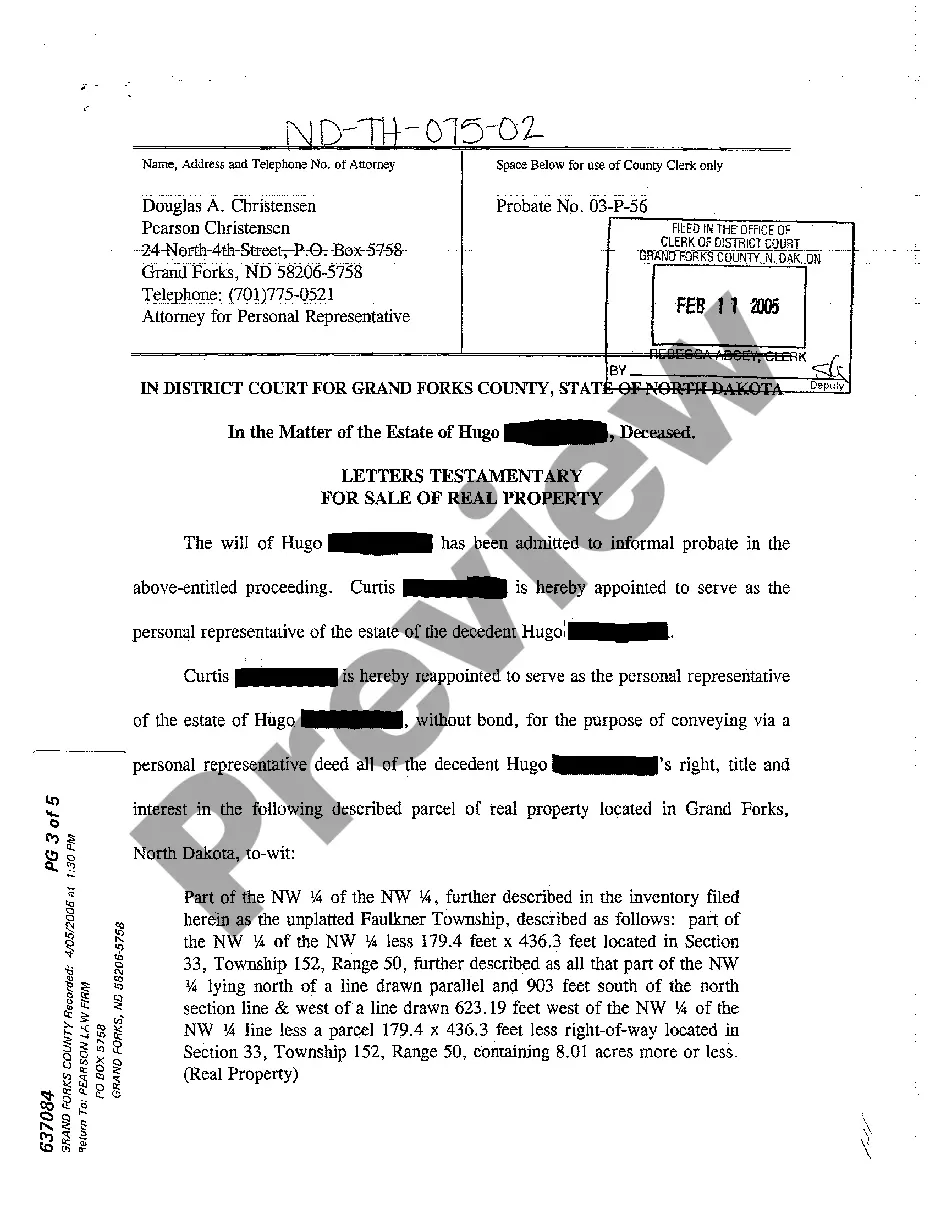

North Dakota Letters Testamentary For Sale of Real Property

Description

How to fill out North Dakota Letters Testamentary For Sale Of Real Property?

Avoid expensive attorneys and find the North Dakota Letters Testamentary For Sale of Real Property you need at a affordable price on the US Legal Forms website. Use our simple groups function to look for and download legal and tax documents. Go through their descriptions and preview them before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to download and complete every form.

US Legal Forms customers simply must log in and download the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet should follow the tips listed below:

- Make sure the North Dakota Letters Testamentary For Sale of Real Property is eligible for use in your state.

- If available, look through the description and make use of the Preview option well before downloading the sample.

- If you’re sure the template is right for you, click on Buy Now.

- If the template is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you may fill out the North Dakota Letters Testamentary For Sale of Real Property manually or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A will generally names an executor to administer the estate. If the decedent's estate has no valid will, you must file a petition with the probate court to administer the estate, and other folks who feel they're just as qualified may file a petition as well.

If there is no named executor, a person, usually a friend, family member or another interested party, may come forward and petition the court to become the administrator of the estate by obtaining letters of administration. If no one comes forward on their own, the court may ask a person to serve as an administrator.

There are two components of letter of testamentary cost: the court fee and the attorney's fees. The court fee ranges from $45 to $1,250, depending on the gross value of the estate. The attorney's fees start at about $2,500 and can go up depending on the complexity of the case.

Do you always need probate or letters of administrationYou usually need probate or letters of administration to deal with an estate if it includes property such as a flat or a house.you discover that the estate is insolvent, that is, there is not enough money in the estate to pay all the debts, taxes and expenses.

Find the local probate court or surrogate's court, as it's sometimes called. File the will and a certified copy of the testator's death certificate . Fill out the necessary paperwork , like a petition form, and provide any additional documents.

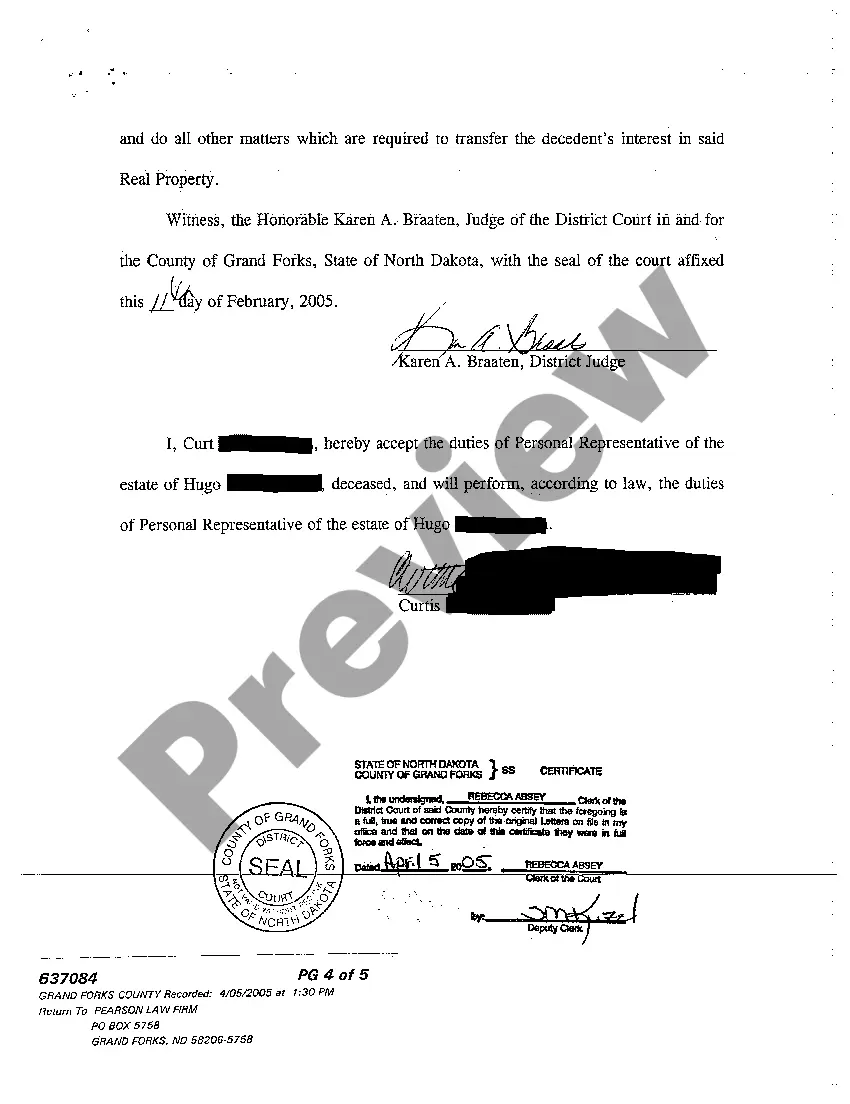

As part of the probate process, letters testamentary are issued by your state's probate court. To obtain the document, you need a copy of the will and the death certificate, which are then filed with the probate court along with whatever letters testamentary forms the court requires as part of your application.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

A common question asked of estate planning attorneys is how to obtain a copy of a deceased person's last will and testament or other probate court records. Because probate files are public court records that anyone can read, if a will has been filed for probate then you should be able to obtain a copy of it.