North Dakota Order for Partial Distribution of Trust

Description

How to fill out North Dakota Order For Partial Distribution Of Trust?

Among countless free and paid templates that you can find on the internet, you can't be certain about their reliability. For example, who made them or if they are competent enough to deal with what you need these to. Always keep relaxed and make use of US Legal Forms! Discover North Dakota Order for Partial Distribution of Trust samples made by professional lawyers and prevent the expensive and time-consuming procedure of looking for an attorney and after that having to pay them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access your earlier saved samples in the My Forms menu.

If you’re using our platform for the first time, follow the tips below to get your North Dakota Order for Partial Distribution of Trust quickly:

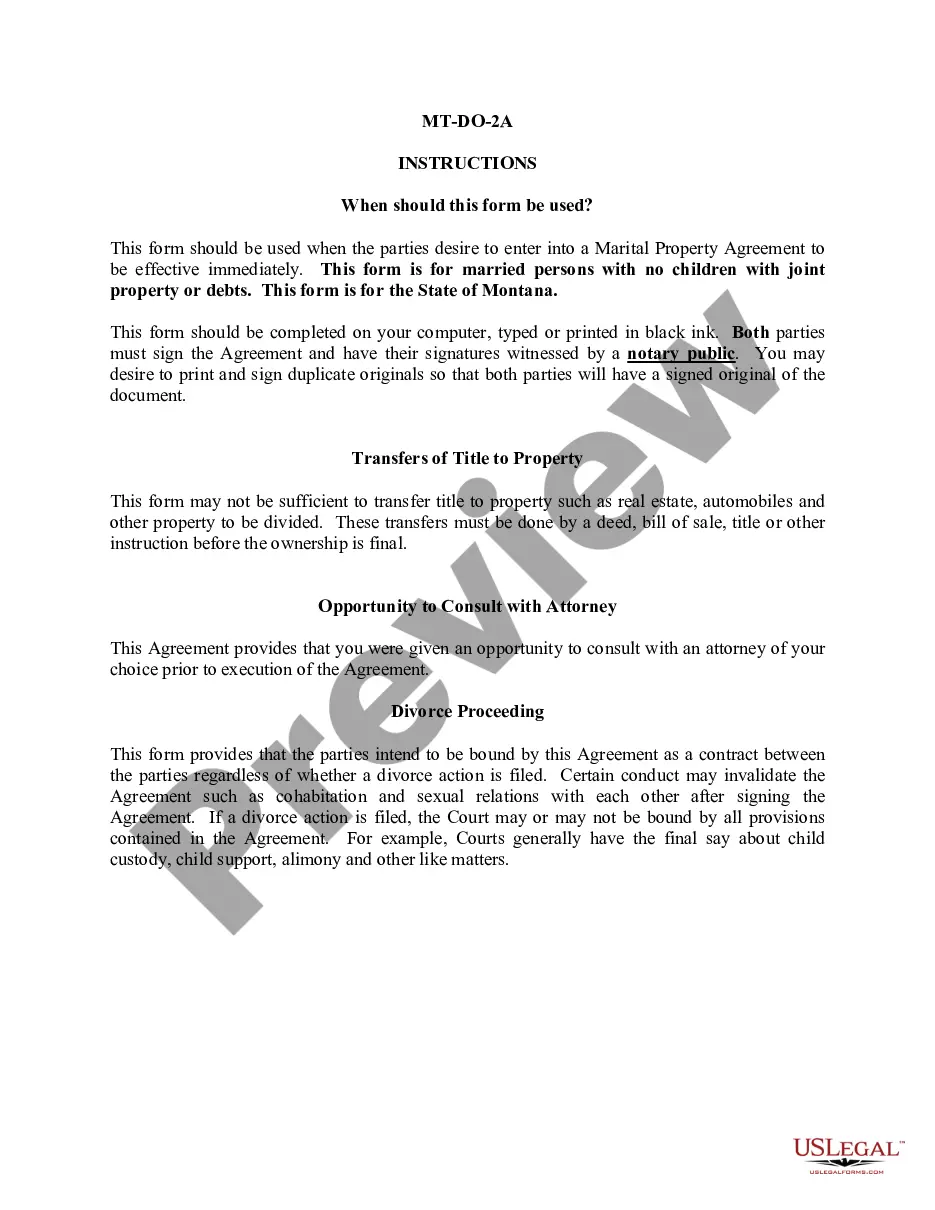

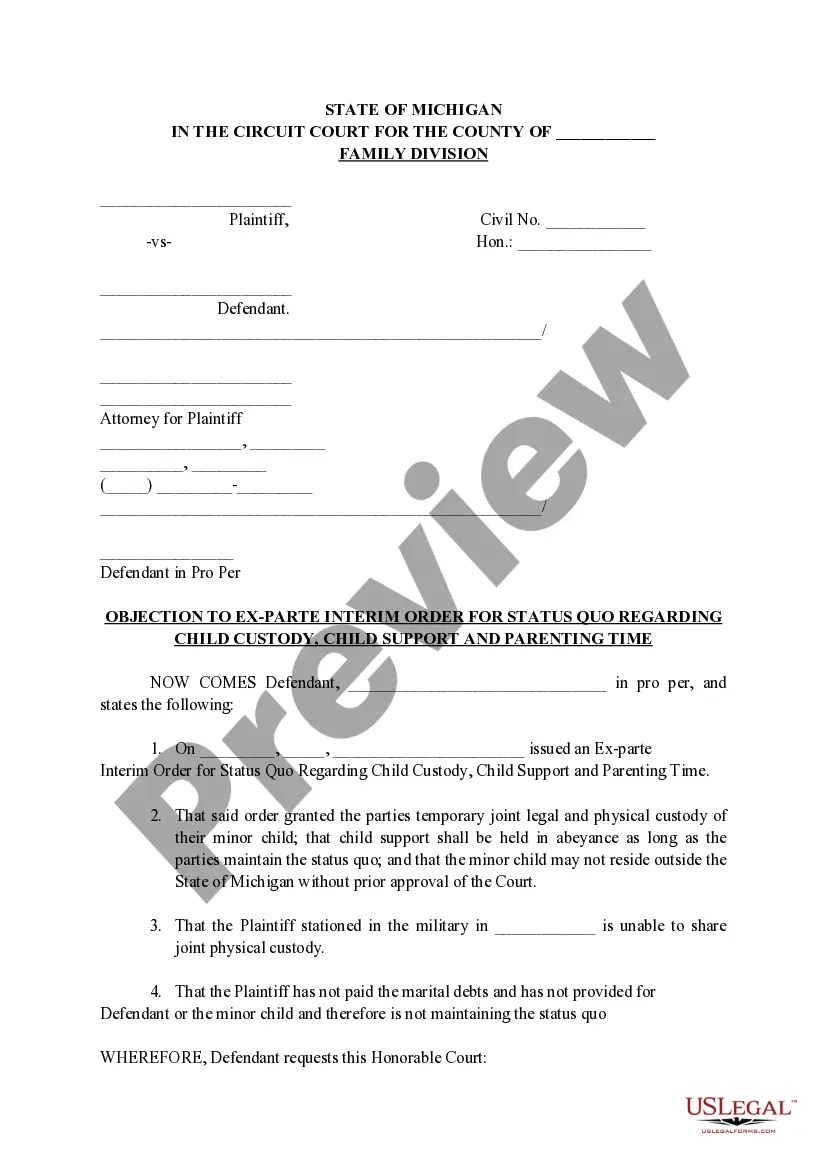

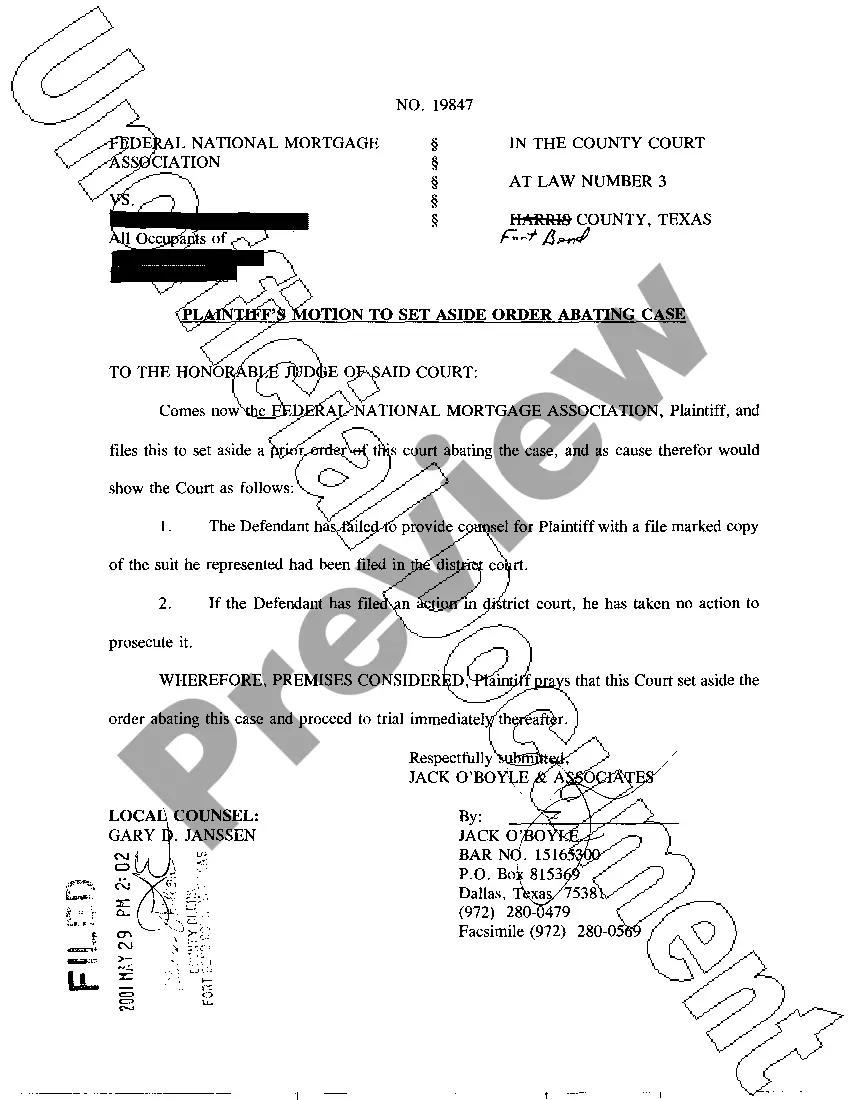

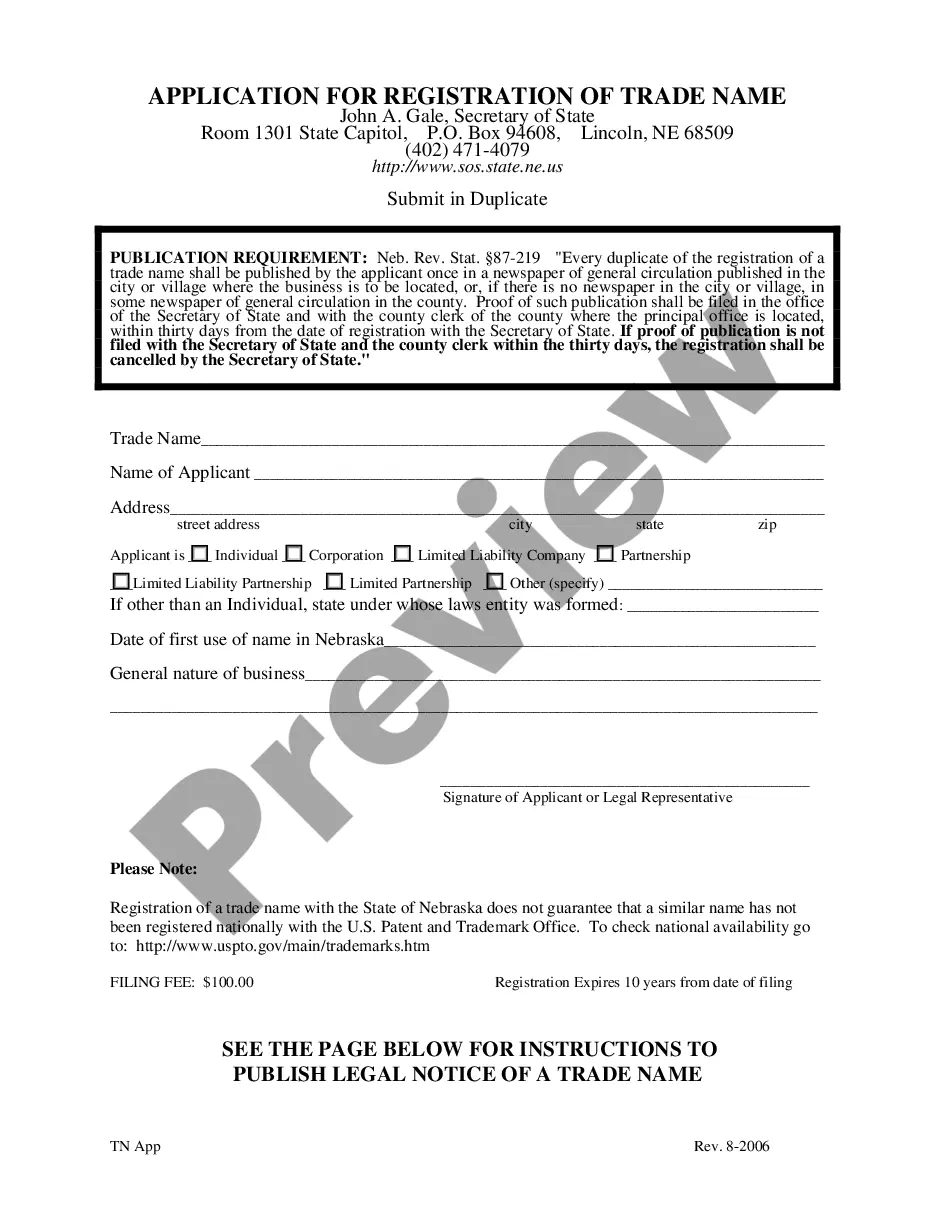

- Make certain that the file you see applies in your state.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another example using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

Once you have signed up and bought your subscription, you may use your North Dakota Order for Partial Distribution of Trust as many times as you need or for as long as it remains active in your state. Edit it in your preferred editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

If you are the beneficiary of a simple trust, you pay tax on its income each year, whether or not you receive it. Usually, though, you will receive the income, if not during the year, then after it ends.That doesn't distribute amounts allocated to the corpus of the trust.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

Planning Tip: If a trust permits accumulation of income and the trust does not distribute it, the trust pays tax on the income.A trust's distributable net income (DNI) determines the amount of the distribution the trust can deduct, and the amount the beneficiary must report as income.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

A simple trust is one that requires mandatory distributions of all income during the taxable year. Simple trusts cannot make any charitable gifts other than from current income and cannot make any distributions of principal.