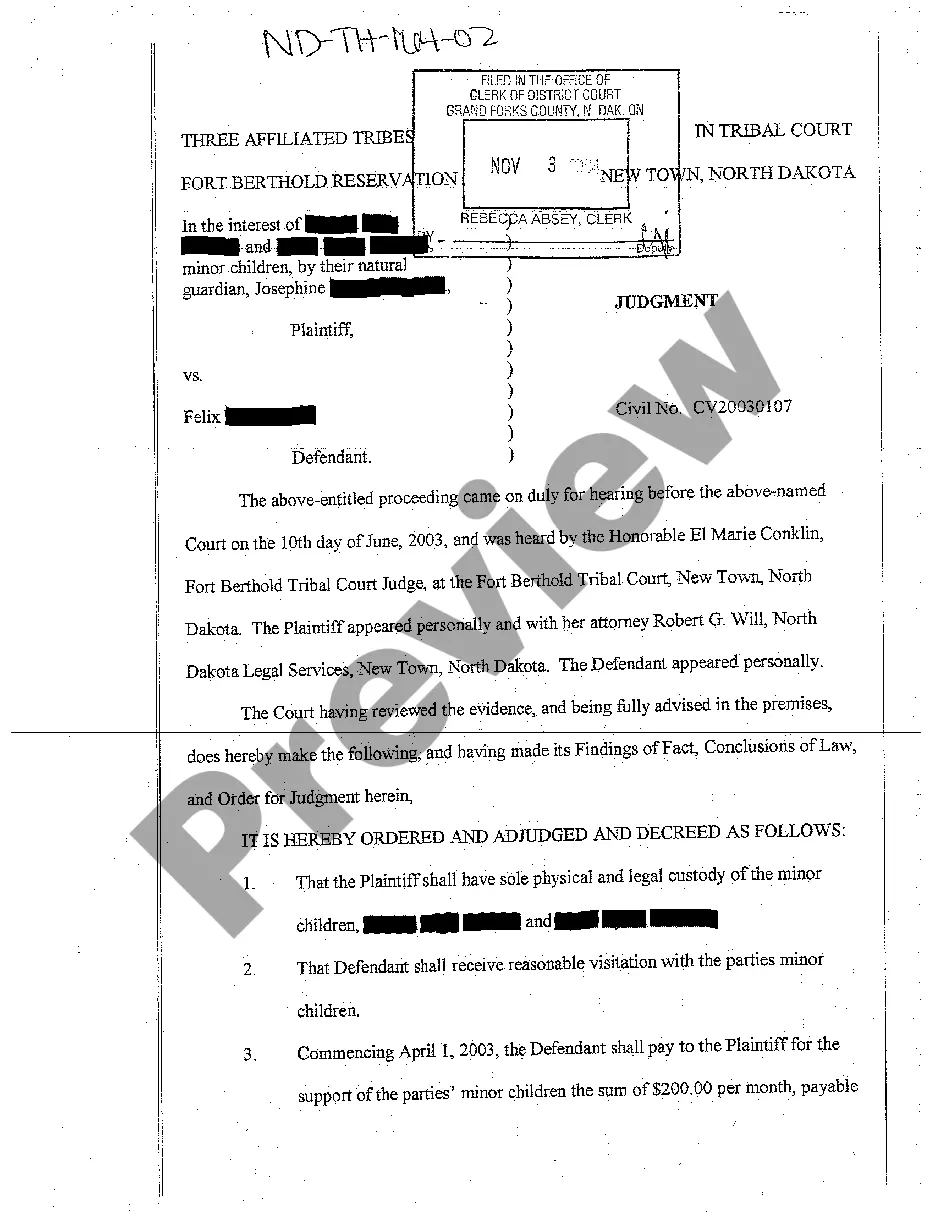

North Dakota Child Support Analysis for Defendant

Description

How to fill out North Dakota Child Support Analysis For Defendant?

Avoid pricey lawyers and find the North Dakota Child Support Analysis for Defendant you want at a affordable price on the US Legal Forms site. Use our simple groups functionality to search for and download legal and tax files. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms provides users with step-by-step instructions on how to download and fill out every single form.

US Legal Forms clients basically must log in and download the specific document they need to their My Forms tab. Those, who have not got a subscription yet need to stick to the tips below:

- Make sure the North Dakota Child Support Analysis for Defendant is eligible for use where you live.

- If available, read the description and make use of the Preview option prior to downloading the sample.

- If you are sure the template fits your needs, click on Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Choose to download the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the form to the gadget or print it out.

Right after downloading, you can complete the North Dakota Child Support Analysis for Defendant by hand or with the help of an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

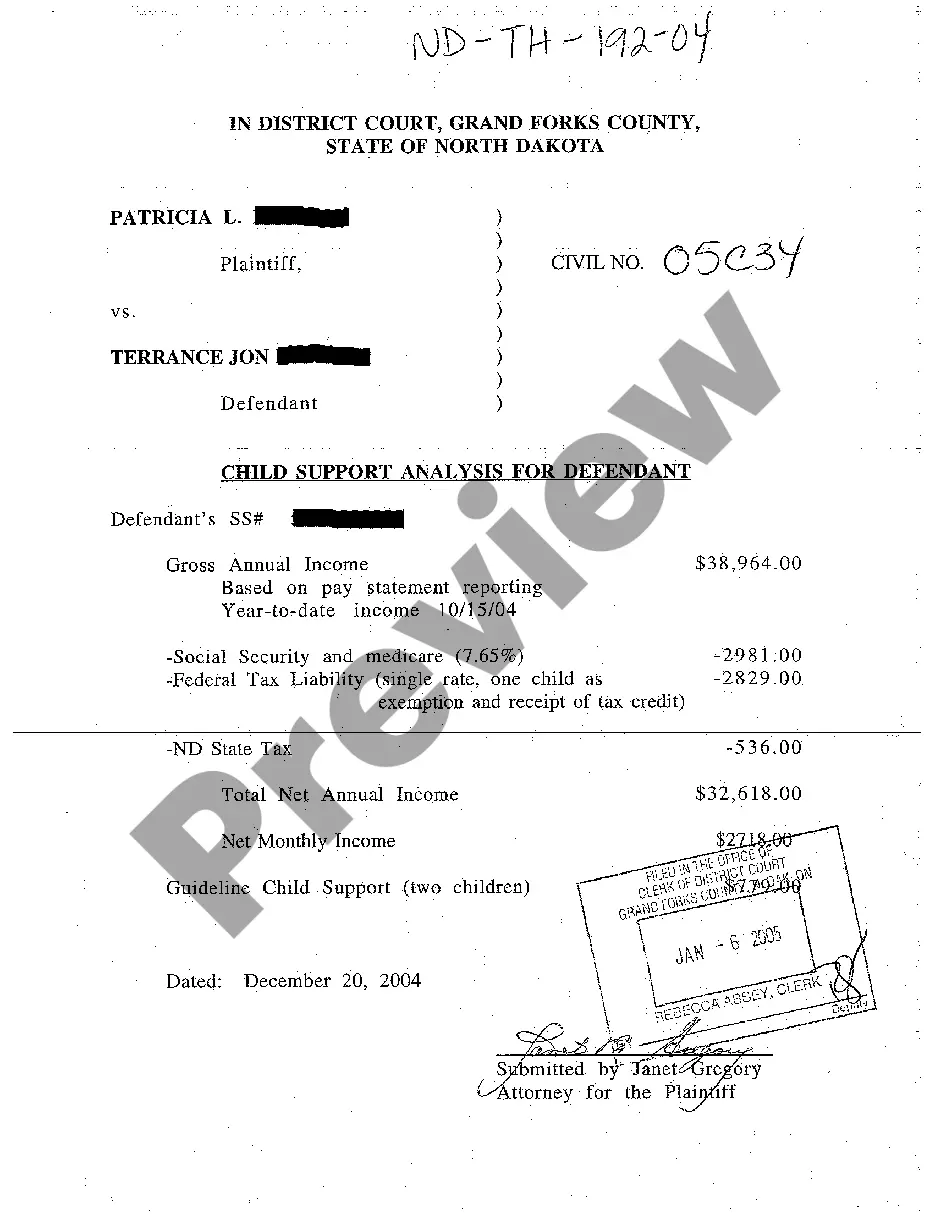

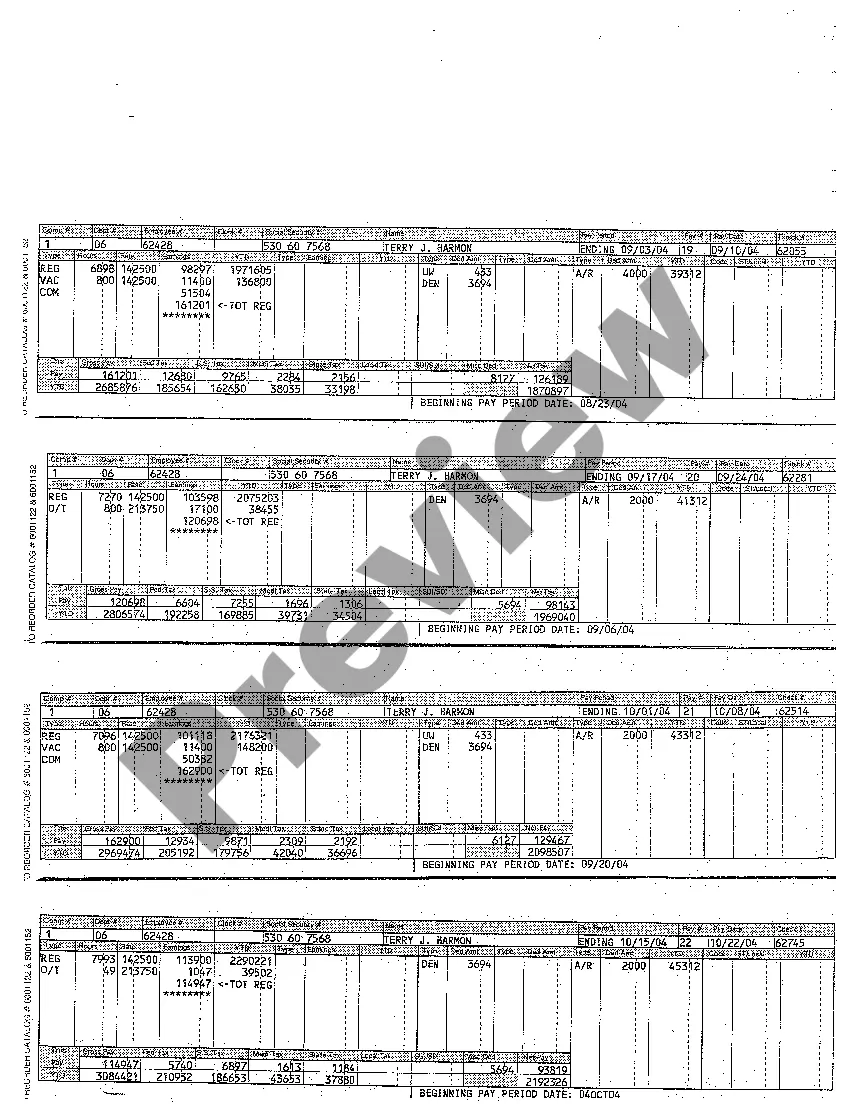

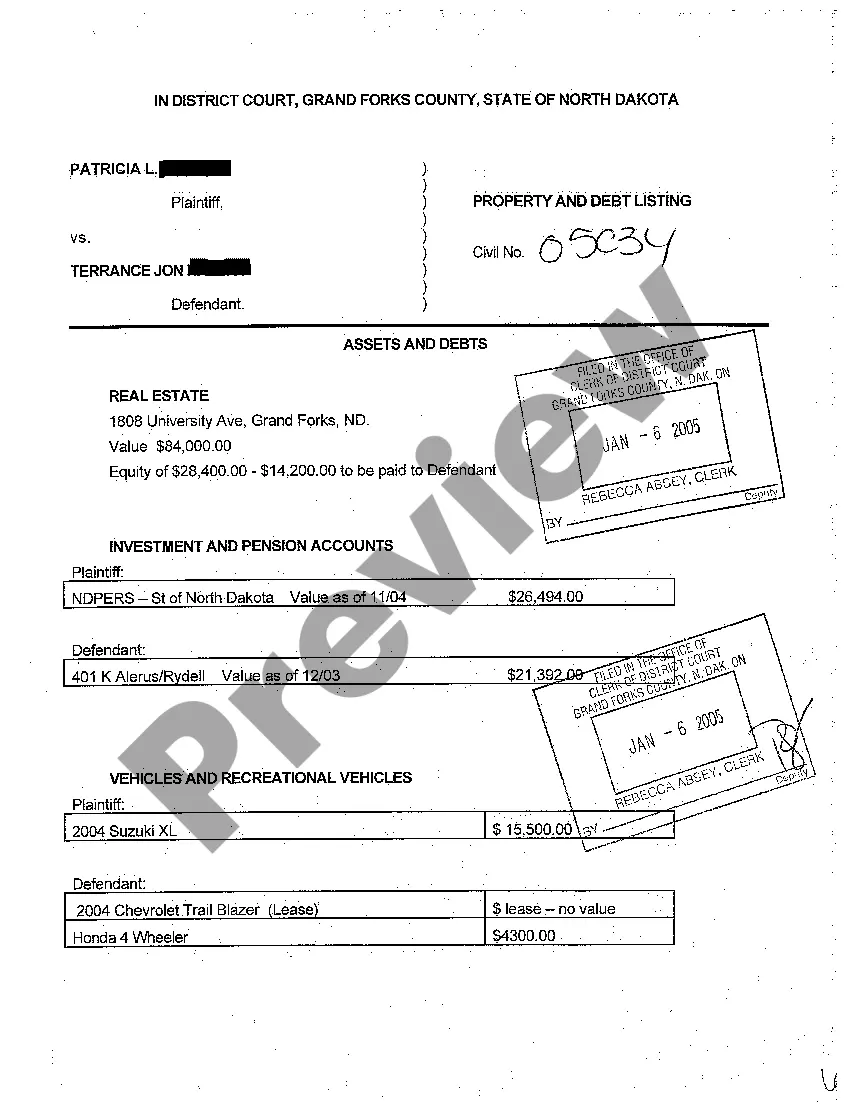

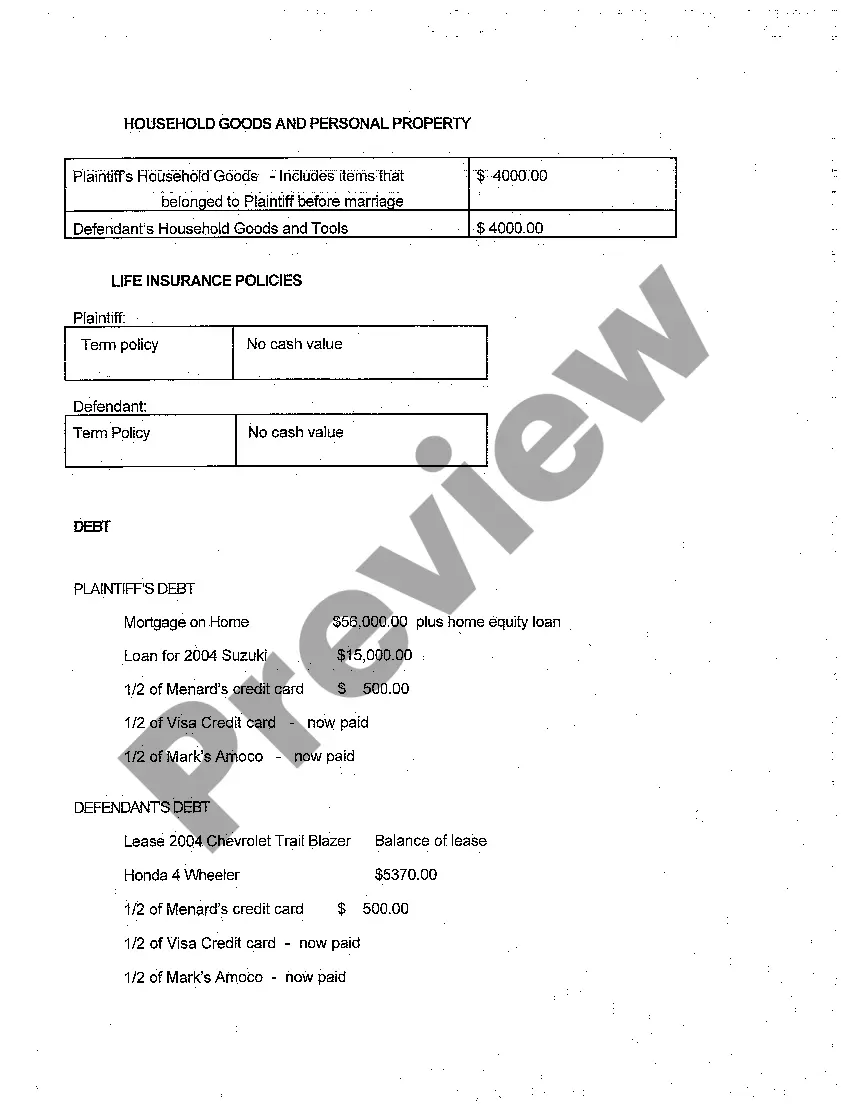

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

RECOMMENDATION 1. The federal Department of Justice recommends that the child support tables be updated every five years, or sooner when changes in federal, provincial, or territorial tax regimes would have a significant impact on table amounts.

In most cases, child support payments continue through the child's 18th birthday or through age 19, if the child is still in high school. With a judge's approval, parents can agree to continue child support for a longer period to cover a child's exceptional medical or physical needs or pay for college. See N. D. Cent.

The biggest factor in calculating child support is how much the parents earn. Some states consider both parents' income, but others consider only the income of the noncustodial parent. In most states, the percentage of time that each parent spends with the children is another important factor.

Calculating the Child Support income percentage one child 18% two children 24% three children 27%

Income. The first and typically most important factor in every child support case is each parent's income. Dependents. Overnight Visits. Health Care Costs. Child Care Expense. Other Deductions.

Modifying Child Support Without Going to Court It is possible to have your child support order modified without having to go to court--but only in very limited circumstances. Some judges include a Cost of Living Adjustment (COLA) clause in all of the child support orders they issue.

In Alberta, the basic amount of child support that someone with an income of $150,000 would have to pay for one child is $1318.00 per month.

The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66.6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.