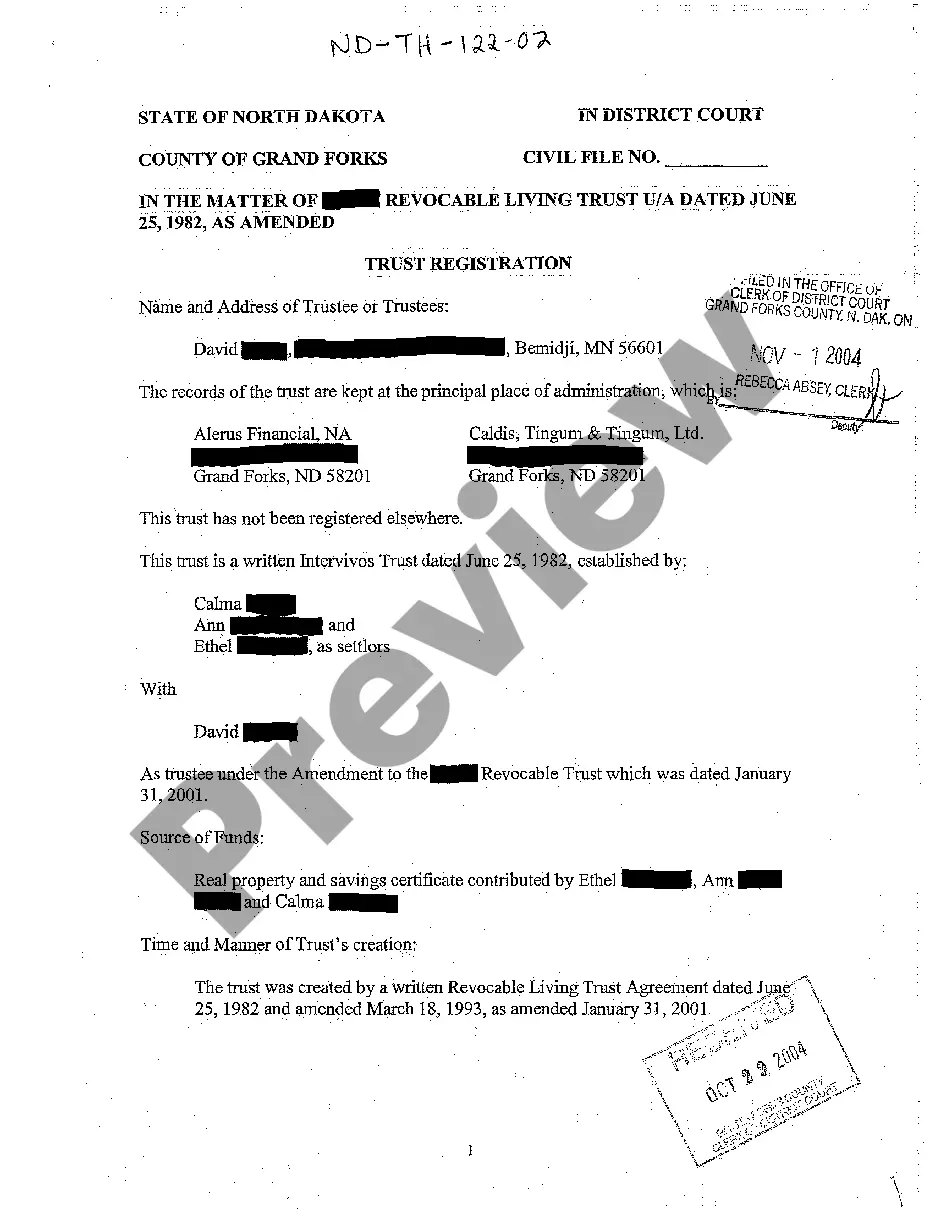

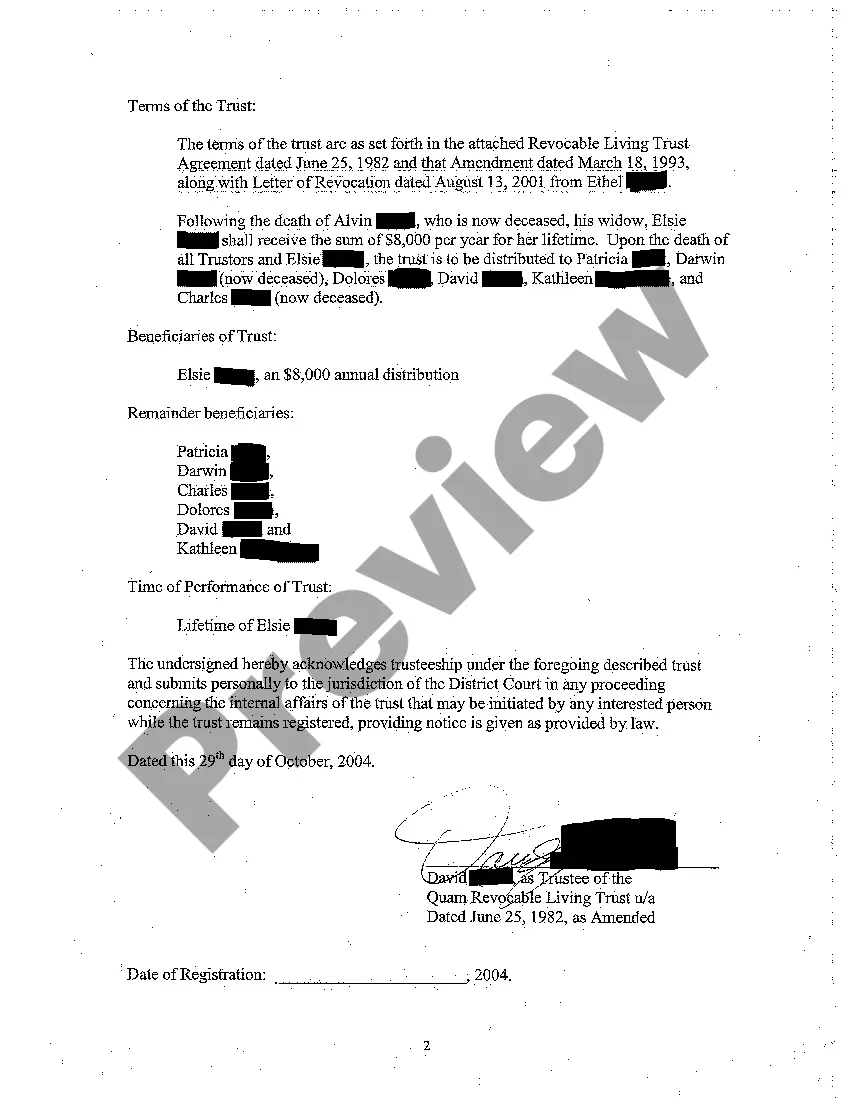

North Dakota Trust Registration

Description

How to fill out North Dakota Trust Registration?

Among lots of free and paid templates that you can get on the internet, you can't be certain about their accuracy and reliability. For example, who made them or if they are skilled enough to deal with what you require these to. Always keep relaxed and make use of US Legal Forms! Find North Dakota Trust Registration templates created by skilled legal representatives and avoid the high-priced and time-consuming procedure of looking for an attorney and after that paying them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you are looking for. You'll also be able to access all of your previously downloaded templates in the My Forms menu.

If you are utilizing our platform the very first time, follow the instructions listed below to get your North Dakota Trust Registration quick:

- Ensure that the file you see is valid in your state.

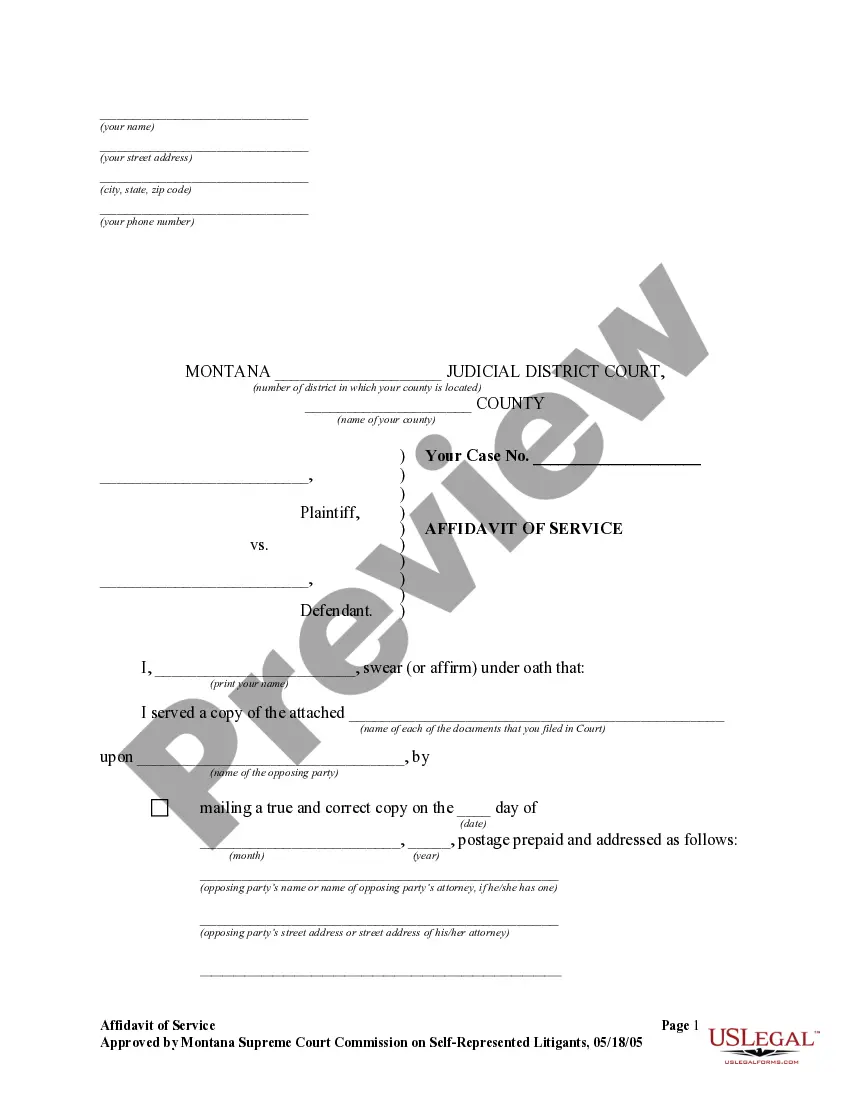

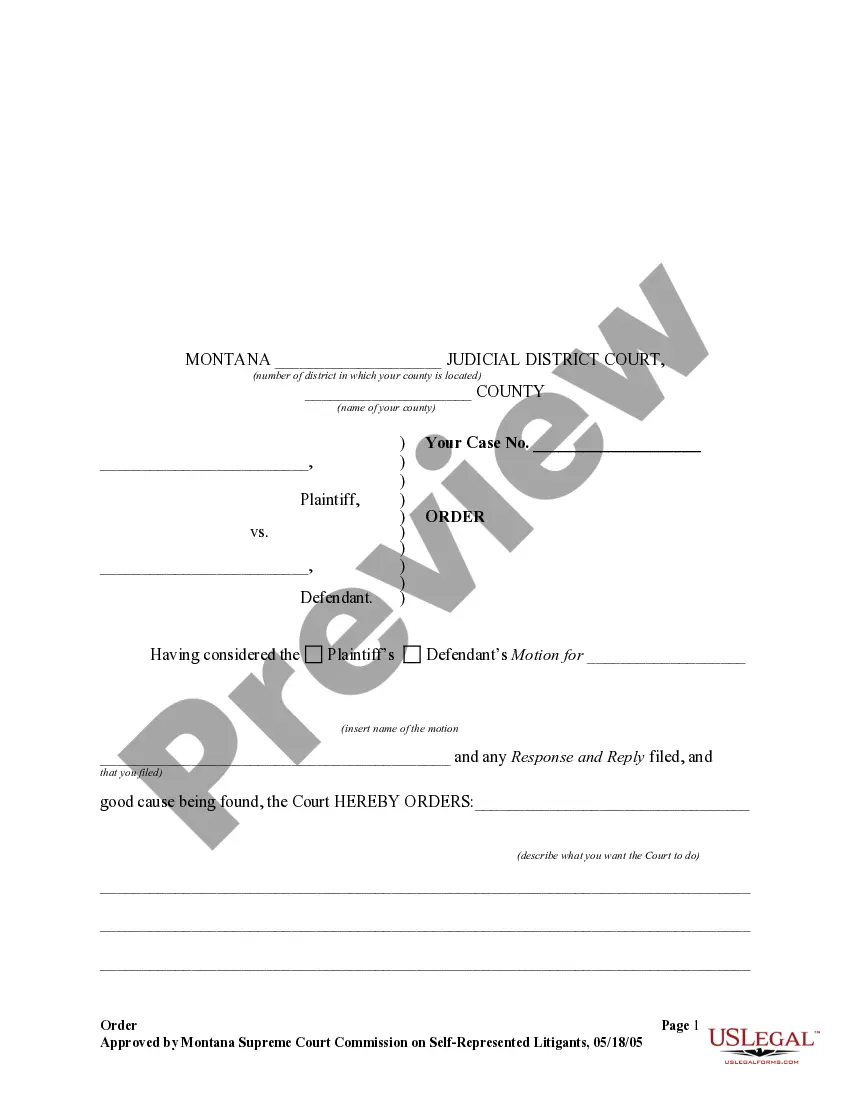

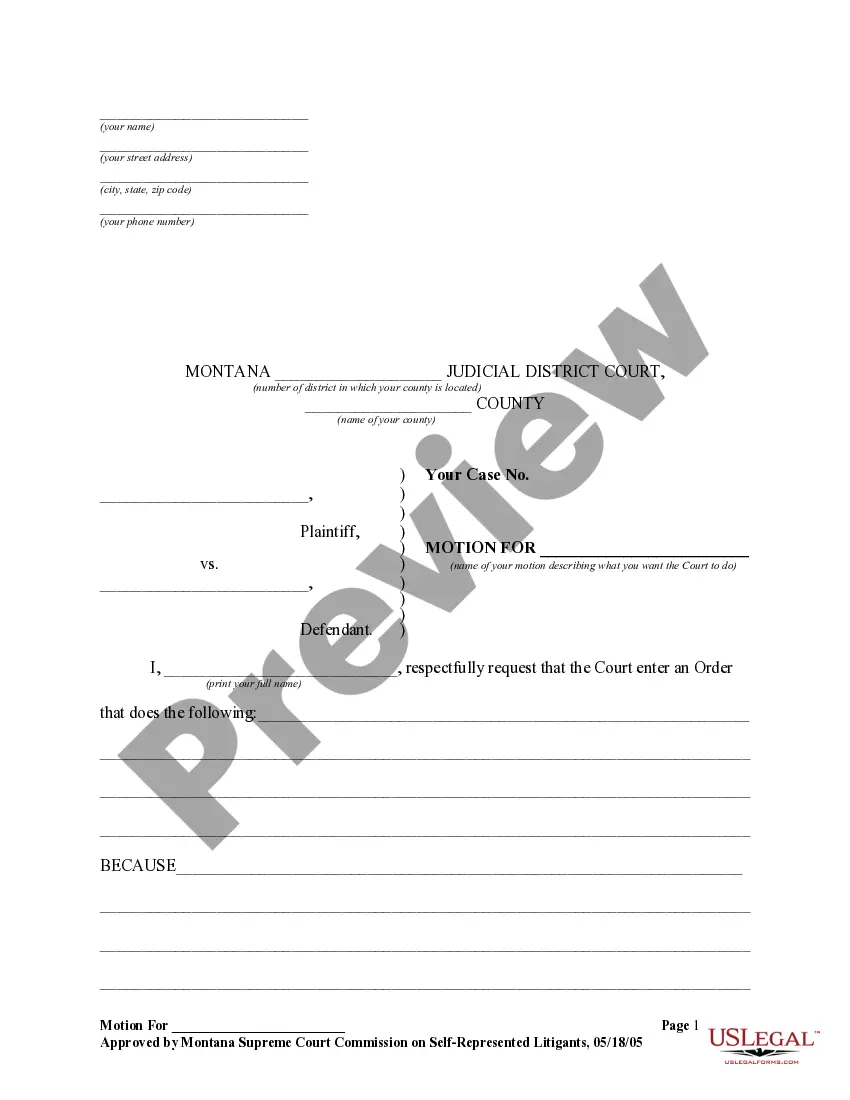

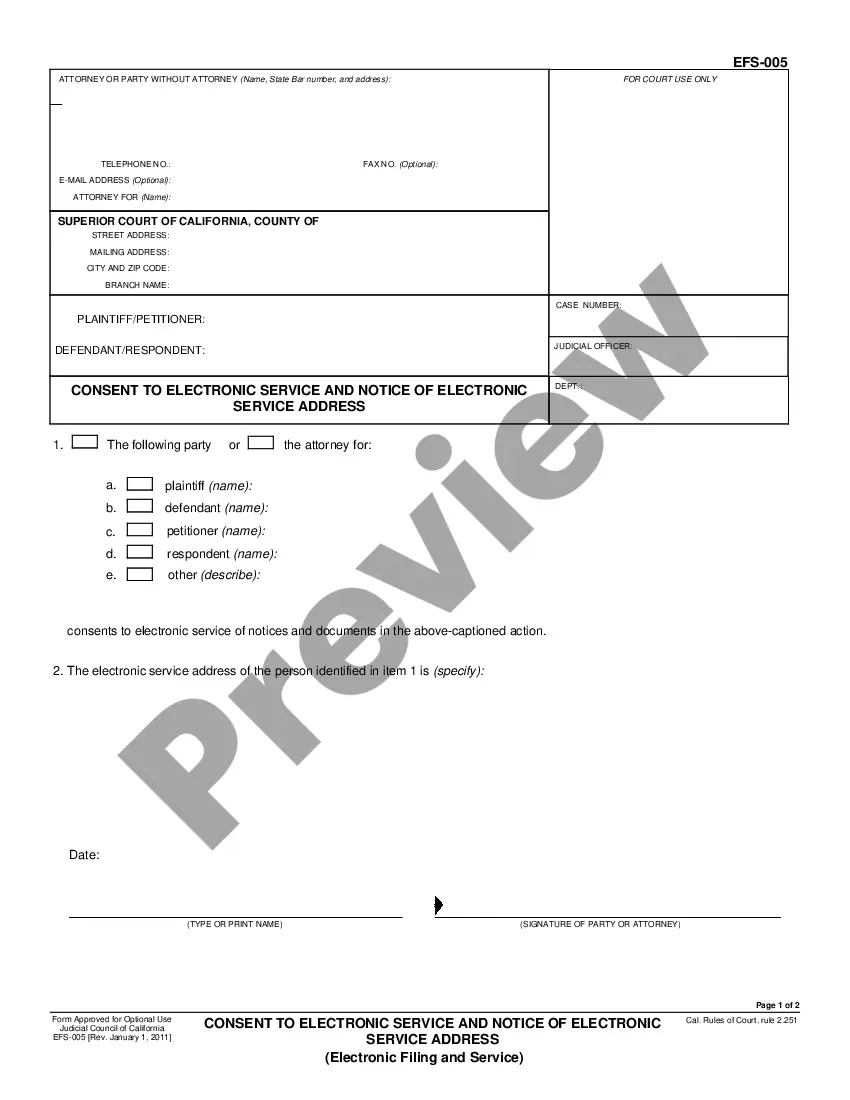

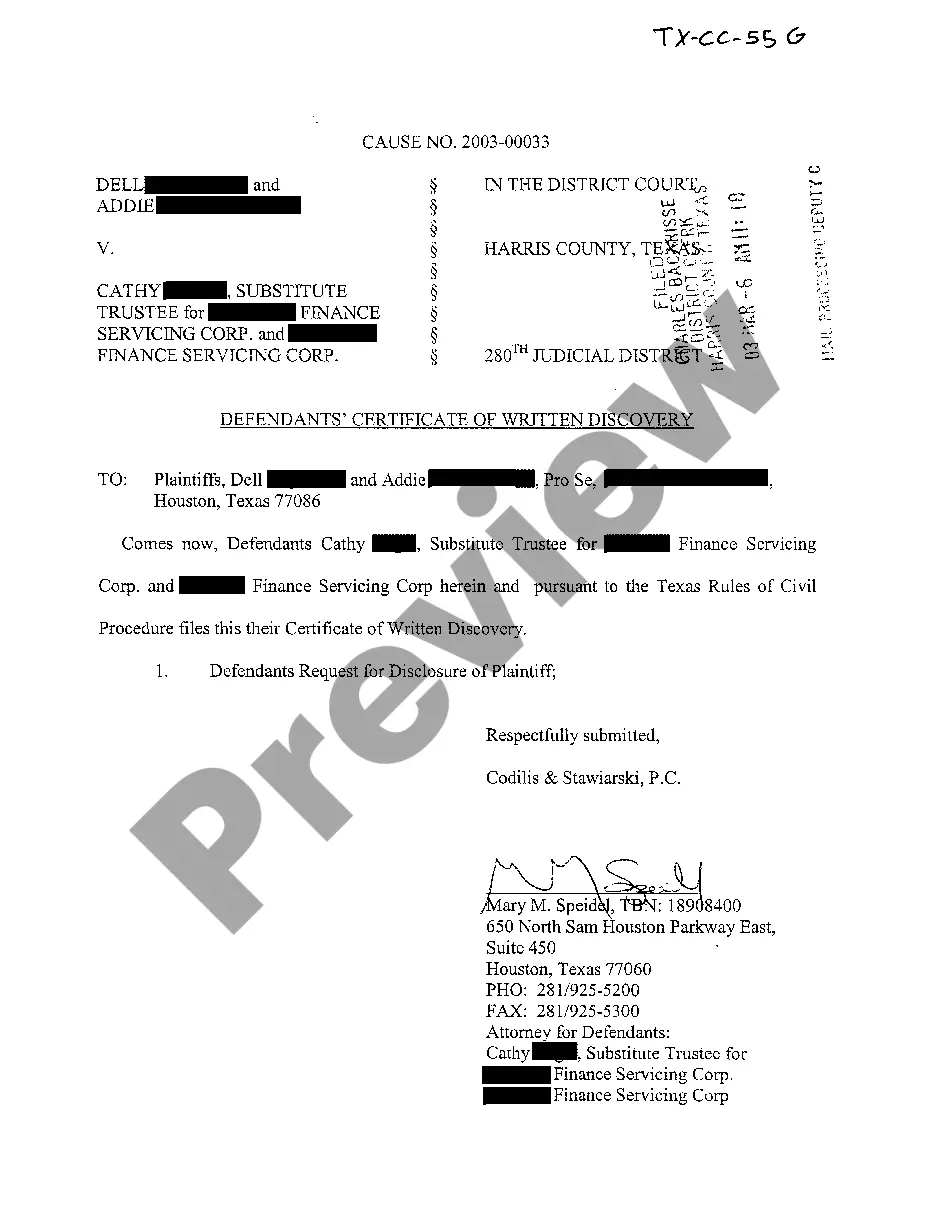

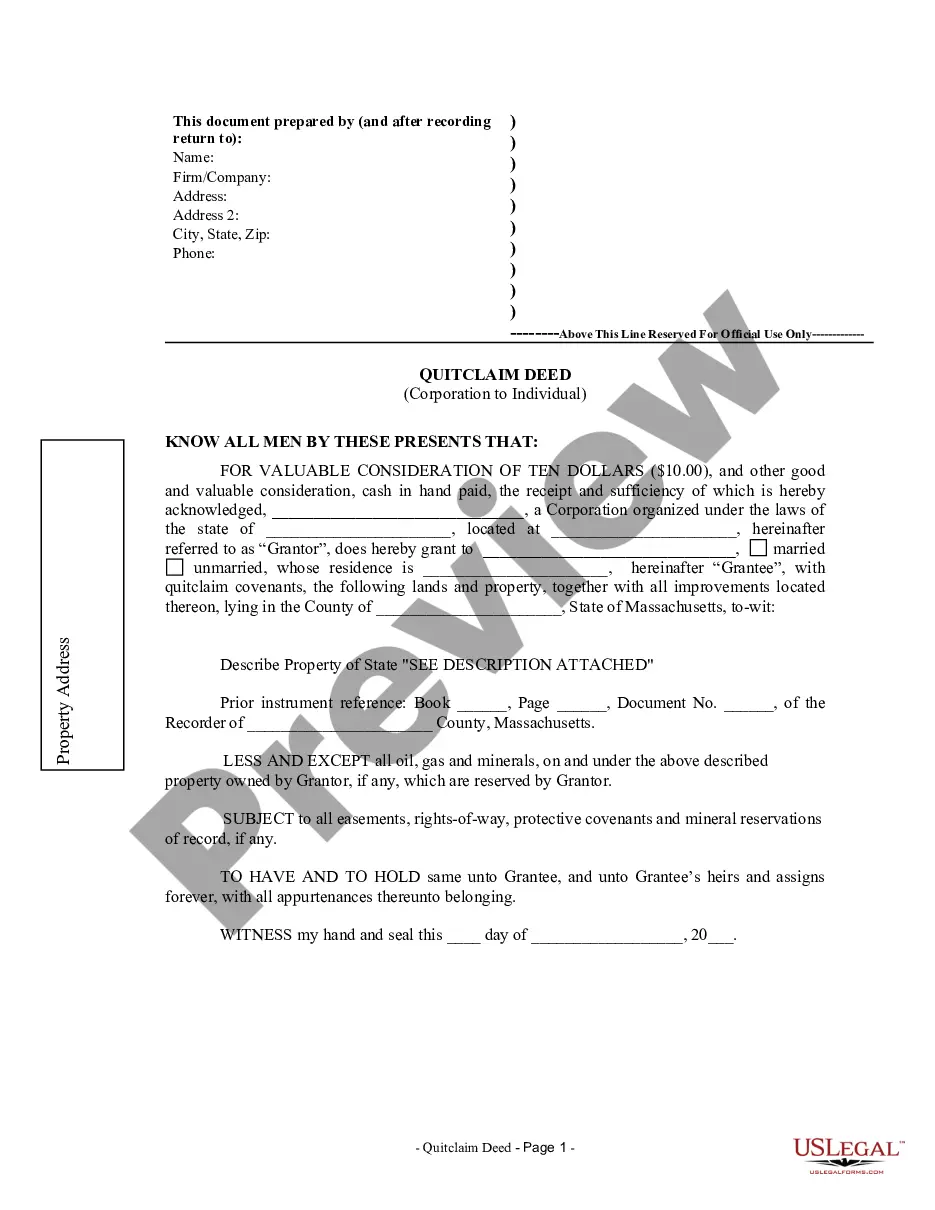

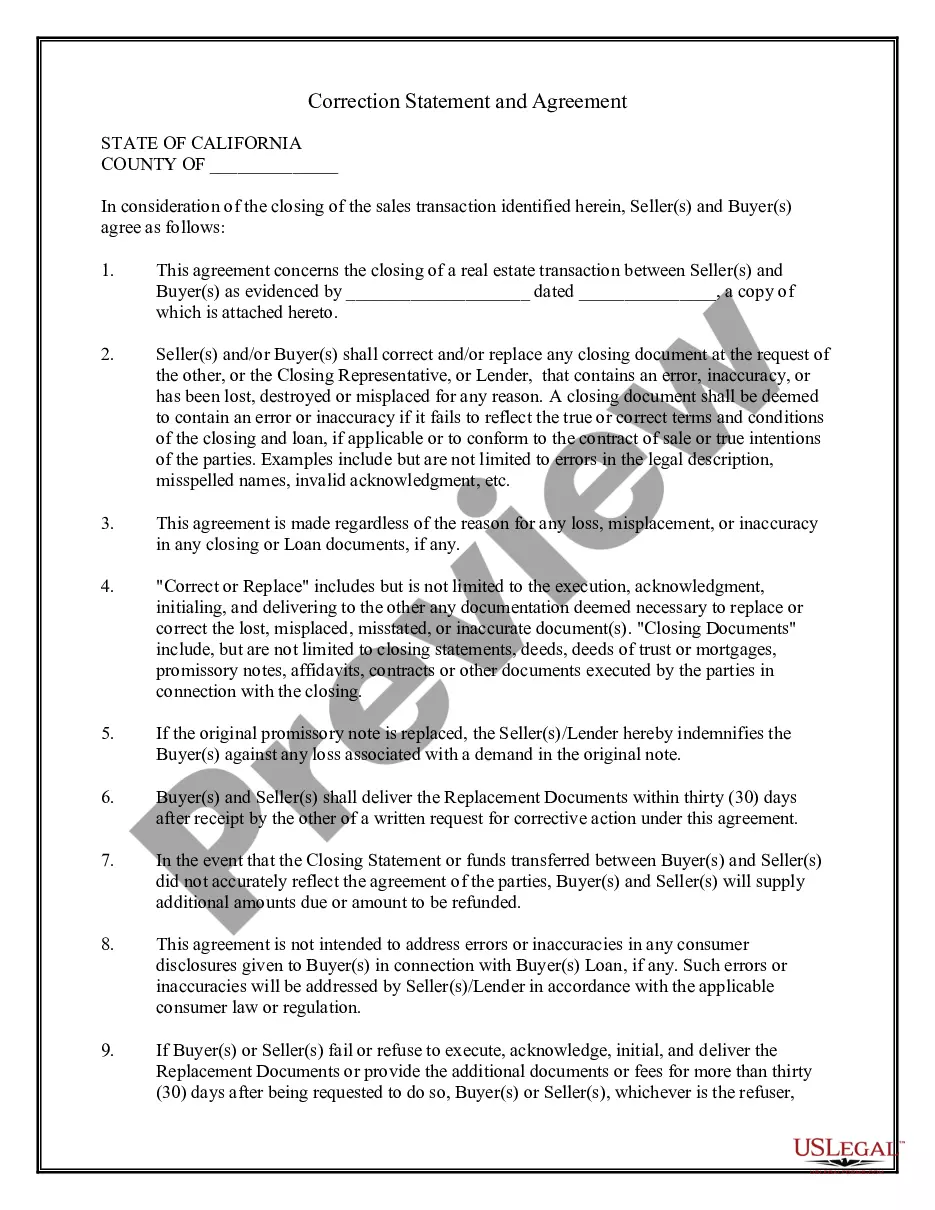

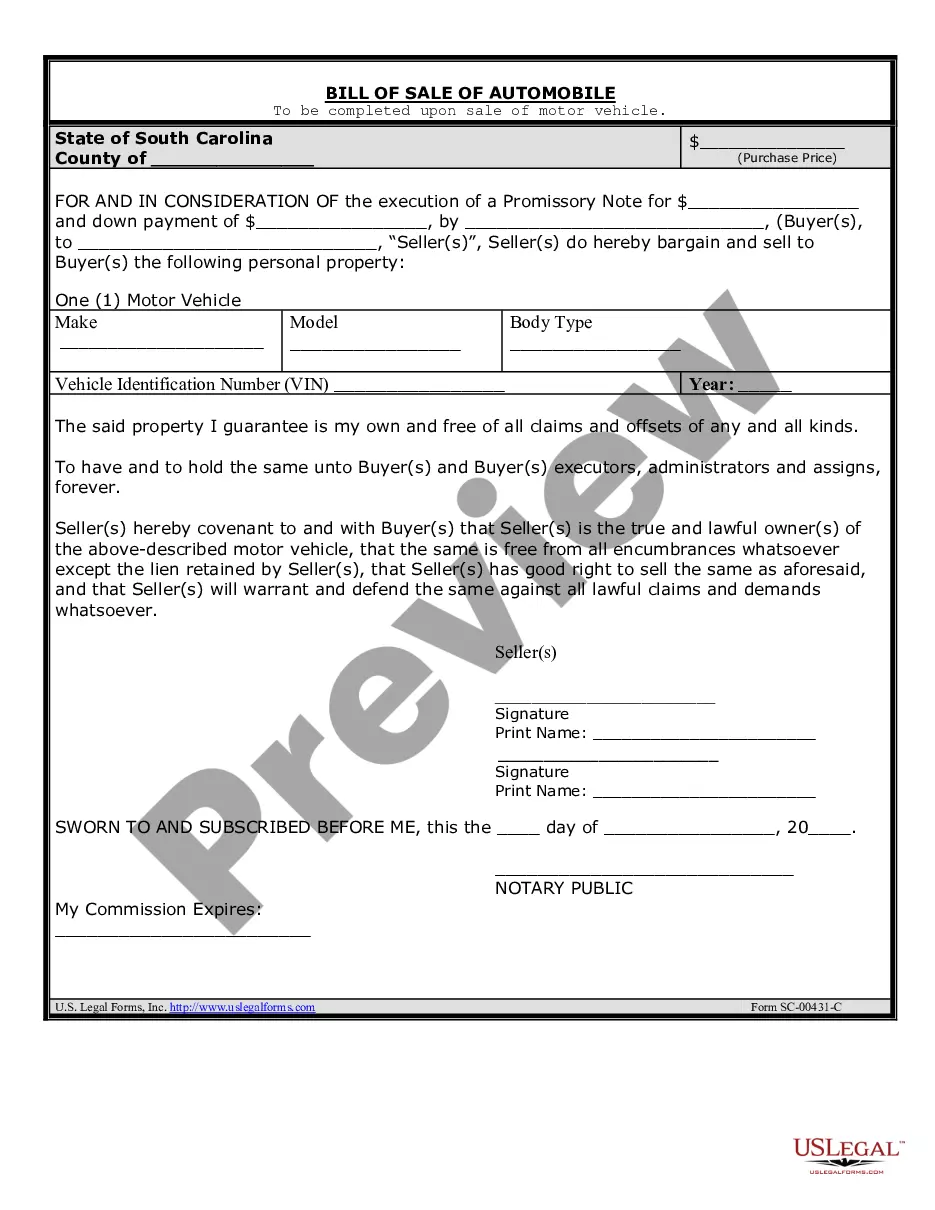

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or look for another sample using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and paid for your subscription, you may use your North Dakota Trust Registration as many times as you need or for as long as it continues to be active where you live. Change it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

Setting up a trust can cost between R4,000 and R12,000. Careful consideration must be given to the wording of the trust deed because you want to ensure that the trust is both tax effective, and also that your family will continue to benefit when you die.

A trust is a legal entity that you transfer ownership of your assets to, perhaps in order to decrease the value of your estate or to simplify passing on assets to your intended beneficiaries after you die. An estate planning attorney may charge at least $1,000 to create a trust for you.

Trusts that hold property will, like other trusts, only need to be registered if the trustees incur a liability to tax. Thus, if the property is occupied by a beneficiary and is not income-producing - no requirement for registration will exist unless a taxable event occurs for IHT, CGT or SDLT purposes.

2. Organize your paperwork. Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

In simple words it is a transfer of property by the owner to another for the benefit of a third person along with or without himself or a declaration by the owner, to hold the property not for himself and another. In India, majority of the Trusts are registered as public charitable trust a form of not-for-profit

All UK trusts will have to register whether or not they have tax liabilities. Those trusts which are already registered will have to provide some additional information about their beneficial owners.

1. In case of a trust, copy of trust deed; in case of society, copy of registration certificate and copy of the memorandum of association of society; in case of section 8 company, copy of the certificate of incorporation and copy of MOA, AOA of company. 2. Copy of PAN Number of Trust.

Step 1 : Choose an appropriate name for your Trust. Step 2 : Determine the Settler/ Author and Trustees of the intended Trust. Step 3 : Prepare a Memorandum of Association and Rules & Regulations of your Trust. Bylaws of the Trust.