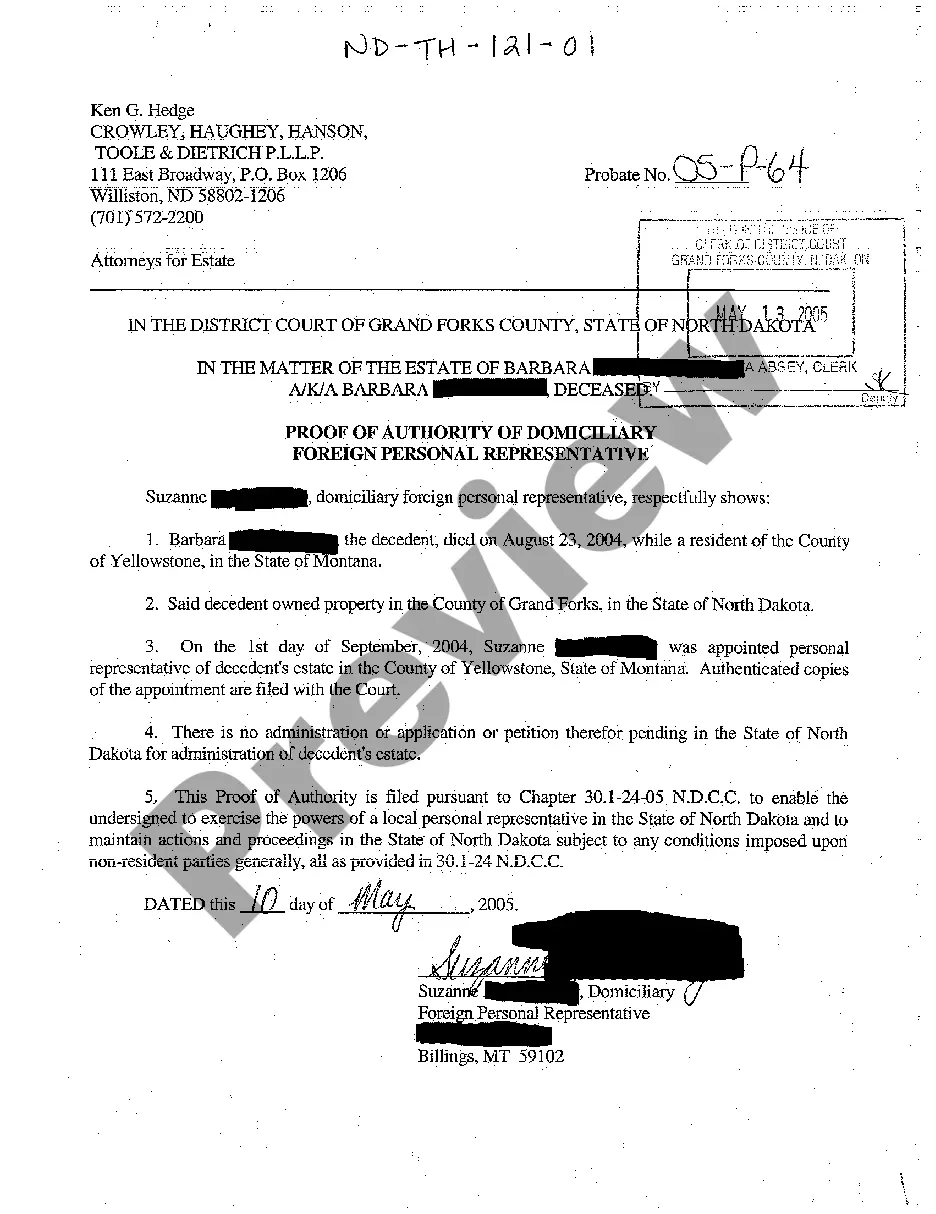

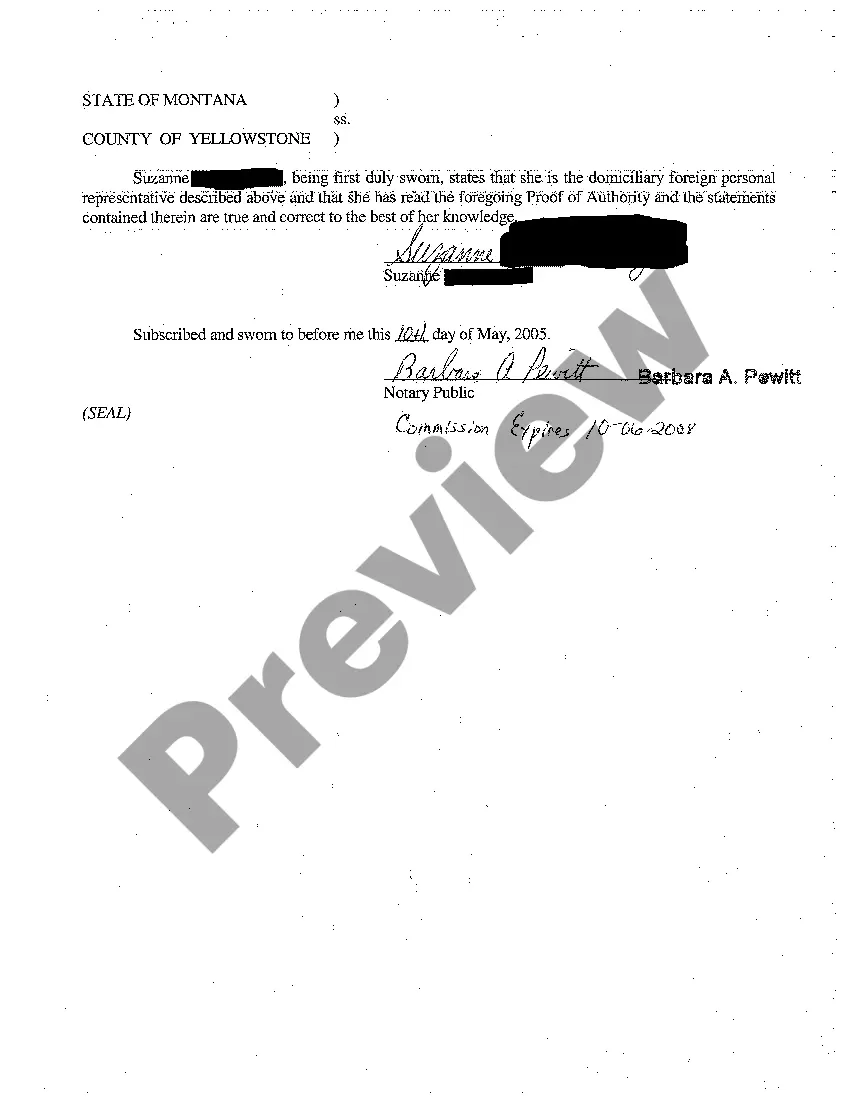

North Dakota Proof of Authority of Domiciliary Foreign Personal Representative

Description

How to fill out North Dakota Proof Of Authority Of Domiciliary Foreign Personal Representative?

Among lots of paid and free templates that you can find online, you can't be sure about their accuracy. For example, who created them or if they are skilled enough to deal with what you need these people to. Always keep relaxed and utilize US Legal Forms! Get North Dakota Proof of Authority of Domiciliary Foreign Personal Representative samples made by skilled legal representatives and avoid the costly and time-consuming process of looking for an lawyer or attorney and after that having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are looking for. You'll also be able to access your previously saved documents in the My Forms menu.

If you’re using our platform for the first time, follow the tips below to get your North Dakota Proof of Authority of Domiciliary Foreign Personal Representative with ease:

- Make certain that the file you find is valid in the state where you live.

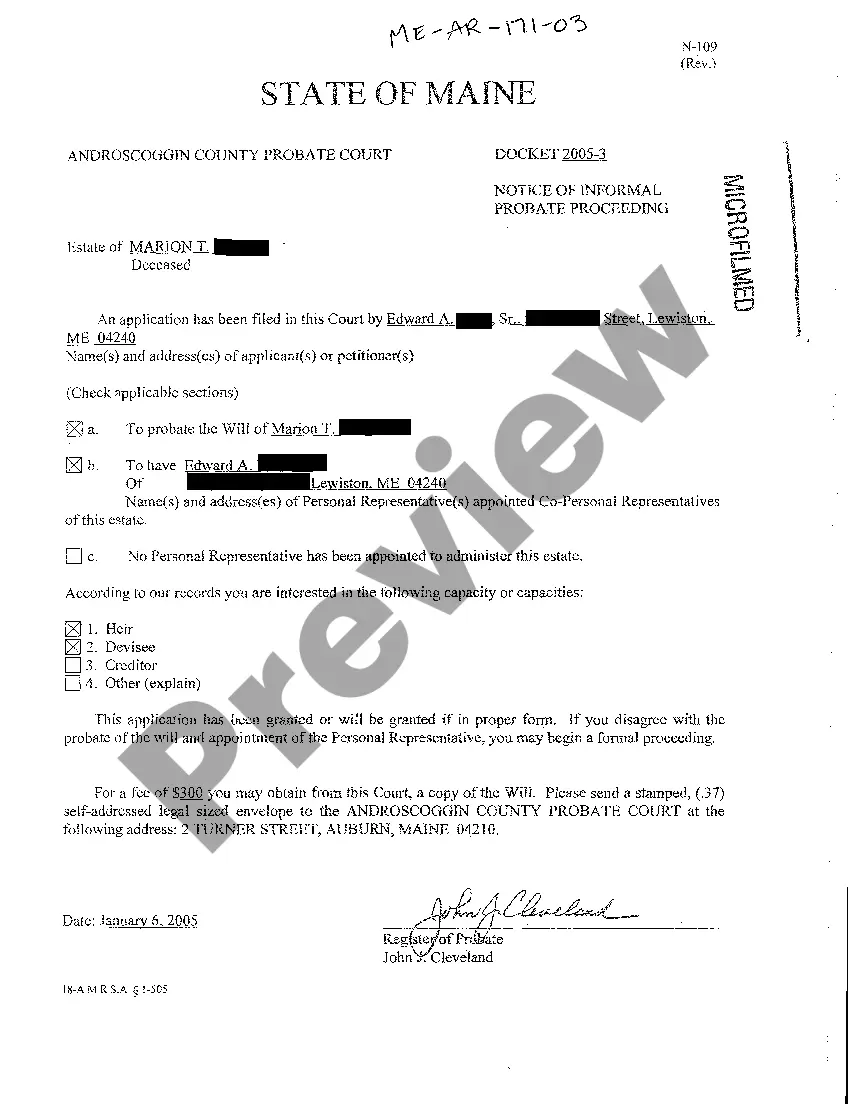

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another template using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and bought your subscription, you can use your North Dakota Proof of Authority of Domiciliary Foreign Personal Representative as many times as you need or for as long as it remains valid where you live. Change it with your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Domiciliary foreign personal representative means a personal representative appointed by another jurisdiction in which the decedent was domiciled at the time of the decedent's death.

Ancillary administration is "the administration of a decedent's estate in a state other than the one in which she lived, for the purpose of disposing of property she owned there." Another definition is the "administration of an estate's asset's in another state." This is often a necessary procedure in probate, because

Locate Documents. Record the preferences of the testator. Check status of property and accounts. Confirm beneficiaries are correct. Make a list of personal possessions. Create a schedule of assets. Make a list of credit cards and debts. Electronic access to information.

An executor is someone named in your will, or appointed by the court, who is given the legal responsibility to take care of any remaining financial obligations. Typical duties include: Distributing assets according to the will. Maintaining property until the estate is settled (e.g., upkeep of a house)

The personal representative is the court representative who has the authority to search for any important documents. The search should include the home, office, place of business, and any safe deposit boxes.

Determine Your Priority for Appointment. Receive Written Waivers From Other Candidates. Contact Court in the County Where Deceased Resided. File the Petition for Administration. Attend the Probate Hearing. Secure a Probate Bond.

A personal representative or legal personal representative is the executor or administrator for the estate of a deceased person.The law requires personal representatives to follow the terms of the deceased person's will, if the individual who died had one.

You can administer an estate even if the deceased died without a will or failed to specify an executor. If your relationship to the deceased doesn't make you the probate court's default choice for administrator, you'll need to get permission from the relatives ahead of you in the priority order.

A personal representative usually is named in a will. However, courts sometimes appoint a personal representative. Usually, whether or not the deceased left a will, the probate court will issue a finding of fact that a will has or has not been filed and a personal representative or administrator has been appointed.