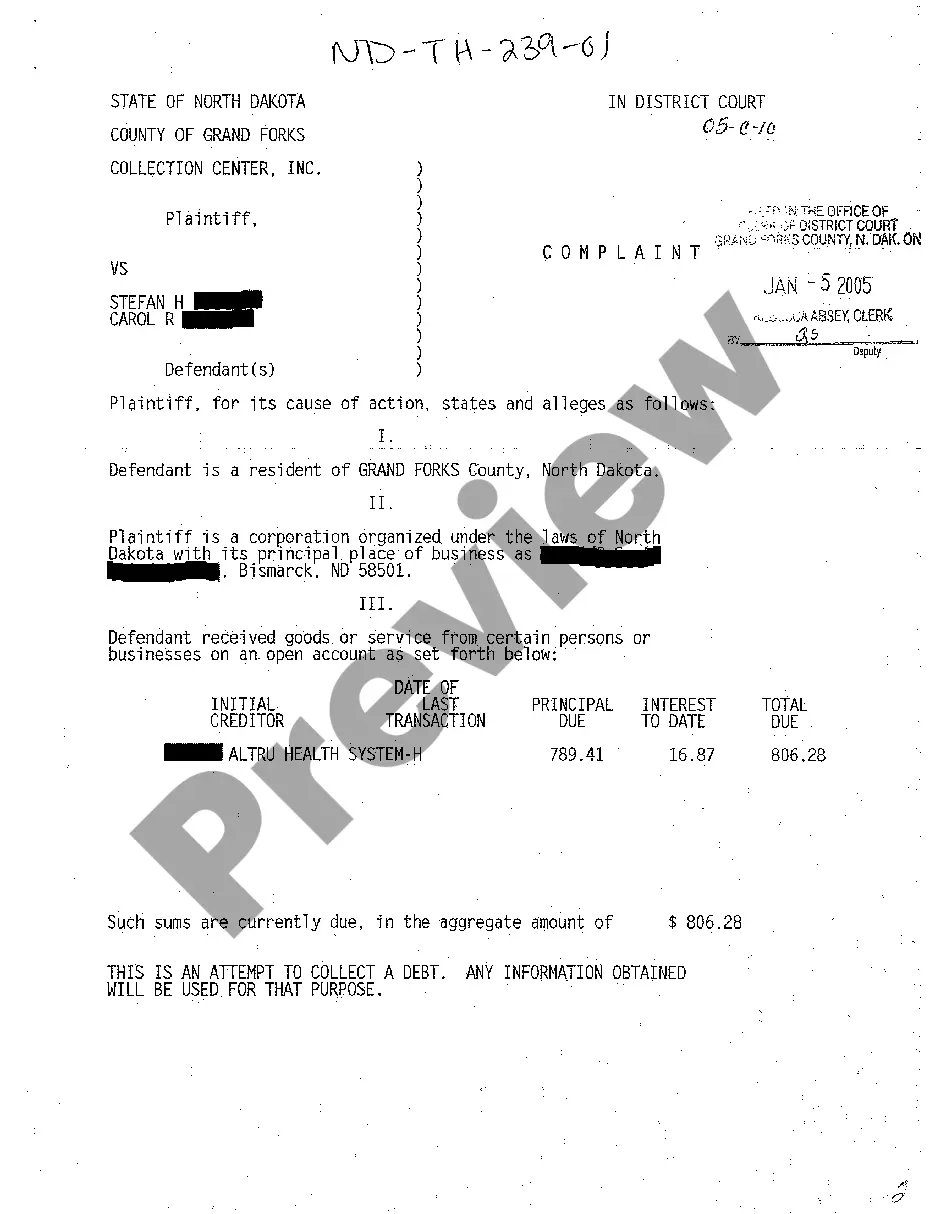

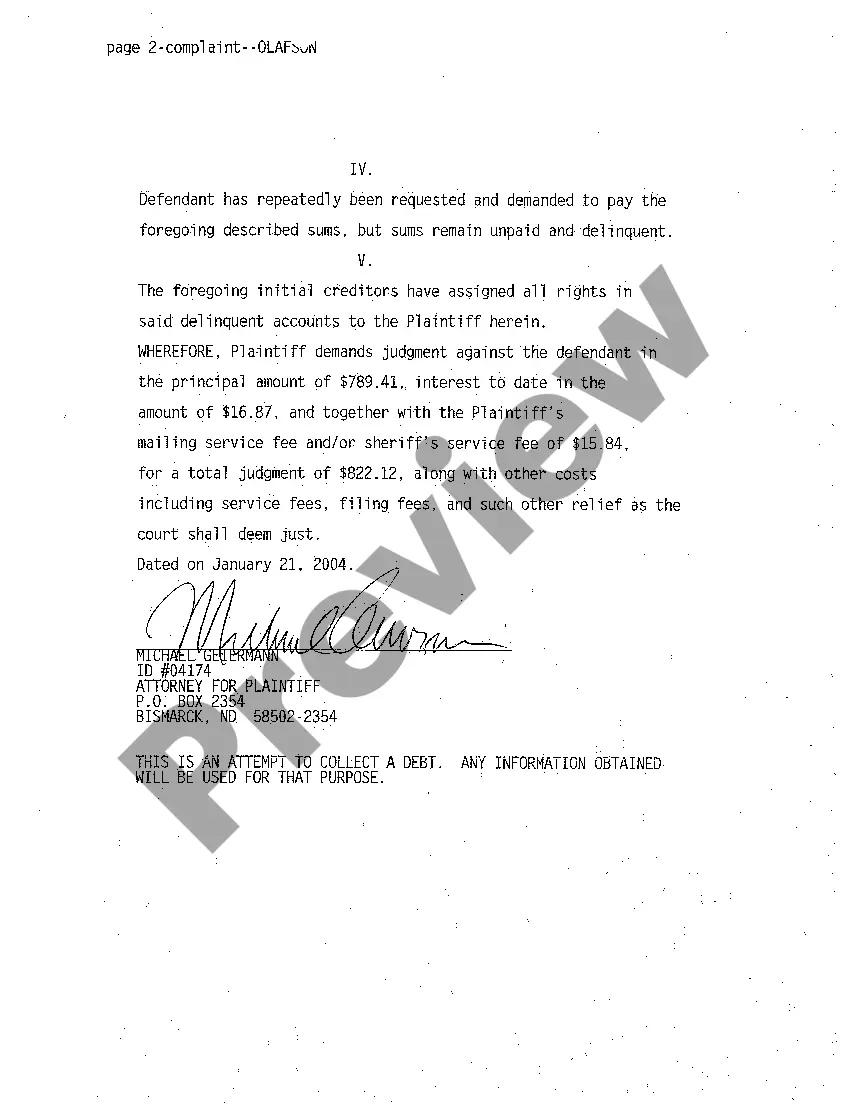

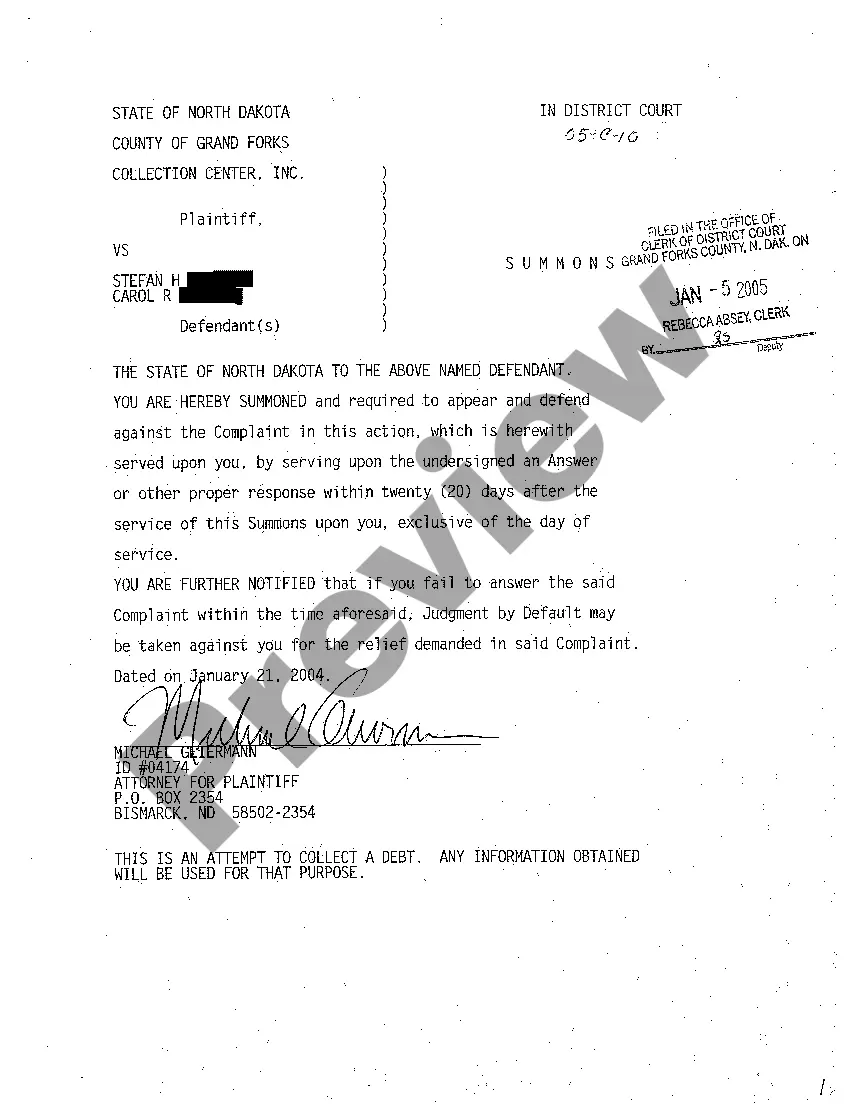

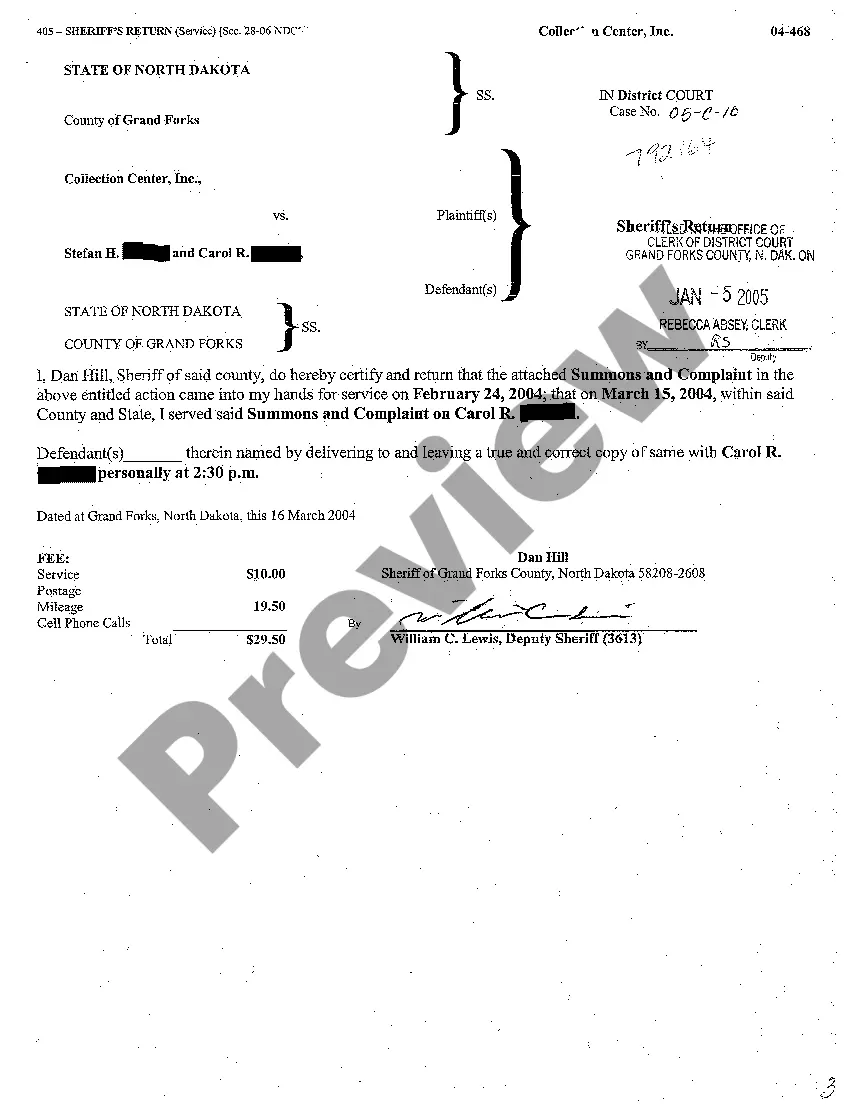

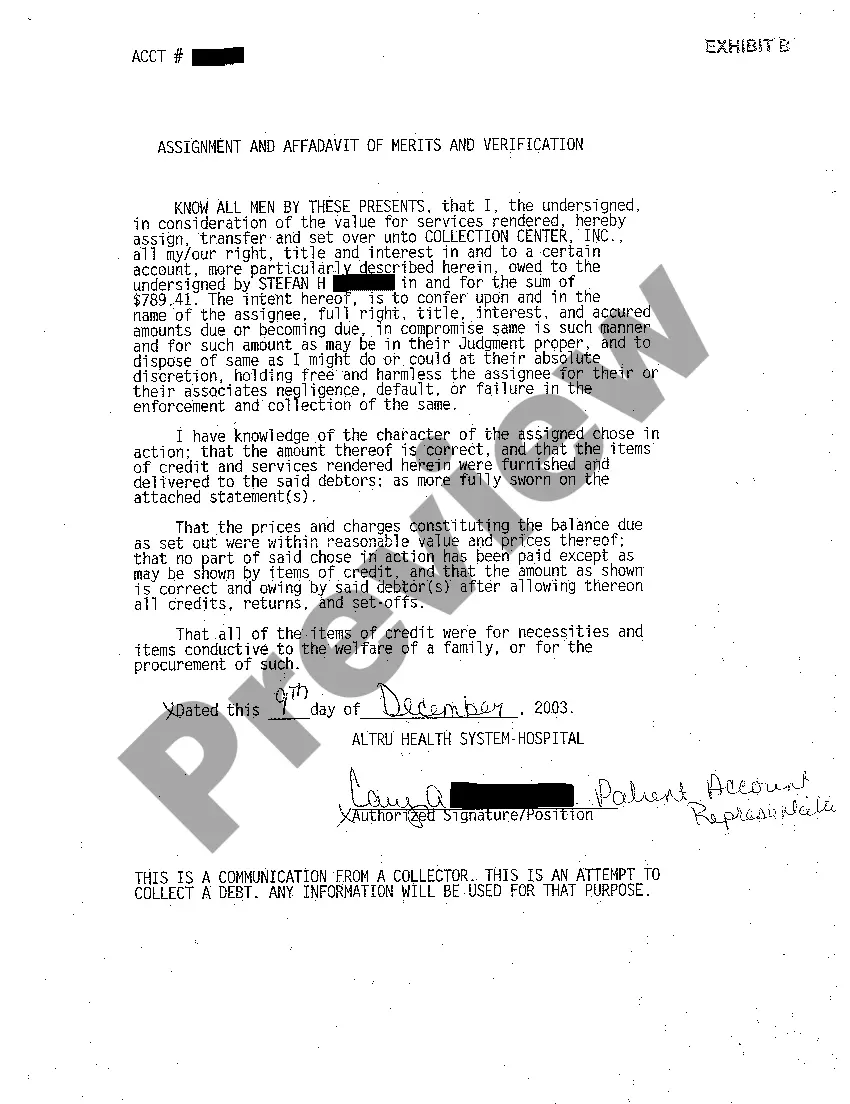

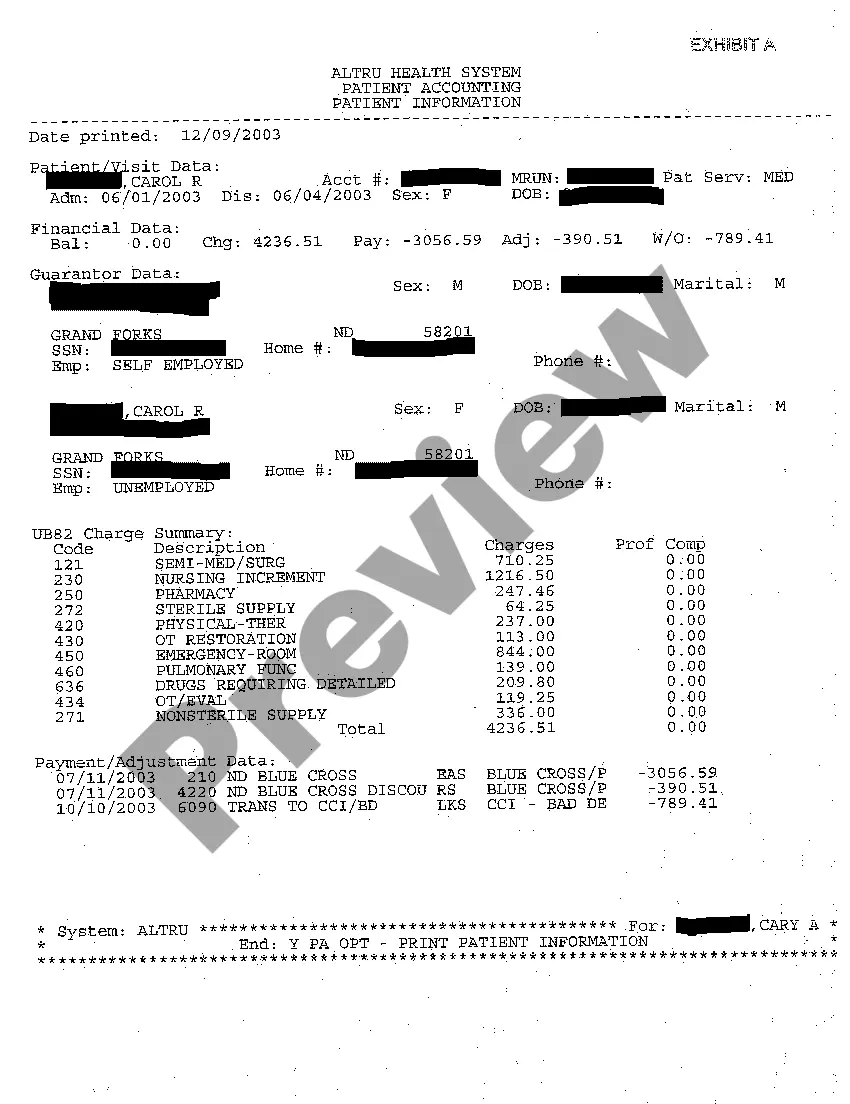

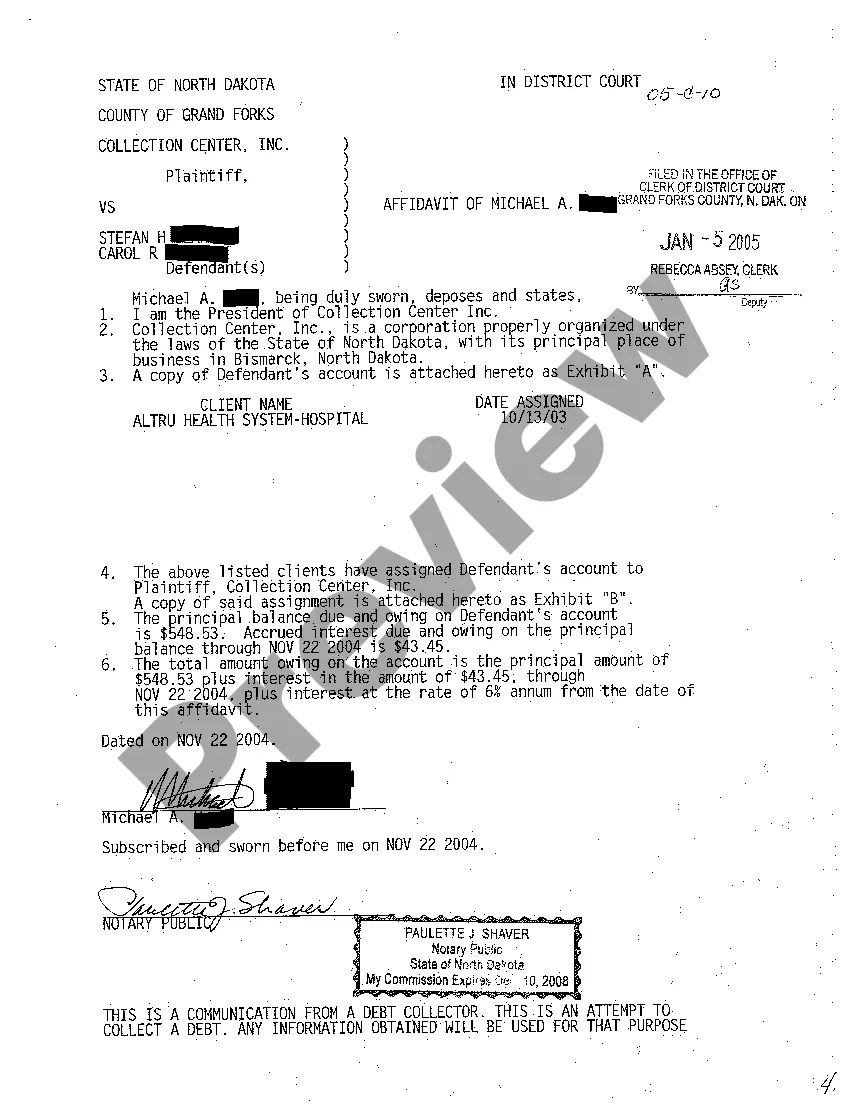

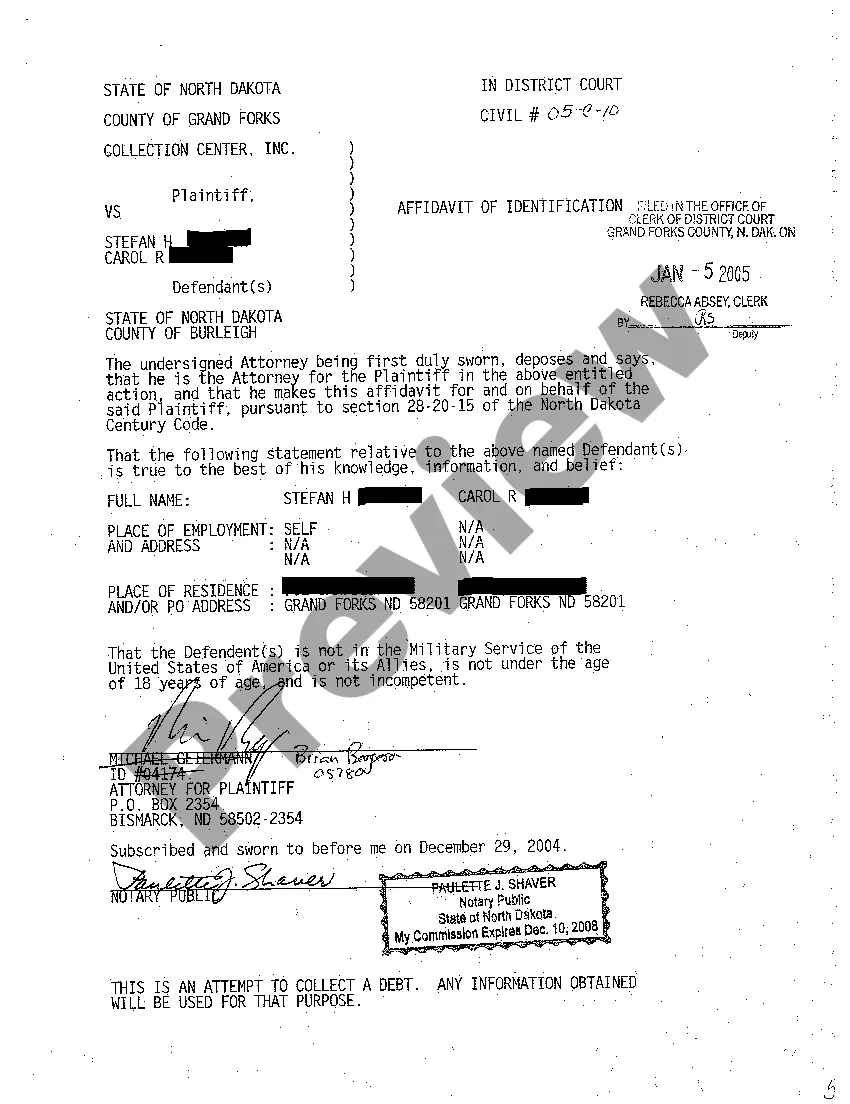

North Dakota Complaint for Recovery of Debt Owed for Medical Services Rendered

Description

How to fill out North Dakota Complaint For Recovery Of Debt Owed For Medical Services Rendered?

Among hundreds of paid and free samples that you find online, you can't be certain about their accuracy. For example, who created them or if they’re competent enough to deal with what you require them to. Keep relaxed and use US Legal Forms! Discover North Dakota Complaint for Recovery of Debt Owed for Medical Services Rendered templates created by skilled attorneys and prevent the expensive and time-consuming process of looking for an attorney and then having to pay them to write a papers for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you are trying to find. You'll also be able to access all your previously saved files in the My Forms menu.

If you are utilizing our service the first time, follow the instructions listed below to get your North Dakota Complaint for Recovery of Debt Owed for Medical Services Rendered fast:

- Make certain that the document you see applies in the state where you live.

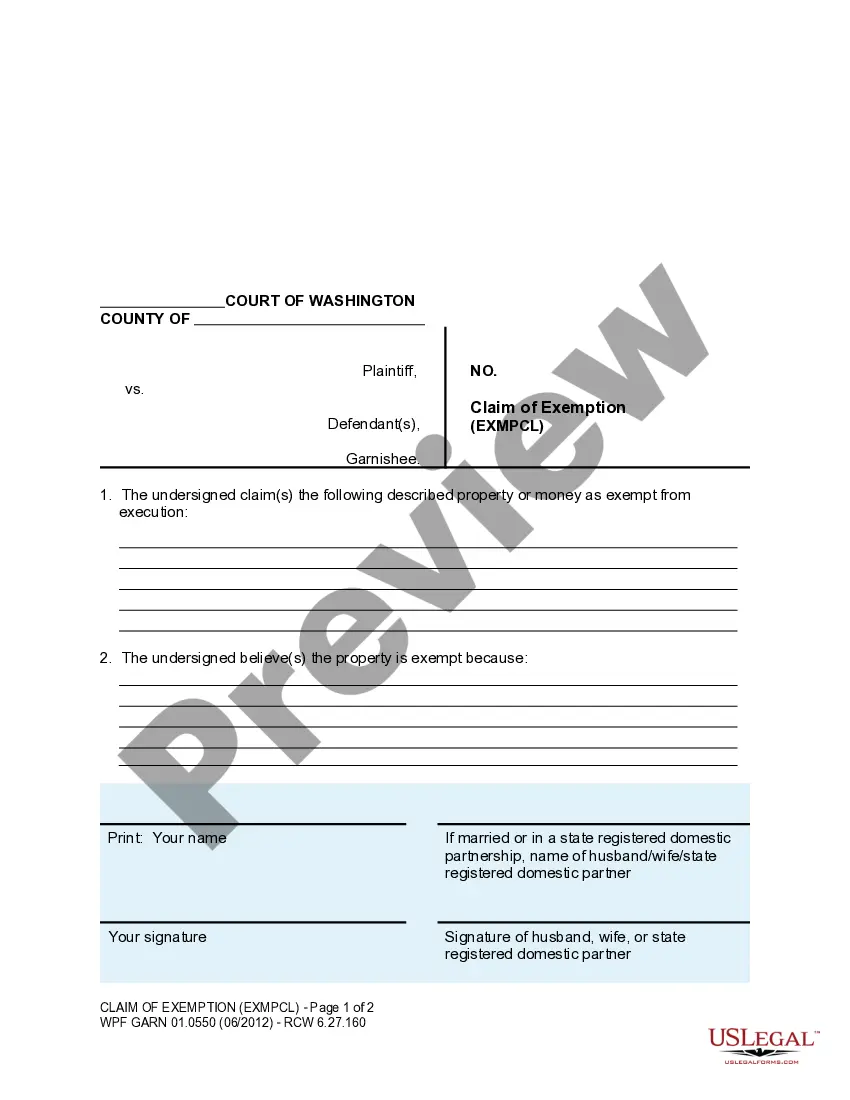

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another template using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you have signed up and bought your subscription, you can use your North Dakota Complaint for Recovery of Debt Owed for Medical Services Rendered as often as you need or for as long as it remains valid where you live. Edit it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

According to the CFPB, the collector would have to confirm it has in addition to the usual info account number associated with the debt, date of default, amount owed at default, and the date and amount of any payment or credit applied after default.

When writing the letter, request that the collection agency or creditor provide you with: Documentation that you owed the debt at some point, such as a contract you signed. How much you owe and the last outstanding action on the debt, which can be shown by documents such as the last statement or bill.

Debt collectors can threaten to sue you if they intend to do so. However, debt collectors cannot threaten to sue you if they don't intend to do so or they legally cannot.A debt collector can only threaten to take actions that are allowed by law. Texas does not allow Texas companies to garnish wages.

You have the right to force the debt collector to prove you owe the money. Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

A debt collector must tell you the name of the creditor, the amount owed, and that you can dispute the debt or seek verification of the debt. Any debt collector who contacts you claiming you owe on a debt is required by law to tell you certain information about the debt.

Debt collectors often assume a debtor won't show up to court to face a debt lawsuit, allowing them to get what they came for (the judgment) without having to do the legwork (provide proof of the debt).Just say, Prove it. Make the debt buyer prove you owe the debt, because if they can't, the case could be dismissed.

Respond to the Lawsuit or Debt Claim. Challenge the Company's Legal Right to Sue. Push Back on Burden of Proof. Point to the Statute of Limitations. Hire Your Own Attorney. File a Countersuit if the Creditor Overstepped Regulations. File a Petition of Bankruptcy.

What Debt Collectors Do. Debt collectors use letters and phone calls to contact delinquent borrowers and try to convince them to repay what they owe.Collectors may report delinquent debts to credit bureaus to encourage consumers to pay, since delinquent debts can do serious damage to a consumer's credit score.