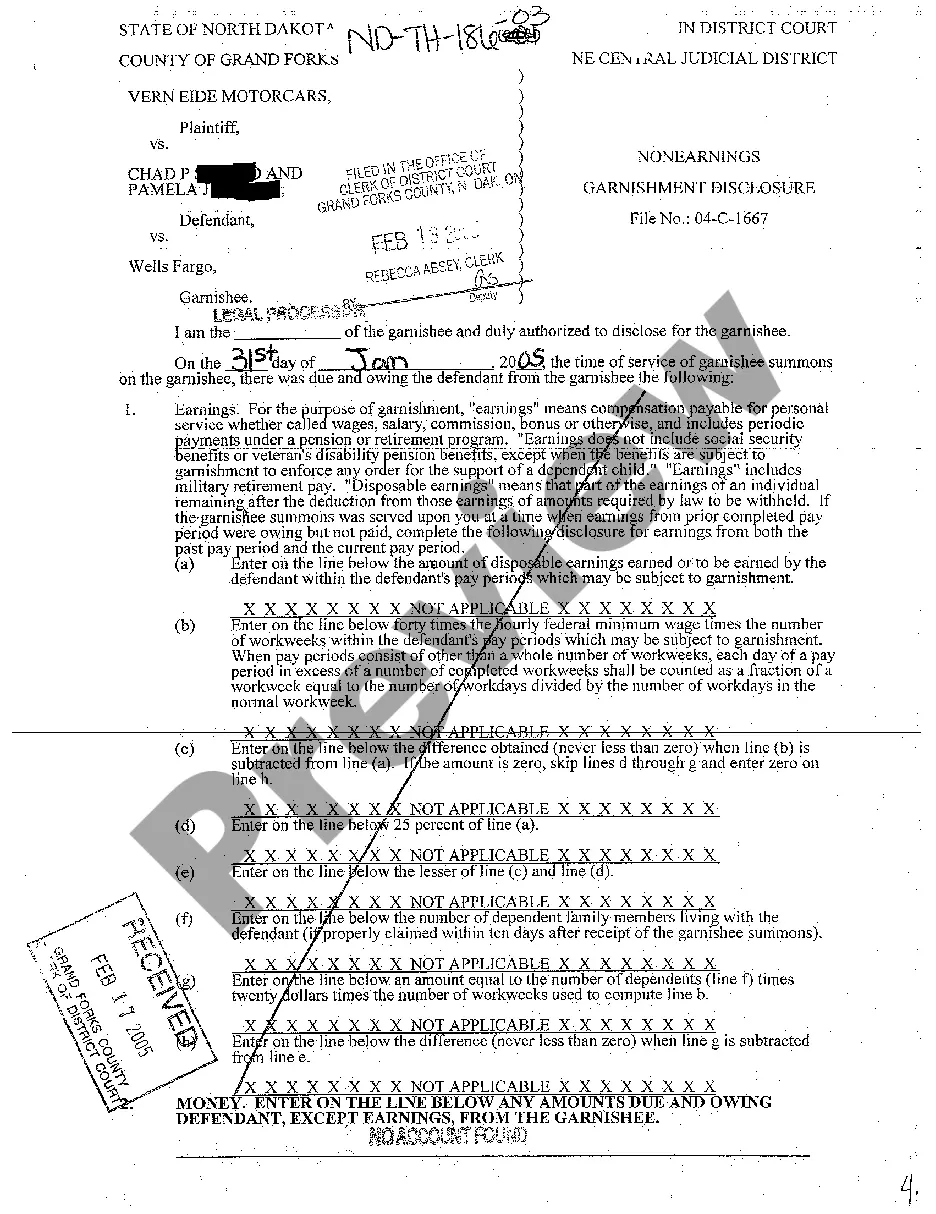

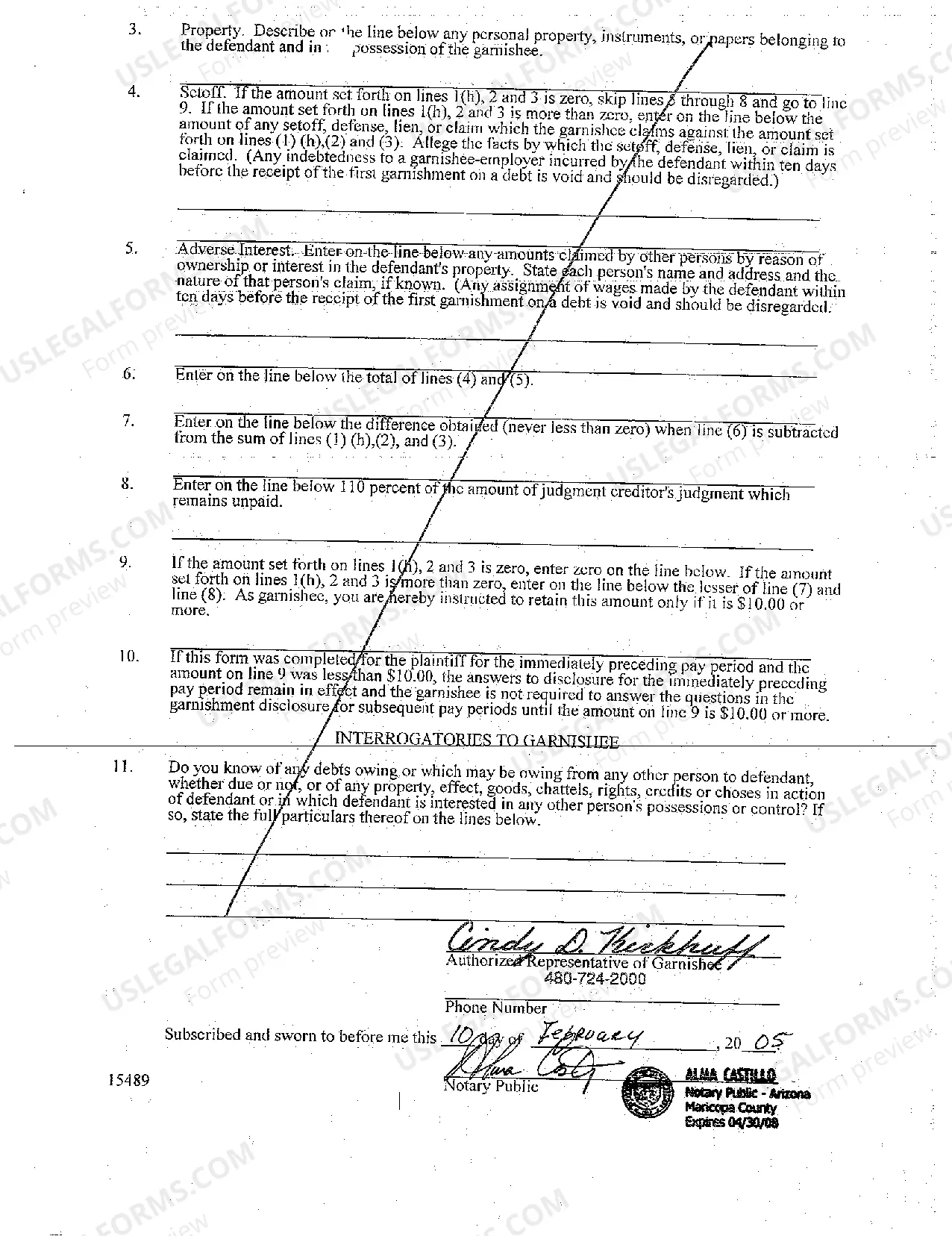

North Dakota Nonearnings Garnishment Disclosure

Description

How to fill out North Dakota Nonearnings Garnishment Disclosure?

Among countless free and paid examples that you can find online, you can't be certain about their reliability. For example, who created them or if they’re qualified enough to take care of what you need these to. Keep relaxed and use US Legal Forms! Get North Dakota Nonearnings Garnishment Disclosure templates created by skilled lawyers and get away from the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access all your earlier acquired templates in the My Forms menu.

If you’re utilizing our website the very first time, follow the guidelines below to get your North Dakota Nonearnings Garnishment Disclosure fast:

- Make certain that the file you see is valid where you live.

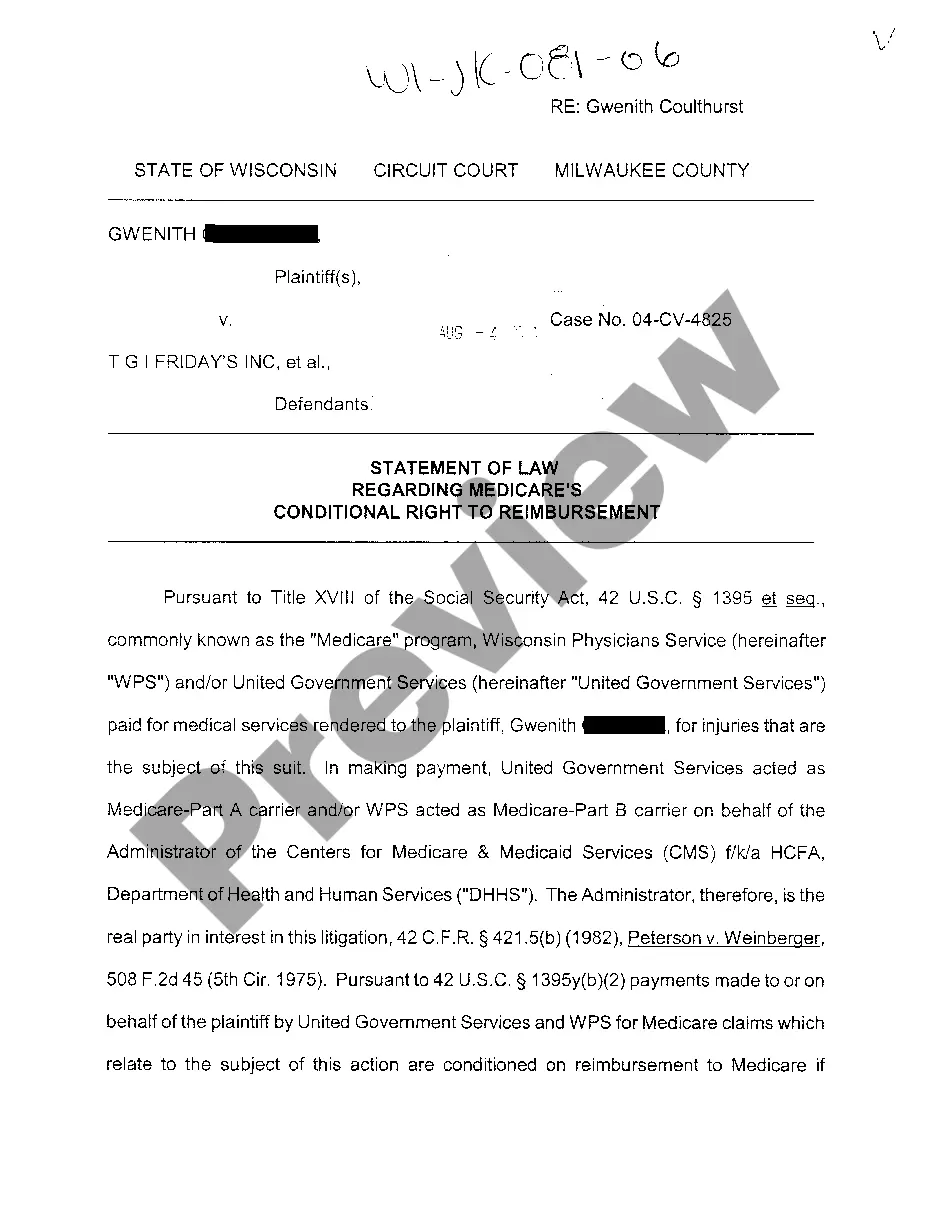

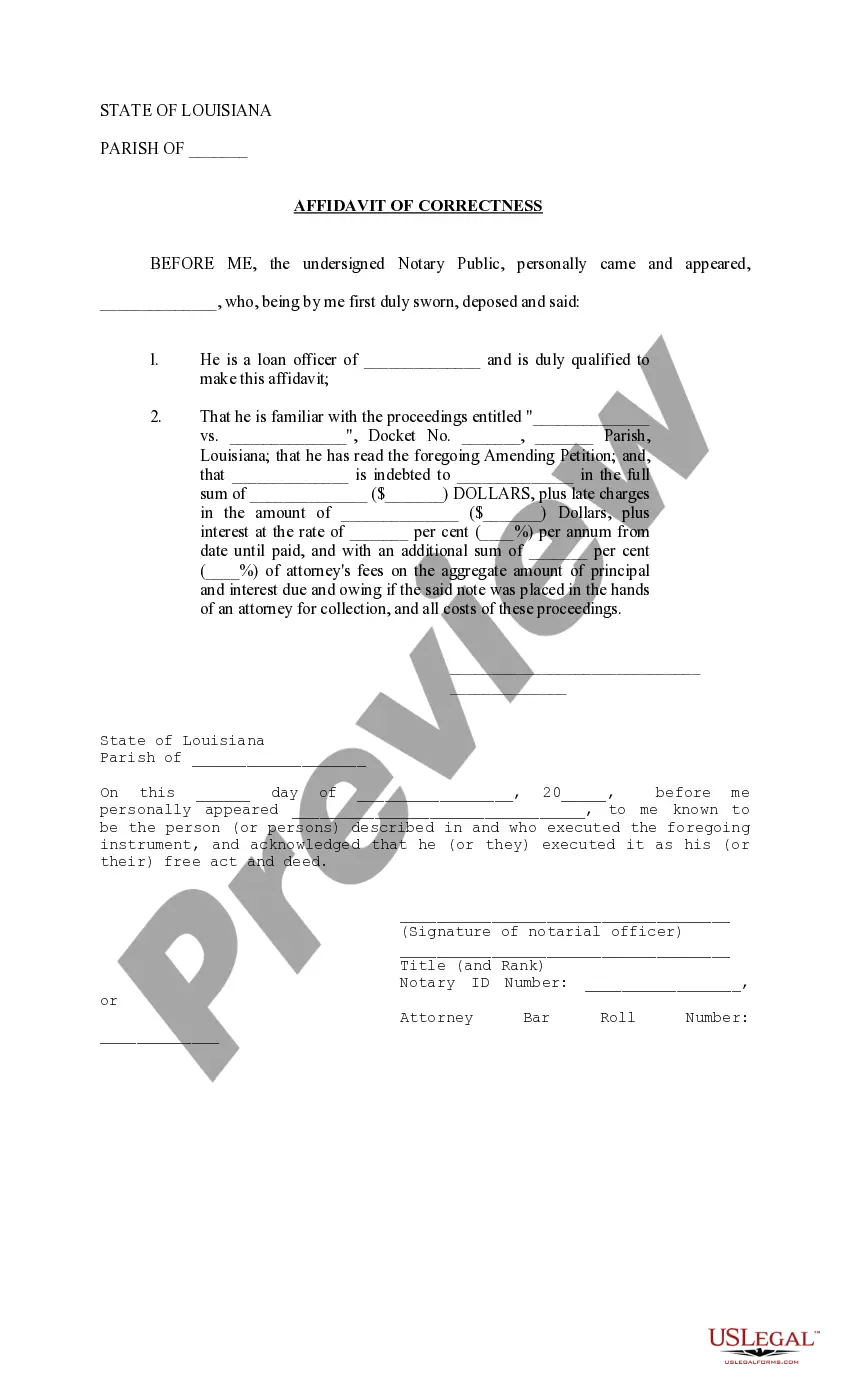

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you may use your North Dakota Nonearnings Garnishment Disclosure as many times as you need or for as long as it continues to be valid where you live. Edit it with your preferred online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

You have some rights in the wage garnishment process, but in most states, it's your responsibility to be aware of and exercise these rights. You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

Since your employer is required to provide you with a copy of garnishment paperwork, you should ask the payroll department at your job. If they are taking money out of your paycheck, they should give you a copy of the documents. Check back through any past correspondence with creditors.

Wage garnishment is sometimes ordered by federal or state courts when you owe back taxes, alimony, child support and certain other debts.This garnishment cannot be strictly "confidential" because the employer must be informed about it in order to garnish the wages.

Wage garnishments negatively impact your credit report and credit score. However, creditors themselves do not typically report their decision to garnish your wages to credit agencies.However, the garnishment will show up on your record through public records, which are accessible to anyone who searches for them.

Court orders, such as an order to garnish your wages, will show up as part of a background check, since court records are public records.

What Happens When a Garnishment Summons Is Served?In the case of a nonearnings garnishment, the garnishee must provide a written disclosure to the creditor within 20 days after service of the garnishment summons that identifies all indebtedness, money, or property that the garnishee owes to the debtor.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.