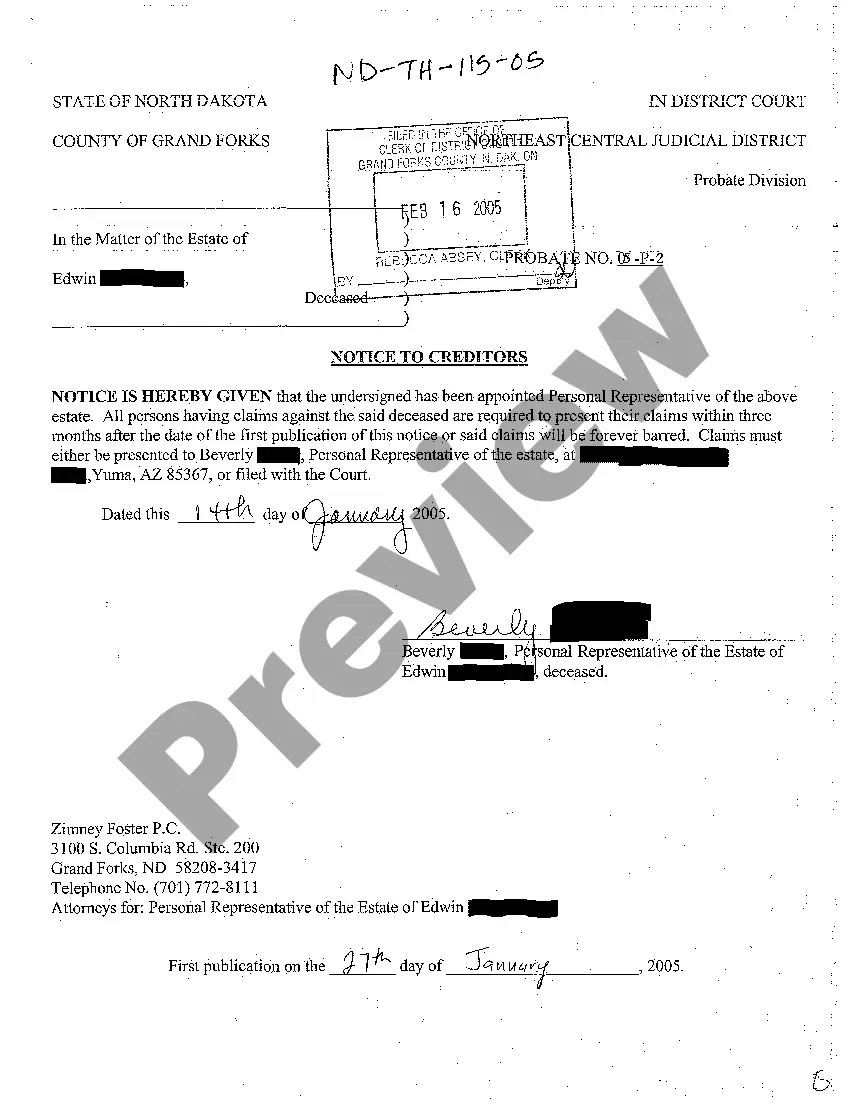

North Dakota Notice to Creditors

Description

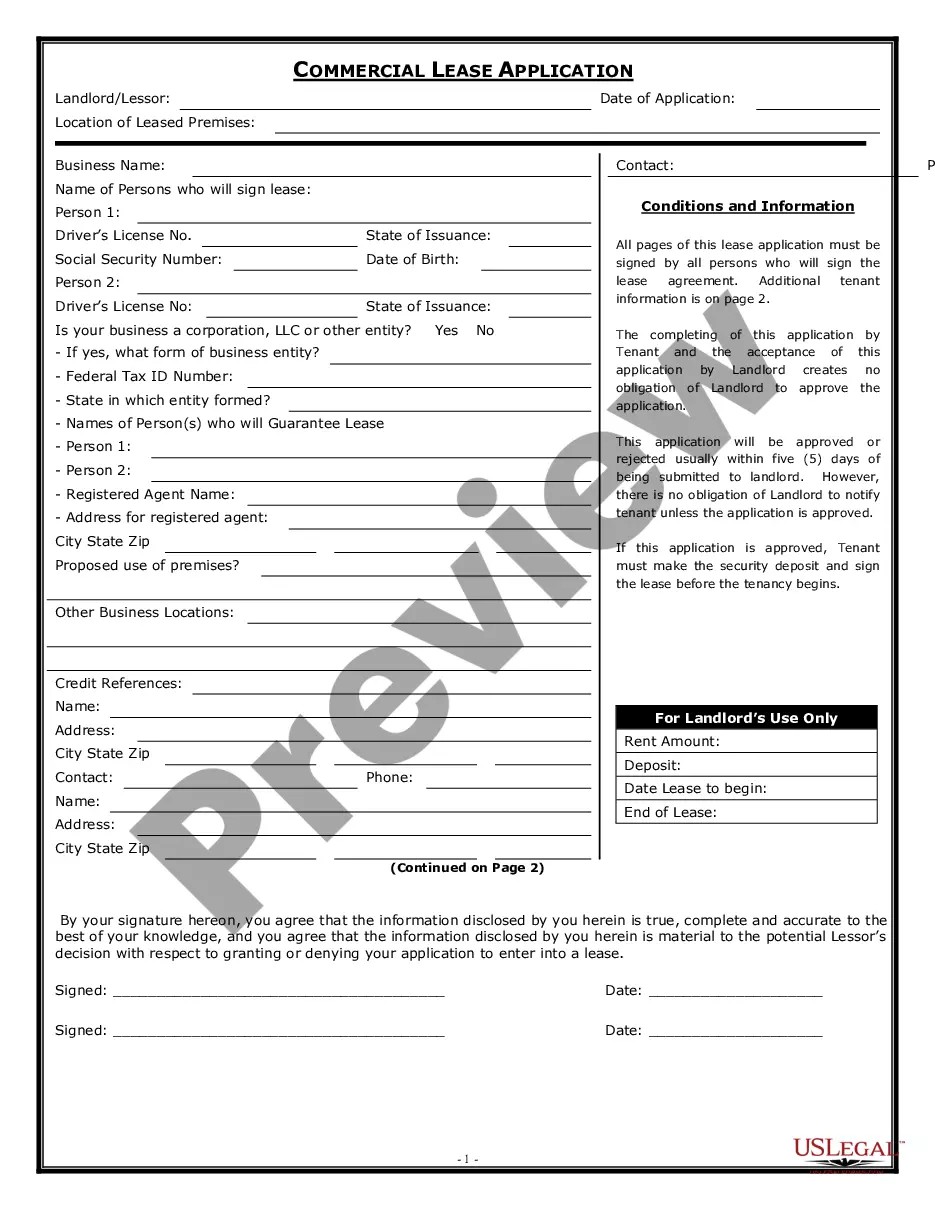

How to fill out North Dakota Notice To Creditors?

Avoid expensive attorneys and find the North Dakota Notice to Creditors you want at a reasonable price on the US Legal Forms site. Use our simple groups function to find and obtain legal and tax forms. Go through their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables customers with step-by-step tips on how to obtain and complete each and every template.

US Legal Forms clients basically must log in and obtain the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the guidelines below:

- Make sure the North Dakota Notice to Creditors is eligible for use in your state.

- If available, read the description and use the Preview option before downloading the sample.

- If you’re sure the document suits you, click Buy Now.

- If the template is incorrect, use the search engine to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, it is possible to fill out the North Dakota Notice to Creditors manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

A notice to creditors refers to a public notice that is addressed to potential creditors and debtors of an estate of a deceased individual. The notice is published by the estate executor in local and national newspapers with a national circulation for several weeks, depending on the estate laws of the state.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

Even in the most routine probates, the law requires a minimum four-month wait after the Notice to Creditors has been issued before any action can be taken to distribute or close the estate.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.

A creditor is an entity (person or institution) that extends credit by giving another entity permission to borrow money intended to be repaid in the future.People who loan money to friends or family are personal creditors.