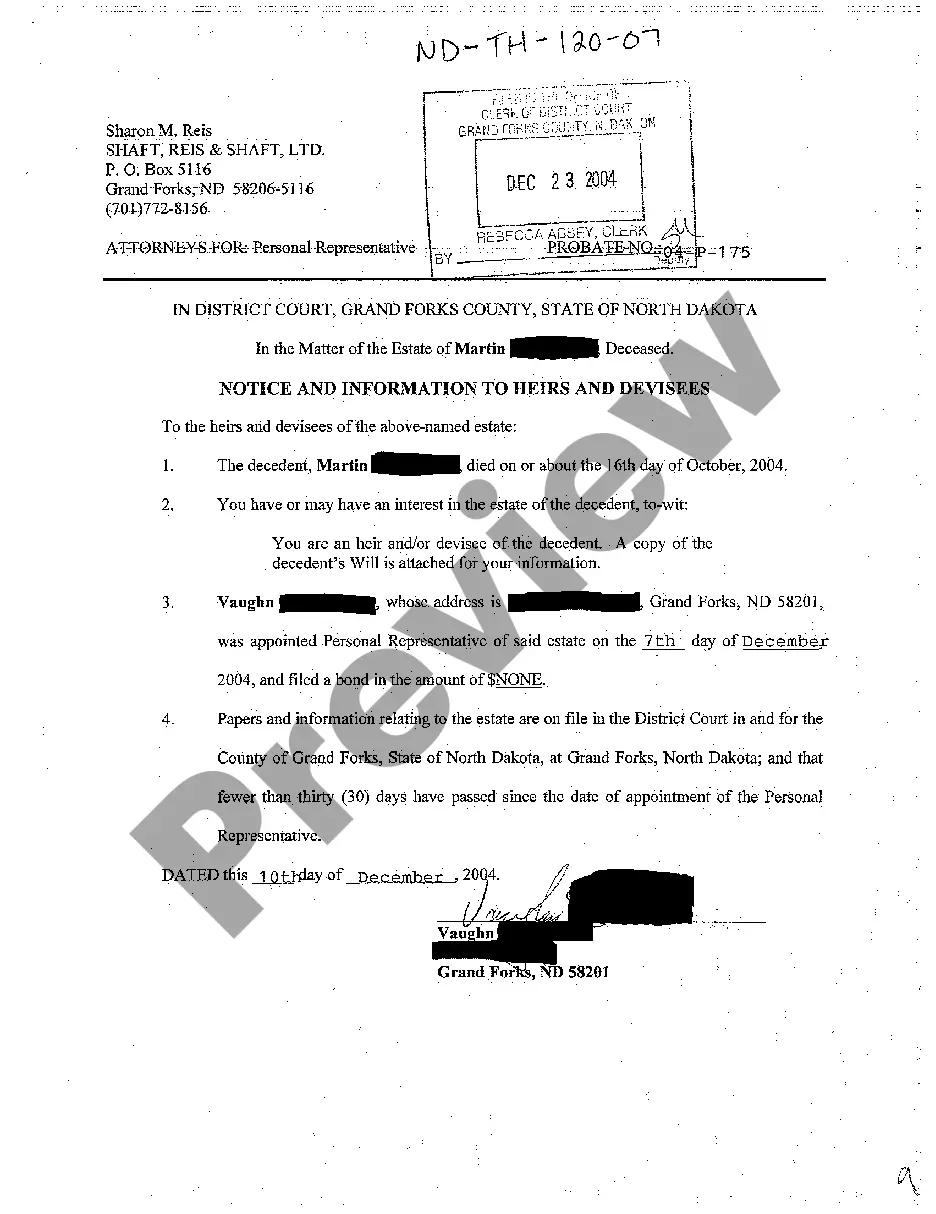

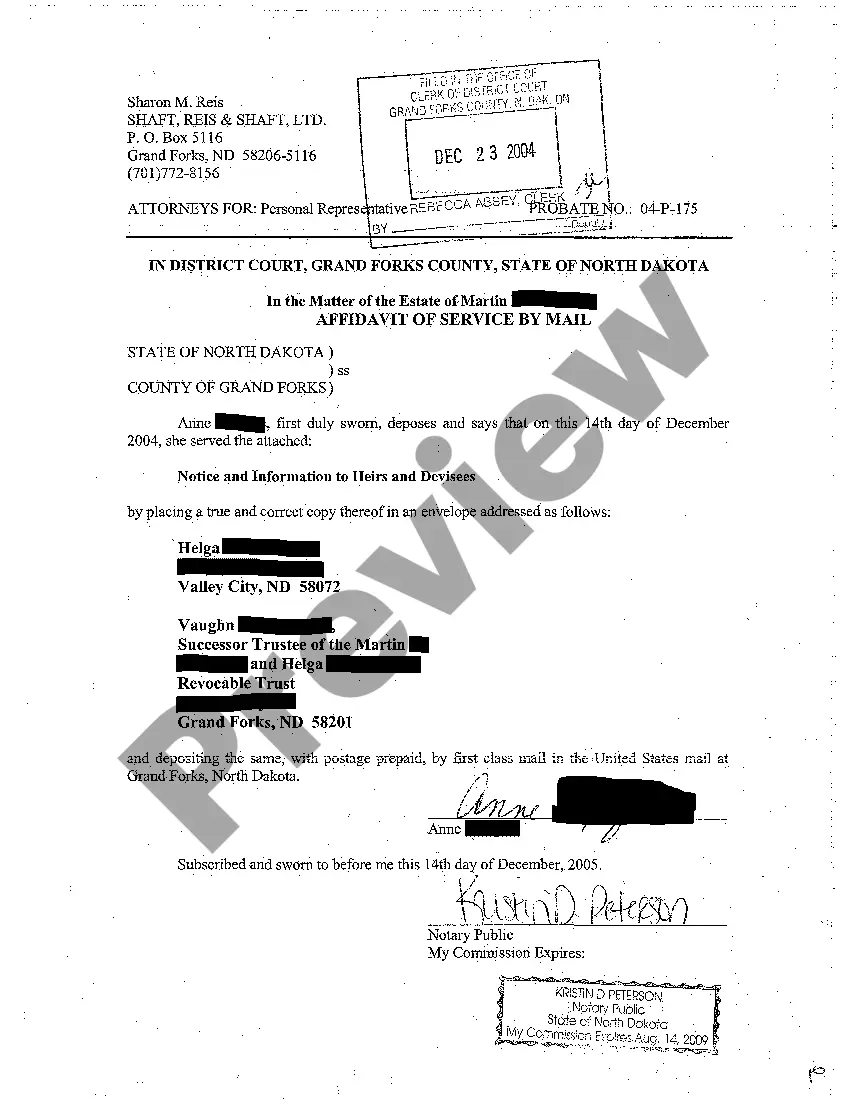

North Dakota Notice and Information to Heirs and Devisees

Description

How to fill out North Dakota Notice And Information To Heirs And Devisees?

Avoid costly lawyers and find the North Dakota Notice and Information to Heirs and Devisees you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to find and download legal and tax forms. Read their descriptions and preview them before downloading. Moreover, US Legal Forms enables users with step-by-step tips on how to obtain and complete every form.

US Legal Forms subscribers merely must log in and download the specific form they need to their My Forms tab. Those, who have not got a subscription yet must follow the tips below:

- Make sure the North Dakota Notice and Information to Heirs and Devisees is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the templates.

- If you’re confident the document fits your needs, click Buy Now.

- In case the form is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, you may fill out the North Dakota Notice and Information to Heirs and Devisees by hand or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

4. When a will has been discovered, copies of the will should be prepared for the beneficiaries and devisees. ANS: T True Correct. A summary of the contents of the will should also be included.

The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

If there is no named executor, a person, usually a friend, family member or another interested party, may come forward and petition the court to become the administrator of the estate by obtaining letters of administration. If no one comes forward on their own, the court may ask a person to serve as an administrator.

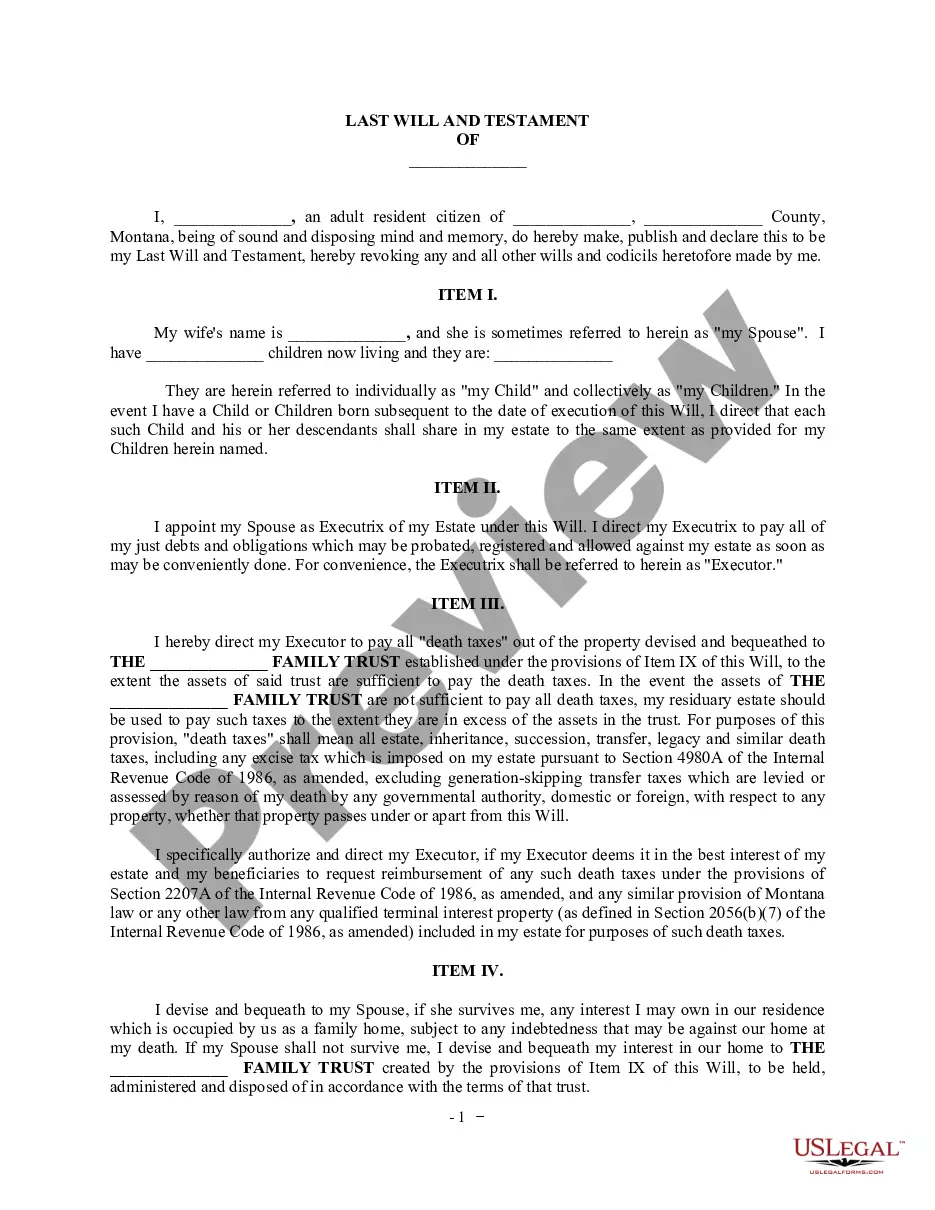

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).