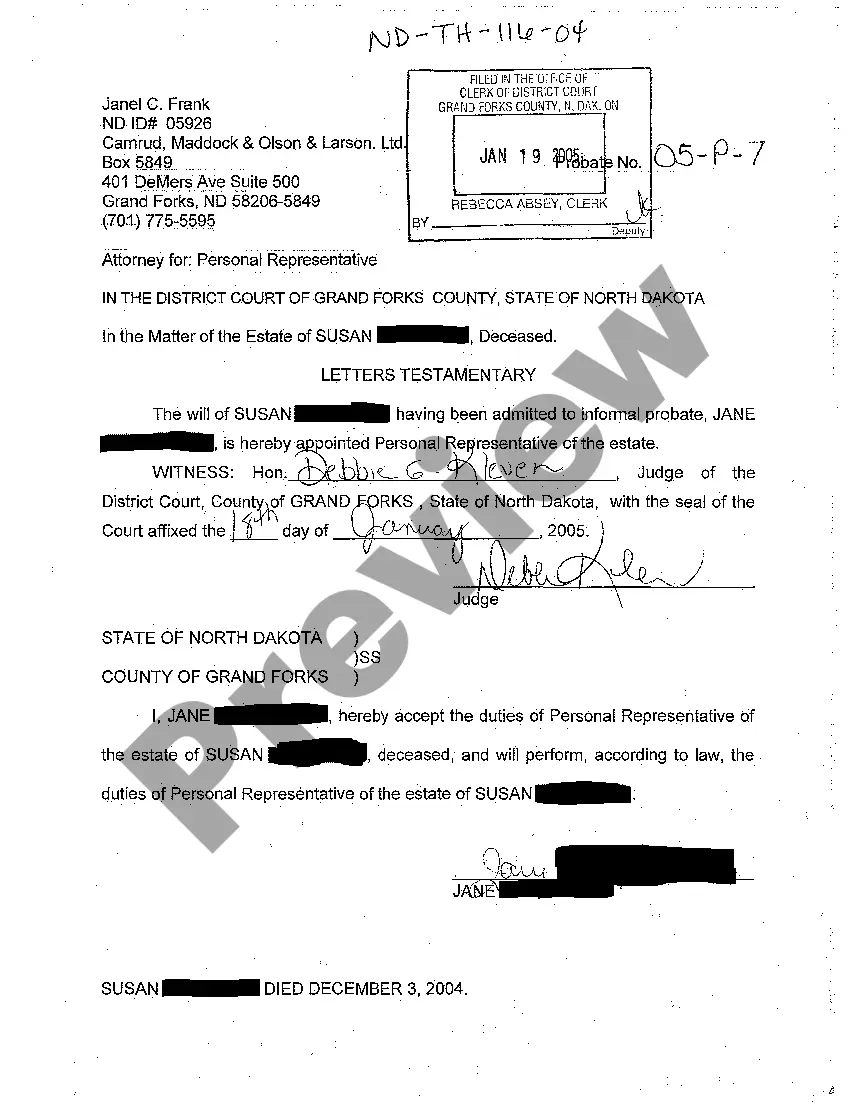

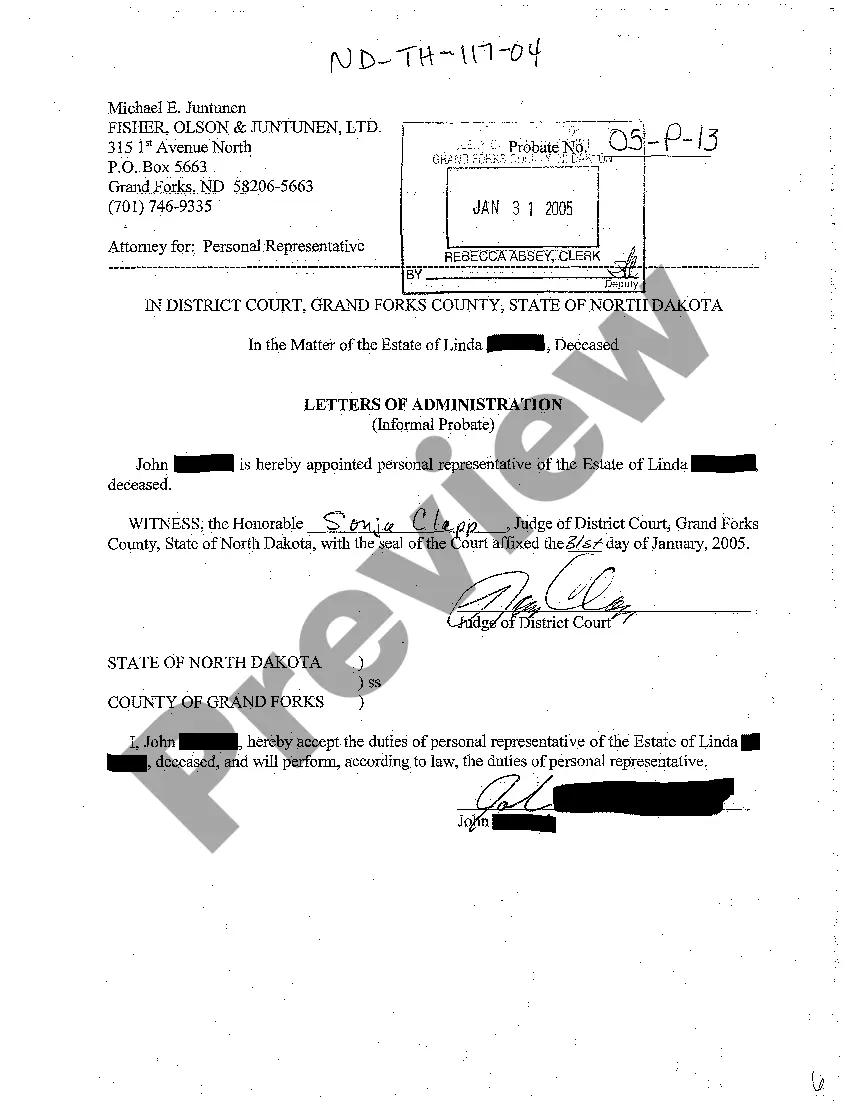

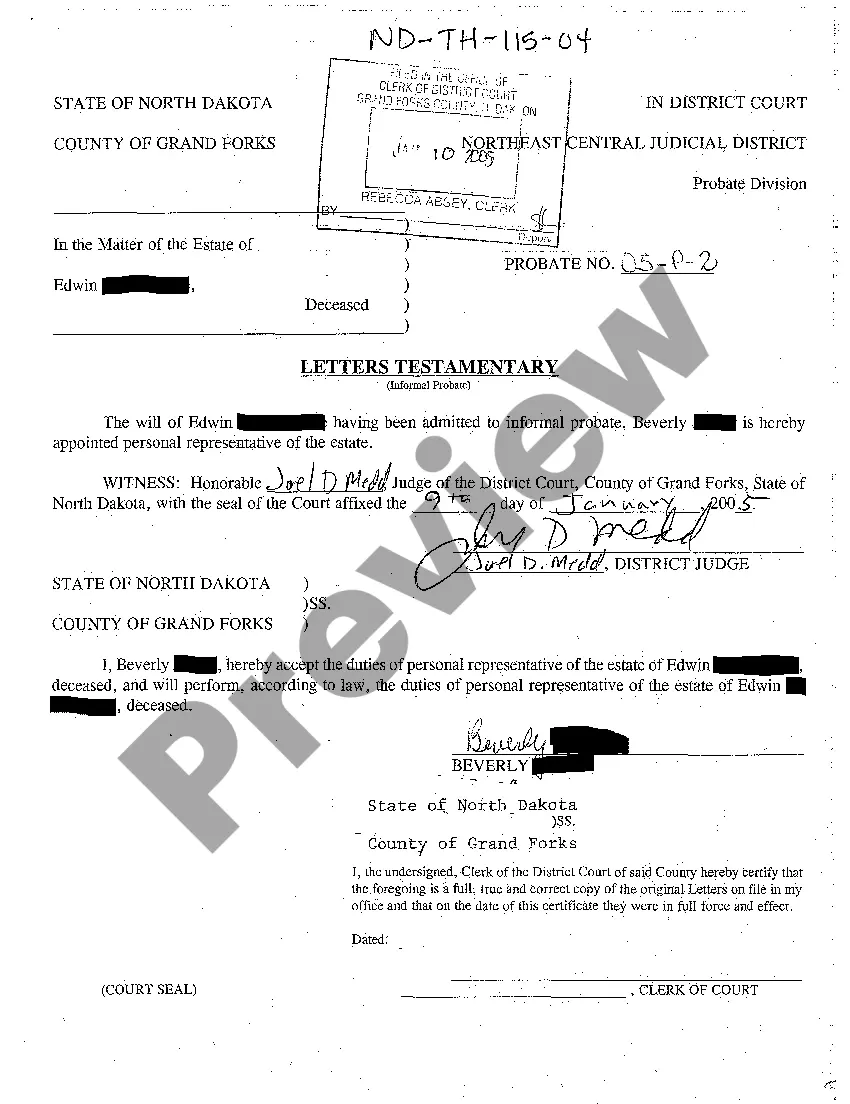

North Dakota Letters Testamentary

Description

How to fill out North Dakota Letters Testamentary?

Avoid costly attorneys and find the North Dakota Letters Testamentary you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to find and obtain legal and tax documents. Read their descriptions and preview them well before downloading. Moreover, US Legal Forms enables customers with step-by-step tips on how to download and complete every form.

US Legal Forms clients simply have to log in and download the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet need to follow the guidelines listed below:

- Ensure the North Dakota Letters Testamentary is eligible for use in your state.

- If available, look through the description and make use of the Preview option well before downloading the templates.

- If you are sure the document suits you, click on Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you may fill out the North Dakota Letters Testamentary by hand or an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Most likely you will need an attorney to obtain letters testamentary. Many attorneys offer a free consultation. At least meet with an attorney to make sure letters testamentary is what you need.

A common question asked of estate planning attorneys is how to obtain a copy of a deceased person's last will and testament or other probate court records. Because probate files are public court records that anyone can read, if a will has been filed for probate then you should be able to obtain a copy of it.

Some banks and building societies will release quite large amounts without the need for probate or letters of administration.If the organisation refuses to release money without probate or letters of administration, you must apply for probate or letters of administration even if it is not otherwise needed.

To obtain your letter of testamentary, you will need to file the will and death certificate in the probate court, along with forms asking for the letter of testamentary. You'll need to provide your information, as well as some basic information about the value of the estate and the date of death.

There are two components of letter of testamentary cost: the court fee and the attorney's fees. The court fee ranges from $45 to $1,250, depending on the gross value of the estate. The attorney's fees start at about $2,500 and can go up depending on the complexity of the case.

The purpose of a letter of testamentary is to show you have the legal right to act as an executor of a particular person's estate. This letter gives you permission to pay an estate's debts, take inventory of the estate's assets and distribute those assets on behalf of the decedent.

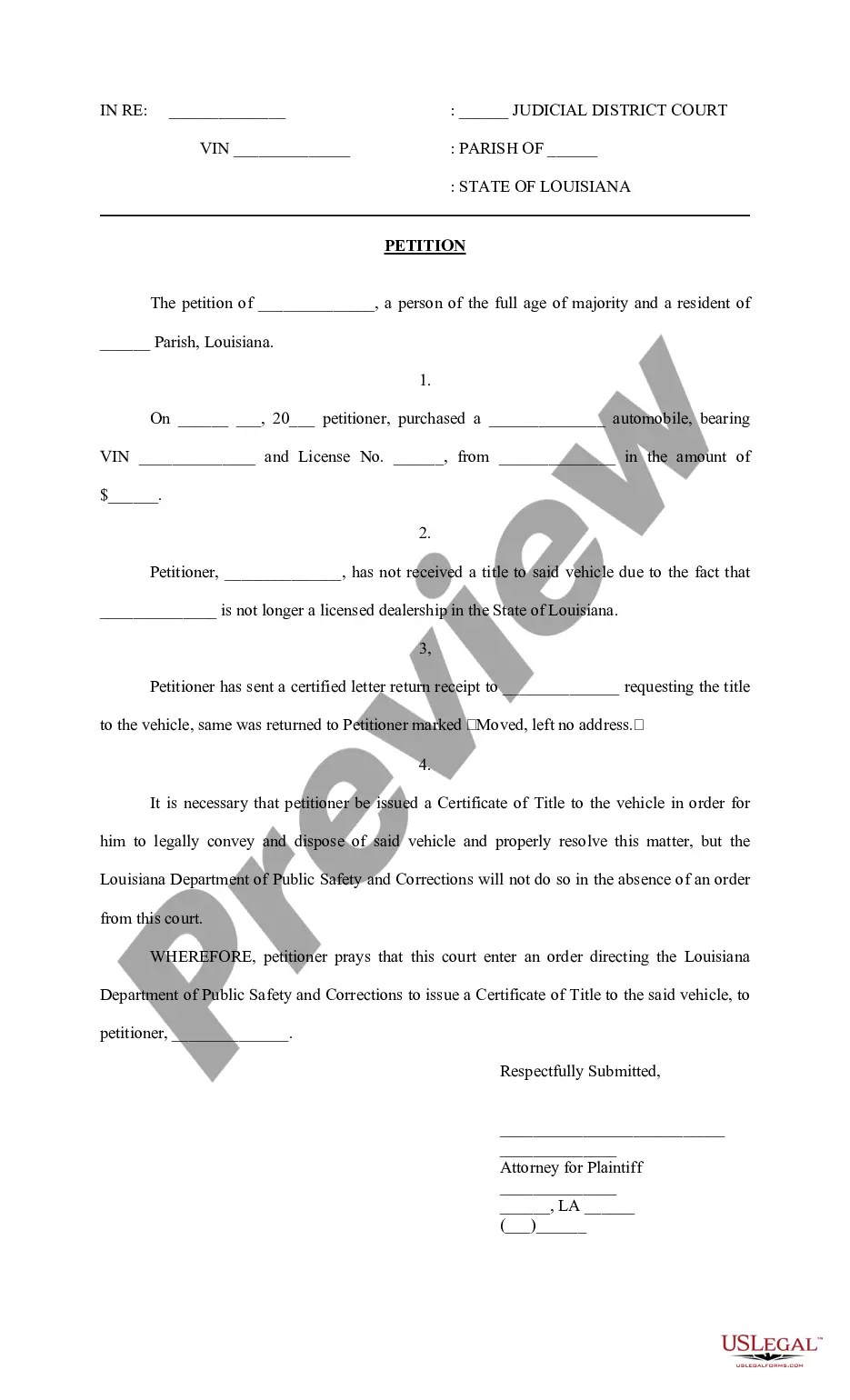

Find the local probate court or surrogate's court, as it's sometimes called. File the will and a certified copy of the testator's death certificate . Fill out the necessary paperwork , like a petition form, and provide any additional documents.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).