North Dakota Last Will and Testament with All Property to Trust called a Pour Over Will

Description North Dakota Trust

How to fill out North Dakota Last Will And Testament With All Property To Trust Called A Pour Over Will?

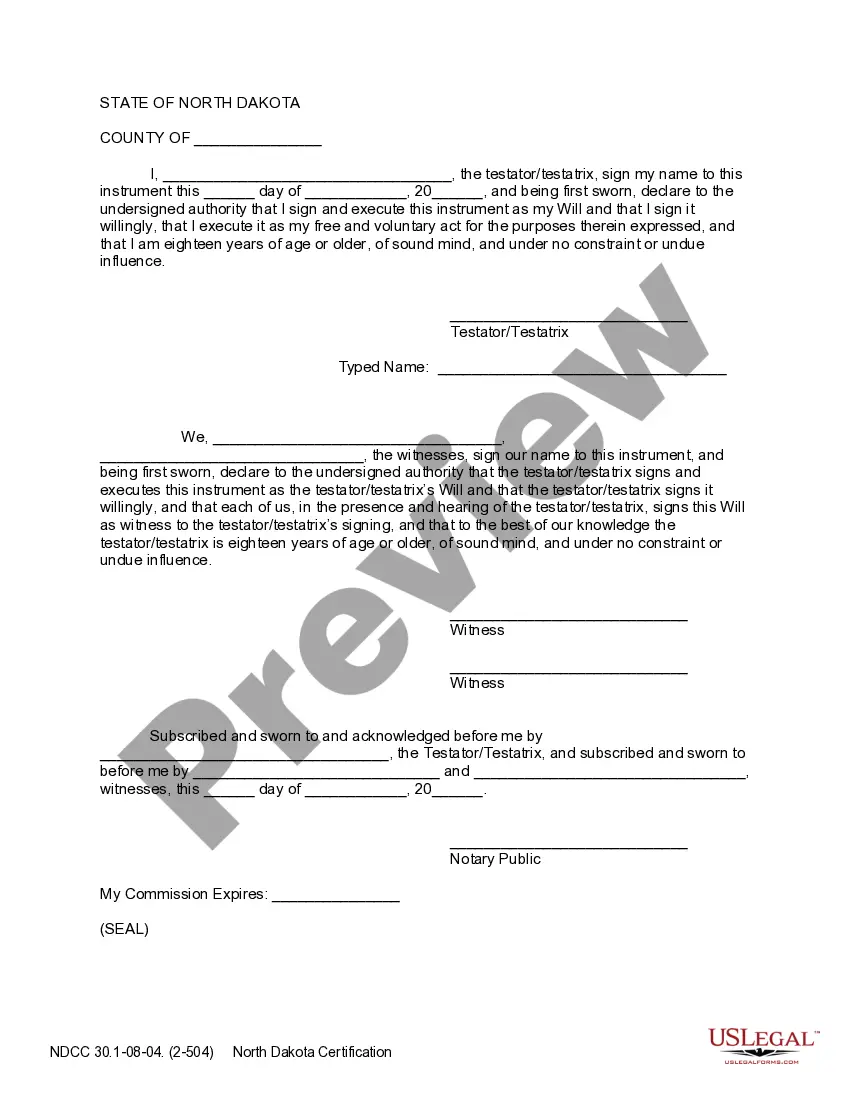

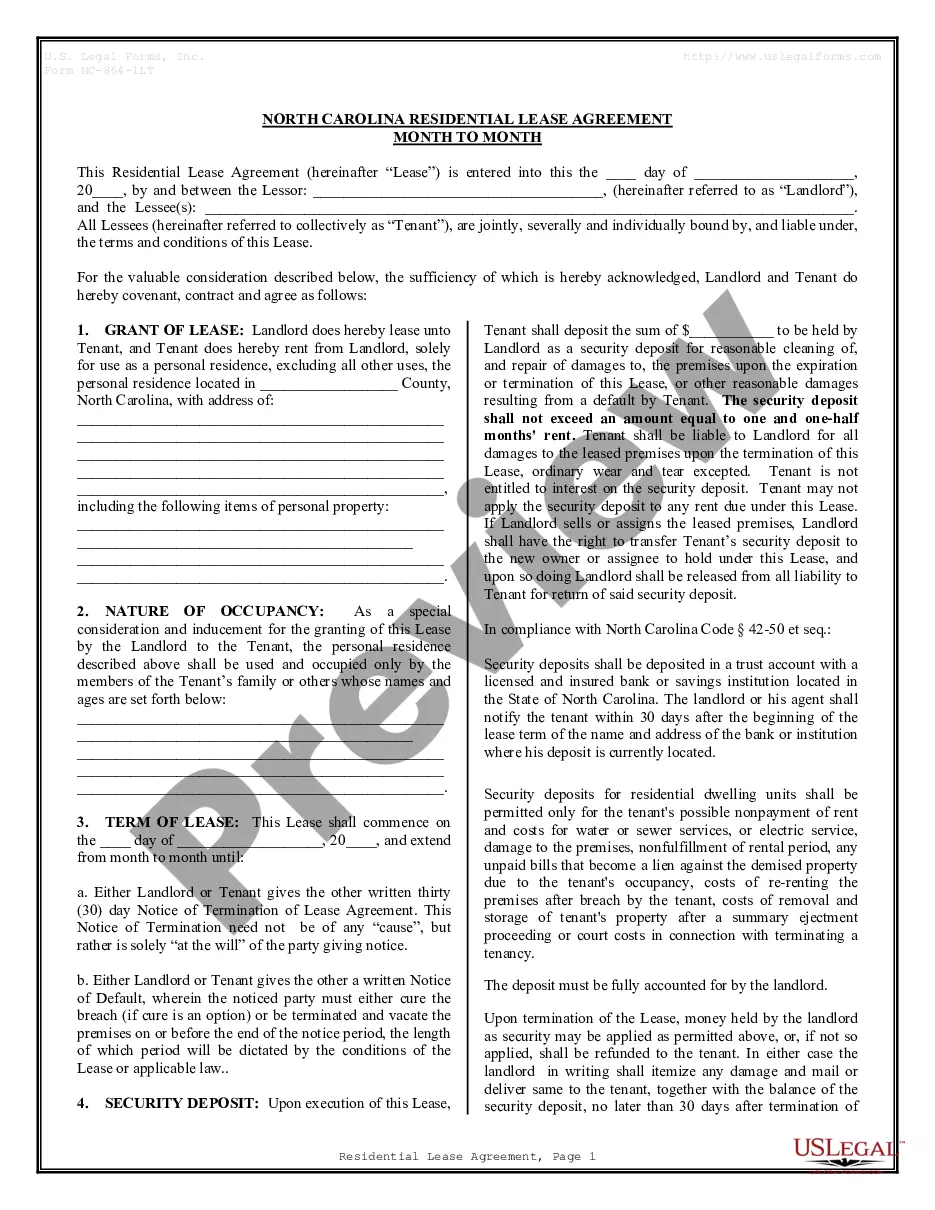

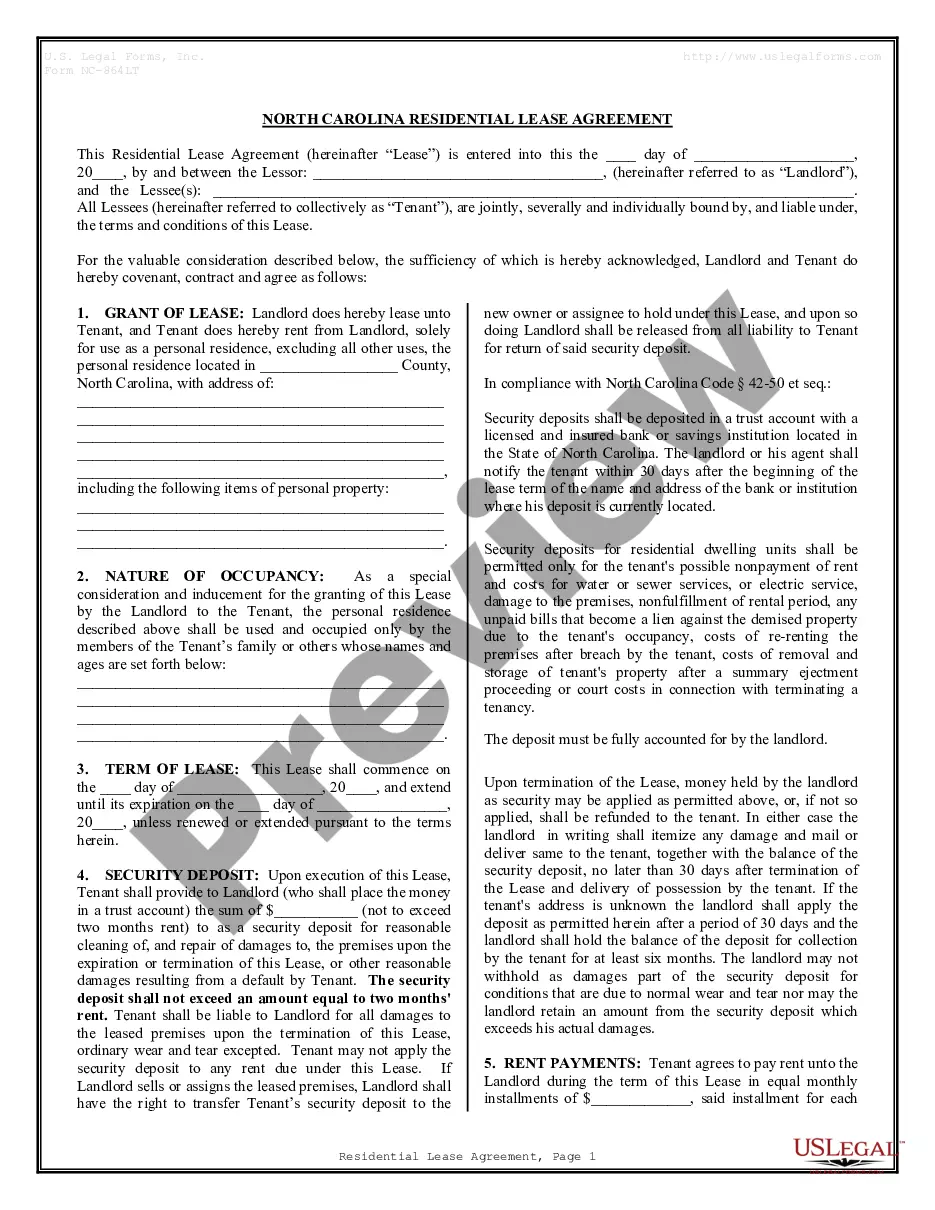

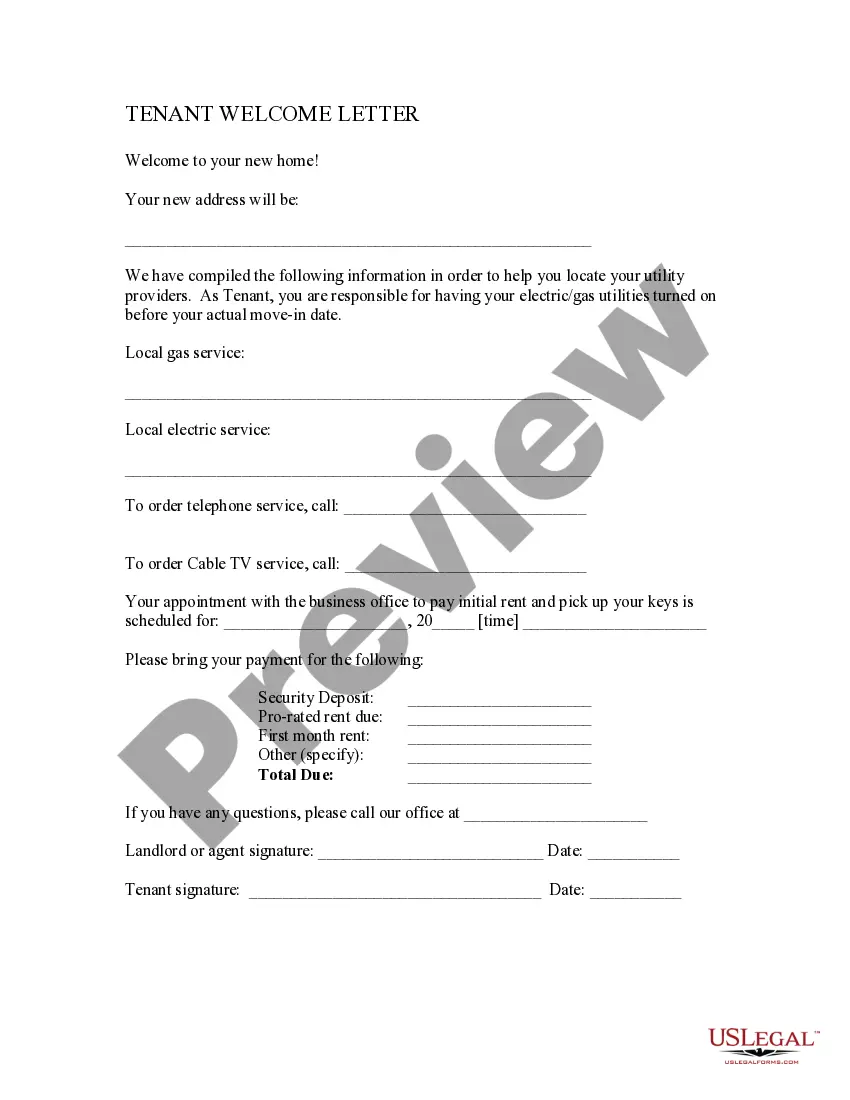

Avoid expensive attorneys and find the North Dakota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will you want at a affordable price on the US Legal Forms website. Use our simple categories functionality to look for and obtain legal and tax documents. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms provides customers with step-by-step instructions on how to download and complete every single form.

US Legal Forms clients simply have to log in and get the particular document they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the tips listed below:

- Ensure the North Dakota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will is eligible for use where you live.

- If available, look through the description and make use of the Preview option prior to downloading the sample.

- If you are sure the document fits your needs, click on Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

Right after downloading, you can complete the North Dakota Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will by hand or an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

A Living Trust is a document that allows individual(s), or 'Grantor', to place their assets to the benefit of someone else at their death or incapacitation. Unlike a Will, a Trust does not go through the probate process with the court.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Deciding between a will or a trust is a personal choice, and some experts recommend having both. A will is typically less expensive and easier to set up than a trust, an expensive and often complex legal document.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Find an online template or service. Make a list of your assets. Be specific about who gets what. If you have minor children, choose a guardian. Give instructions for your pet. Choose an executor. Name a 'residuary beneficiary' List your funeral preferences.

One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it. A will is a document that directs who will receive your property at your death and it appoints a legal representative to carry out your wishes.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.This is true whether you are preparing a revocable living trust, corporate bylaws, LLC documents, or any other legal documents.

This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust. Having this information available will make it easier to prepare your trust distribution provisions.