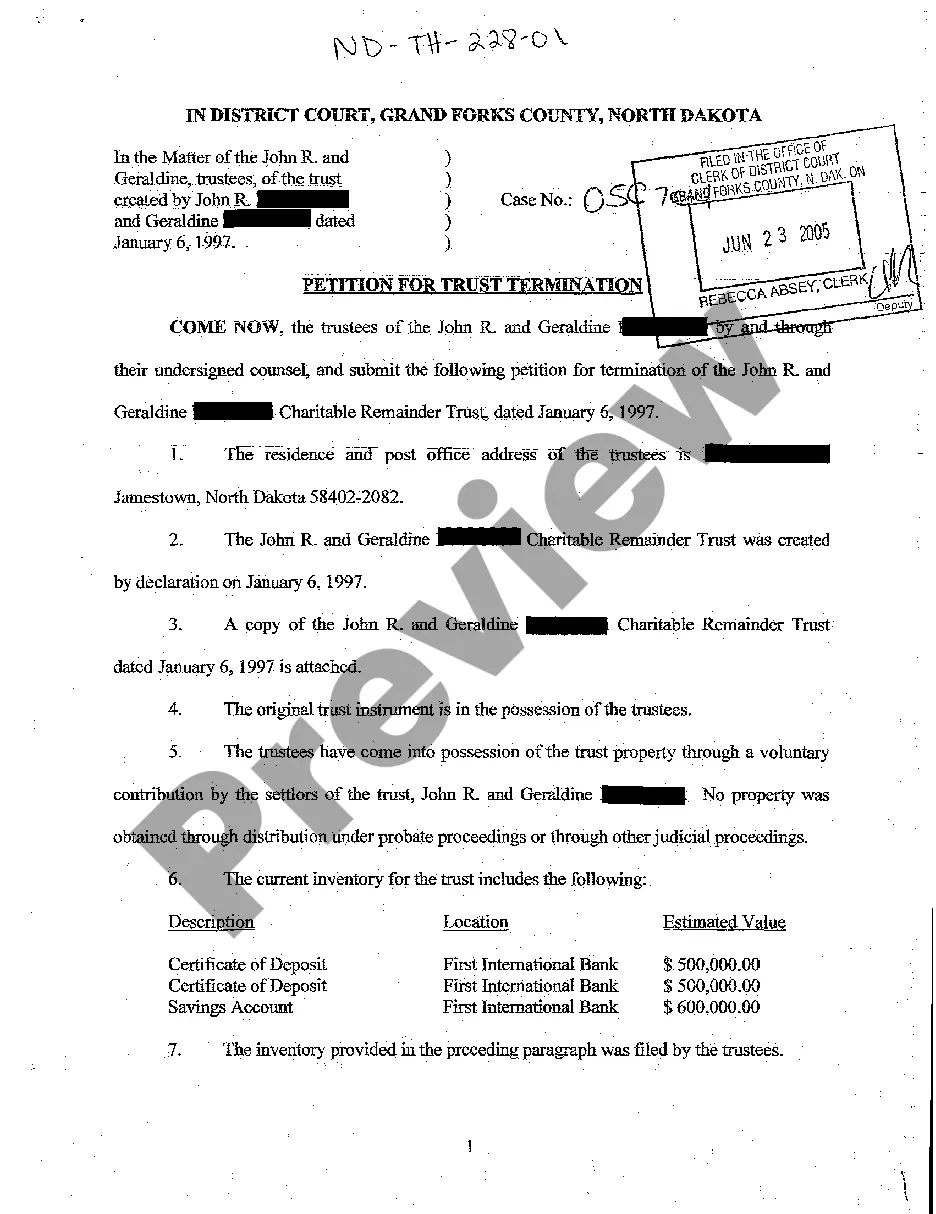

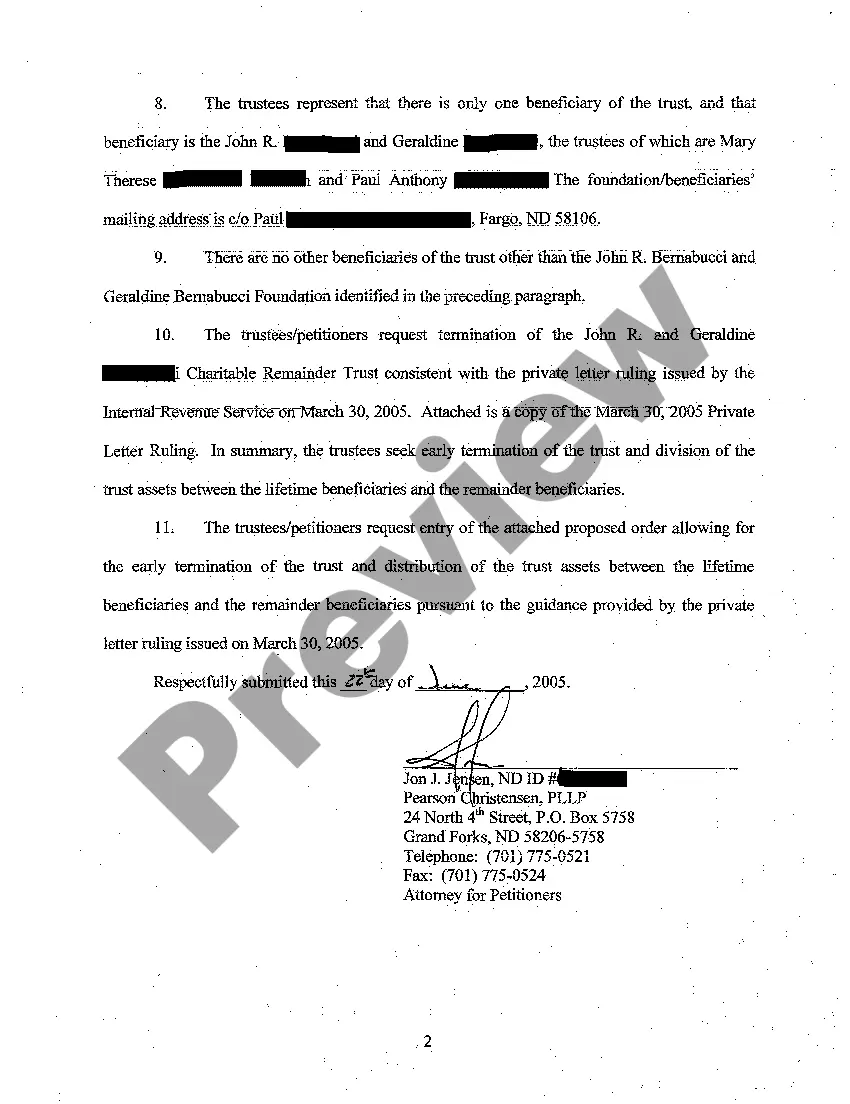

North Dakota Petition for Trust Termination

Description

How to fill out North Dakota Petition For Trust Termination?

Among lots of paid and free samples that you’re able to get on the internet, you can't be certain about their accuracy and reliability. For example, who created them or if they’re competent enough to deal with the thing you need these people to. Keep relaxed and use US Legal Forms! Find North Dakota Petition for Trust Termination samples created by professional attorneys and avoid the high-priced and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you are trying to find. You'll also be able to access all of your previously downloaded documents in the My Forms menu.

If you are using our website the very first time, follow the tips listed below to get your North Dakota Petition for Trust Termination with ease:

- Make sure that the file you find applies in the state where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another template using the Search field in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you’ve signed up and purchased your subscription, you can utilize your North Dakota Petition for Trust Termination as often as you need or for as long as it stays active where you live. Revise it in your favored online or offline editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.

Some statutes may allow a trustee to modify or terminate a trust without a court or beneficiary approval, while others may allow modification or termination only with the approval of a beneficiary or a court. Still others may allow termination only if the trust is under a certain value.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

An irrevocable trust has a grantor, a trustee, and a beneficiary or beneficiaries. Once the grantor places an asset in an irrevocable trust, it is a gift to the trust and the grantor cannot revoke it.To take advantage of the estate tax exemption and remove taxable assets from the estate.

An irrevocable trust is a trust with terms and provisions that cannot be changed. However, under certain circumstances, changes to an irrevocable trust can be made and a trust can even be terminated. A material purpose of the trust no longer exists.

In other words, a California court may now terminate an irrevocable trust if all beneficiaries of the trust agree despite the presence of a spendthrift provision in the trust as long as the court finds good cause to do so.

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

The grantor may be able to terminate an irrevocable trust, by following the state laws on dissolution. The laws of each state vary in this area. For example, New Jersey has adopted the Uniform Trust Code, which stipulates that an irrevocable trust can be terminated by consent of the trustee and the beneficiaries.

Trusts are designed to terminate after the purposes of the trust have been fulfilled. For example, the trust agreement may state that it terminates upon the death of a named beneficiary, when its assets fall below a certain dollar amount, upon the expiration of a set date or after all trust assets are distributed.