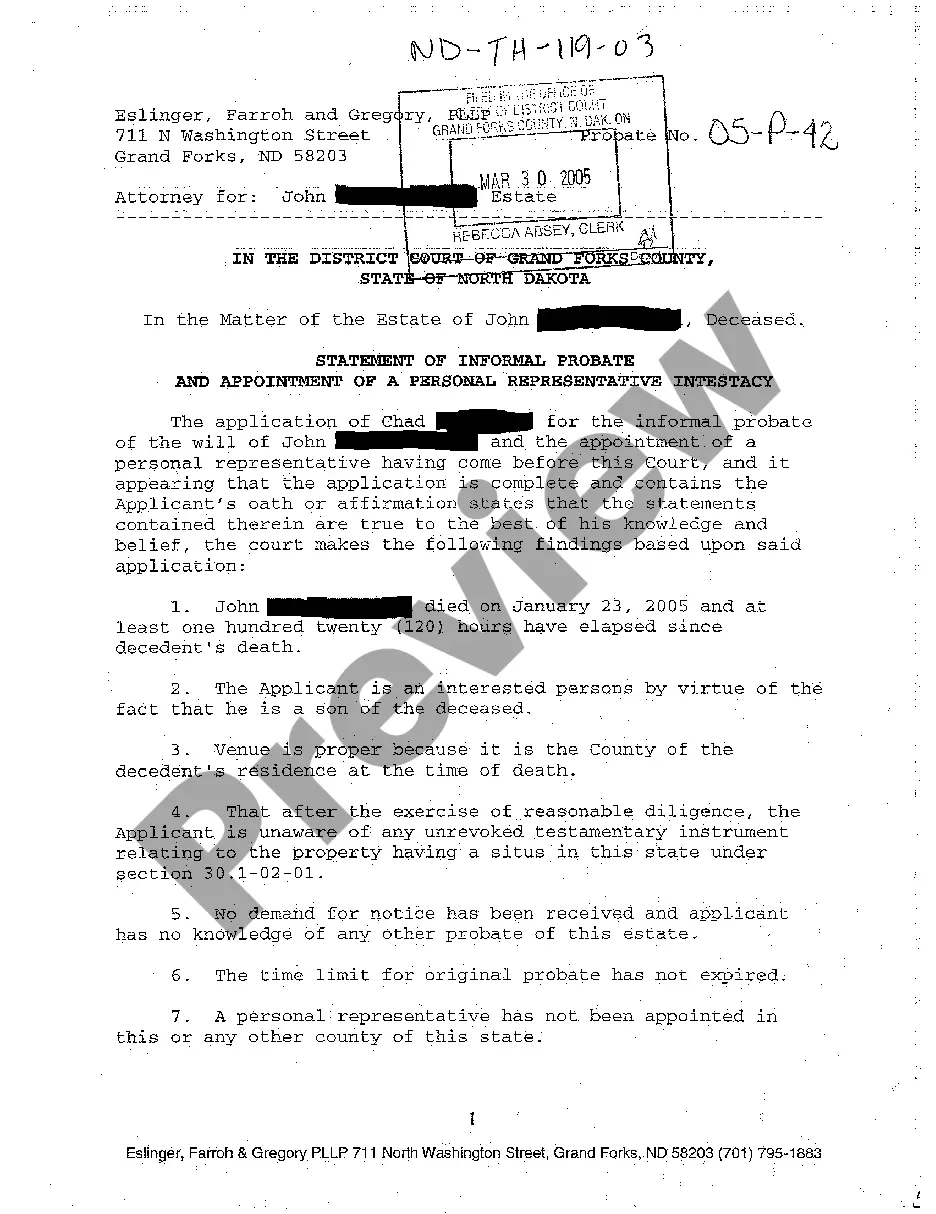

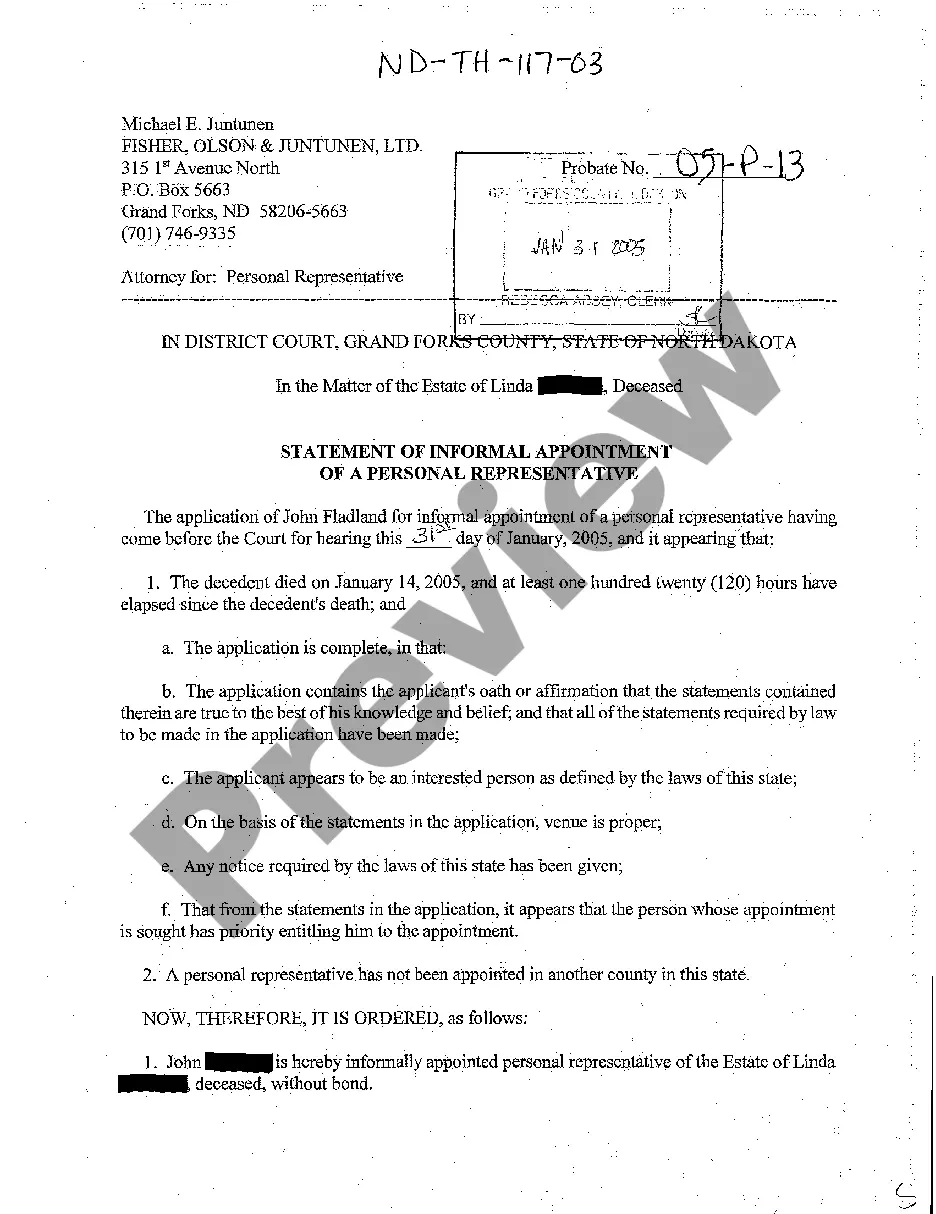

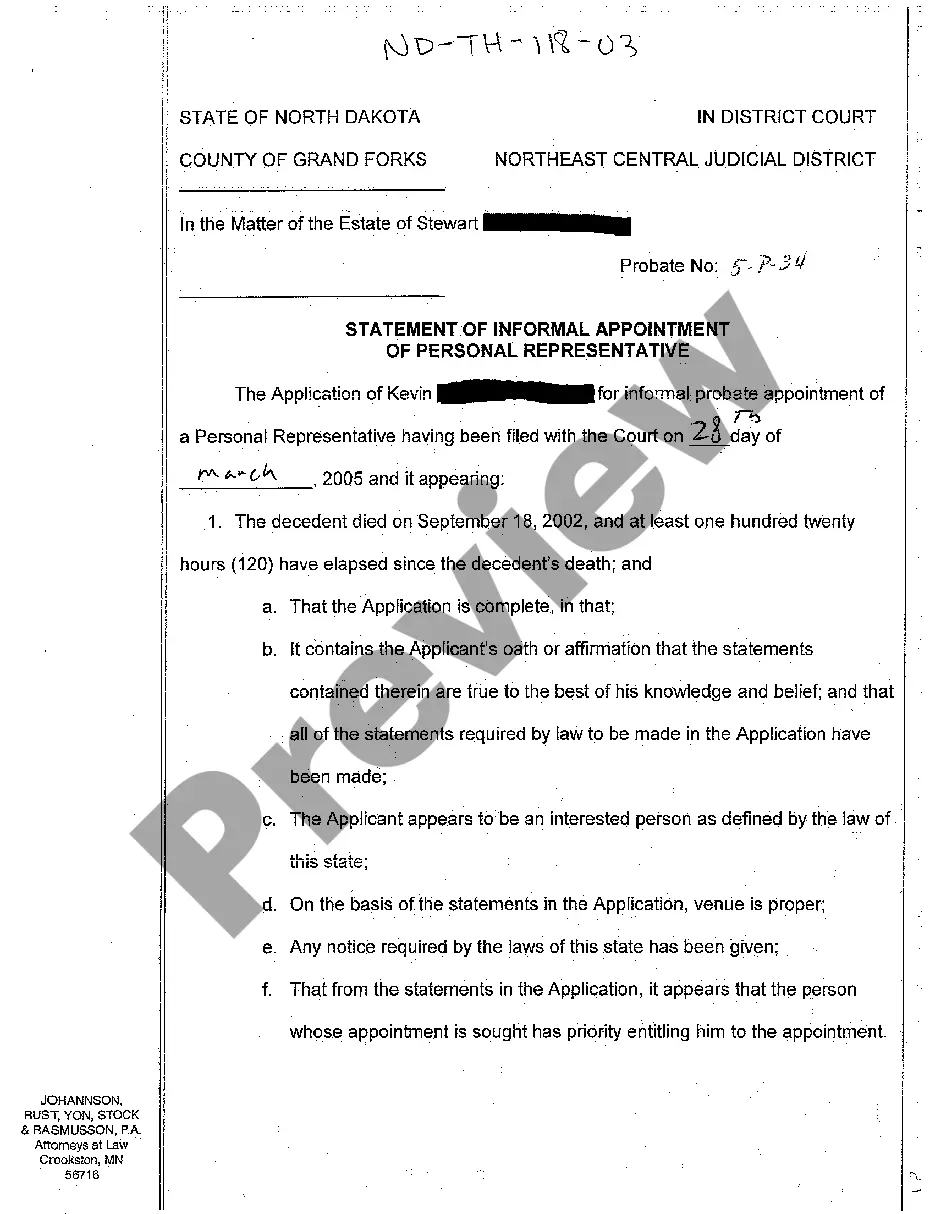

North Dakota Statement of Informal Probate and Appointment of a Personal Representative Intestacy

Description

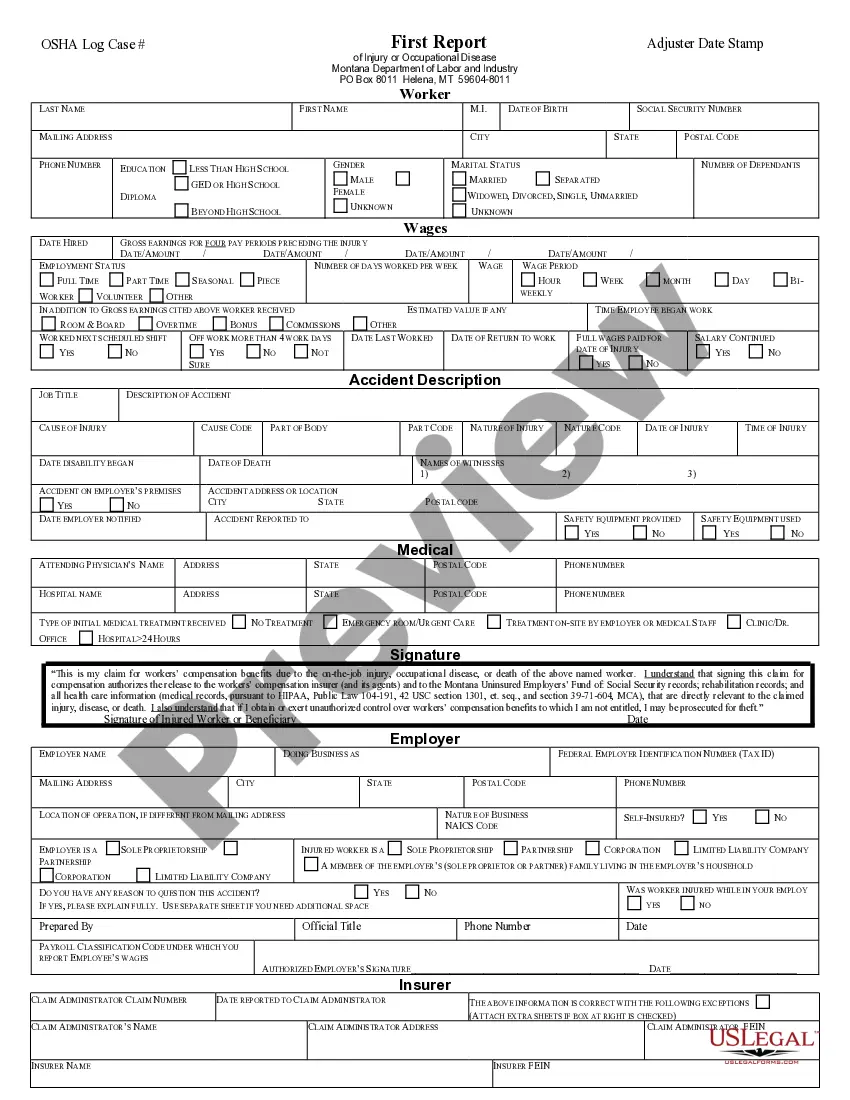

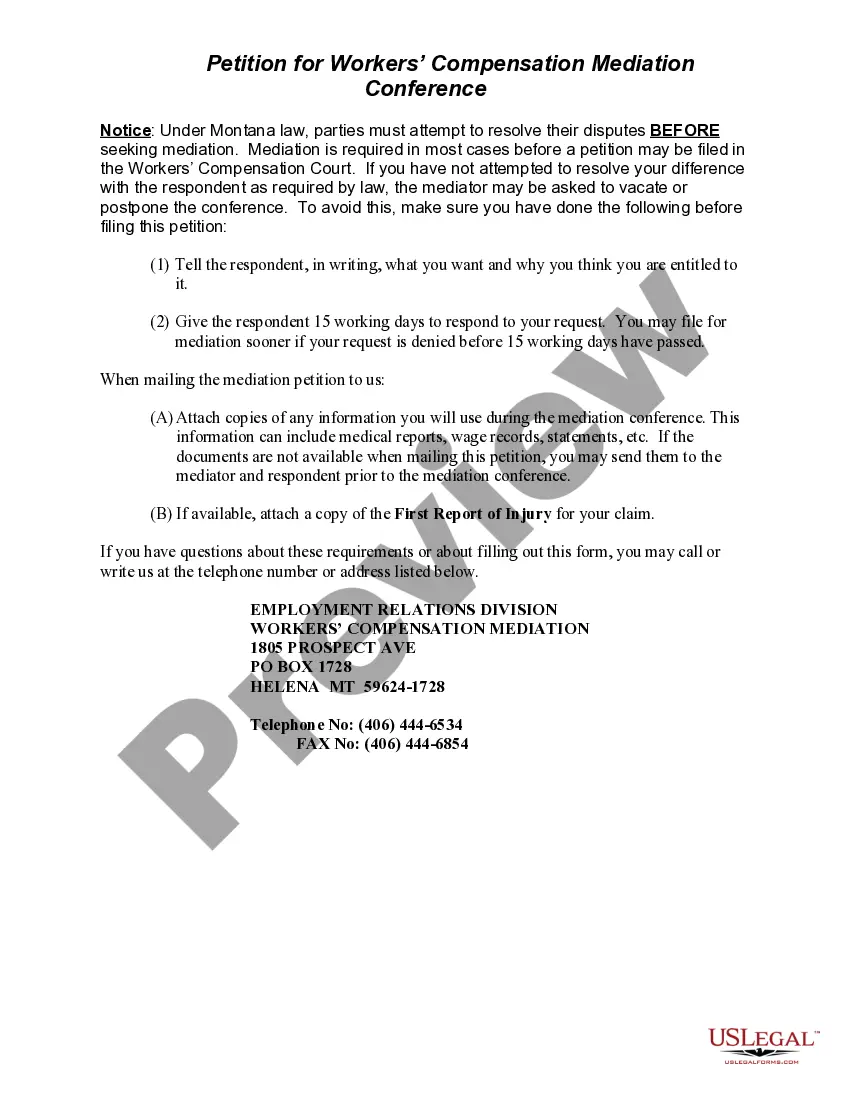

How to fill out North Dakota Statement Of Informal Probate And Appointment Of A Personal Representative Intestacy?

Avoid pricey lawyers and find the North Dakota Statement of Informal Probate and Appointment of a Personal Representative Intestacy you want at a reasonable price on the US Legal Forms site. Use our simple categories function to search for and obtain legal and tax files. Go through their descriptions and preview them just before downloading. Moreover, US Legal Forms enables users with step-by-step tips on how to obtain and complete every single template.

US Legal Forms subscribers basically need to log in and obtain the particular document they need to their My Forms tab. Those, who have not obtained a subscription yet must stick to the guidelines below:

- Ensure the North Dakota Statement of Informal Probate and Appointment of a Personal Representative Intestacy is eligible for use where you live.

- If available, look through the description and make use of the Preview option before downloading the templates.

- If you are sure the template fits your needs, click on Buy Now.

- If the form is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, it is possible to fill out the North Dakota Statement of Informal Probate and Appointment of a Personal Representative Intestacy manually or with the help of an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

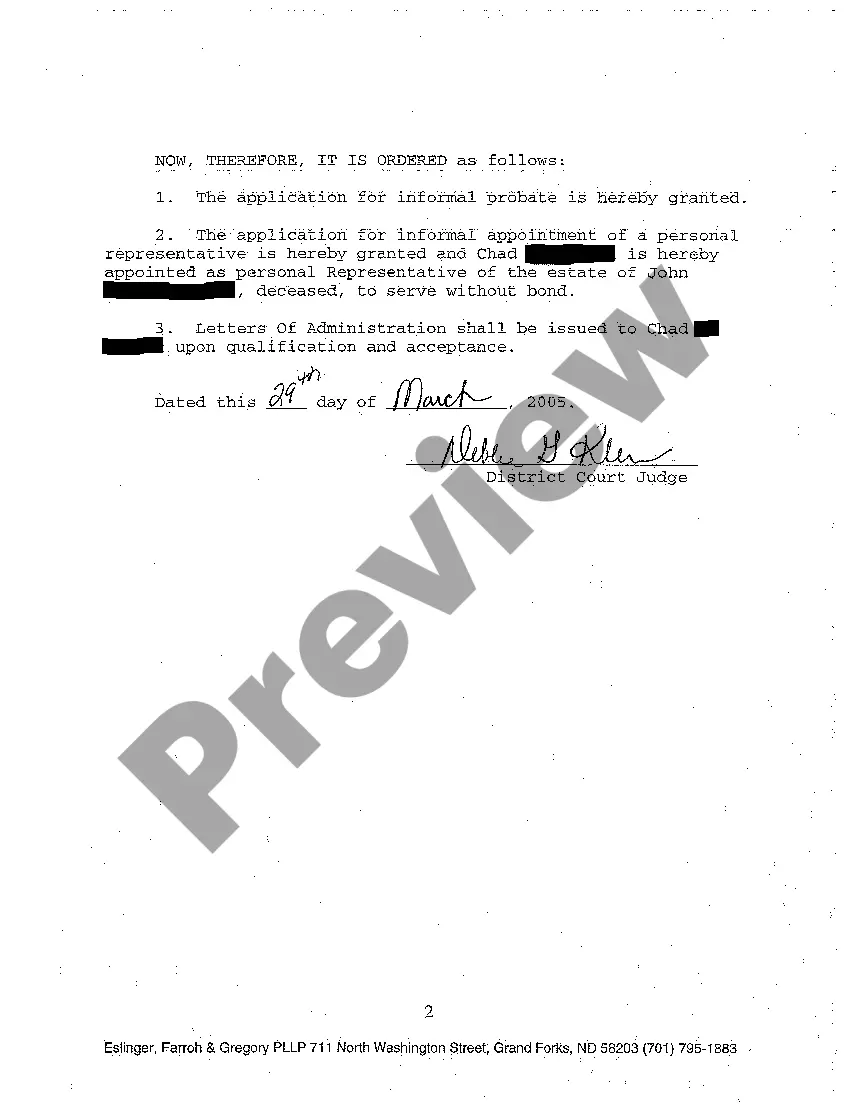

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

When someone dies without a will, it's called dying intestate. When that happens, none of the potential heirs has any say over who gets the estate (the assets and property). When there's no will, the estate goes into probate.Legal fees are paid out of the estate and it often gets expensive.

When a person dies, his or her property must be collected by the personal representative. After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.

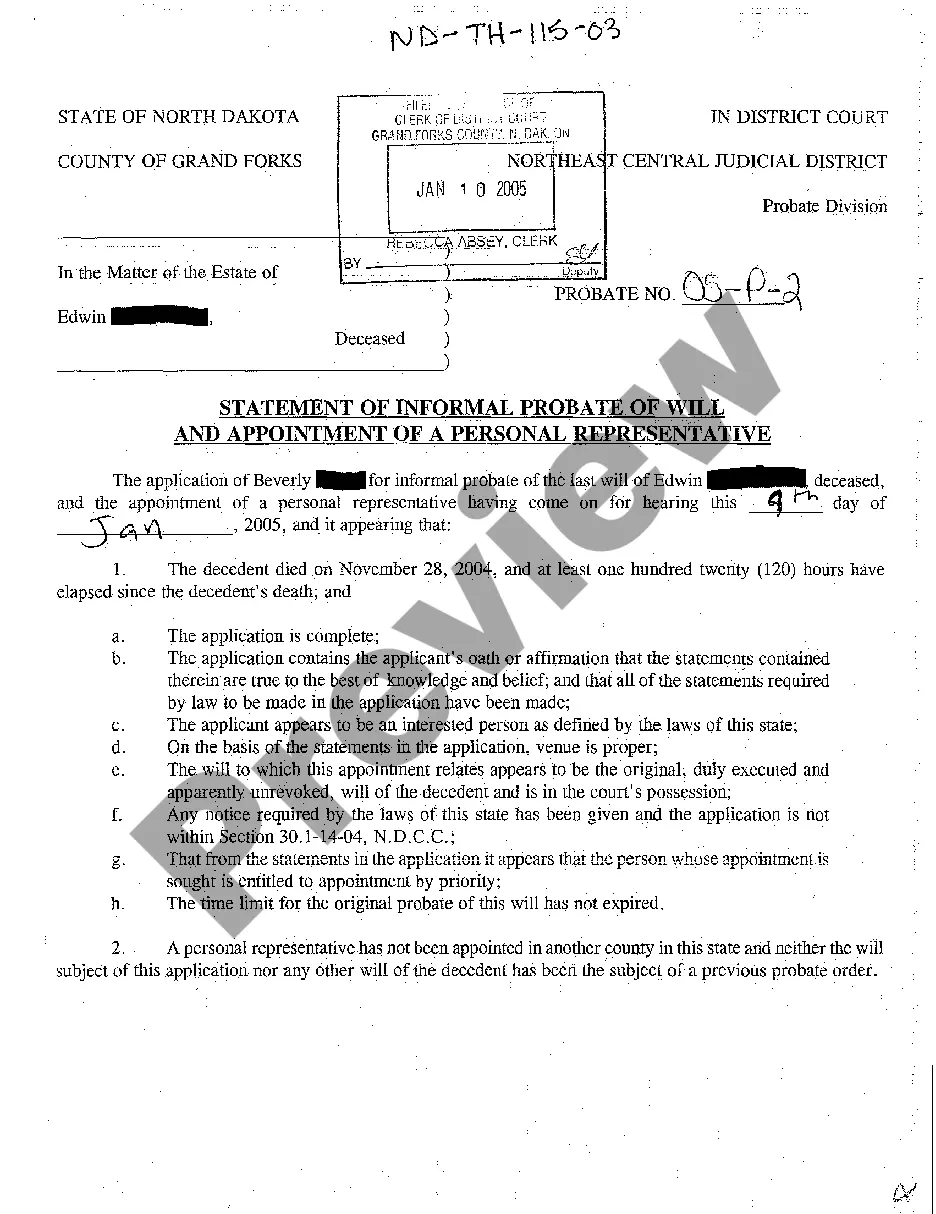

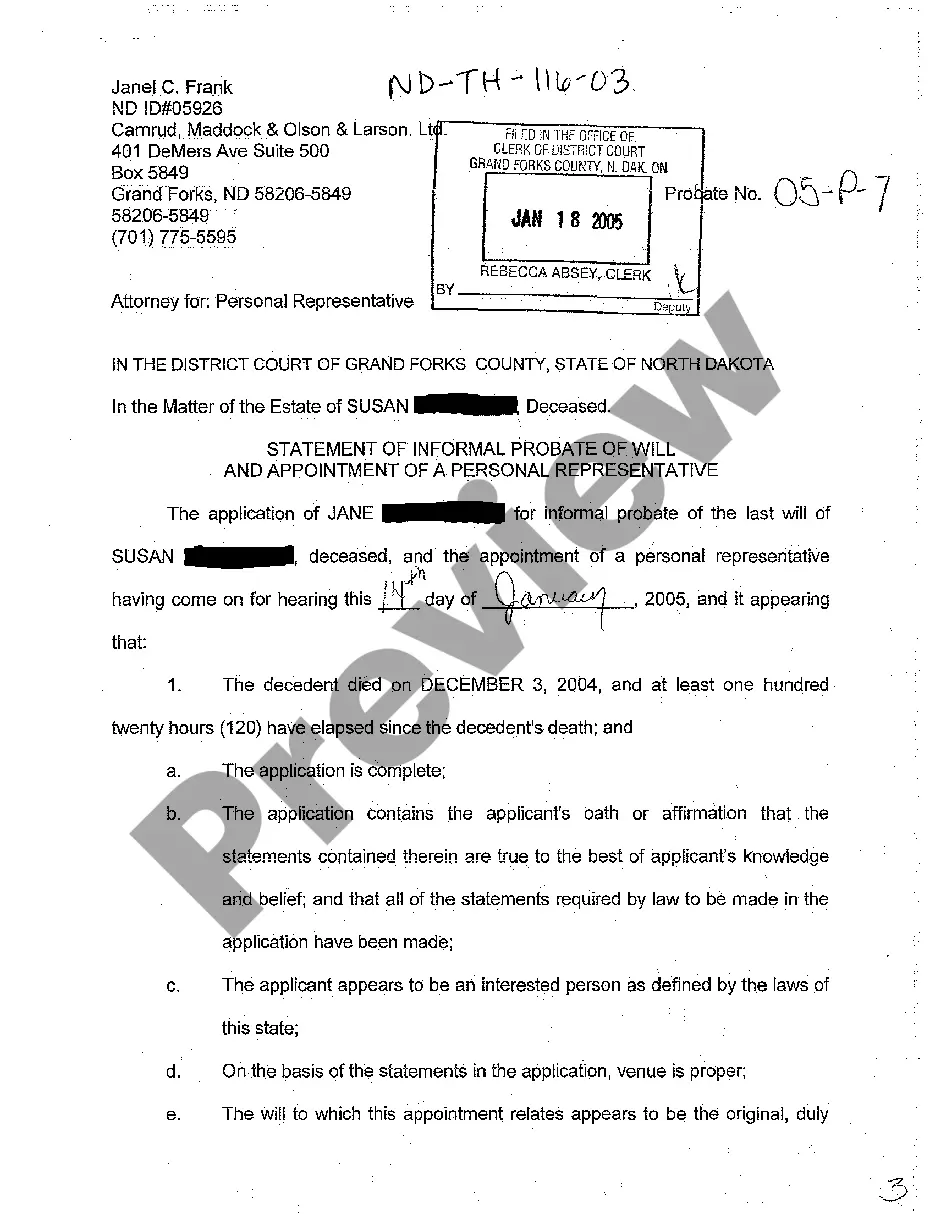

When someone dies without a Will they are said to have died 'intestate' and there is no-one with immediate authority to act as a Personal Representative to administer their Estate. Instead, an application must be made to the Probate Registry for a Grant of Letters of Administration.

Some banks and building societies will release quite large amounts without the need for probate or letters of administration.If the organisation refuses to release money without probate or letters of administration, you must apply for probate or letters of administration even if it is not otherwise needed.

A will generally names an executor to administer the estate. If the decedent's estate has no valid will, you must file a petition with the probate court to administer the estate, and other folks who feel they're just as qualified may file a petition as well.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

In a probate case, an executor (if there is a will) or an administrator (if there is no will) is appointed by the court as personal representative to collect the assets, pay the debts and expenses, and then distribute the remainder of the estate to the beneficiaries (those who have the legal right to inherit), all