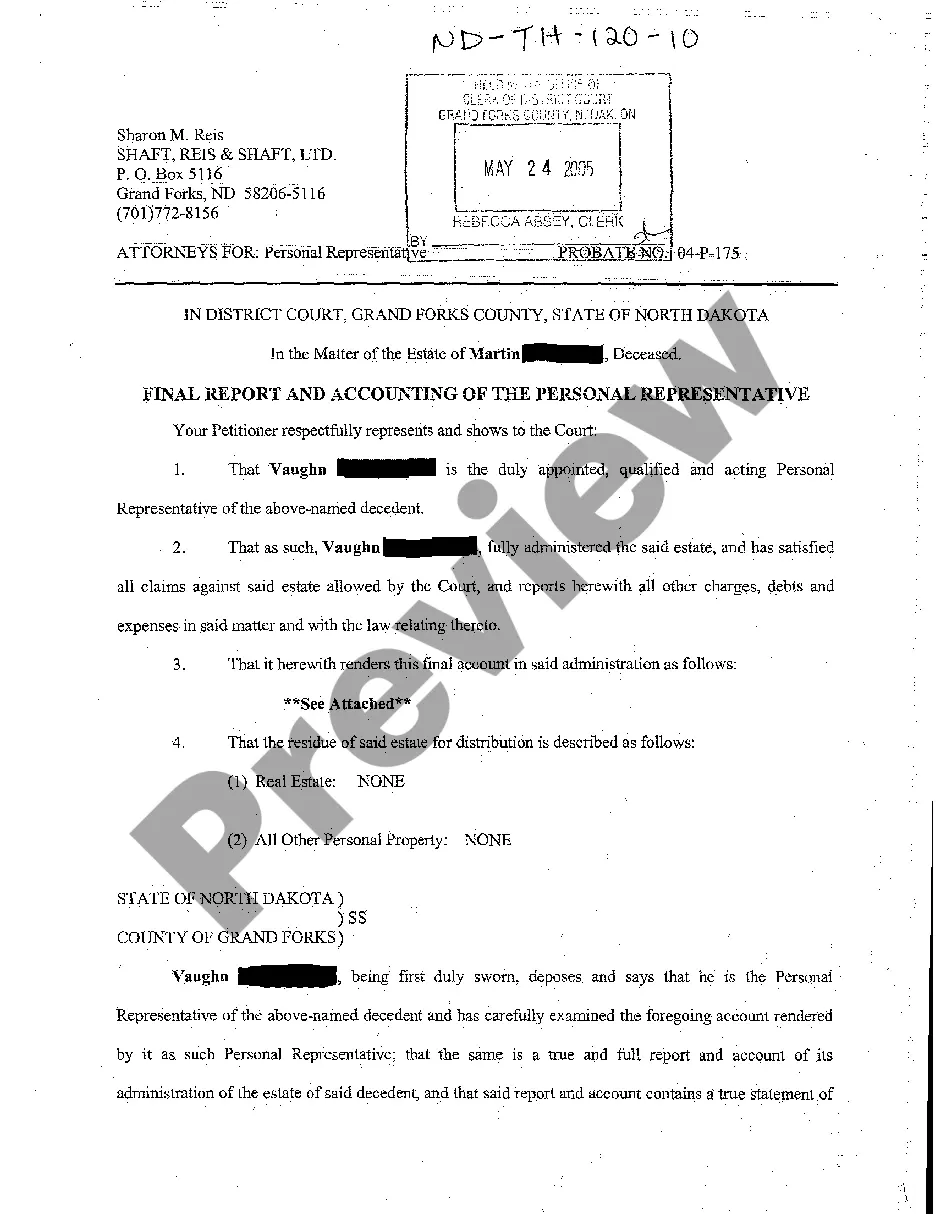

North Dakota Final Report and Accounting of the Personal Representative

Description

How to fill out North Dakota Final Report And Accounting Of The Personal Representative?

Avoid expensive attorneys and find the North Dakota Final Report and Accounting of the Personal Representative you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to look for and obtain legal and tax files. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and fill out every single template.

US Legal Forms subscribers just must log in and get the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the guidelines below:

- Make sure the North Dakota Final Report and Accounting of the Personal Representative is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you’re confident the document fits your needs, click on Buy Now.

- If the form is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

After downloading, you are able to fill out the North Dakota Final Report and Accounting of the Personal Representative manually or with the help of an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

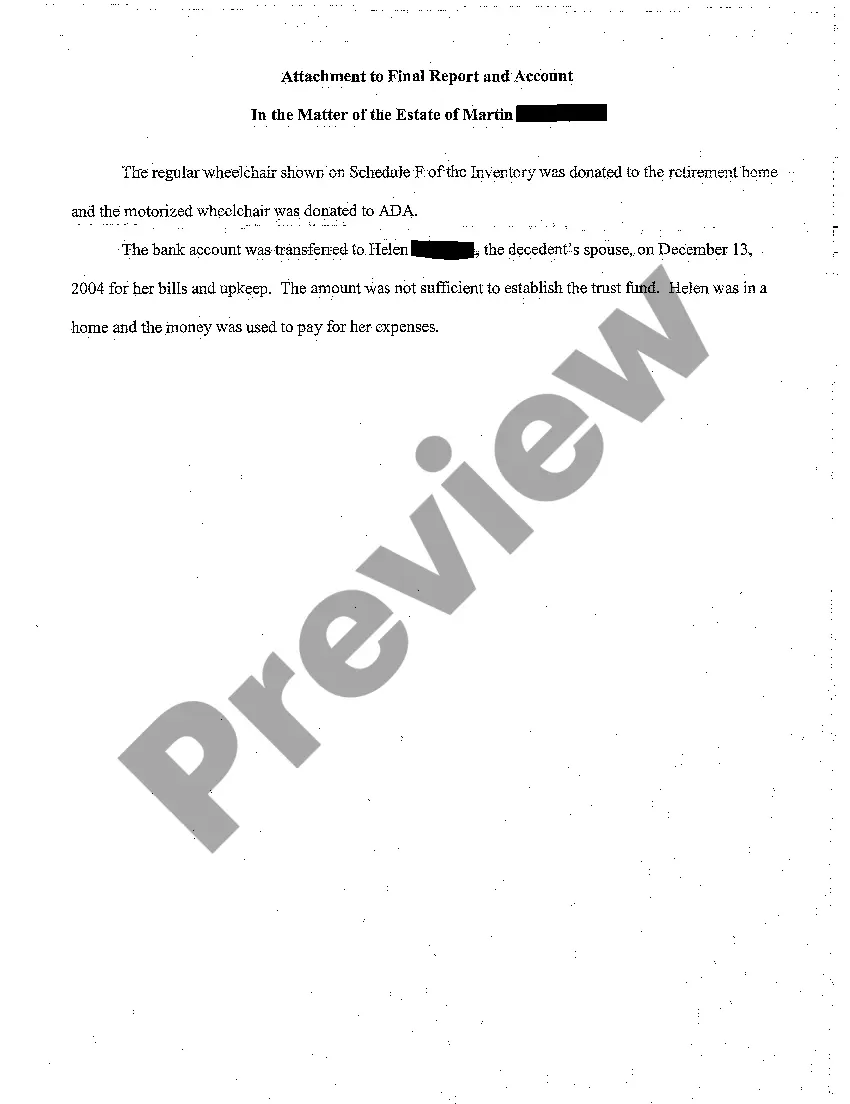

When a person dies, his or her property must be collected by the personal representative. After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.

As a will can be written by the testator at any point during their lives, it is possible for the named executor or executors to pass away prior to the testator. If there is more than one named executor and only one passes away prior to the testator, the remaining executor(s) will continue their duties.

Which is NOT a duty of the personal representative in closing the estate after the distribution of assets?The law firm's fee must be paid before assets are distributed. Signing and filing a petition for settlement and distribution Incorrect. The court will then issue an order setting a hearing on the final account.

If an Executor passes away before they are able to complete the duties required by them to settle the assets and estate, but after the court has granted the probate. The beneficiaries will need to find out if the executor has left a will.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

By River Braun, J.D. If a will's executor dies or is unable to serve for other reasons, the court appoints another person. After your death, this person, also called an agent, personal representative, or fiduciary, handles your estate.

A power of attorney is no longer valid after death. The only person permitted to act on behalf of an estate following a death is the personal representative or executor appointed by the court. Assets need to be protected. Following the death of a loved one, there is often a period of chaos.

As a fiduciary, a personal representative can be removed for waste, embezzlement, mismanagement, fraud, and for any other reason the court deems sufficient.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.