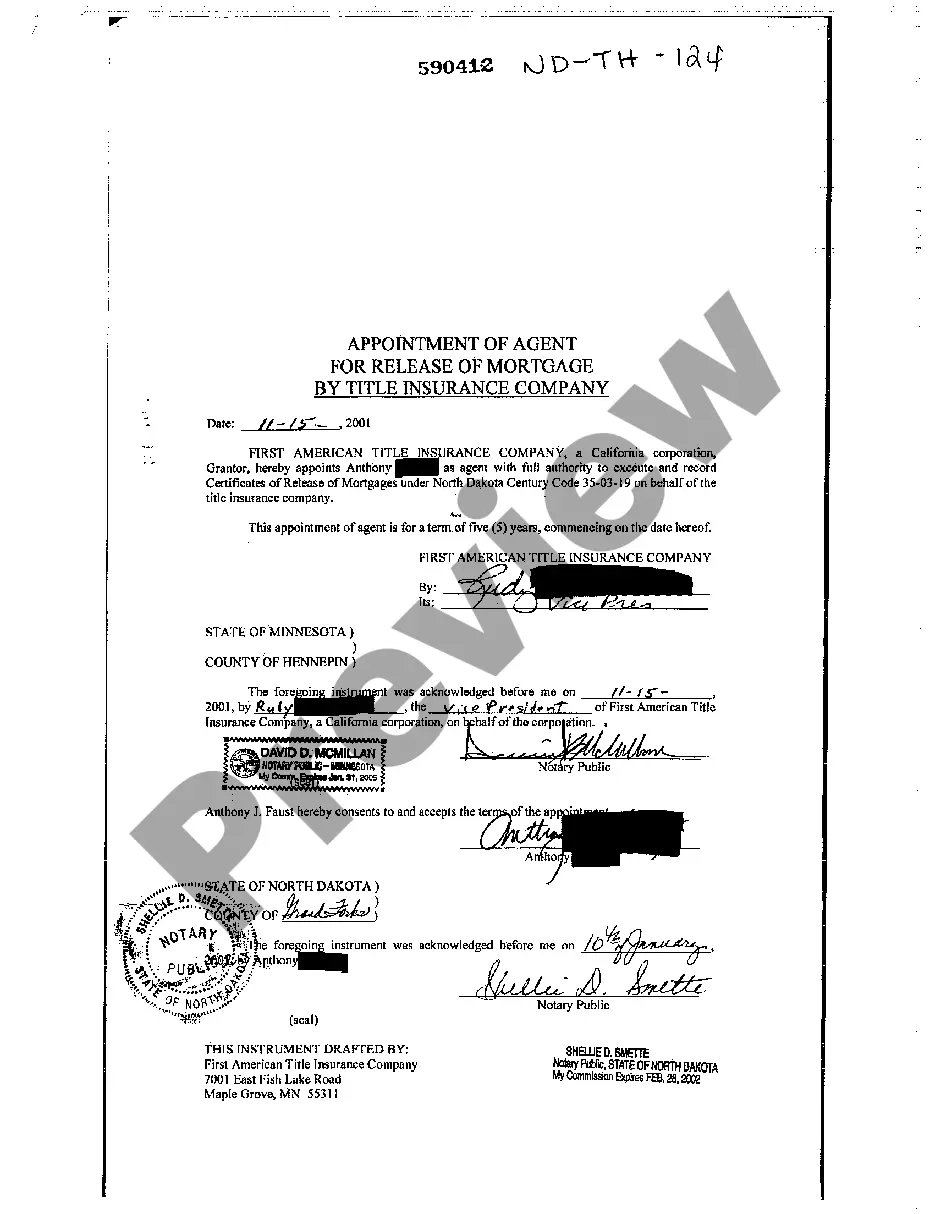

North Dakota Appointment of Agent for Release of Mortgage by Title Insurance Company

Description

How to fill out North Dakota Appointment Of Agent For Release Of Mortgage By Title Insurance Company?

Avoid pricey attorneys and find the North Dakota Appointment of Agent for Release of Mortgage by Title Insurance Company you need at a affordable price on the US Legal Forms website. Use our simple groups function to look for and download legal and tax files. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms enables users with step-by-step tips on how to obtain and fill out every single form.

US Legal Forms clients merely have to log in and get the particular document they need to their My Forms tab. Those, who have not got a subscription yet should follow the guidelines below:

- Ensure the North Dakota Appointment of Agent for Release of Mortgage by Title Insurance Company is eligible for use in your state.

- If available, look through the description and make use of the Preview option before downloading the templates.

- If you’re sure the document is right for you, click on Buy Now.

- In case the template is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you may complete the North Dakota Appointment of Agent for Release of Mortgage by Title Insurance Company manually or with the help of an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

Things Not Covered in Your Title Policy Any defects created after the issuance of the policy, or defects that you create. Issues arising as the result of failing to pay your mortgage. Issues arising as the result of failing to obey the law or certain covenants.Restrictive covenants that limit the use of the property.

In title theory states, a lender holds the actual legal title to a piece of real estate for the life of the loan while the borrower/mortgagor holds the equitable title.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.