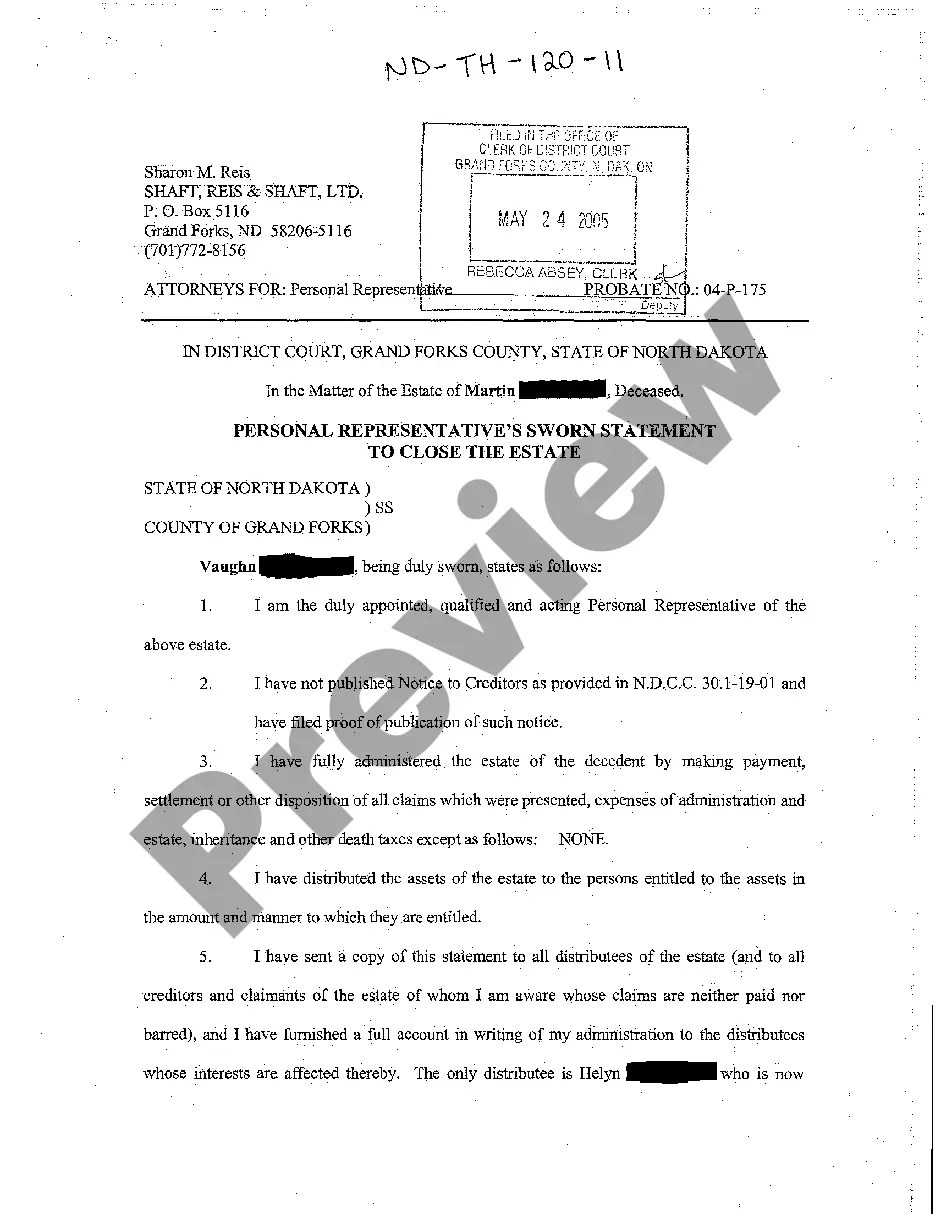

North Dakota Personal Representative's Sworn Statement to Close the Estate

Description

How to fill out North Dakota Personal Representative's Sworn Statement To Close The Estate?

Avoid pricey attorneys and find the North Dakota Personal Representative's Sworn Statement to Close the Estate you need at a affordable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax documents. Read their descriptions and preview them well before downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and fill out each and every template.

US Legal Forms subscribers merely must log in and download the particular document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the guidelines below:

- Ensure the North Dakota Personal Representative's Sworn Statement to Close the Estate is eligible for use where you live.

- If available, read the description and use the Preview option well before downloading the templates.

- If you are sure the document meets your needs, click on Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

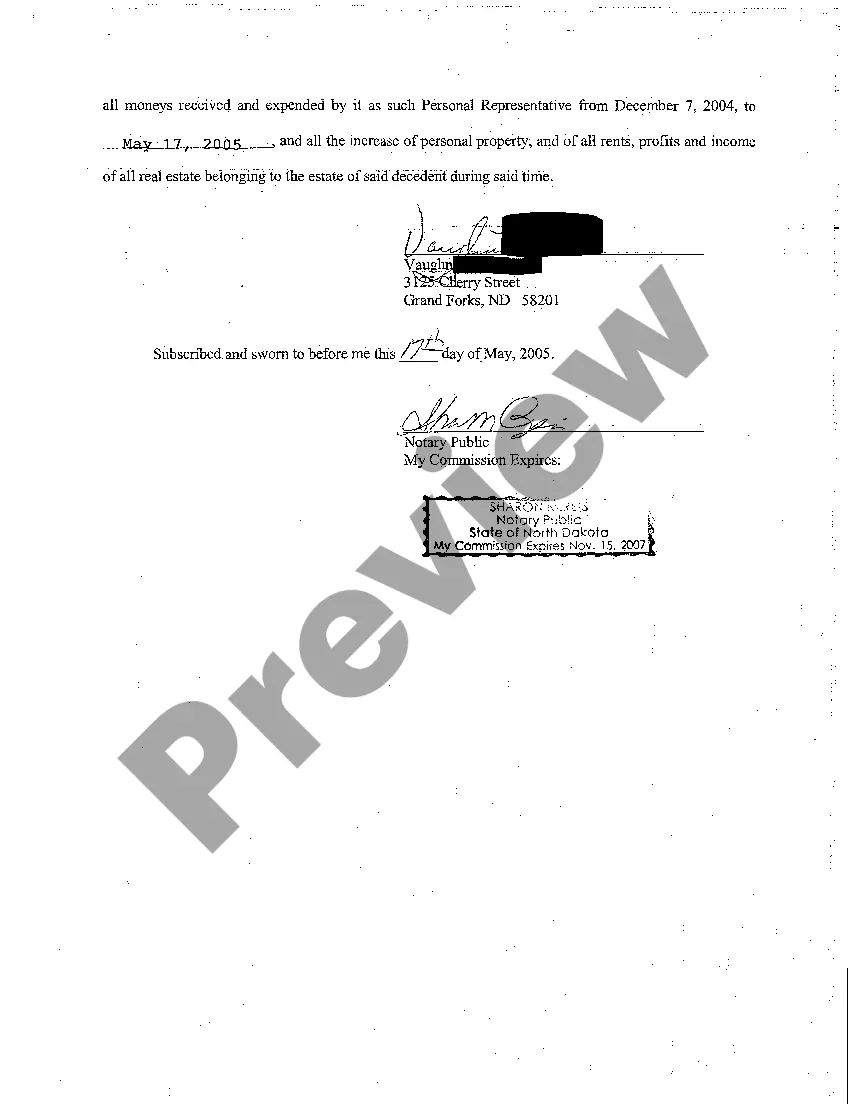

After downloading, it is possible to fill out the North Dakota Personal Representative's Sworn Statement to Close the Estate by hand or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

If you are named as an executor in the deceased's will, you must produce proof of your executor status and provide a certified copy of the death certificate before the bank will provide access to the account.Present either of these letters to the bank along with the death certificate to close the account.

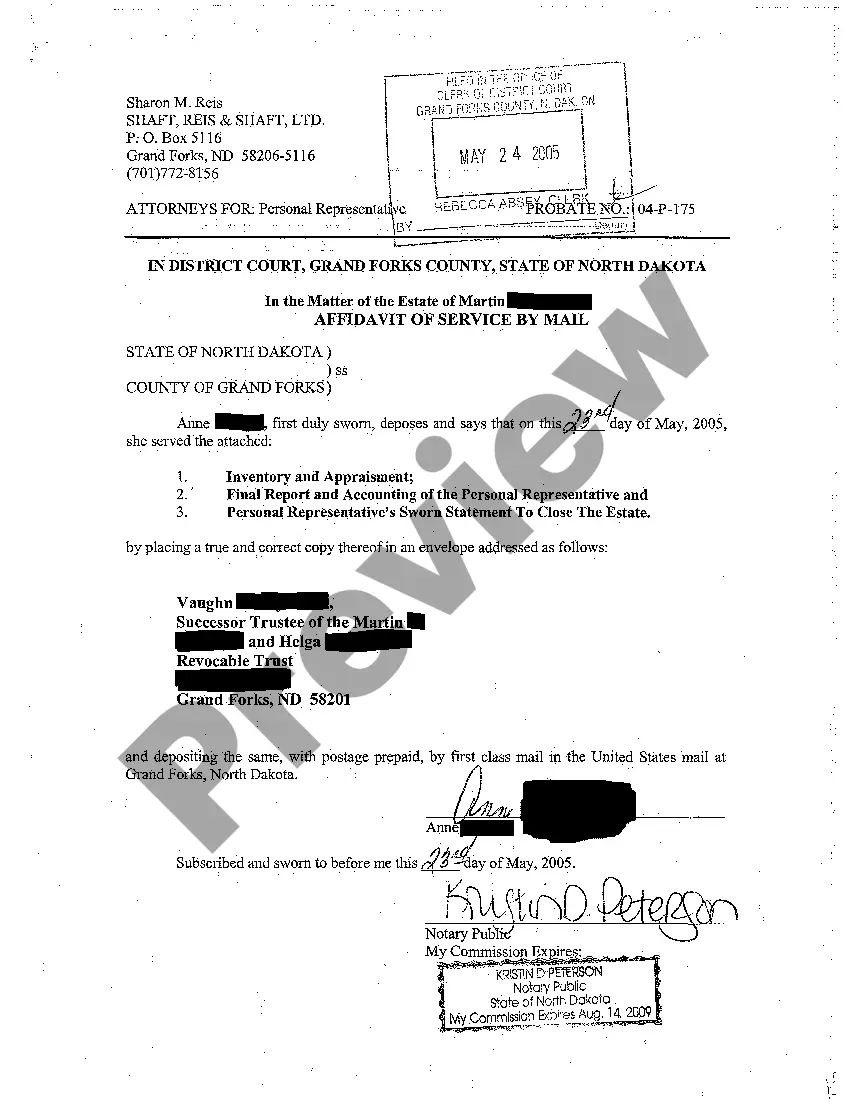

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

Which is NOT a duty of the personal representative in closing the estate after the distribution of assets?The law firm's fee must be paid before assets are distributed. Signing and filing a petition for settlement and distribution Incorrect. The court will then issue an order setting a hearing on the final account.

However, if the other beneficiary is someone you do not know well, someone who you suspect will spend all the money right away, or someone who will not readily help you pay for a future bill, then you should keep the account open, perhaps until two years have passed since the date of death.

Get appointed as administrator or personal representative of the estate. Identify, record and gather all the decedent's assets. Pay the decedent's outstanding debts and taxes. Distribute the remaining assets to family, heirs or beneficiaries. Terminate or close the estate.