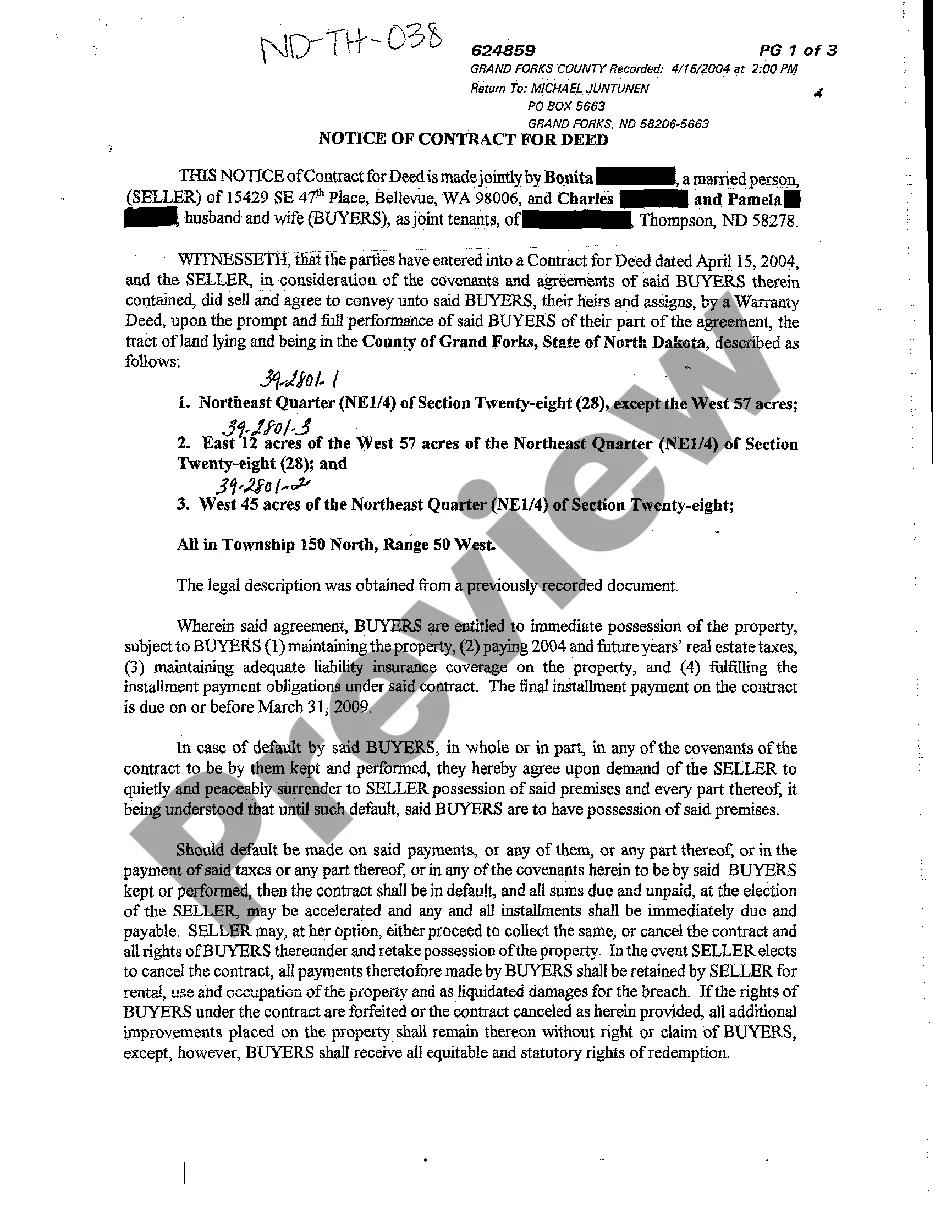

North Dakota Notice of Contract for Deed

Description

How to fill out North Dakota Notice Of Contract For Deed?

Avoid expensive attorneys and find the North Dakota Notice of Contract for Deed you need at a affordable price on the US Legal Forms site. Use our simple categories function to look for and download legal and tax forms. Go through their descriptions and preview them well before downloading. Additionally, US Legal Forms enables customers with step-by-step instructions on how to obtain and fill out every form.

US Legal Forms clients merely need to log in and download the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the guidelines below:

- Ensure the North Dakota Notice of Contract for Deed is eligible for use where you live.

- If available, read the description and use the Preview option prior to downloading the templates.

- If you’re sure the document fits your needs, click Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you may fill out the North Dakota Notice of Contract for Deed by hand or with the help of an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

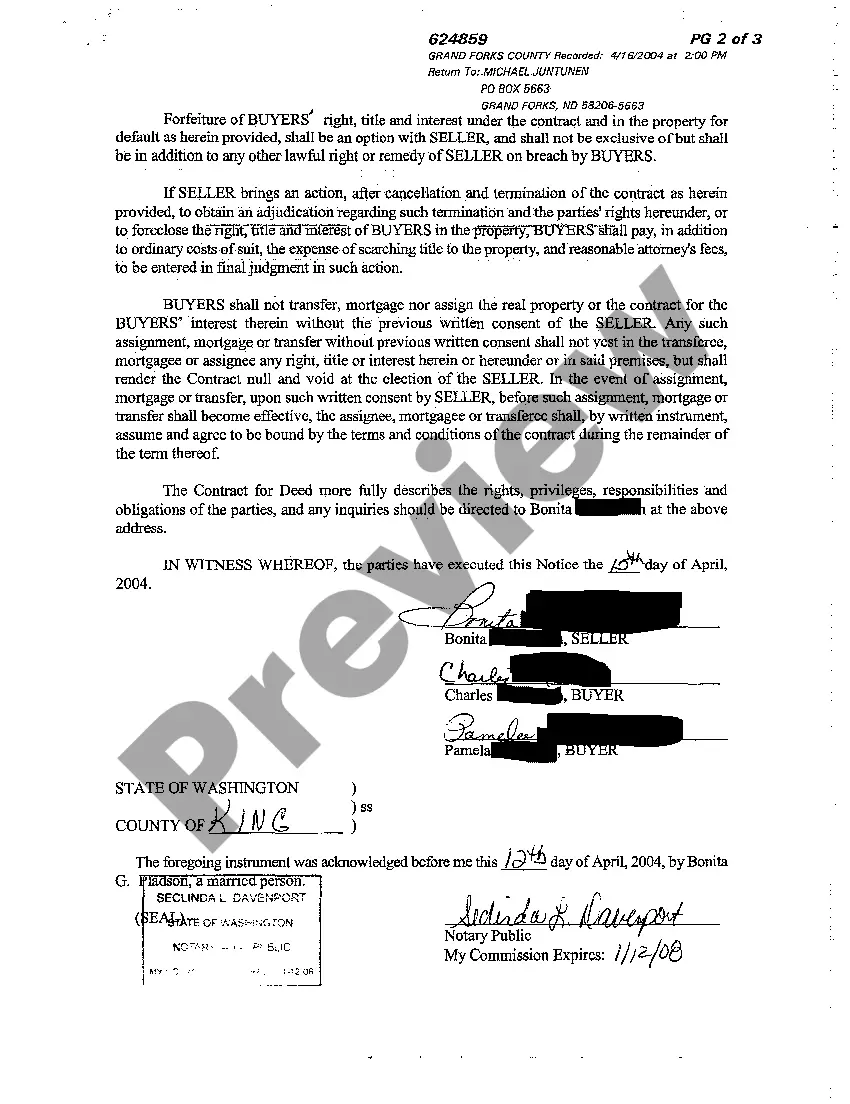

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.

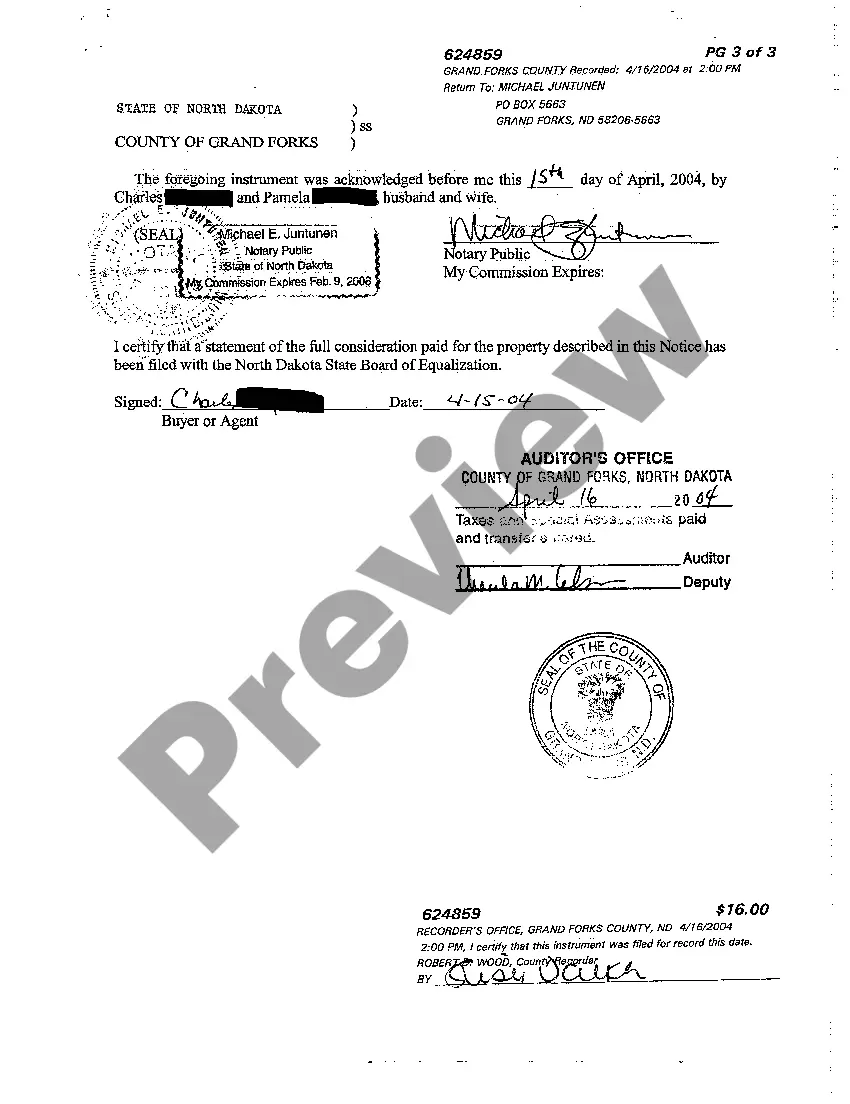

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.A seller can cancel a contract for deed for buyer's default in making the monthly payments.