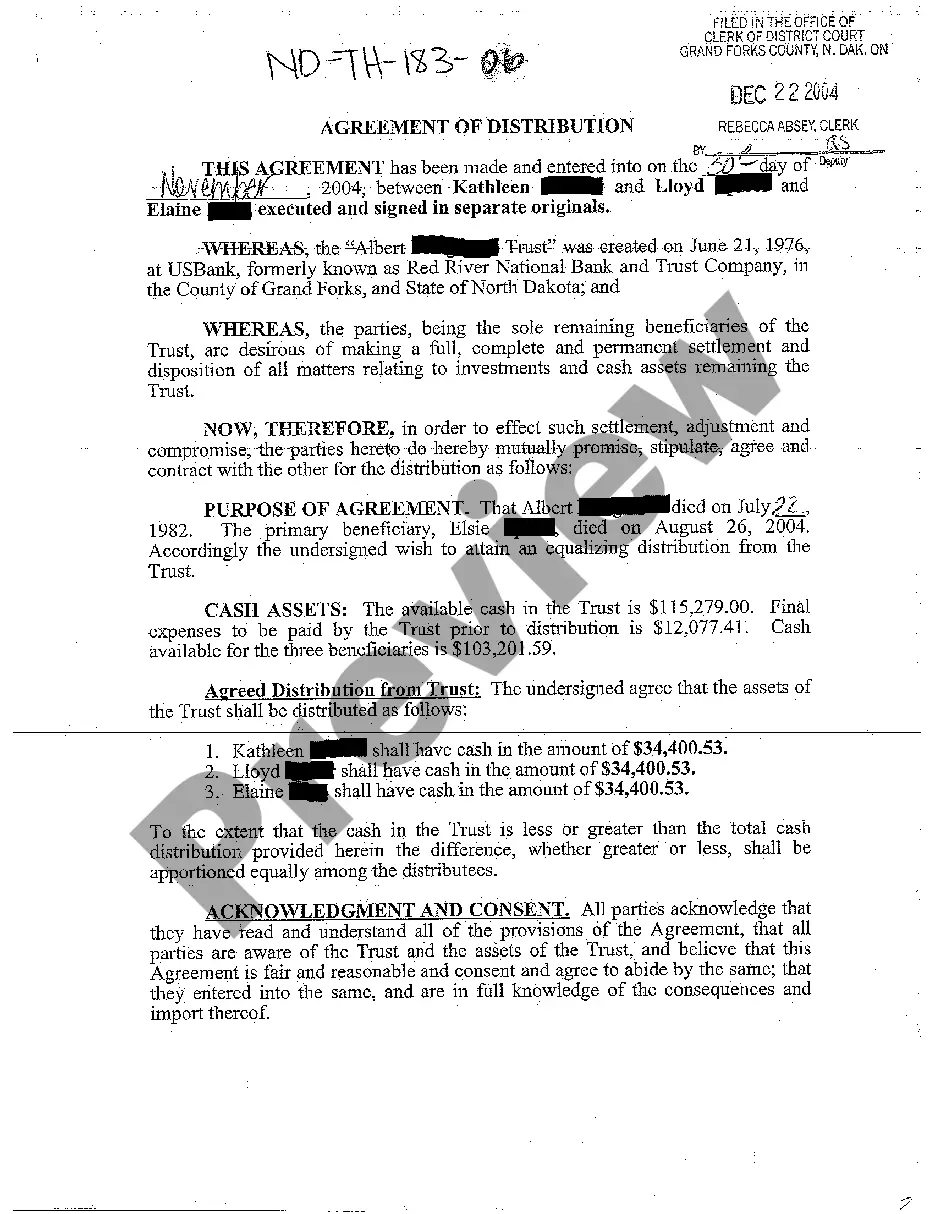

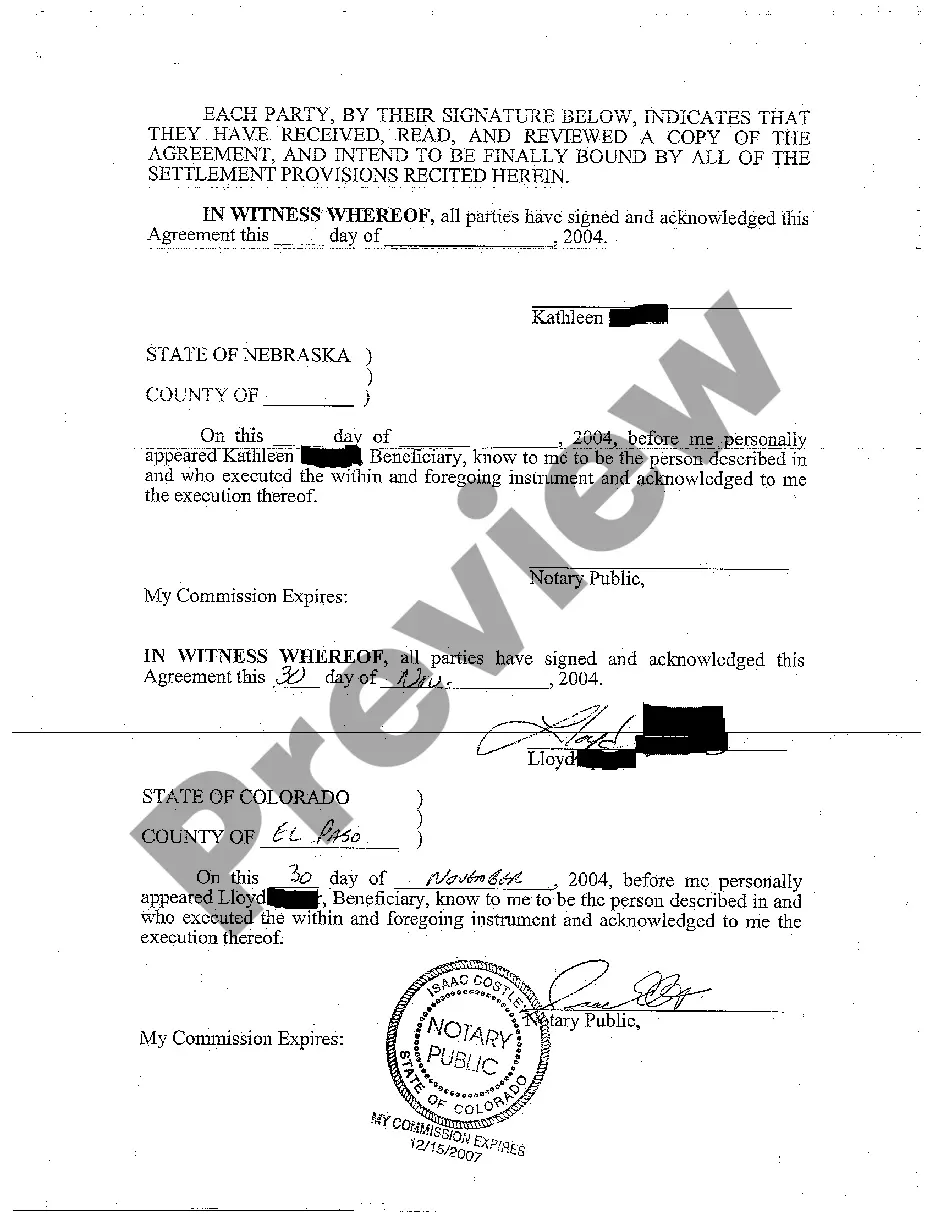

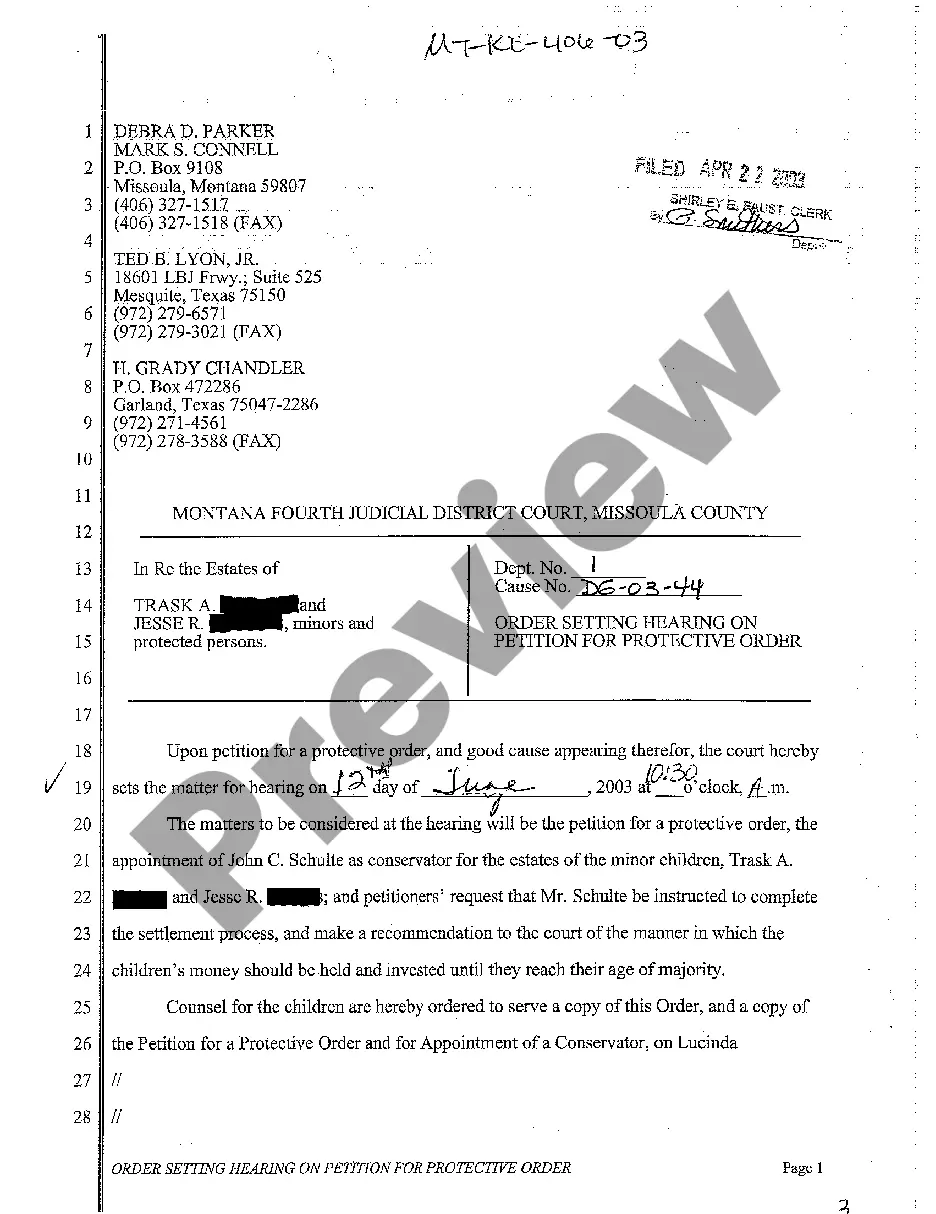

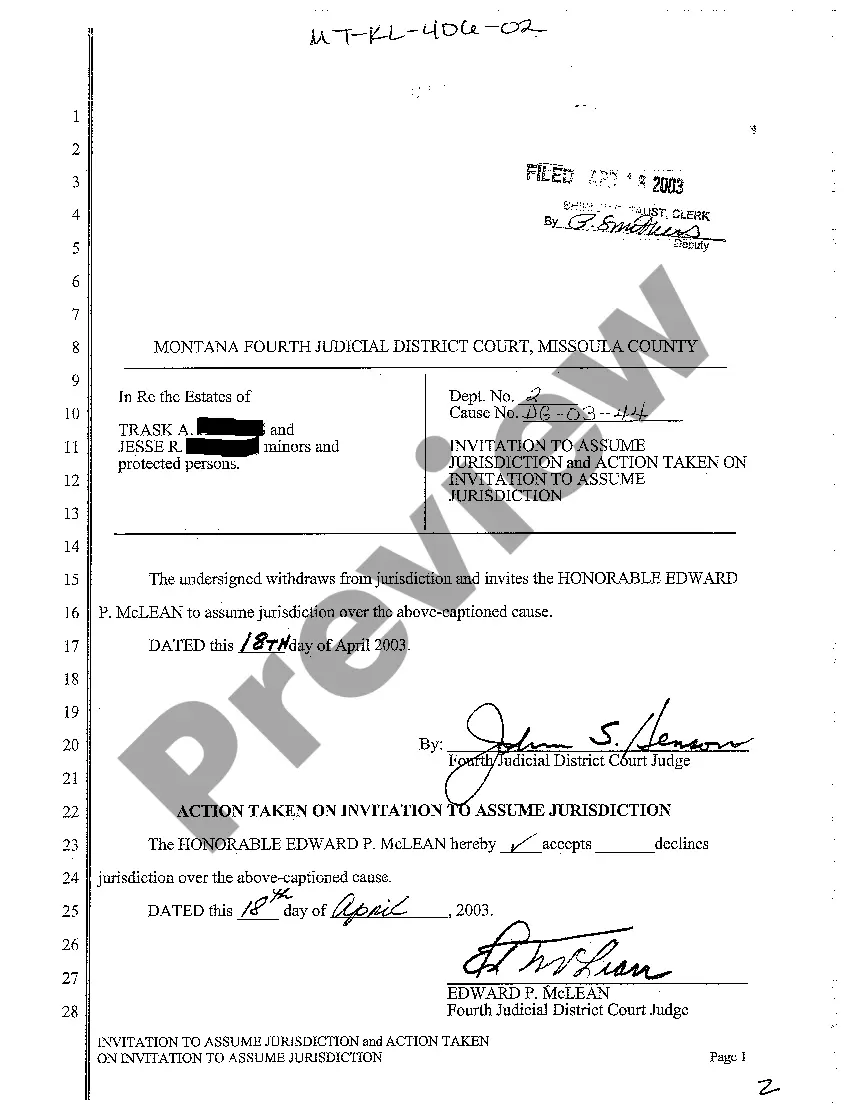

North Dakota Agreement of Distribution by Beneficiaries

Description Distribution Letter To Beneficiaries

How to fill out North Dakota Agreement Of Distribution By Beneficiaries?

Avoid costly lawyers and find the North Dakota Agreement of Distribution by Beneficiaries you need at a reasonable price on the US Legal Forms site. Use our simple categories function to find and download legal and tax documents. Read their descriptions and preview them just before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to download and fill out every form.

US Legal Forms customers simply must log in and download the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the tips listed below:

- Ensure the North Dakota Agreement of Distribution by Beneficiaries is eligible for use where you live.

- If available, read the description and make use of the Preview option well before downloading the templates.

- If you are sure the document is right for you, click on Buy Now.

- In case the template is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, it is possible to fill out the North Dakota Agreement of Distribution by Beneficiaries manually or an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

An inheritance is not subject to income taxes. The federal estate tax now applies only to a tiny minority of super-wealthy taxpayers, estimated at about 2,000 a year in total. Income from traditional IRAs that are inherited will be taxable when the beneficiary takes distributions.

When trust beneficiaries receive distributions from the trust's principal balance, they do not have to pay taxes on the distribution.The trust must pay taxes on any interest income it holds and does not distribute past year-end. Interest income the trust distributes is taxable to the beneficiary who receives it.

Unlike a simple trust a complex trust or estate is not required to distribute all of its income currently, can distribute principal, and can make charitable contributions.

North Dakota residents do not need to worry about a state estate or inheritance tax. North Dakota does not have these kinds of taxes, which some states levy on people who either owned property in the state where they lived (estate tax) or who inherit property from someone who lived there (inheritance tax).

As noted above, an irrevocable trust must pay income tax on its earnings.Typically, the beneficiary isn't required to pay income taxes on distributions that come from principal because tax law presumes that the grantor already paid income taxes on it when he placed it in the trust and tries to avoid double taxation.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Any income that trust inheritance assets earn is reported on the grantor's personal return and he pays taxes on it.If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year.

Generally speaking, inheritance is not subject to tax in California. If you are a beneficiary, you will not have to pay tax on your inheritance.