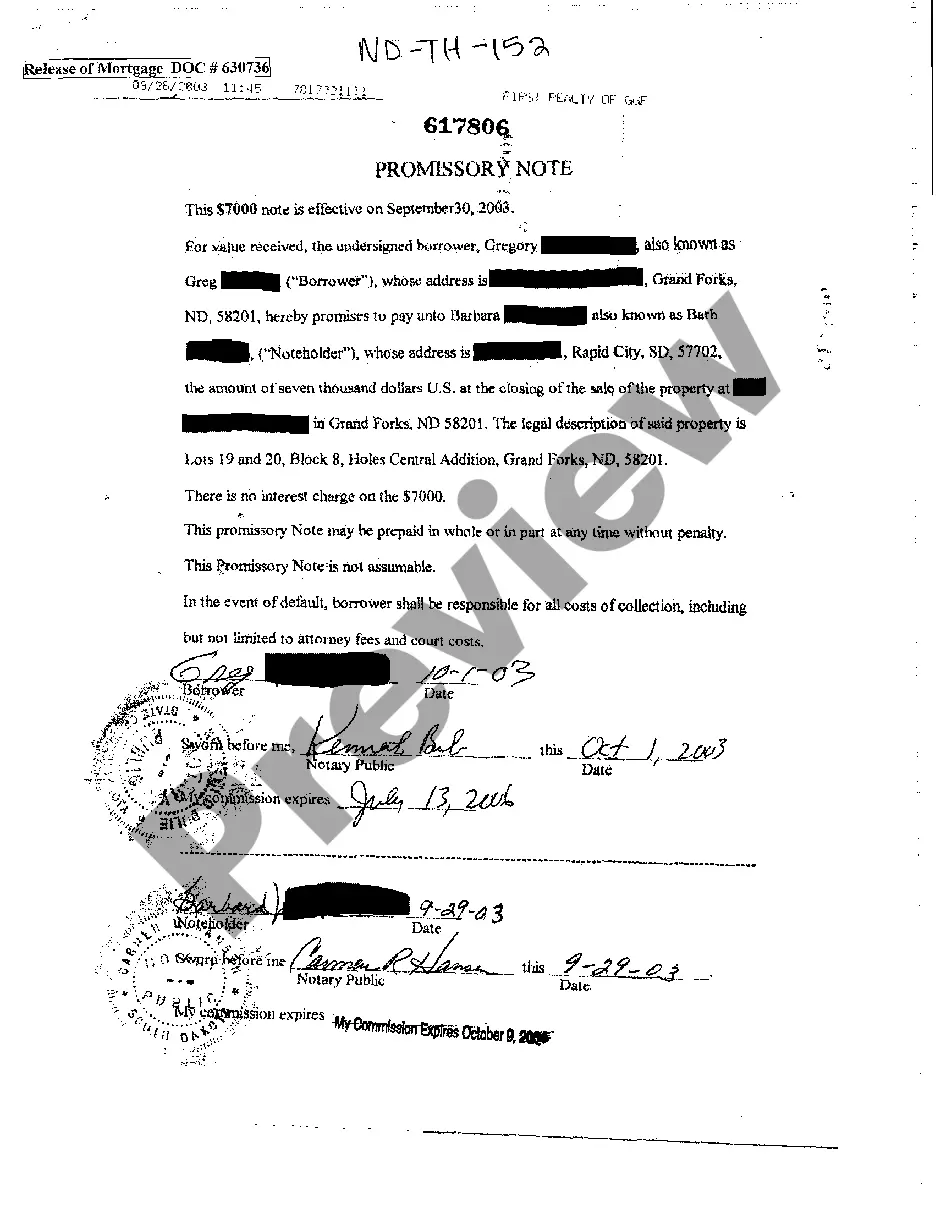

North Dakota Promissory Note for Loan to be Paid out of Closing Proceeds, No Interest

Description

How to fill out North Dakota Promissory Note For Loan To Be Paid Out Of Closing Proceeds, No Interest?

Avoid pricey lawyers and find the North Dakota Promissory Note for Loan to be Paid out of Closing Proceeds, No Interest you need at a affordable price on the US Legal Forms website. Use our simple categories functionality to look for and download legal and tax documents. Read their descriptions and preview them well before downloading. Additionally, US Legal Forms provides customers with step-by-step tips on how to obtain and fill out each and every template.

US Legal Forms customers just need to log in and obtain the specific form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must stick to the tips listed below:

- Make sure the North Dakota Promissory Note for Loan to be Paid out of Closing Proceeds, No Interest is eligible for use where you live.

- If available, look through the description and use the Preview option well before downloading the sample.

- If you’re confident the template suits you, click Buy Now.

- In case the form is incorrect, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to download the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you can fill out the North Dakota Promissory Note for Loan to be Paid out of Closing Proceeds, No Interest manually or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Calculating Simple Interest If your loan is for a period of years, multiply the product of principal times interest by the number of years.For example, for a nine-month promissory note, divide 9 by 12 (the number of months in a year) to equal 0.75. Multiply 750 by 0.75 to equal 562.50.

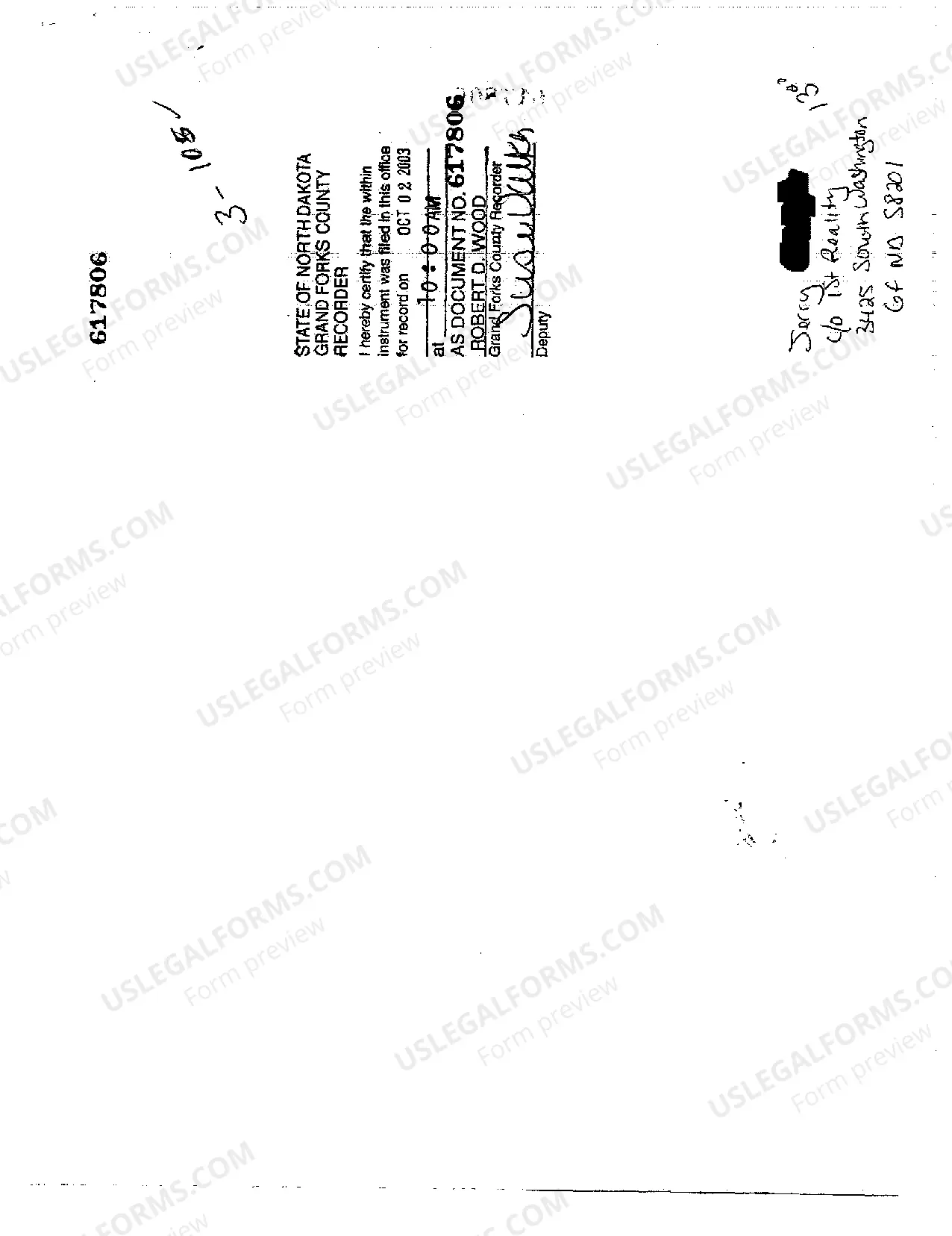

A promissory note is usually held by the party owed money; once the debt has been fully discharged, it must be canceled by the payee and returned to the issuer.

Use our promissory note if you prefer a standard basic contract. Do I have to charge the Borrower interest? No, the Lender can choose whether or not to charge interest. If the Lender decides to charge interest, they can pick how much interest to charge.

A promissory note is a written promise, basically an IOU, to pay money to someone. The note document serves as written evidence of the amount of the debt. To start, decide how much money you'll lend, the amount of interest you'll charge, if any, and the type of repayment schedule.

The lender holds the promissory note while the loan is being repaid, then the note is marked as paid and returned to the borrower when the loan is satisfied. Promissory notes aren't the same as mortgages, but the two often go hand in hand when someone is buying a home.

A promissory note typically contains all the terms pertaining to the indebtedness, such as the principal amount, interest rate, maturity date, date and place of issuance, and issuer's signature.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.