North Dakota Mineral Deed Individual to Individual

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out North Dakota Mineral Deed Individual To Individual?

Avoid pricey lawyers and find the North Dakota Mineral Deed Individual to Individual you need at a affordable price on the US Legal Forms website. Use our simple groups function to look for and download legal and tax files. Read their descriptions and preview them well before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to obtain and complete every template.

US Legal Forms subscribers simply must log in and get the particular form they need to their My Forms tab. Those, who have not got a subscription yet should stick to the tips below:

- Make sure the North Dakota Mineral Deed Individual to Individual is eligible for use where you live.

- If available, look through the description and use the Preview option just before downloading the sample.

- If you are confident the document suits you, click Buy Now.

- In case the template is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to download the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you can fill out the North Dakota Mineral Deed Individual to Individual manually or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds. The county will return the recorded original documents to the new owner.

Appendix A of Statement 141 provides examples of intangible assets. Those examples include mineral rights as an example of an intangible asset that should be recognized apart from goodwill.

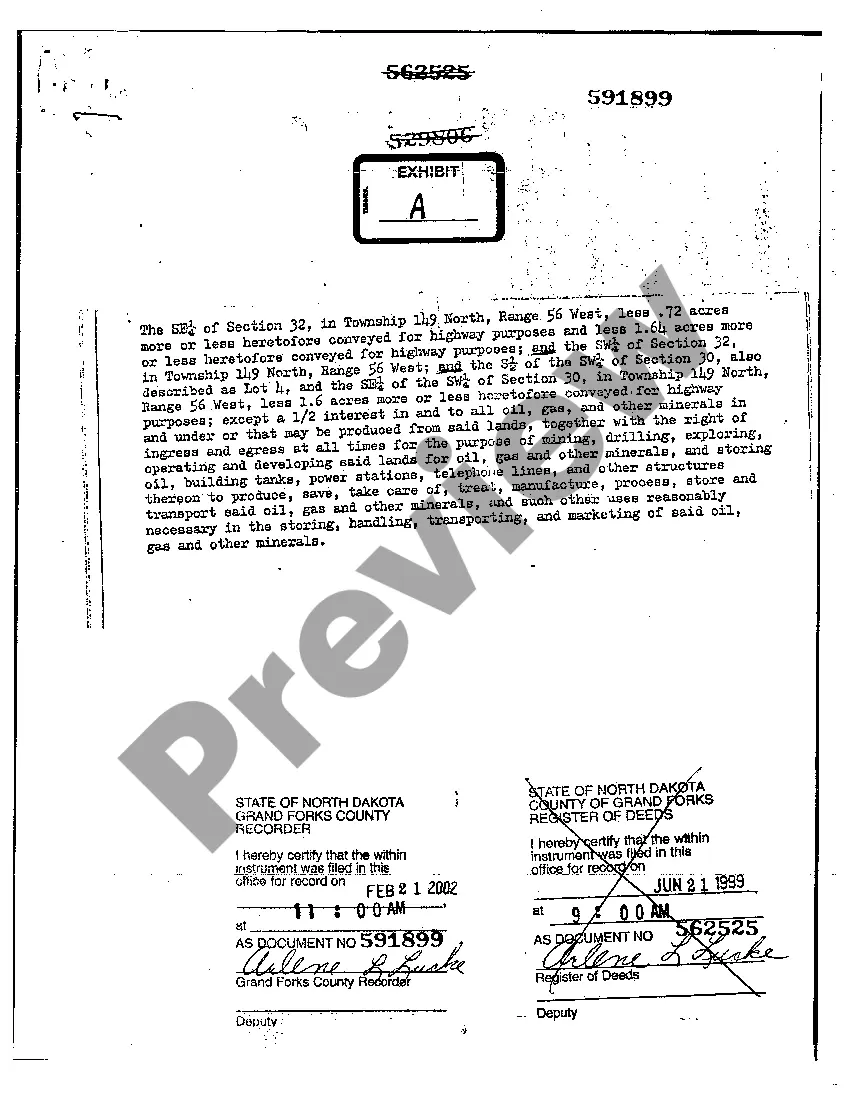

Mineral rights can be complex. By law, property falls into two categories real or personal. Real property includes land and whatever is permanently attached to land, found on it either by nature, (water, trees, or minerals) or by man (buildings, fences, bridges, roads).

Mineral rights are automatically included as a part of the land in a property conveyance, unless and until the ownership gets separated at some point by an owner/seller. An owner can separate the mineral rights from his or her land by:Conveying the land to one person and the mineral rights to another.

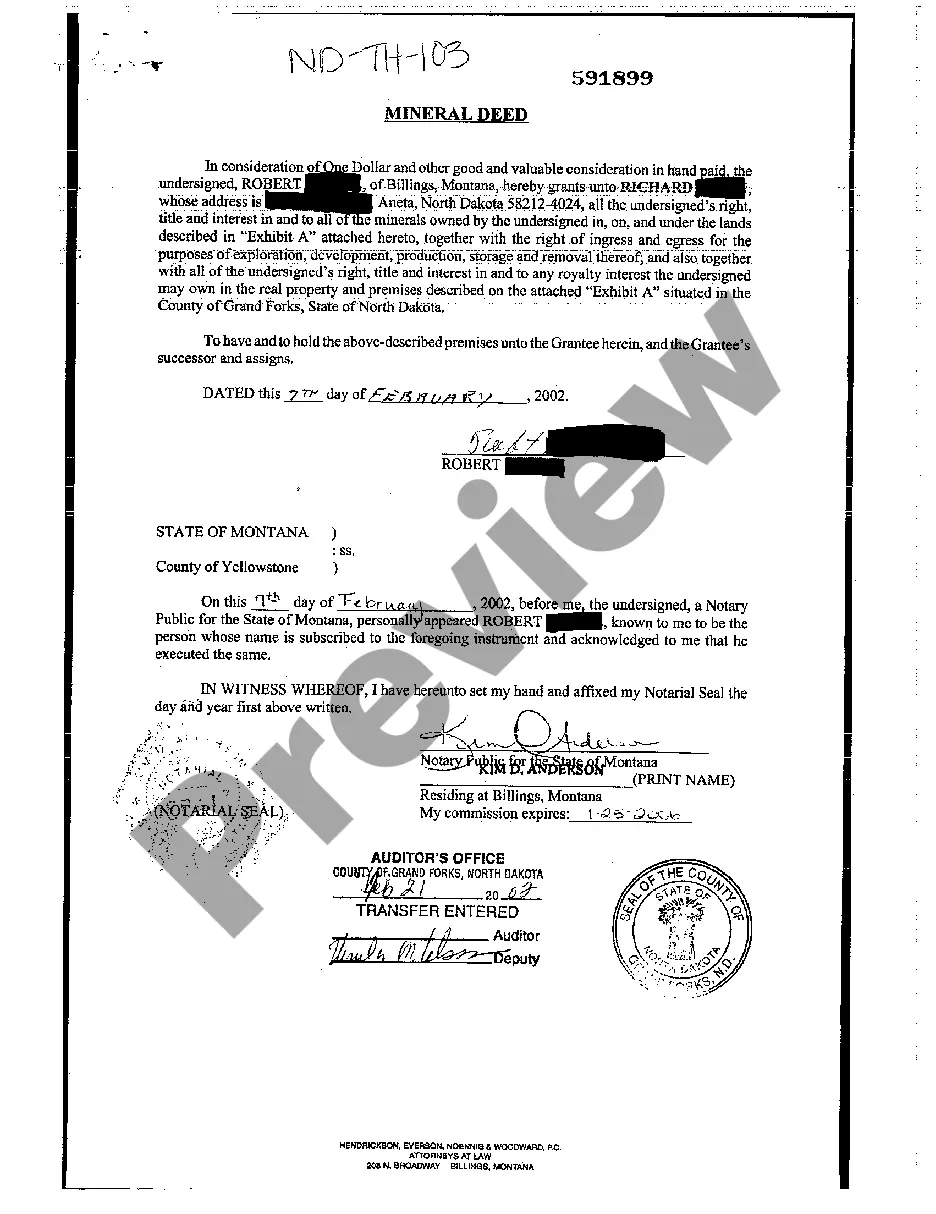

In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

A mineral owner's rights typically include the right to use the surface of the land to access and mine the minerals owned. This might mean the mineral owner has the right to drill an oil or natural gas well, or excavate a mine on your property.

Call the county where the minerals are located and ask how to transfer mineral ownership after death. They will probably advise you to submit a copy of the death certificate, probate documents (if any), and a copy of the will (or affidavit of heirship if there is no will).

Mineral rights don't come into effect until you begin to dig below the surface of the property. But the bottom line is: if you do not have the mineral rights to a parcel of land, then you do not have the legal ability to explore, extract, or sell the naturally occurring deposits below.

The IRS classifies the sale of mineral rights as a capital gain event, which is one of the most favorable tax treatments in the U.S. tax code.As you can see, capital gains tax rates are generally lower than ordinary income tax rates.