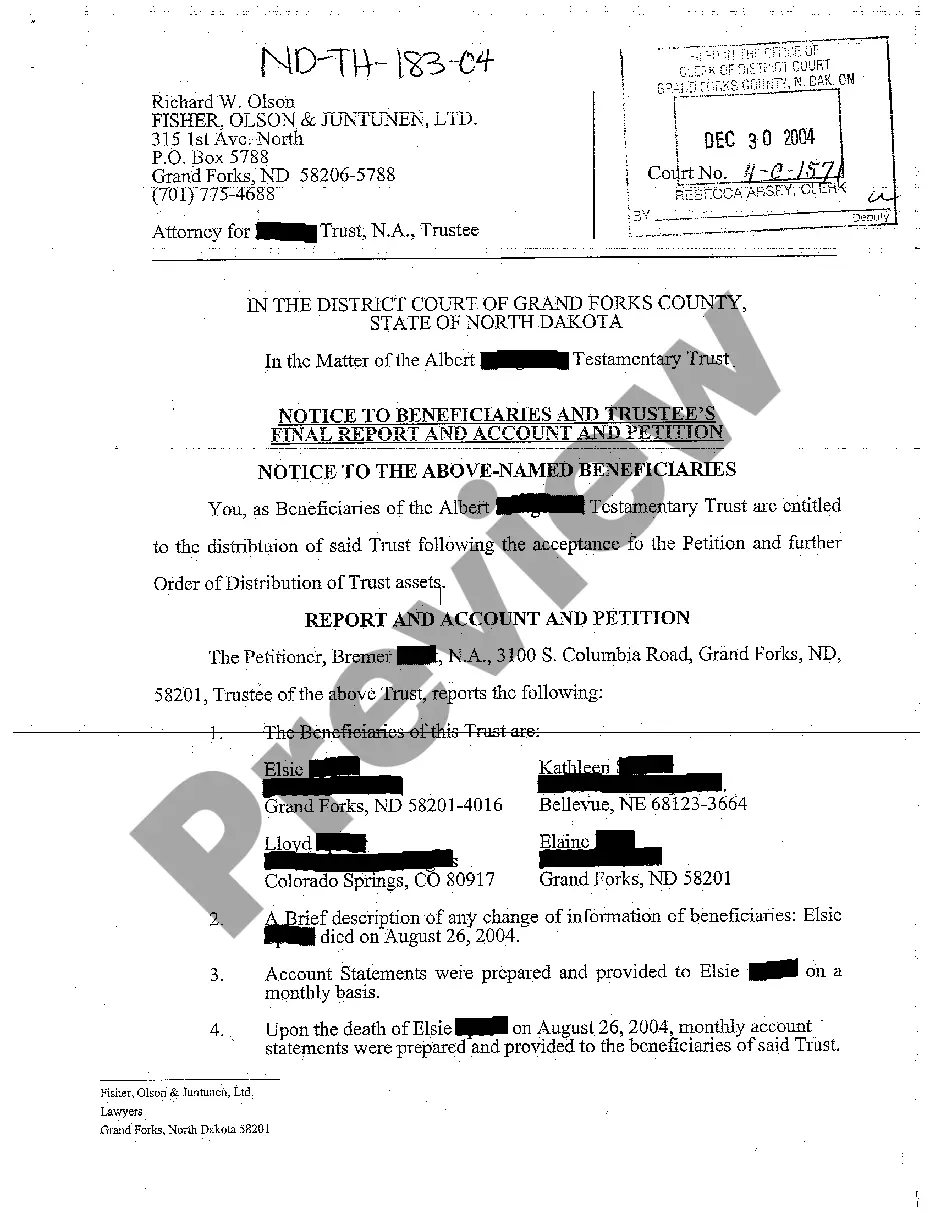

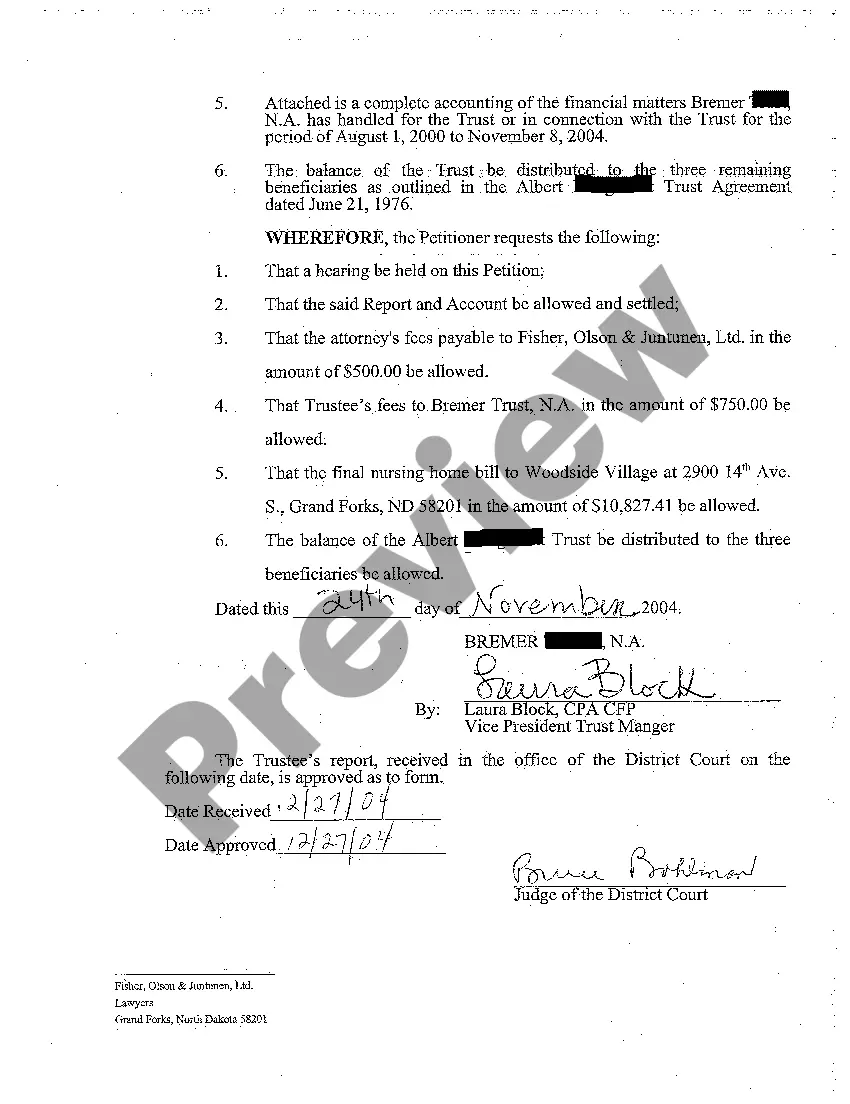

North Dakota Notice to Beneficiaries and Trustee's Final Report and Account and Petition

Description

How to fill out North Dakota Notice To Beneficiaries And Trustee's Final Report And Account And Petition?

Avoid expensive lawyers and find the North Dakota Notice to Beneficiaries and Trustee's Final Report and Account and Petition you want at a affordable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax files. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to obtain and complete every form.

US Legal Forms subscribers merely need to log in and obtain the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet must follow the tips below:

- Make sure the North Dakota Notice to Beneficiaries and Trustee's Final Report and Account and Petition is eligible for use where you live.

- If available, read the description and use the Preview option prior to downloading the sample.

- If you’re confident the document suits you, click on Buy Now.

- In case the form is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Choose to download the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you may complete the North Dakota Notice to Beneficiaries and Trustee's Final Report and Account and Petition manually or an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

All taxes and liabilities paid from the estate, including medical expenses, attorney fees, burial or cremation expenses, estate sale costs, appraisal expenses, and more. The executor should keep all receipts for any services or transactions needed to liquidate the assets of the deceased.

Under California law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired.A revocable living trust becomes an irrevocable trust (because the settlor of the trust has passed away).

A trustee cannot comingle trust assets with any other assets.If the trustee is not the grantor or a beneficiary, the trustee is not permitted to use the trust property for his or her own benefit. Of course the trustee should not steal trust assets, but this responsibility also encompasses misappropriation of assets.

A trustee has a duty to report and account to the trust beneficiaries. If you are a trust beneficiary, you have a right to information about the trust, your interest in the trust, and the various assets of the trust and how they are being administered, invested and distributed.

Under California law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Specifically, these trust notification requirements can come into play when: Someone passes away and, upon death, a new trust is formed by the terms of a will.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

When a Trustee resigns, they must still act in the best interests of the Trust and the Trust beneficiaries. That means the Trust assets must be managed prudently while a new Trustee is selected. Further, the Trustee is required to provide an accounting to the Trust beneficiaries upon resignation.

A trustee is required by law to notify beneficiaries of a trust upon the settlor's death. The settlor is the person who created the trust. The trustee has 60 days from the settlor's death to provide the notification to the beneficiaries.The name, address, and telephone number of the trustee.