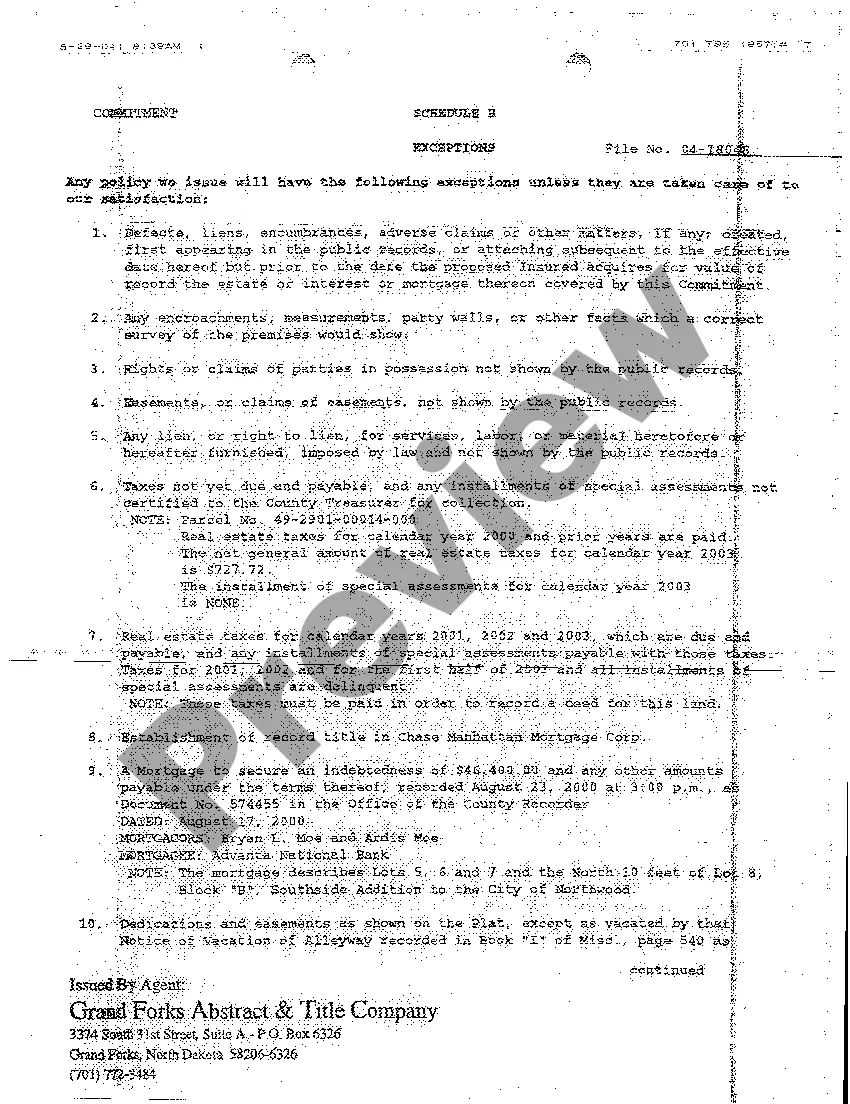

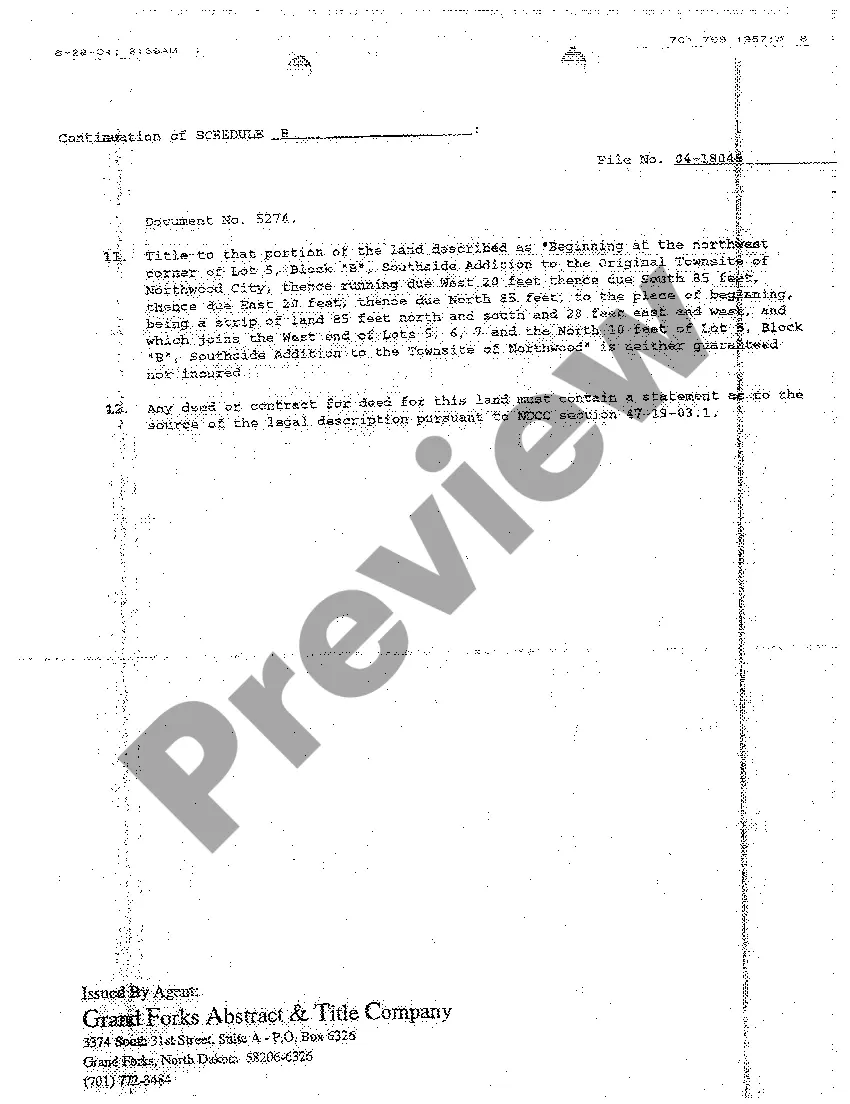

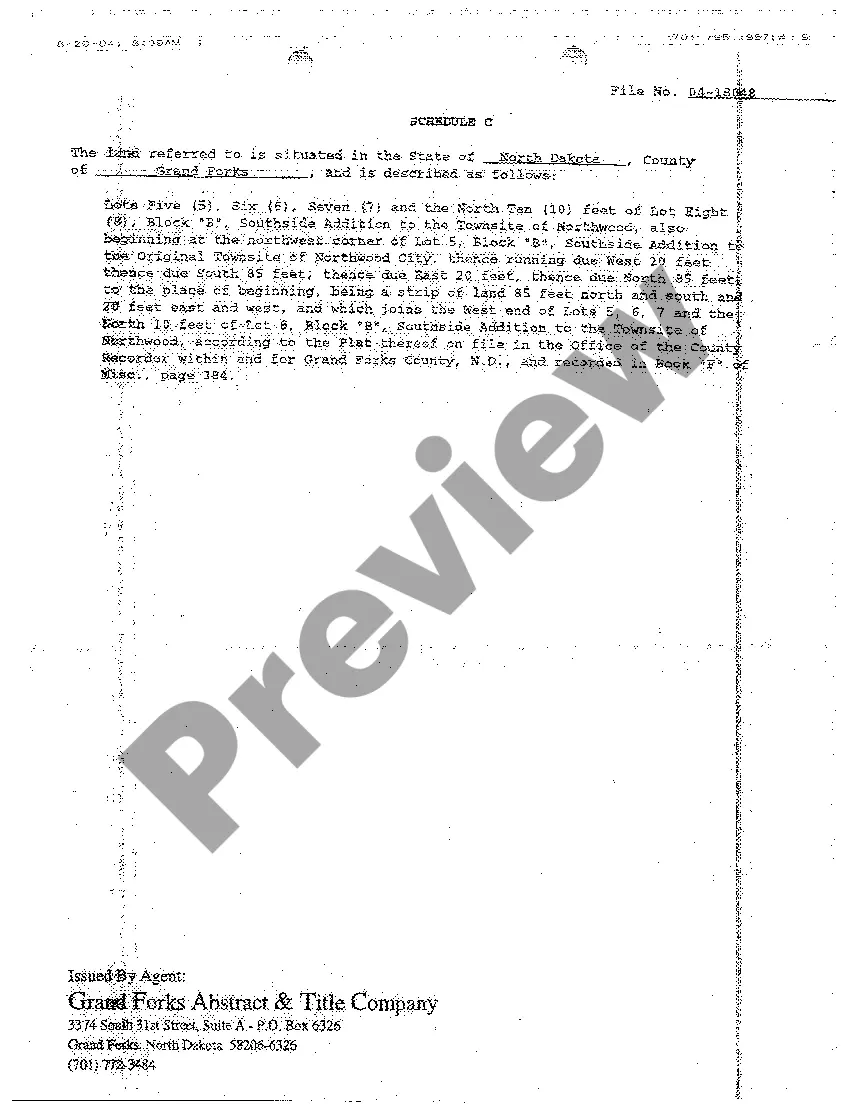

North Dakota Commitment for Title Insurance

Description Title Insurance In North Dakota

How to fill out North Dakota Commitment For Title Insurance?

Avoid costly lawyers and find the North Dakota Commitment for Title Insurance you need at a reasonable price on the US Legal Forms site. Use our simple categories functionality to look for and obtain legal and tax documents. Read their descriptions and preview them prior to downloading. Additionally, US Legal Forms enables users with step-by-step instructions on how to obtain and complete each and every template.

US Legal Forms customers just have to log in and get the particular form they need to their My Forms tab. Those, who haven’t obtained a subscription yet must stick to the tips below:

- Make sure the North Dakota Commitment for Title Insurance is eligible for use in your state.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you’re confident the template is right for you, click Buy Now.

- In case the template is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, it is possible to fill out the North Dakota Commitment for Title Insurance by hand or an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

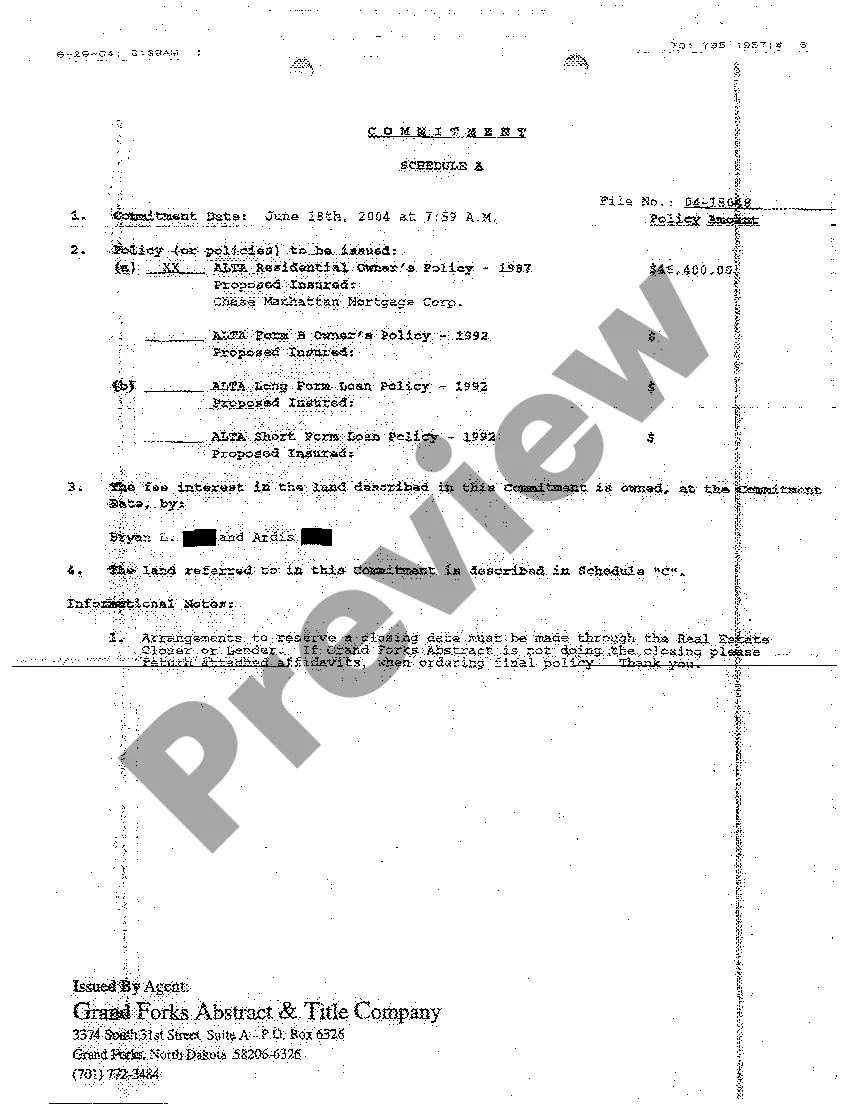

Process Takes Around Two Weeks The title process usually takes about two weeks; however, depending on the property and transaction type, this can vary dramatically. Your real estate agent or escrow/title officer can give you updates on the timetable as the closing progresses.

Although the average time it takes for a lender to completely close a mortgage is 53 days, it could be as little as 15 days. The actual timing of the mortgage commitment letter arriving in escrow depends on many factors and must arrive before the house can close.

The effective date of the Commitment is the last day through which the title has been run and expires by lapse of time, six months from the effective date, if no title insurance has been issued. The OWNER'S POLICY insures the owner's interest in the property being insured.

A title commitment (or whatever name yours goes by) is basically the title company's promise to issue a title insurance policy for the property after closing. The title commitment contains the same terms, conditions, and exclusions that will be in the actual insurance policy.

It's never too late to buy title insurance, even if it's been years since you bought the house. Just research local title companies and tell them your situation. You can also call a local real estate agent and ask for their title company recommendation.

The role of a title company is to verify that the title to the real estate is legitimately given to the home buyer. Essentially, they make sure that a seller has the rights to sell the property to a buyer.

Once your application for a mortgage loan has been approved and you have received a commitment letter from the lender, the final step before you can call the house your own is the closing, or settlement, of the purchase transaction and mortgage loan.

The title company will mail you your own copy when the title commitment is complete. It is normally the title company's responsibility to send a copy to the buyer and/or lender prior to closing. In the closing process, there is nothing the lender should provide the buyer in the title insurance aspect, Tacher says.