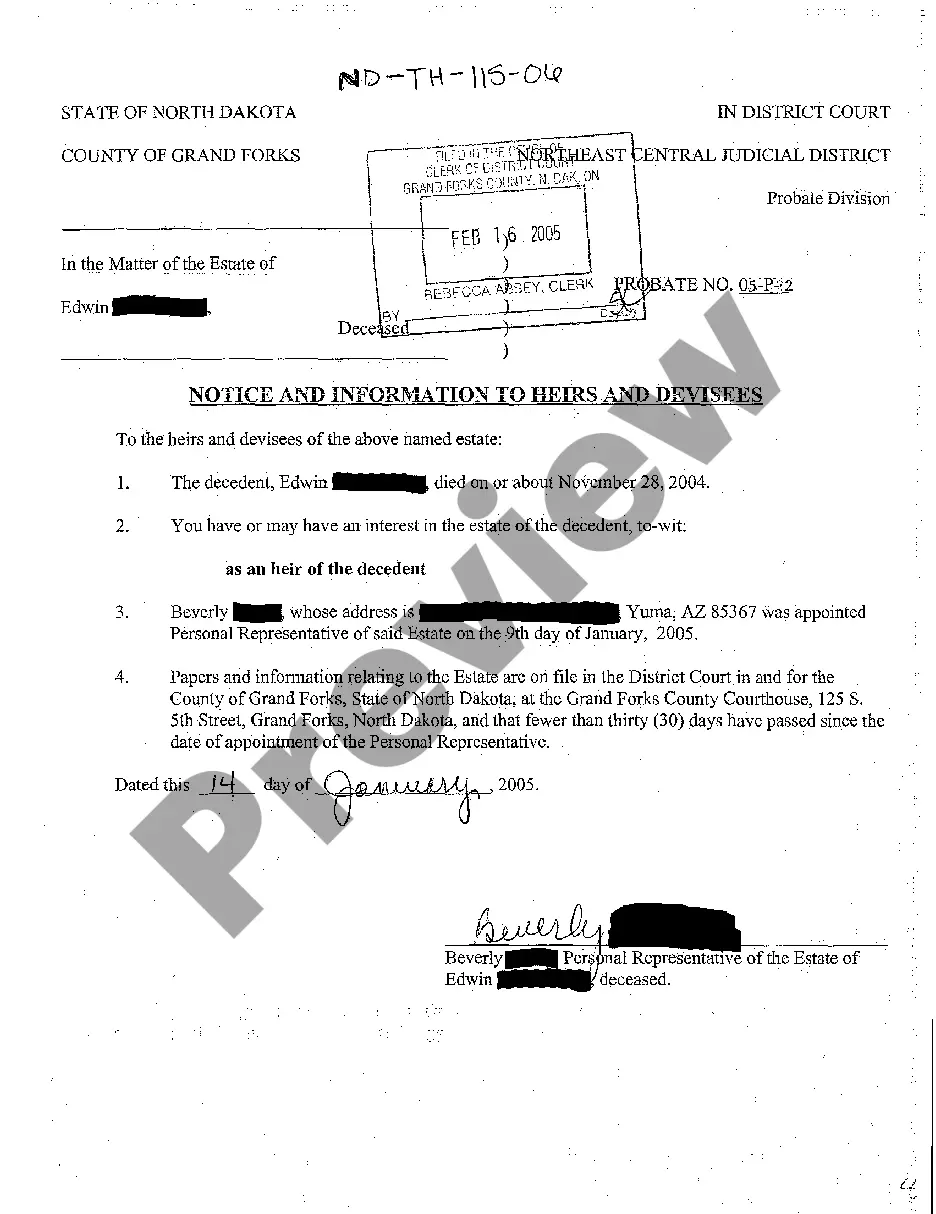

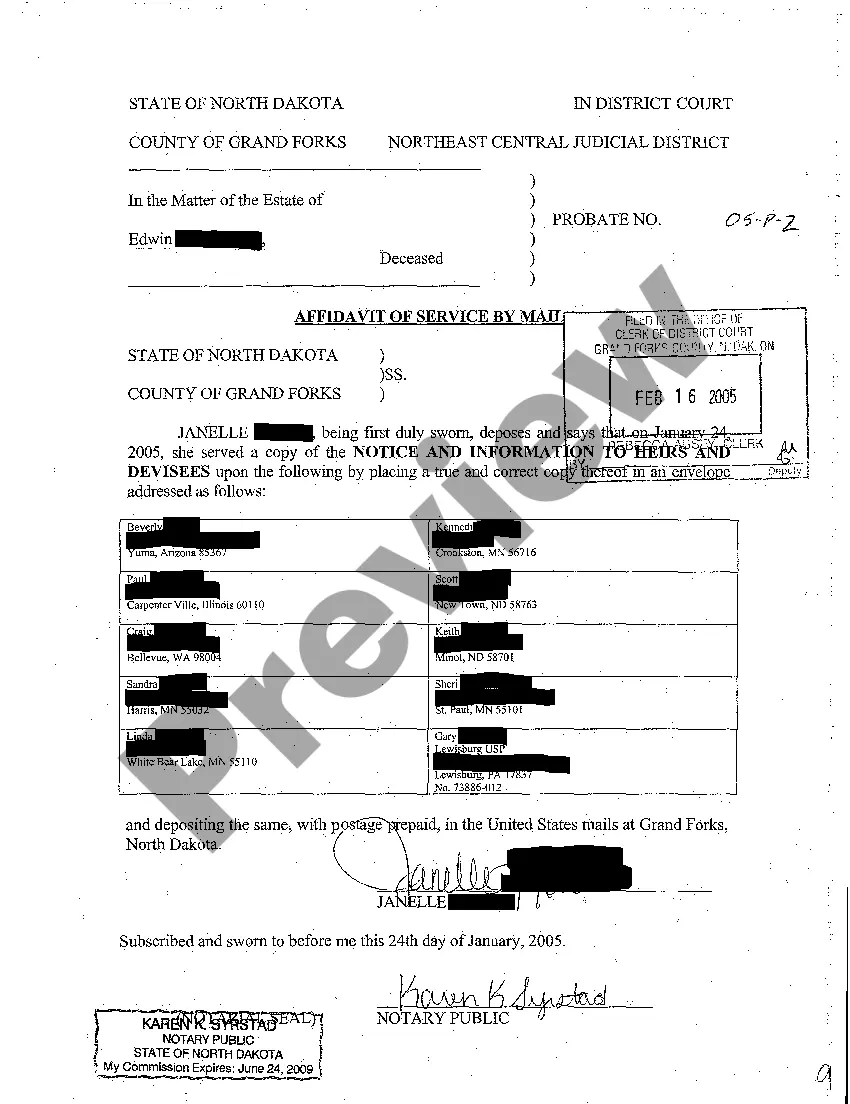

North Dakota Notice and Information to Heirs and Devisees

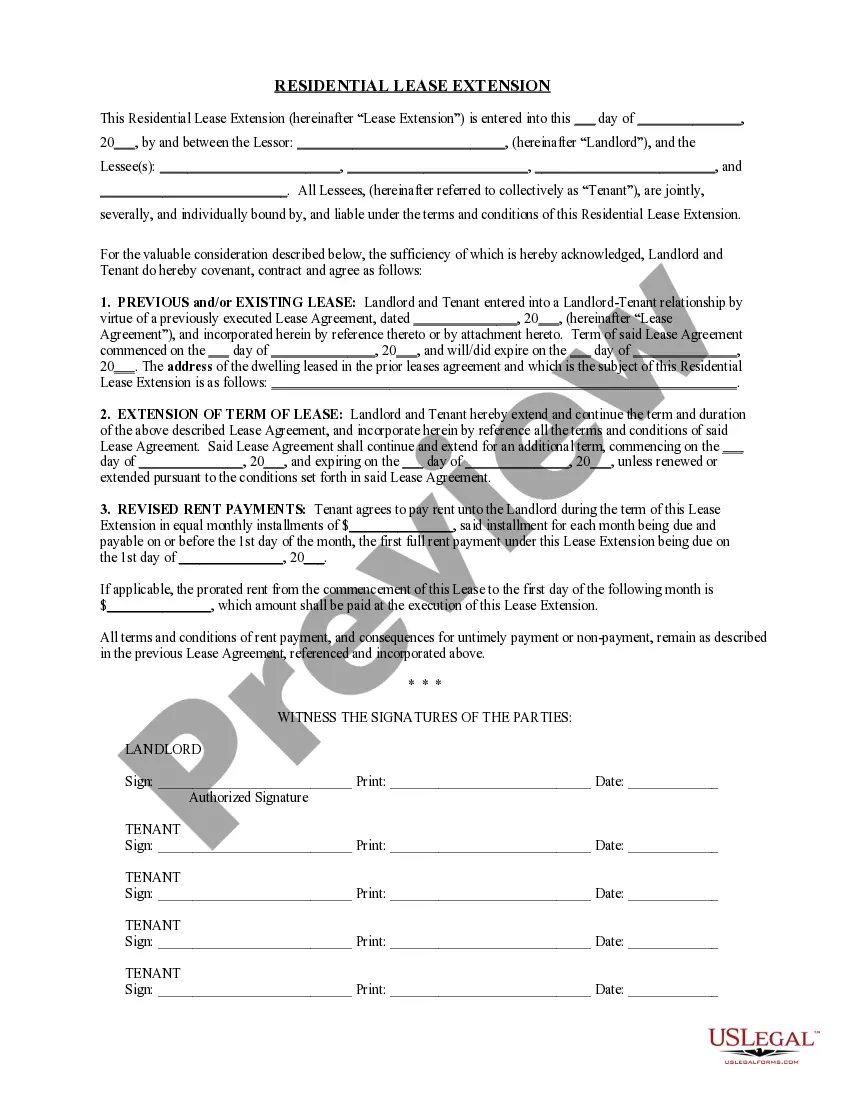

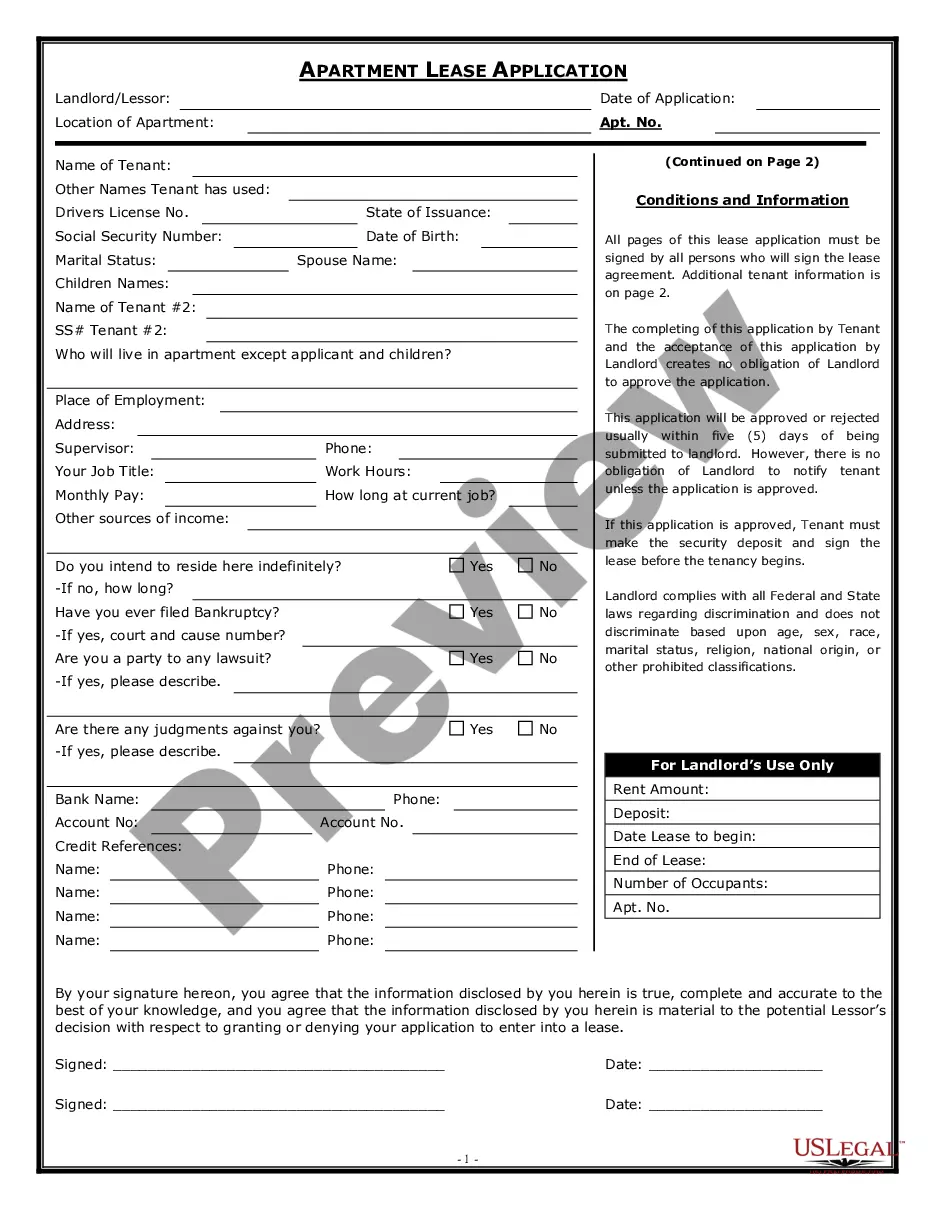

Description

How to fill out North Dakota Notice And Information To Heirs And Devisees?

Avoid pricey attorneys and find the North Dakota Notice and Information to Heirs and Devisees you need at a affordable price on the US Legal Forms site. Use our simple groups function to find and obtain legal and tax forms. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms enables customers with step-by-step tips on how to download and fill out each and every form.

US Legal Forms subscribers basically must log in and get the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the guidelines below:

- Ensure the North Dakota Notice and Information to Heirs and Devisees is eligible for use where you live.

- If available, read the description and use the Preview option well before downloading the templates.

- If you are confident the document is right for you, click on Buy Now.

- In case the form is incorrect, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, you are able to complete the North Dakota Notice and Information to Heirs and Devisees manually or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

4. When a will has been discovered, copies of the will should be prepared for the beneficiaries and devisees. ANS: T True Correct. A summary of the contents of the will should also be included.

The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

If there is no named executor, a person, usually a friend, family member or another interested party, may come forward and petition the court to become the administrator of the estate by obtaining letters of administration. If no one comes forward on their own, the court may ask a person to serve as an administrator.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).