This will must be signed in the presence of two witnesses, not related to you or named in your will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the will.

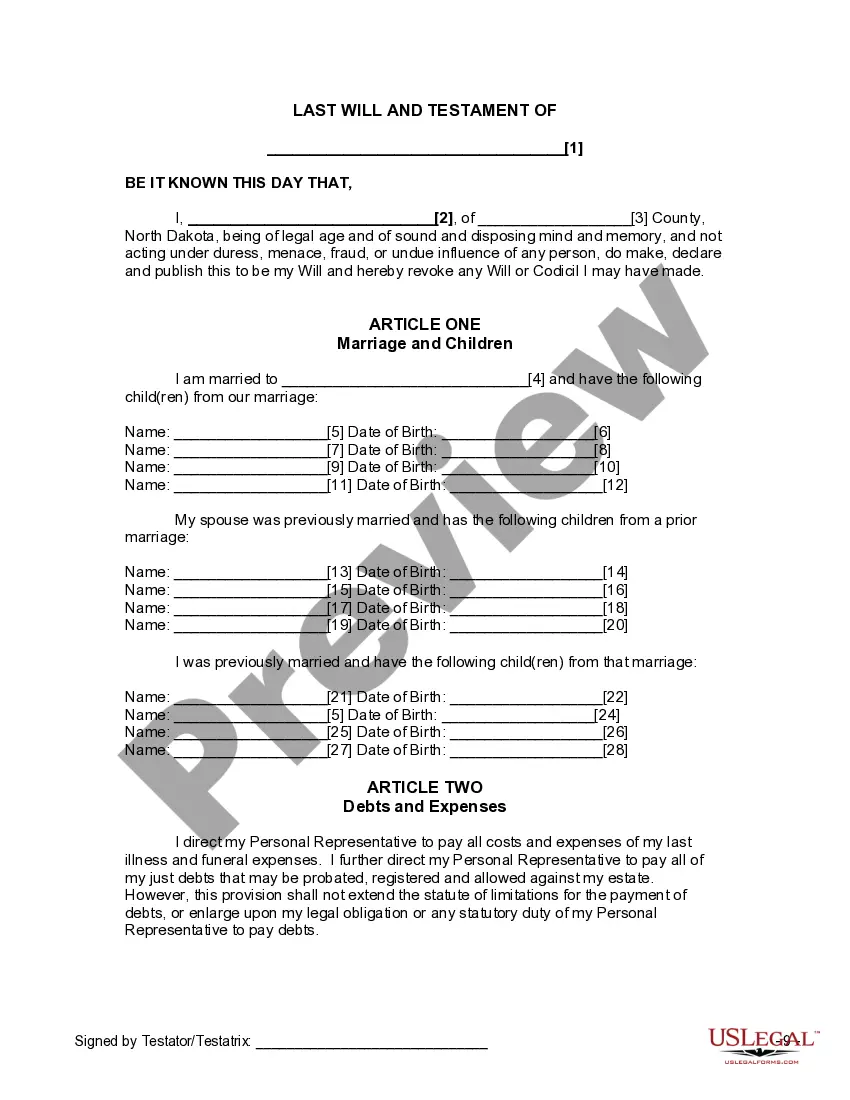

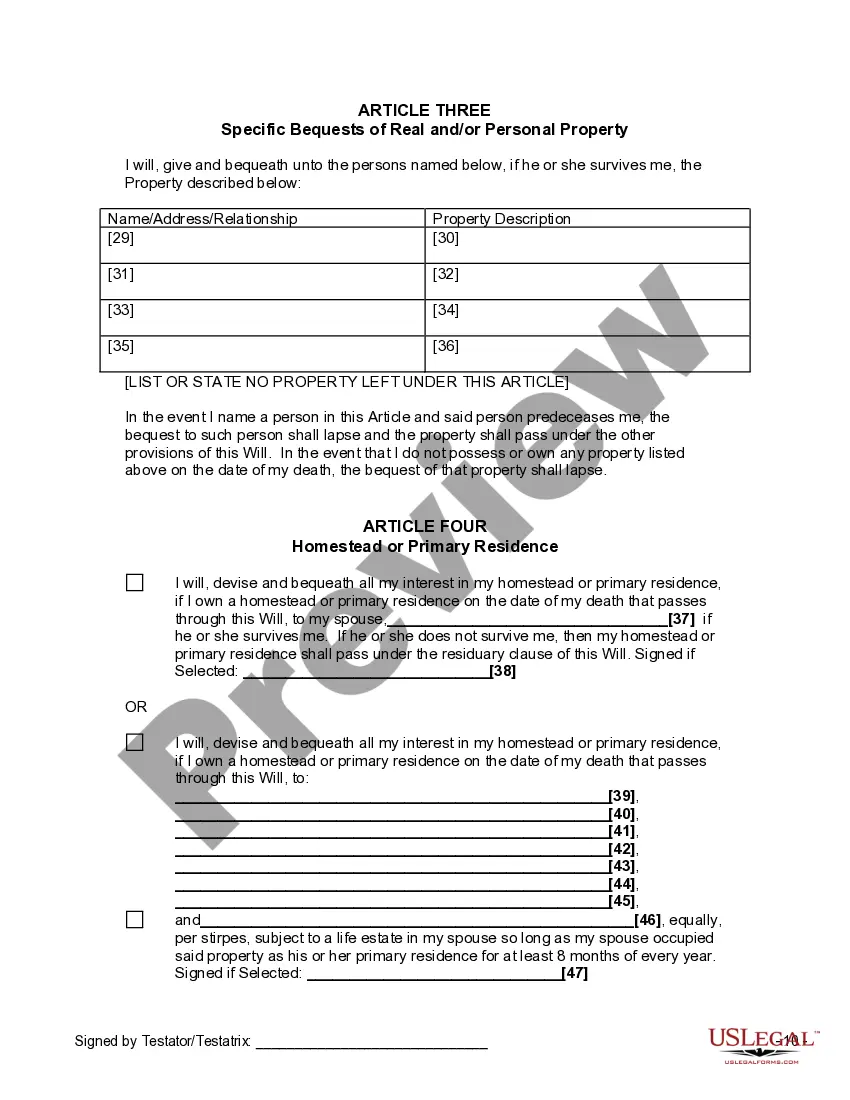

North Dakota Last Will and Testament for Divorced and Remarried Person with Mine, Yours and Ours Children

Description

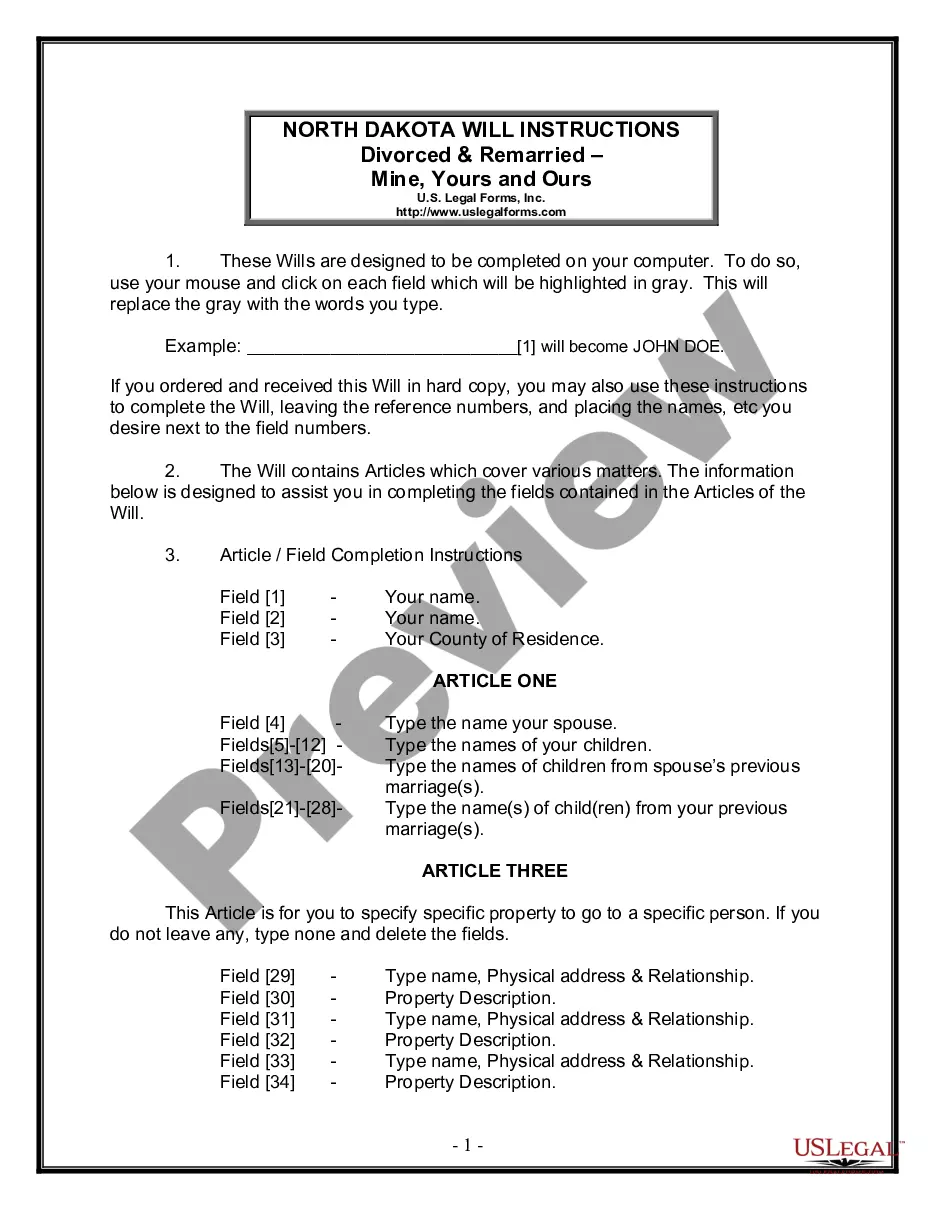

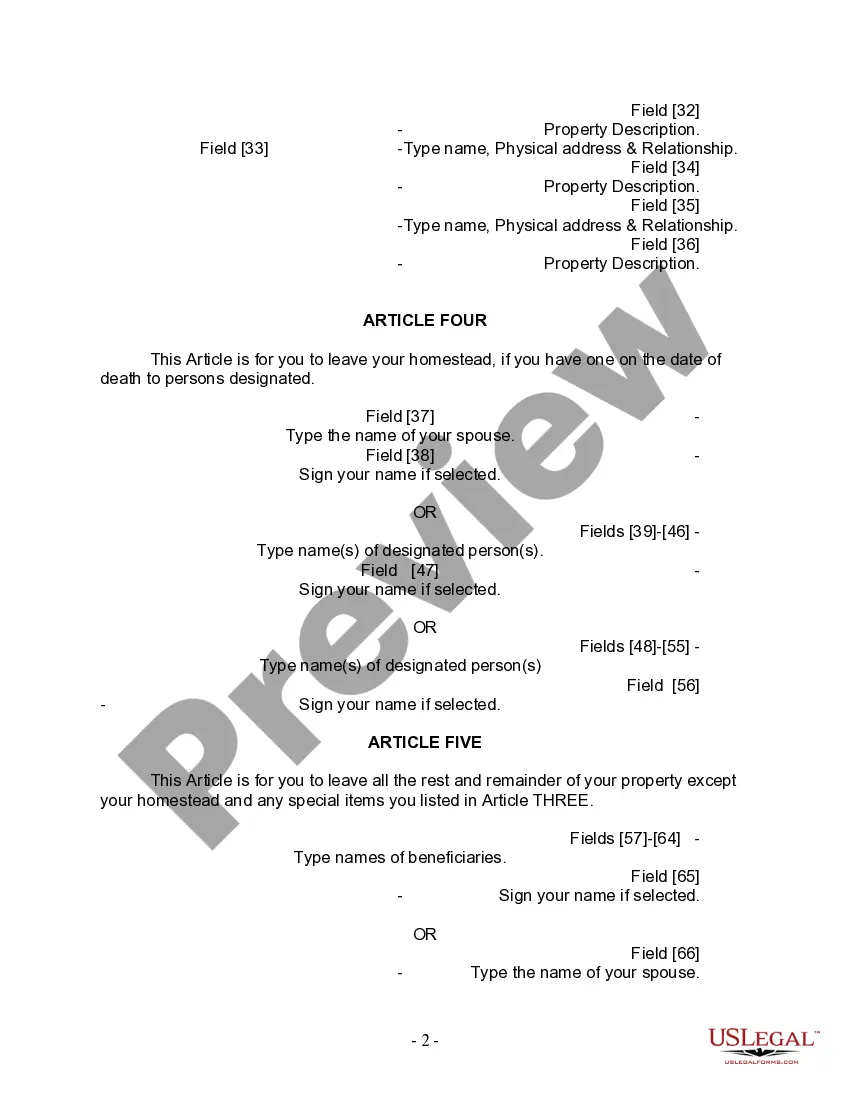

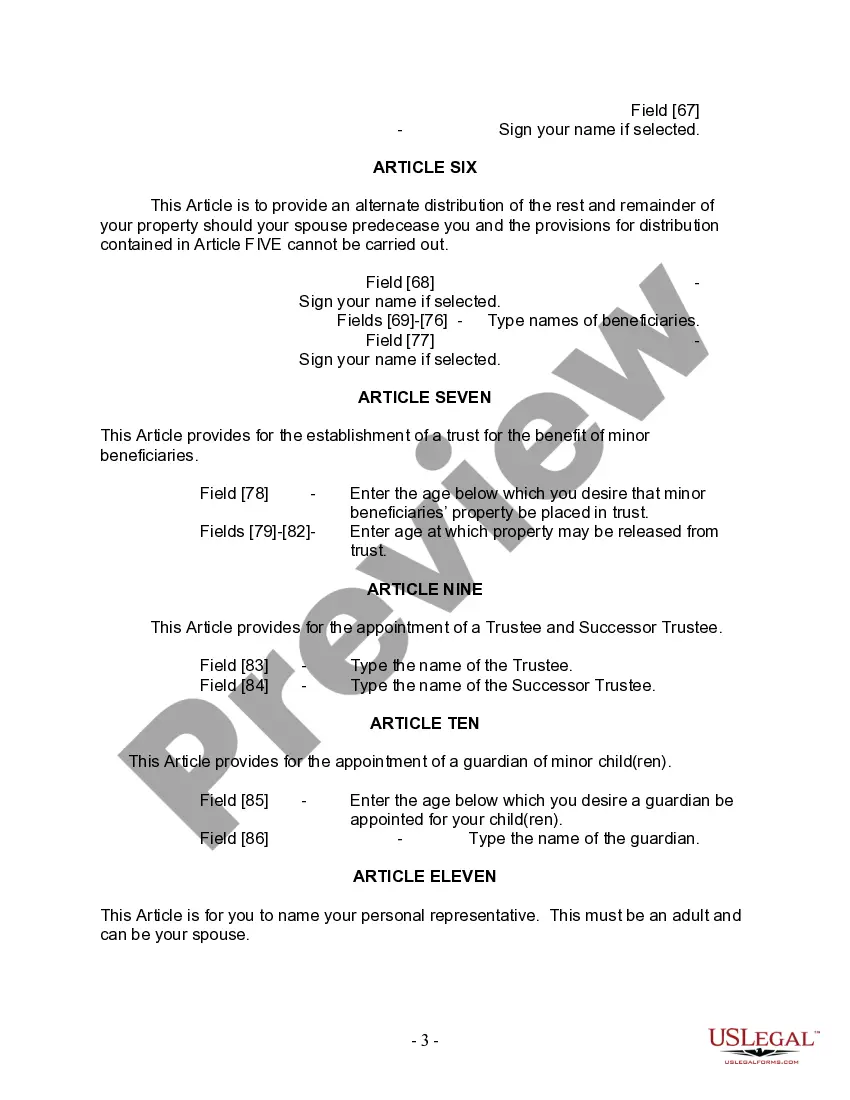

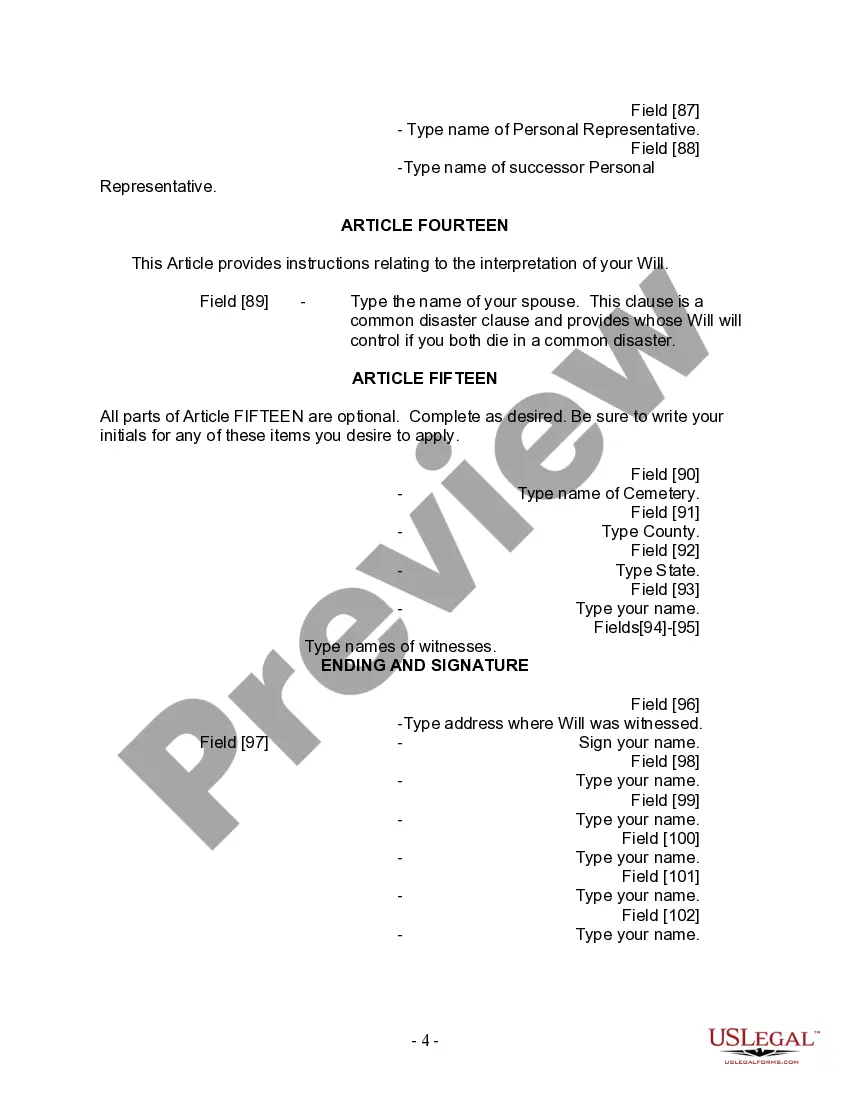

How to fill out North Dakota Last Will And Testament For Divorced And Remarried Person With Mine, Yours And Ours Children?

Avoid pricey attorneys and find the North Dakota Legal Last Will and Testament Form for Divorced and Remarried Person with Mine, Yours and Ours Children you need at a reasonable price on the US Legal Forms website. Use our simple categories function to search for and download legal and tax files. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms enables users with step-by-step instructions on how to download and complete each form.

US Legal Forms clients merely need to log in and get the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet need to stick to the tips below:

- Ensure the North Dakota Legal Last Will and Testament Form for Divorced and Remarried Person with Mine, Yours and Ours Children is eligible for use in your state.

- If available, read the description and make use of the Preview option before downloading the templates.

- If you are confident the template meets your needs, click Buy Now.

- If the template is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

Right after downloading, you are able to complete the North Dakota Legal Last Will and Testament Form for Divorced and Remarried Person with Mine, Yours and Ours Children manually or by using an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

If Probate is needed but you don't apply for it, the beneficiaries won't be able to receive their inheritance. Instead the deceased person's assets will be frozen and held in a state of limbo. No one will have the legal authority to access, sell or transfer them.

A. You don't have to have a lawyer to create a basic will you can prepare one yourself. It must meet your state's legal requirements and should be notarized.But be careful: For anything complex or unusual, like distributing a lot of money or cutting someone out, you'd do best to hire a lawyer.

Simply having a last will does not avoid probate; in fact, a will must go through probate. To probate a will, the document is filed with the court, and a personal representative is appointed to gather the decedent's assets and take care of any outstanding debts or taxes.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.

A properly drafted will that you have executed under the laws of one state will generally be valid under the laws of any other state.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.