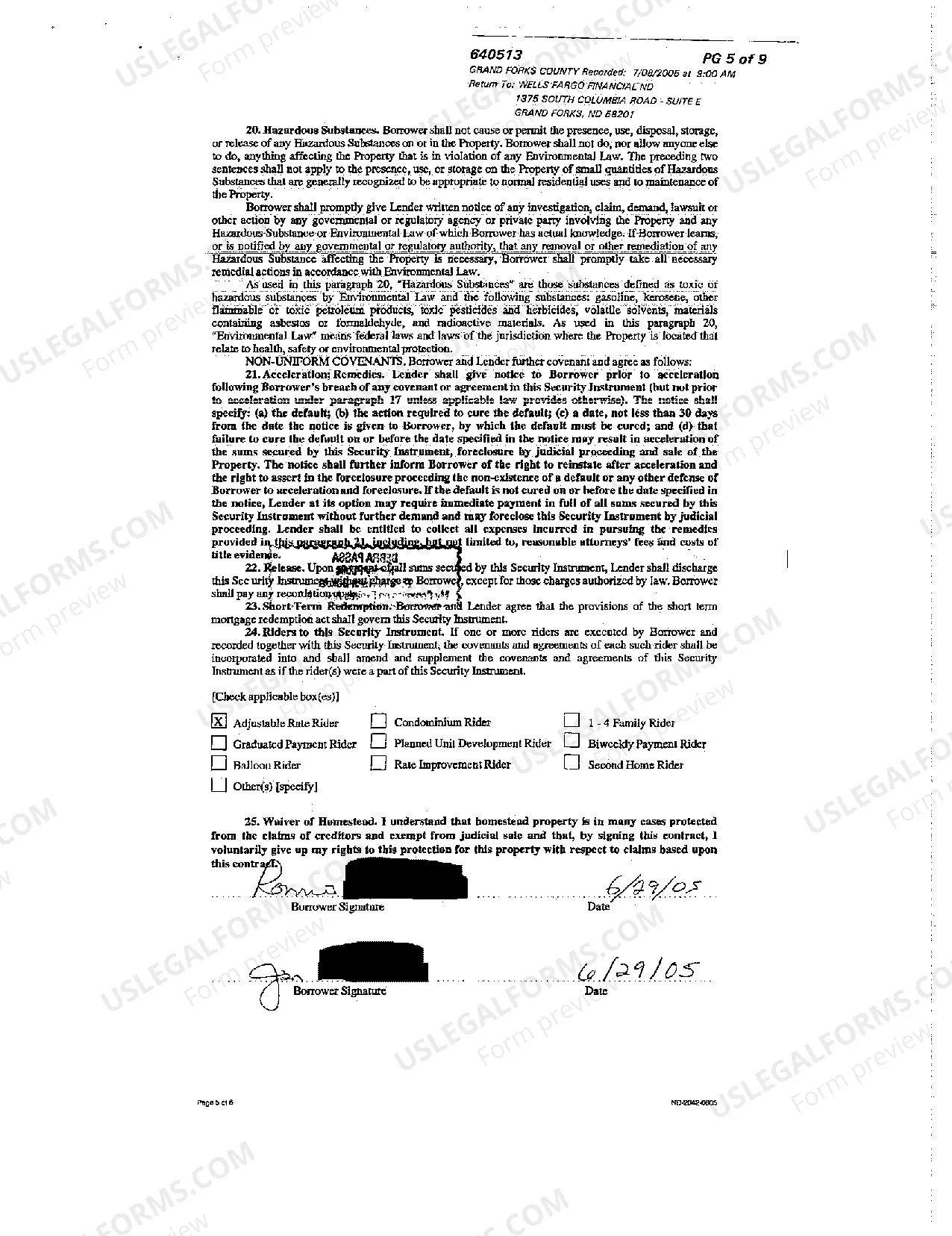

North Dakota Short-Term Mortgage Redemption

Description

How to fill out North Dakota Short-Term Mortgage Redemption?

Among lots of free and paid samples which you find on the web, you can't be sure about their reliability. For example, who created them or if they’re competent enough to deal with the thing you need these people to. Always keep relaxed and utilize US Legal Forms! Get North Dakota Short-Term Mortgage Redemption samples created by professional legal representatives and get away from the costly and time-consuming procedure of looking for an attorney and after that having to pay them to write a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you are seeking. You'll also be able to access your earlier saved samples in the My Forms menu.

If you are making use of our website the very first time, follow the instructions below to get your North Dakota Short-Term Mortgage Redemption with ease:

- Make certain that the document you discover applies in your state.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another sample using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you’ve signed up and bought your subscription, you can utilize your North Dakota Short-Term Mortgage Redemption as often as you need or for as long as it continues to be valid in your state. Revise it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

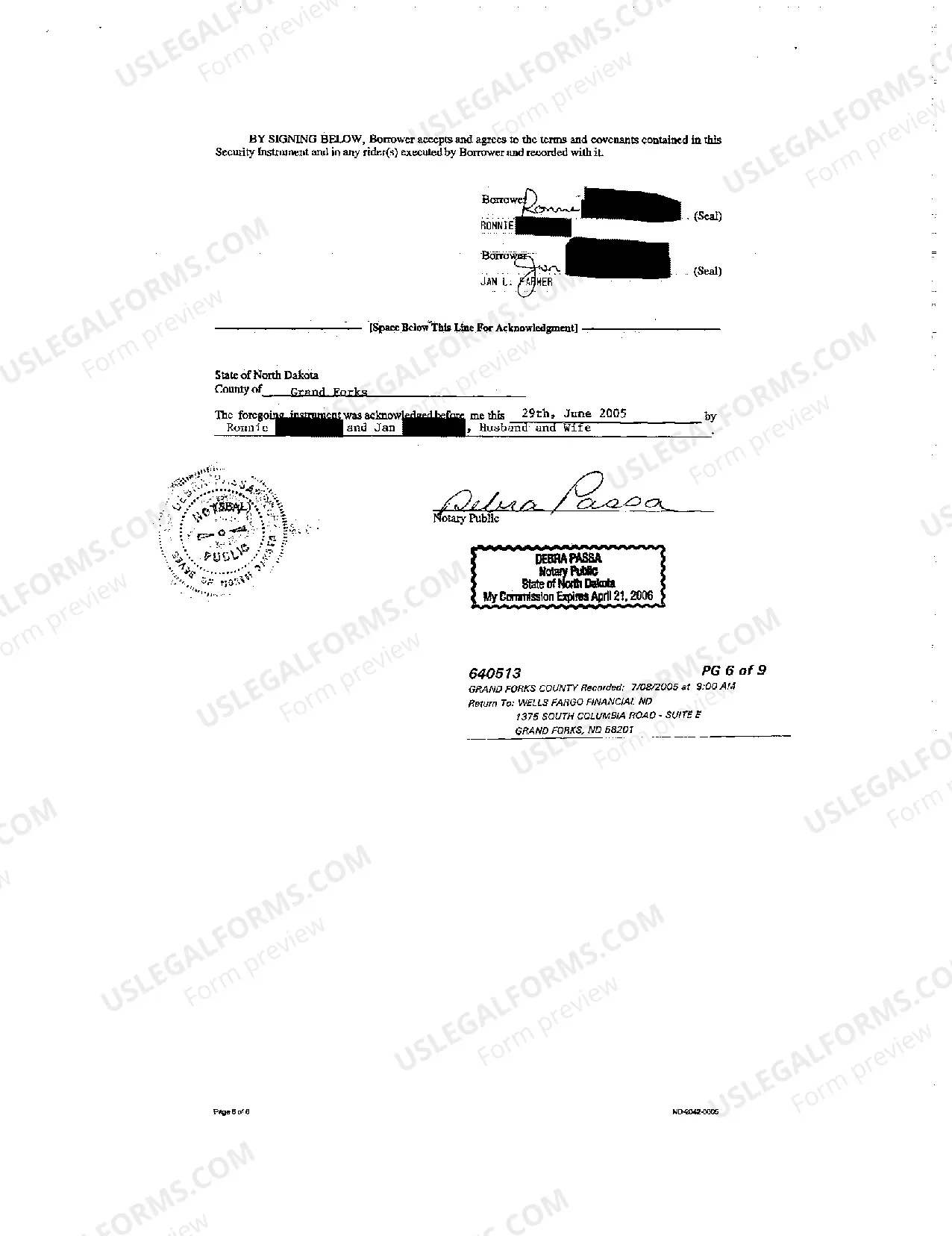

During the redemption period, you or your tenant may continue to live in the property and are not required to make any mortgage payments. You also have the right to sell the property to another person or re-purchase the property.

Stop a foreclosure sale from taking place by paying off the mortgage debt or. repurchase the property after a foreclosure sale by paying a specific sum of money within a limited period of time.

The best way to qualify for a home loan with a foreclosure on your credit report is to immediately begin rebuilding your credit. Sub-prime lenders would approve mortgages for credit scores as low as 580 in this past, but this is no longer the case.

Right of redemption is a legal process that allows a delinquent mortgage borrower to reclaim their home or other property subject to foreclosure if they are able to repay their obligations in time.

The right of redemption allows individuals who have defaulted on their mortgages the ability to reclaim their property by paying the amount due (plus interest and penalties) before the foreclosure process begins, or, in some states, even after a foreclosure sale (for the foreclosure price, plus interest and penalties).

When available, the right of redemption allows you to get your home back after a foreclosure. If you stop making your mortgage payments, the bank may use a process called foreclosure to sell your home and use the proceeds to repay the amount you borrowed, plus fees and costs.

Yes you can waive your right to redemption. Mortgage companies often will pay you for a waiver of your redemption rights in certain circumstances.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

The "right of redemption" is the right of a homeowner to either: stop a foreclosure sale from taking place by paying off the mortgage debt or. repurchase the property after a foreclosure sale by paying a specific sum of money within a limited period of time.