North Dakota Claim Against Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

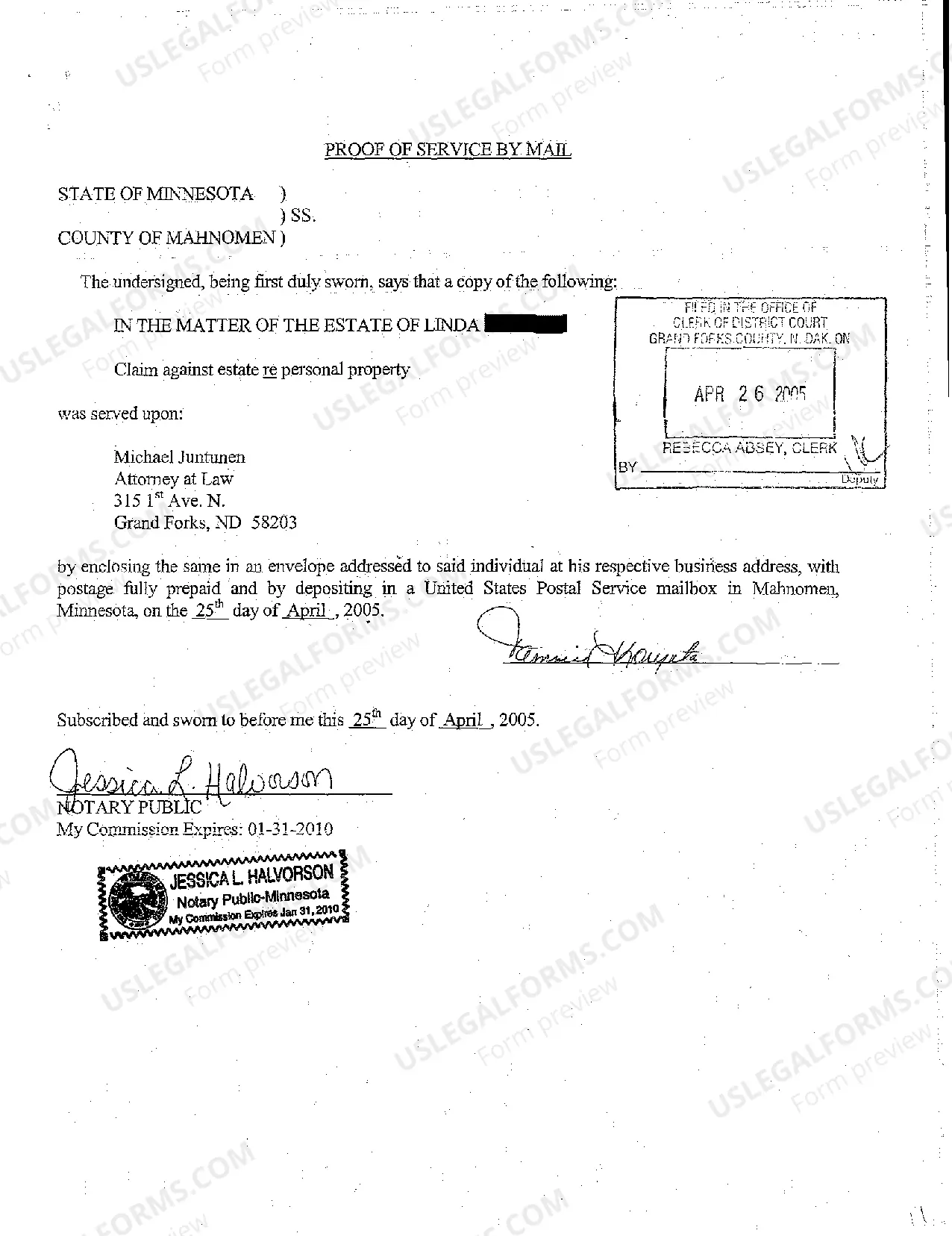

How to fill out North Dakota Claim Against Estate?

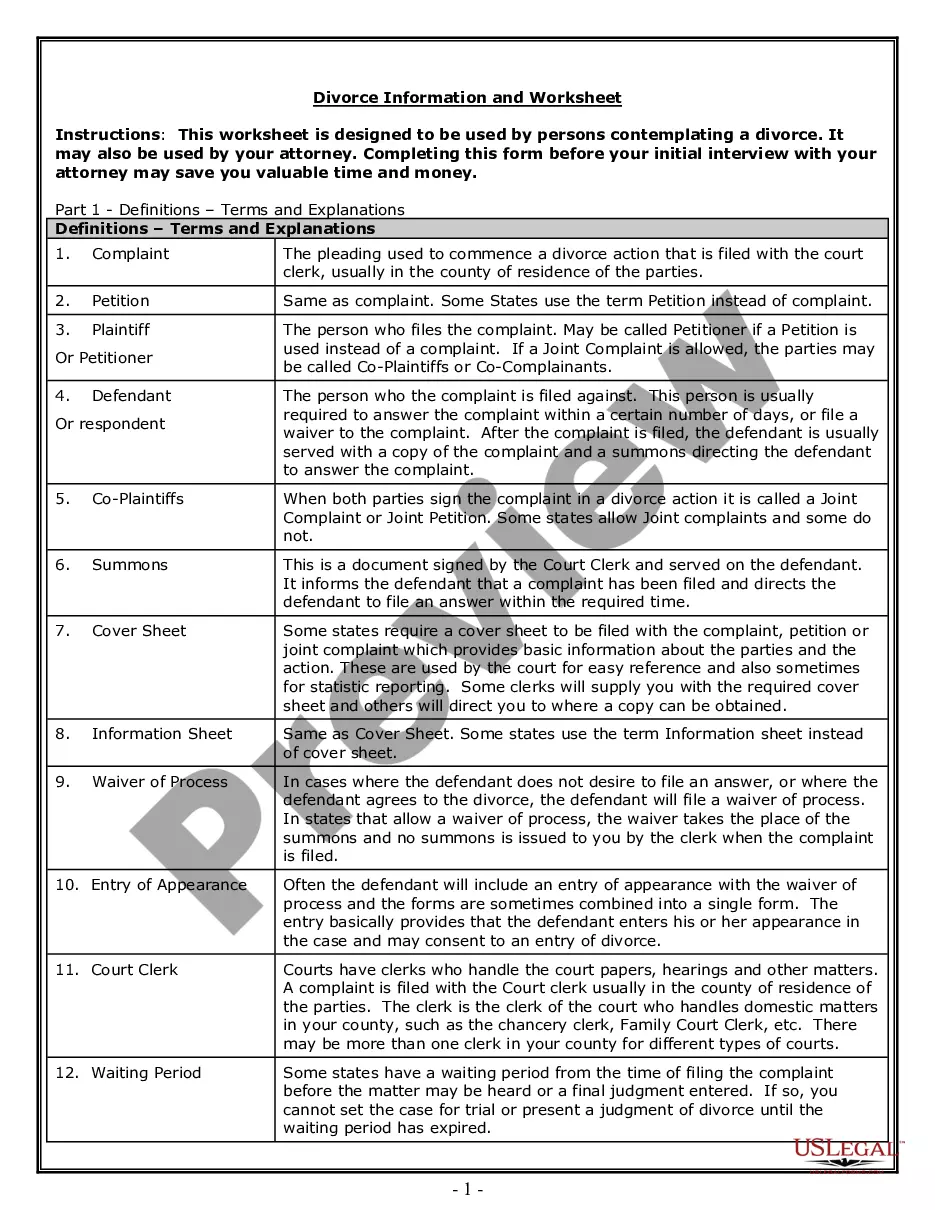

Avoid costly attorneys and find the North Dakota Claim Against Estate you want at a reasonable price on the US Legal Forms website. Use our simple groups function to find and obtain legal and tax forms. Go through their descriptions and preview them prior to downloading. Additionally, US Legal Forms provides users with step-by-step tips on how to download and complete each and every form.

US Legal Forms customers just need to log in and download the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the guidelines listed below:

- Make sure the North Dakota Claim Against Estate is eligible for use in your state.

- If available, look through the description and use the Preview option well before downloading the sample.

- If you are sure the document suits you, click on Buy Now.

- In case the template is incorrect, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you are able to fill out the North Dakota Claim Against Estate by hand or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

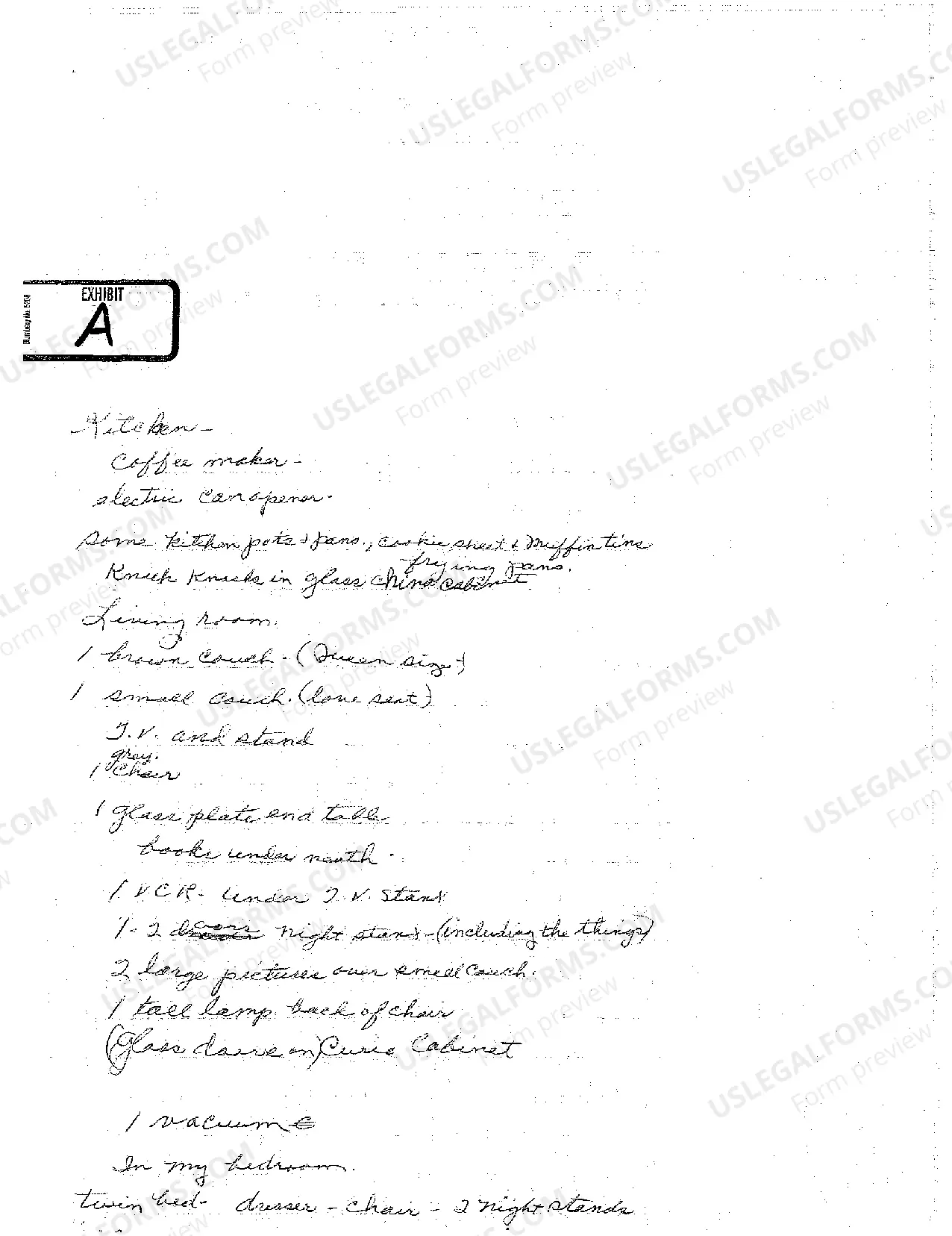

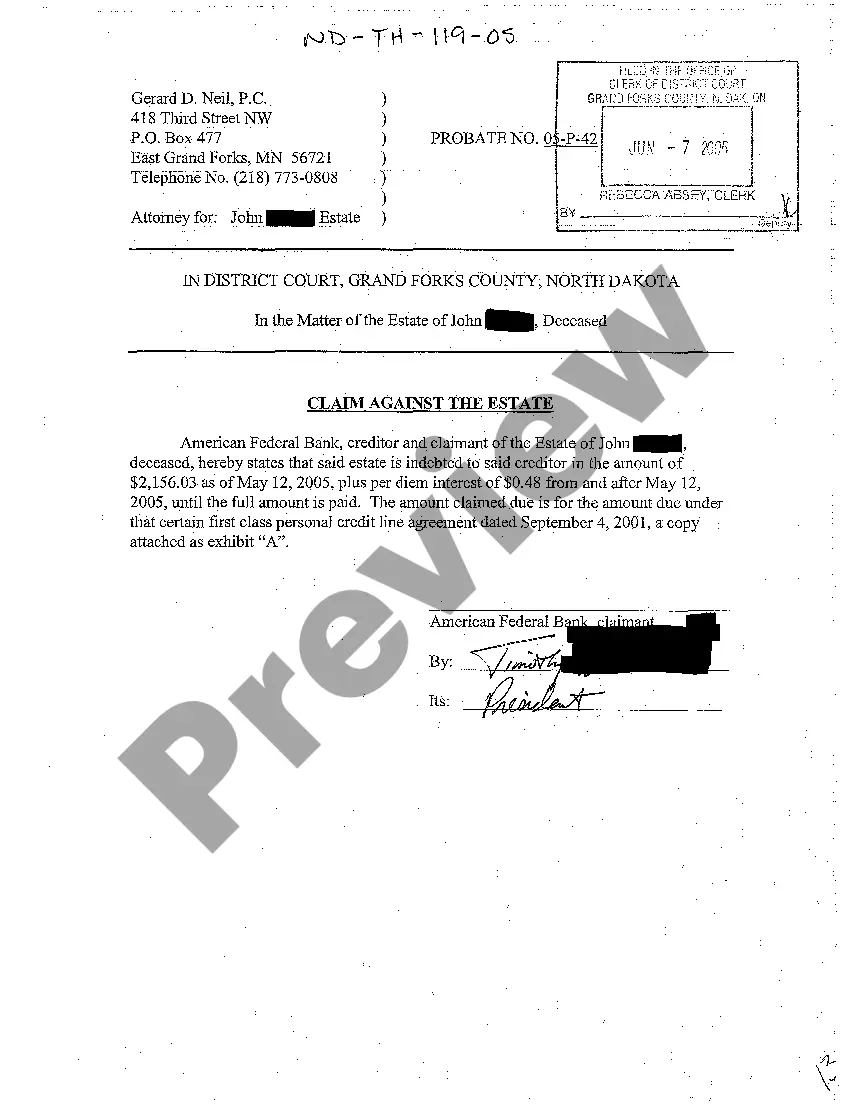

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

A claim for reasonable financial provision must be made within six months after probate or letters of administration have been issued, although the court can extend this period in certain circumstances (eg if the applicant has not made an earlier claim because of negotiations with the executors or administrators).

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

Find the Correct Probate Court. The probate court handles issues involving a deceased person's estate, along with potential disputes regarding outstanding debts, issues with heirs, etc. Confirm the Debt. Complete the Claim Form. File the Claim Form.

The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

Your father's share of the house only forms part of his estate if it was owned as 'tenants in common'.And regardless of all this, your late father's wife will normally be entitled to make a claim against his estate if she wishes to.

Submit your claim directly to the probate court and serve a copy on the personal representative. If you file a formal claim and the personal representative rejects it, you can file suit against the estate within three months of the rejection.

Is there a time limit for a claim against a deceased estate? Yes, there is. You have only 6 months from the date of the grant of probate to make a claim. In some very limited circumstances, an extension of this time frame may be granted.