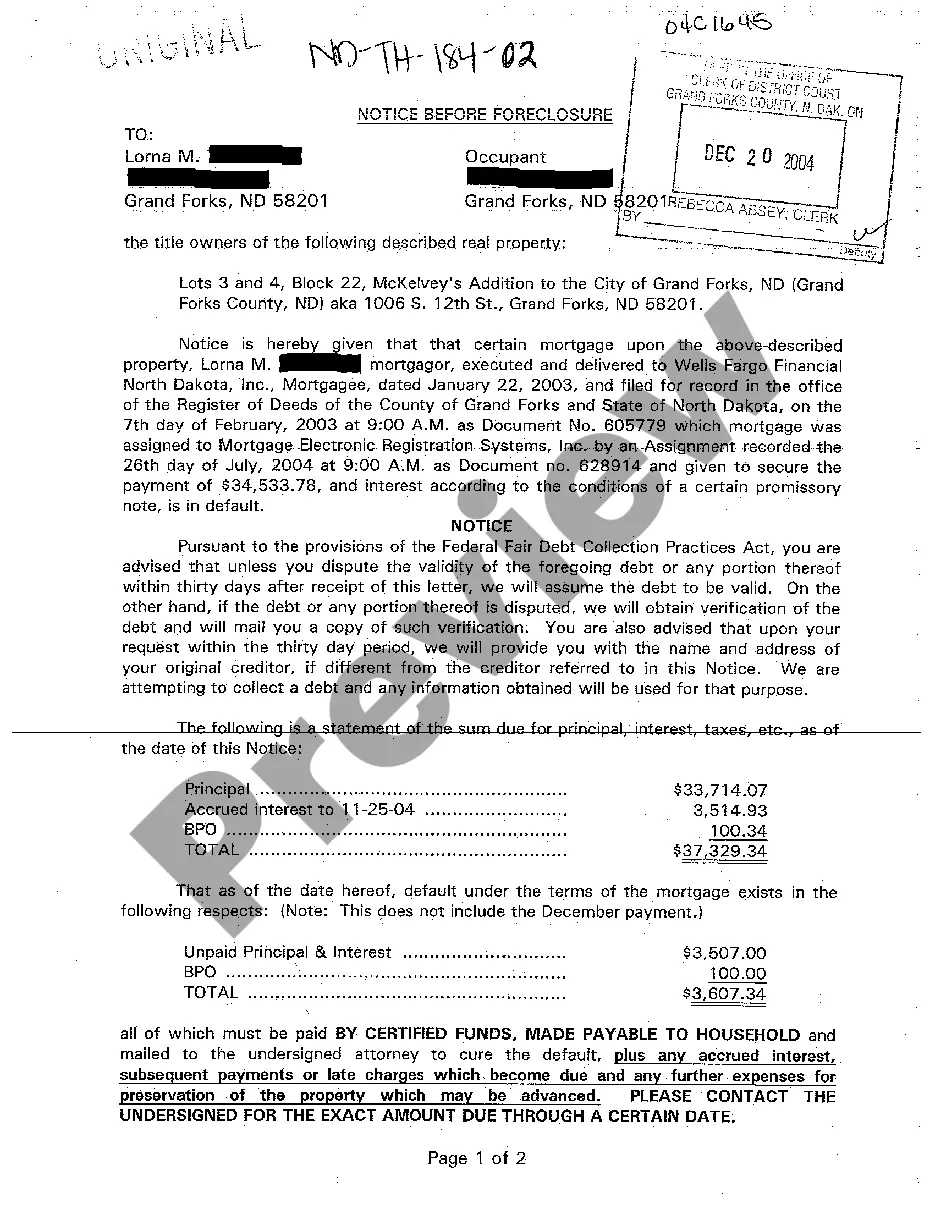

North Dakota Notice Before Foreclosure

Description

How to fill out North Dakota Notice Before Foreclosure?

Among hundreds of free and paid samples which you get online, you can't be sure about their accuracy and reliability. For example, who created them or if they are competent enough to deal with the thing you need these to. Keep relaxed and make use of US Legal Forms! Locate North Dakota Notice Before Foreclosure templates made by skilled legal representatives and prevent the high-priced and time-consuming procedure of looking for an attorney and then paying them to write a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re trying to find. You'll also be able to access all of your earlier saved templates in the My Forms menu.

If you’re making use of our website for the first time, follow the tips below to get your North Dakota Notice Before Foreclosure quick:

- Ensure that the document you discover is valid in the state where you live.

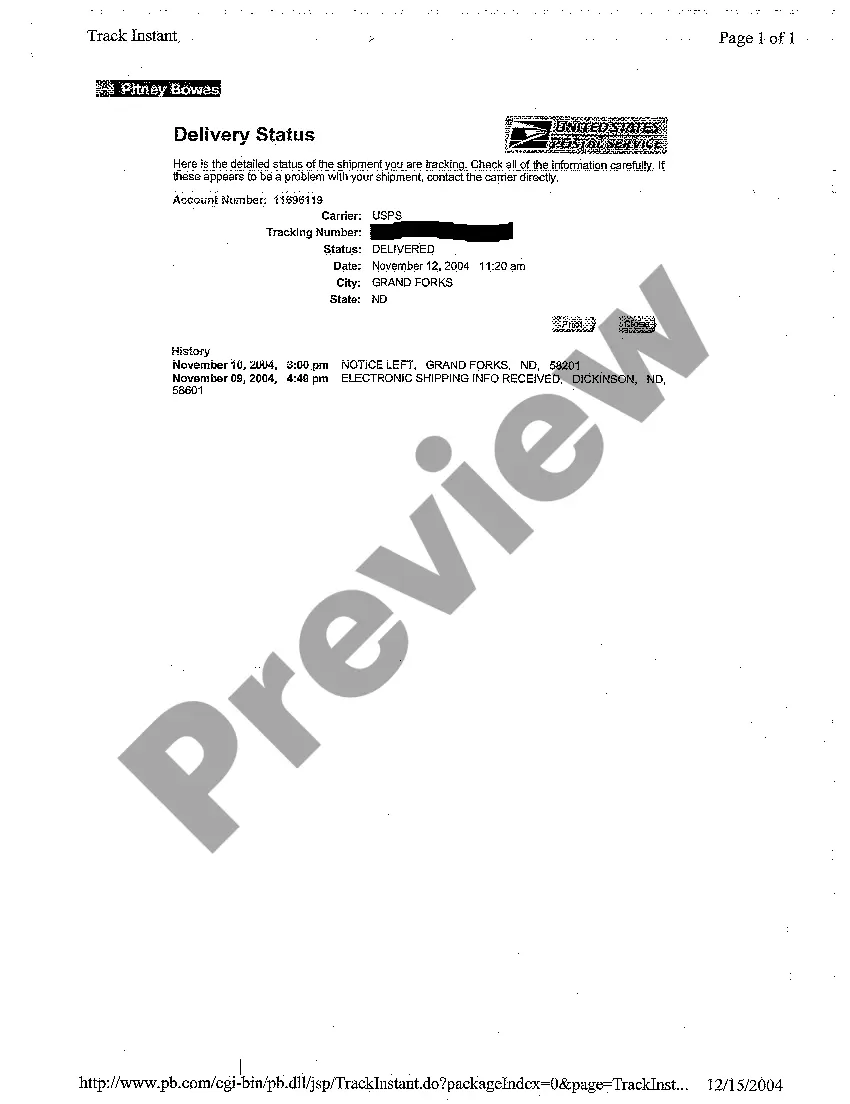

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another example using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and purchased your subscription, you can use your North Dakota Notice Before Foreclosure as many times as you need or for as long as it stays active where you live. Revise it with your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A notice of default is the first step to a bank or mortgage lender's foreclosure process.If the mortgage is not paid up to date, the lender will seize the home. A notice of default is also known as a reinstatement period, notice of public auction, or notice of foreclosure.

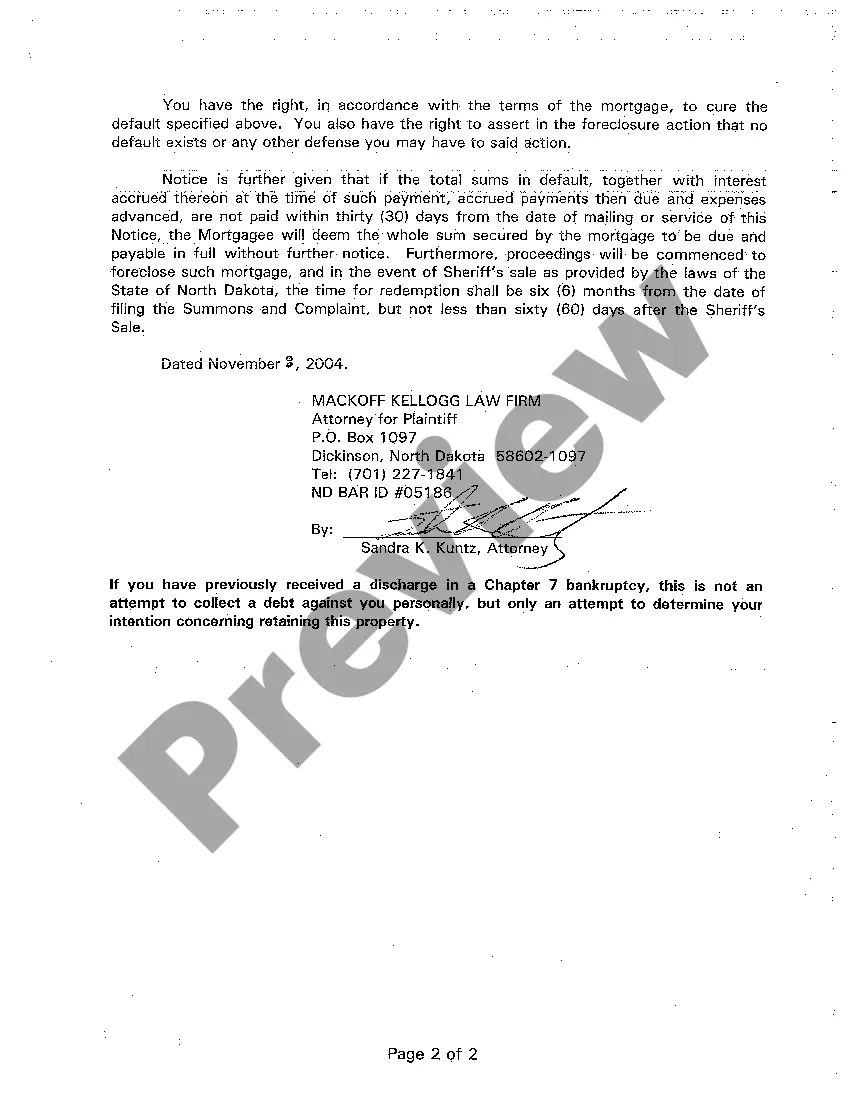

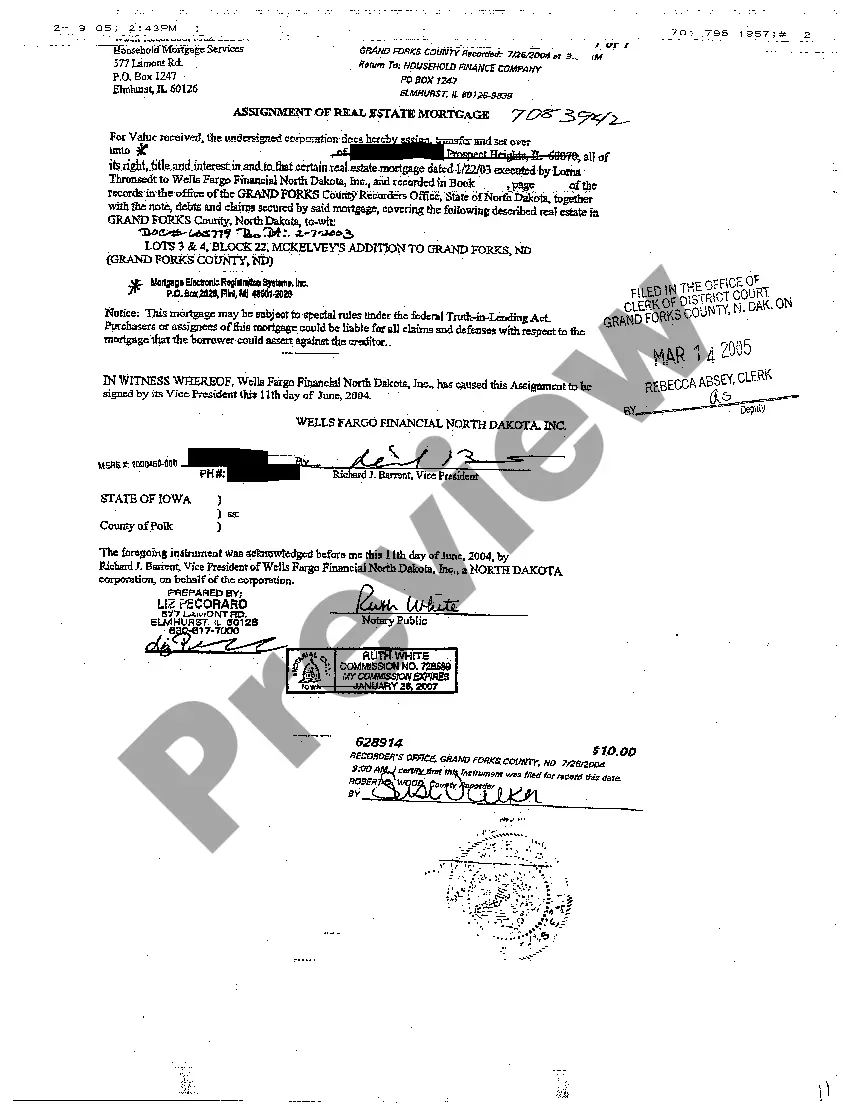

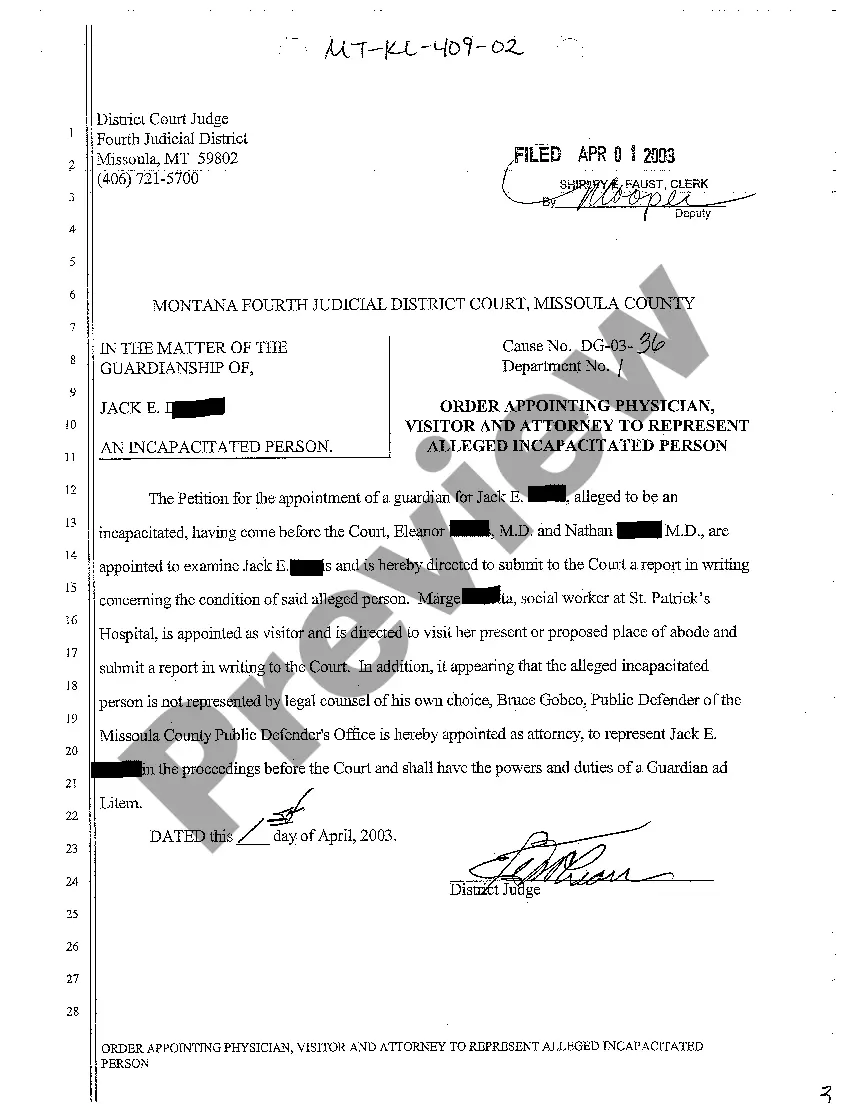

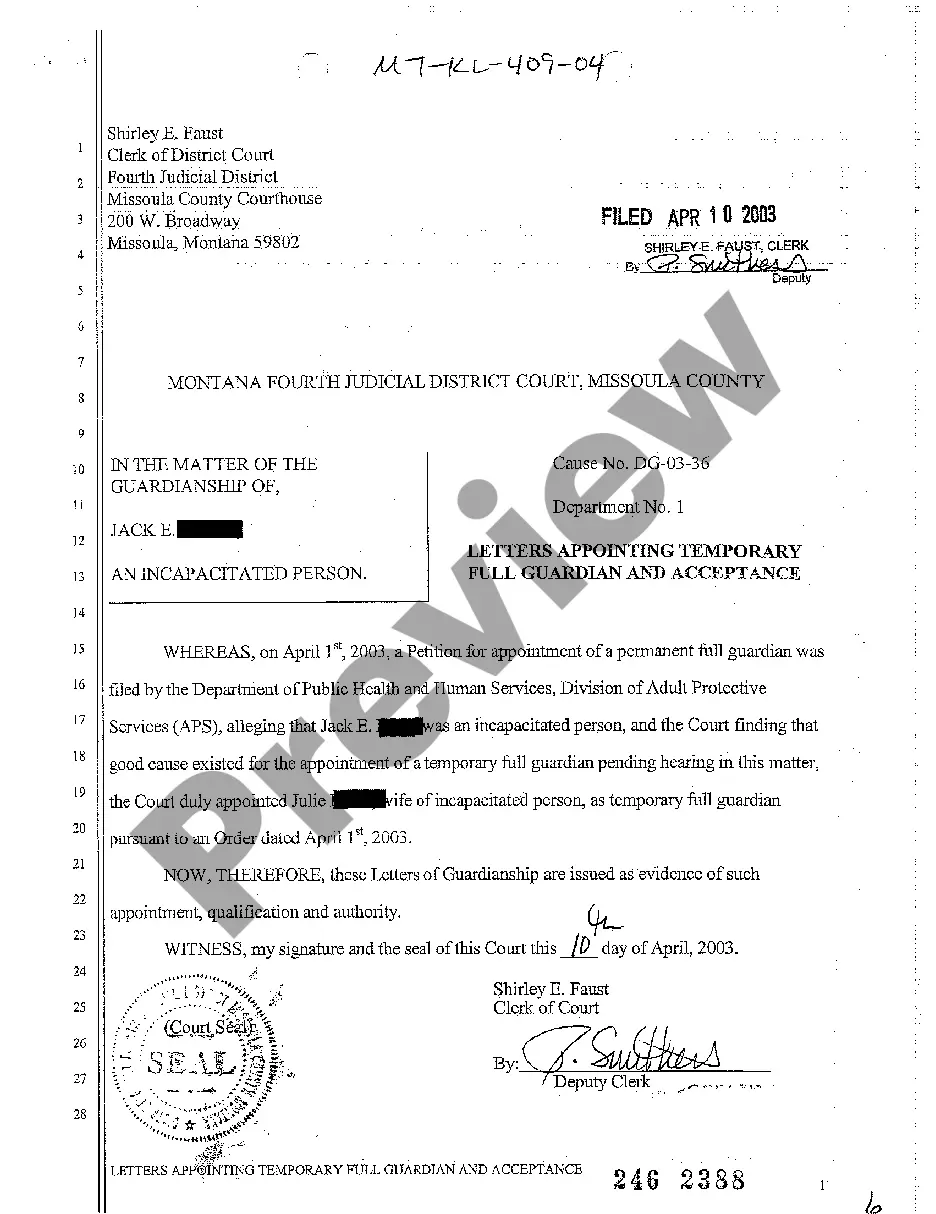

In most states, lenders are required to provide a homeowner with sufficient notice of default. The lender must also provide notice of the property owner's right to cure the default before the lender can initiate a foreclosure proceeding. Written proof of money owed under the mortgage.

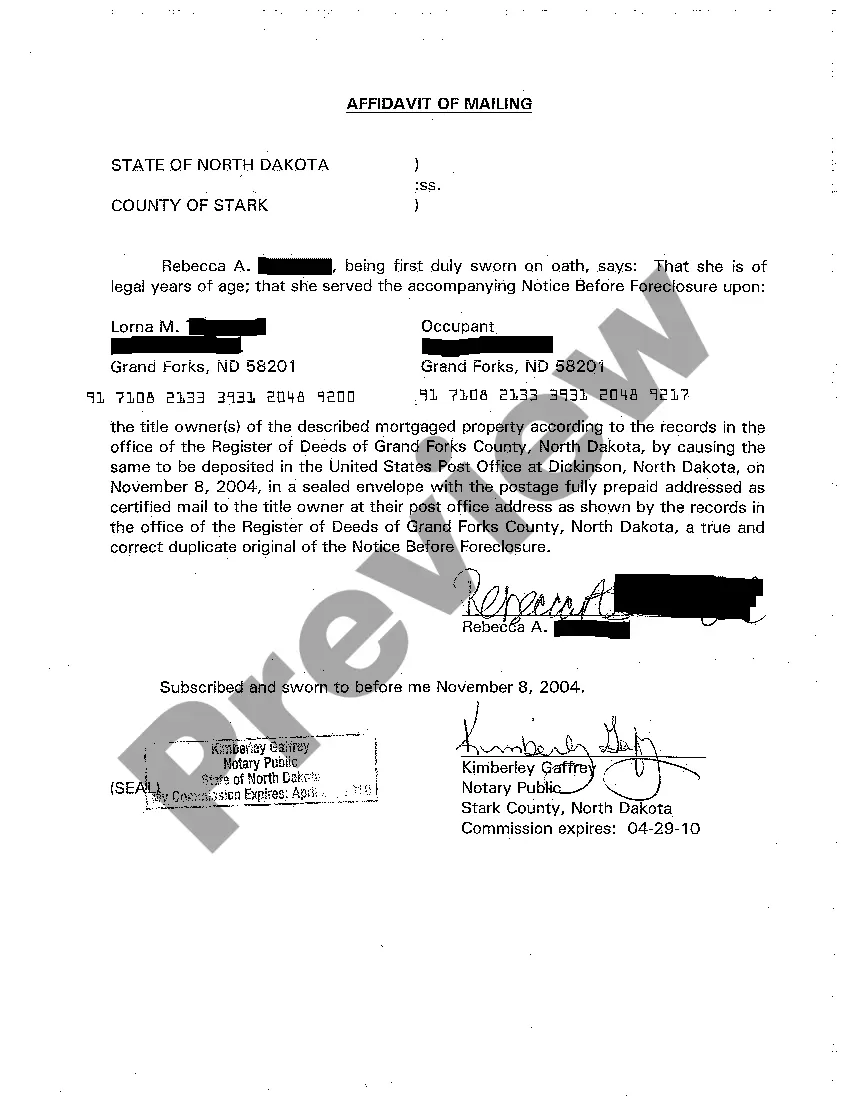

Notice Of Default The lender will also give public notice to the County Recorder's office or file a lawsuit with the court. This officially begins the preforeclosure process, which can last 3 10 months.

"Commencement of Foreclosure" for HUD's purposes is the first public action required by law such as filing a complaint or petition, recording a notice of default, or publication of a notice of sale.

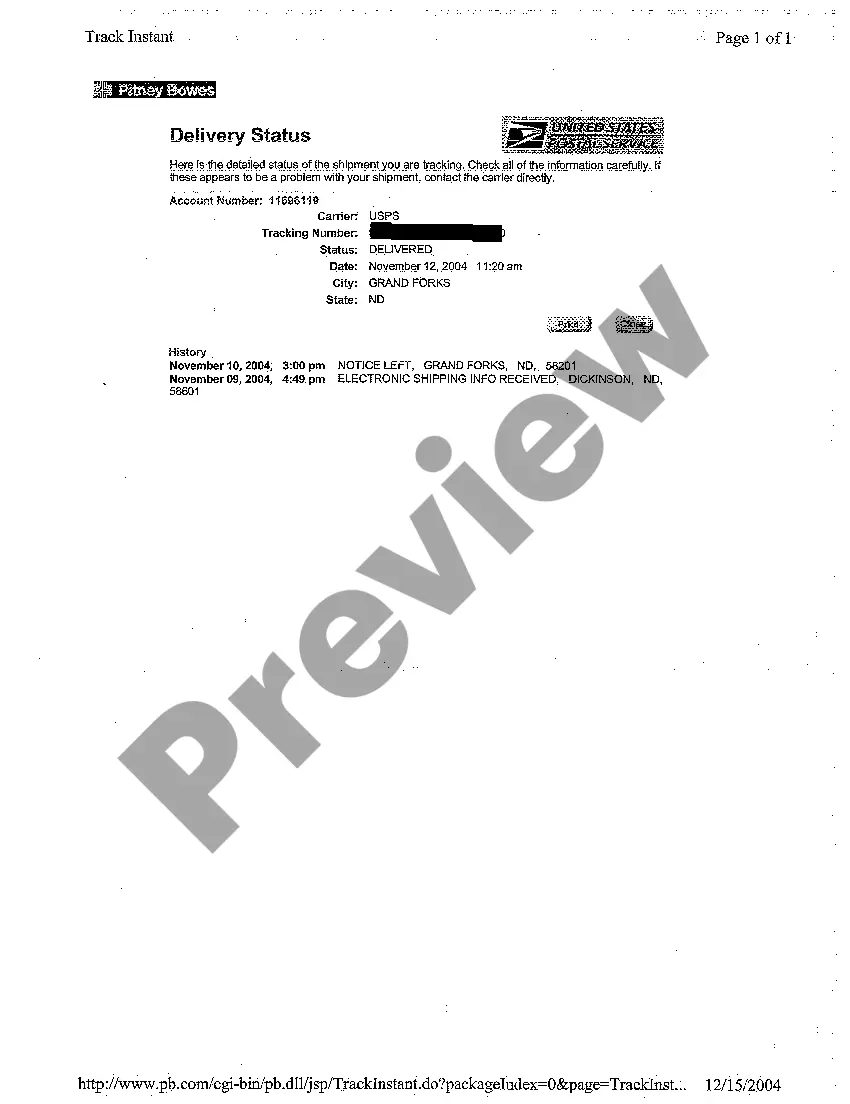

The borrower defaults on the loan. The lender issues a notice of default (NOD). A notice of trustee's sale is recorded in the county office. The lender tries to sell the property at a public auction.