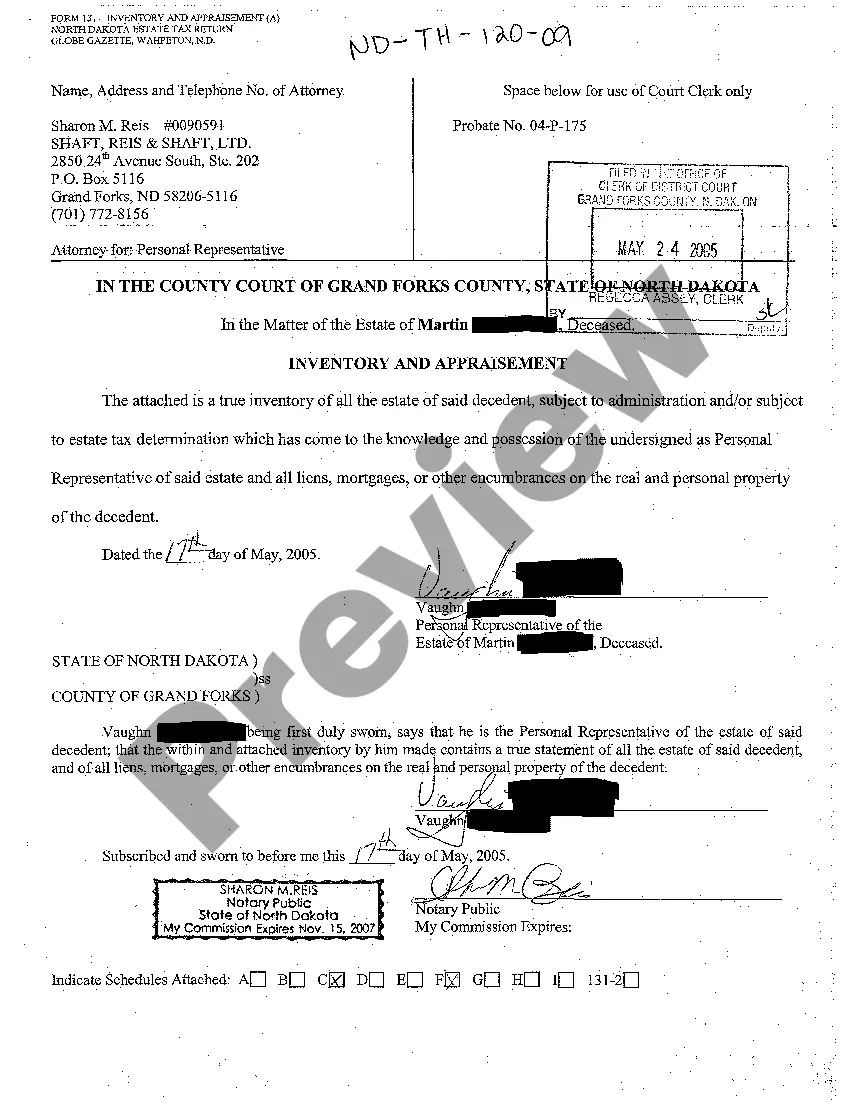

North Dakota Inventory and Appraisement

Description

How to fill out North Dakota Inventory And Appraisement?

Avoid expensive lawyers and find the North Dakota Inventory and Appraisement you want at a affordable price on the US Legal Forms website. Use our simple groups functionality to look for and download legal and tax files. Read their descriptions and preview them before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to download and complete each form.

US Legal Forms clients just need to log in and get the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to follow the guidelines below:

- Ensure the North Dakota Inventory and Appraisement is eligible for use in your state.

- If available, look through the description and make use of the Preview option prior to downloading the templates.

- If you are sure the document fits your needs, click on Buy Now.

- In case the form is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you can complete the North Dakota Inventory and Appraisement by hand or with the help of an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Real Estate, Bank Accounts, and Vehicles.Stocks and Bonds.Life Insurance and Retirement Plans.Wages and Business Interests.Intellectual Property.Debts and Judgments.

In short, yes. Household items do have to go through the probate process as they are considered probate assets with no explicit or individual title. These assets (items like furniture, clothing, collections, artwork, jewelry, etc.)

In general, an estate inventory checklist will include financial assets that belonged to the deceased.You will need a certified copy of the death certificate to show the bank to find out the amounts held in each account. Probate inventory samples generally list savings bonds, annuities and certificates of deposit.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

Put important documents where the executor can find them. A typical executor spends a lot of time searching for pieces of paper: the will, bank statements, insurance policies, birth and marriage certificates, divorce decrees, military discharge papers, cemetery deeds2026 you get the idea.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.