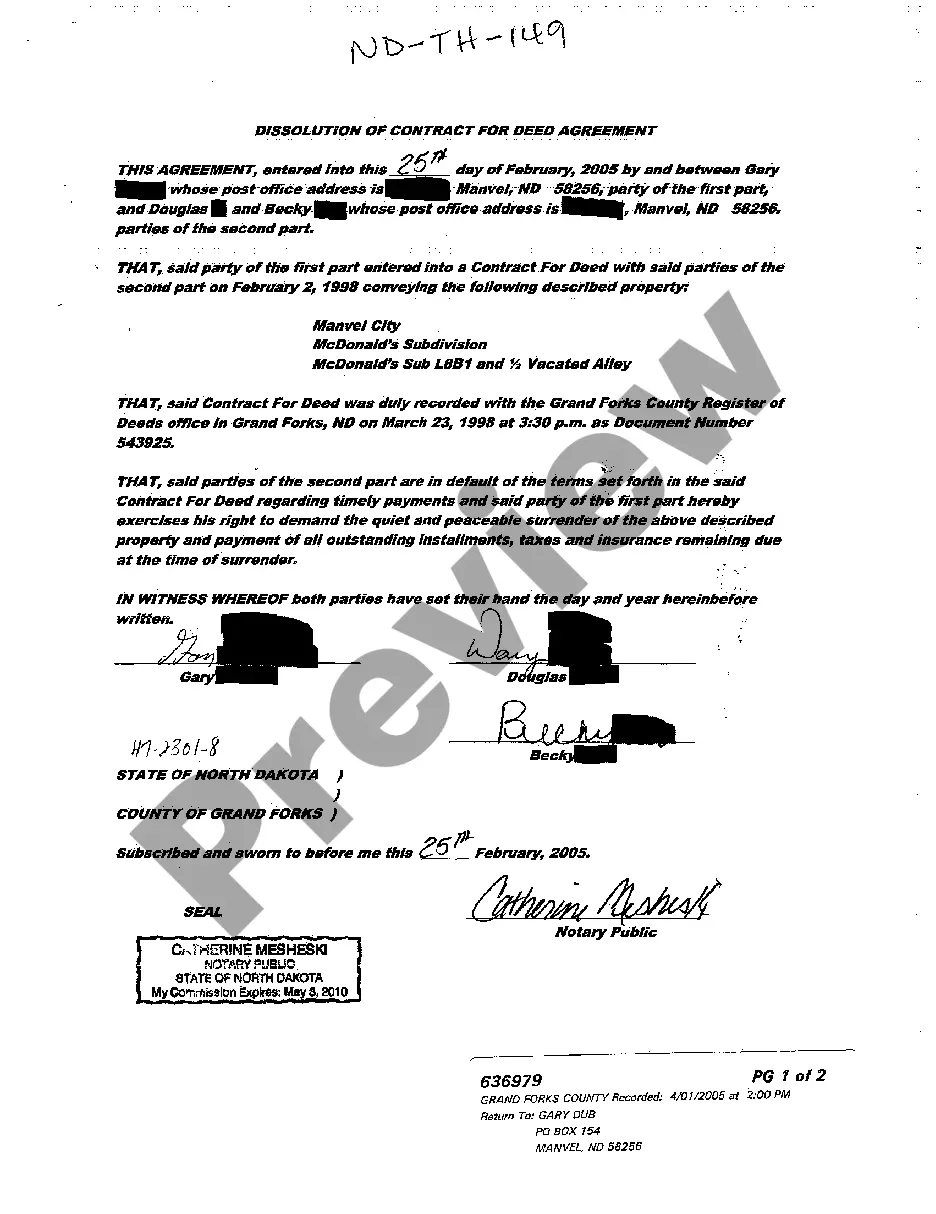

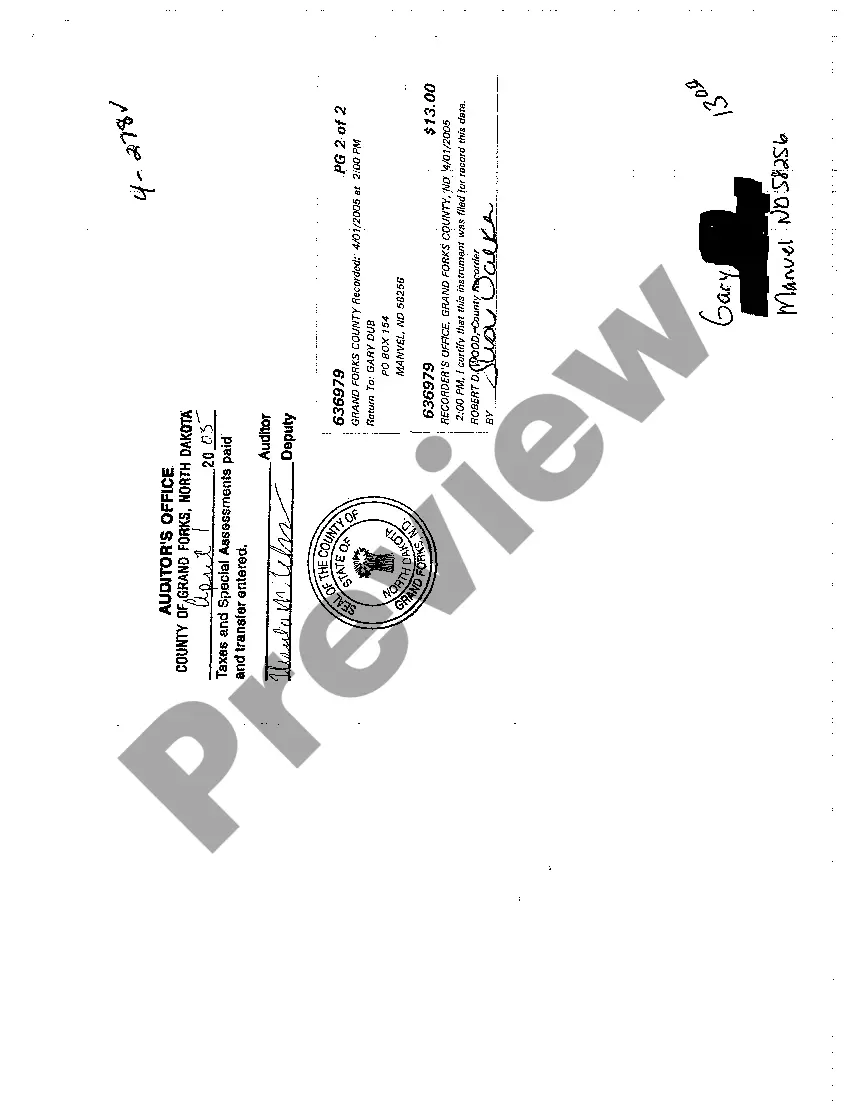

North Dakota Dissolution of Contract for Deed Agreement

Description

How to fill out North Dakota Dissolution Of Contract For Deed Agreement?

Avoid expensive lawyers and find the North Dakota Dissolution of Contract for Deed Agreement you need at a reasonable price on the US Legal Forms site. Use our simple groups functionality to search for and download legal and tax files. Go through their descriptions and preview them before downloading. Additionally, US Legal Forms provides customers with step-by-step tips on how to download and fill out each template.

US Legal Forms customers merely need to log in and get the particular form they need to their My Forms tab. Those, who have not got a subscription yet must stick to the guidelines below:

- Ensure the North Dakota Dissolution of Contract for Deed Agreement is eligible for use where you live.

- If available, look through the description and make use of the Preview option just before downloading the sample.

- If you’re confident the template fits your needs, click Buy Now.

- If the form is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your gadget or print it out.

Right after downloading, you are able to fill out the North Dakota Dissolution of Contract for Deed Agreement by hand or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Contact the other party and ask whether they are willing to negotiate the cancellation of the contract. Offer the other party an incentive to cancel the contract for deed.

Adding a co-borrower to a mortgage loan isn't as simple as calling your mortgage company and making a request, and you can't add a co-borrower without refinancing the mortgage.With a refinance, you can add someone's name to the mortgage, as well as take someone's name off the mortgage.

It is not necessary for the seller to go to court to cancel the contract. In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.

In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.A seller can cancel a contract for deed for buyer's default in making the monthly payments.

When refinancing out of a land contract, you may use any loan program such as a conventional loan, FHA loan, VA loan, or even a USDA loan. If the balance is higher than these loans allow, you may use a jumbo mortgage to refinance the land contract.

Technically, you don't refinance a contract for deed. Instead, you get a new bank mortgage to pay off the seller who holds the contract. To figure out whether such a move is your best choice or even doable in your particular case, you need to look at your contract's wording, your finances and the property involved.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.