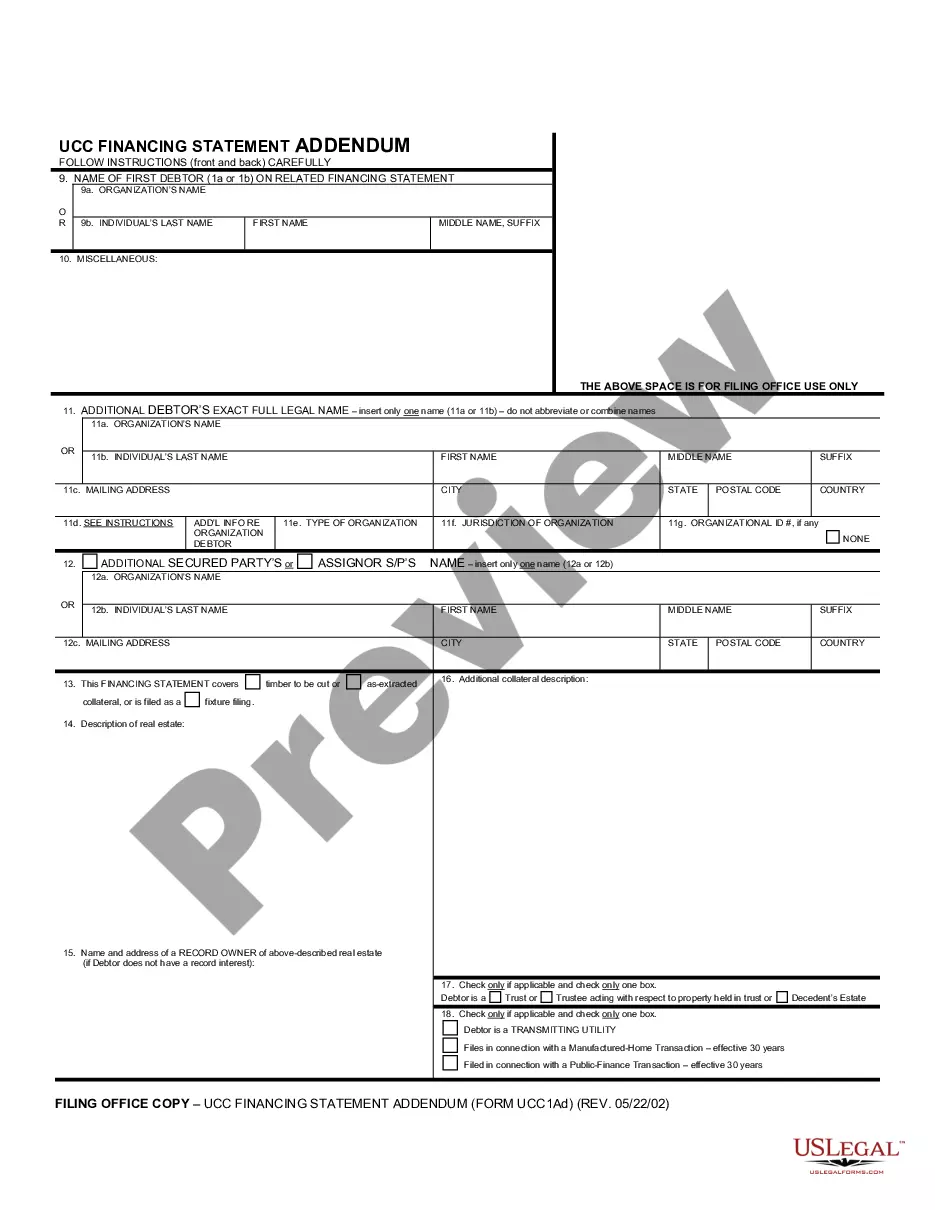

North Dakota UCC1 Financing Statement Addendum

Description Ucc Financing Statement

How to fill out North Dakota UCC1 Financing Statement Addendum?

Avoid expensive attorneys and find the North Dakota UCC1 Financing Statement Addendum you want at a affordable price on the US Legal Forms site. Use our simple categories functionality to find and download legal and tax forms. Read their descriptions and preview them prior to downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to obtain and fill out each form.

US Legal Forms customers merely need to log in and obtain the specific form they need to their My Forms tab. Those, who have not got a subscription yet need to stick to the guidelines listed below:

- Ensure the North Dakota UCC1 Financing Statement Addendum is eligible for use where you live.

- If available, read the description and use the Preview option before downloading the sample.

- If you are confident the document fits your needs, click Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Click Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, it is possible to fill out the North Dakota UCC1 Financing Statement Addendum by hand or an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

It should be noted that UCC financing statements filed now generally do not contain a grant of the security interest and generally are not signed or otherwise authenticated by the Debtor and therefore would not satisfy the requirement of a security agreement.

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

Rules vary by State around releasing a UCC lien after a borrower satisfied the debt. Primarily there are two main ways to remove them. One way is by having the lender file a UCC-3 Financing Statement Amendment. Another way to remove a UCC filing is by swearing an oath of full payment at the secretary of state office.

If you're approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

Also known as a UCC-3, and, depending on the context, a UCC-3 financing statement amendment, a UCC-3 termination statement, and a UCC-3 continuation statement. Under the Uniform Commercial Code, a UCC-3 is used to continue, assign, terminate, or amend an existing UCC-1 financing statement (UCC-1).

To assign (1) some or all of Assignor's right to amend the identified financing statement, or (2) the Assignor's right to amend the identified financing statement with respect to some (but not all) of the collateral covered by the identified financing statement: Check box in item 3 and enter name of Assignee in item 7a

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

Form UCC3 is used to amend (make changes to) a UCC1 filing.However, it is important to note that for a UCC1 filing a termination is only an amendment and that the UCC1 filing may be amended further, even after a termination has been filed. Box 3 Continuation A UCC1 filing is good for five years.

Section 9-503 of the UCC provides various, more specific rules regarding the sufficiency of a debtor's name on a financing statement.However, unlike with a security agreement, on a financing statement it is acceptable to use a supergeneric description of collateral.