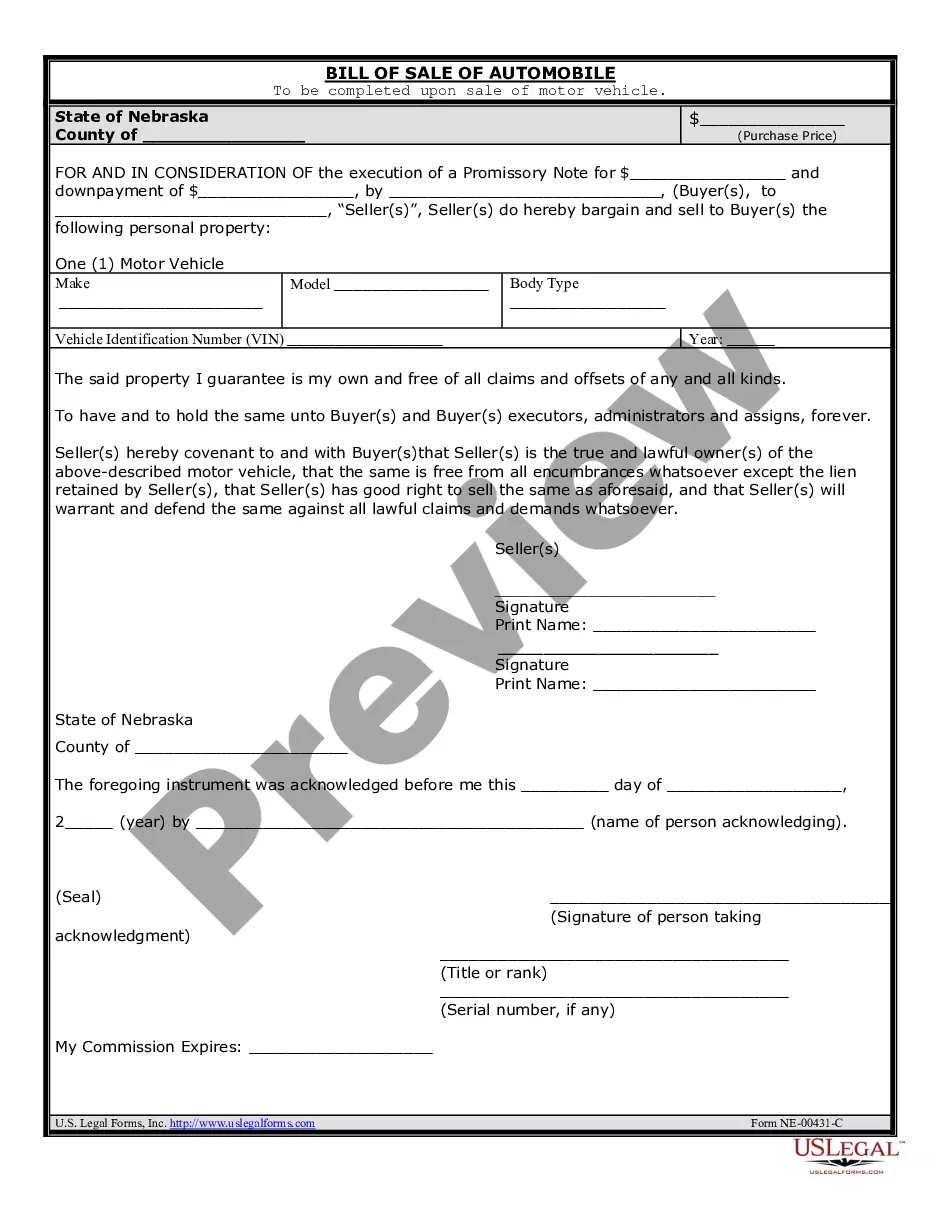

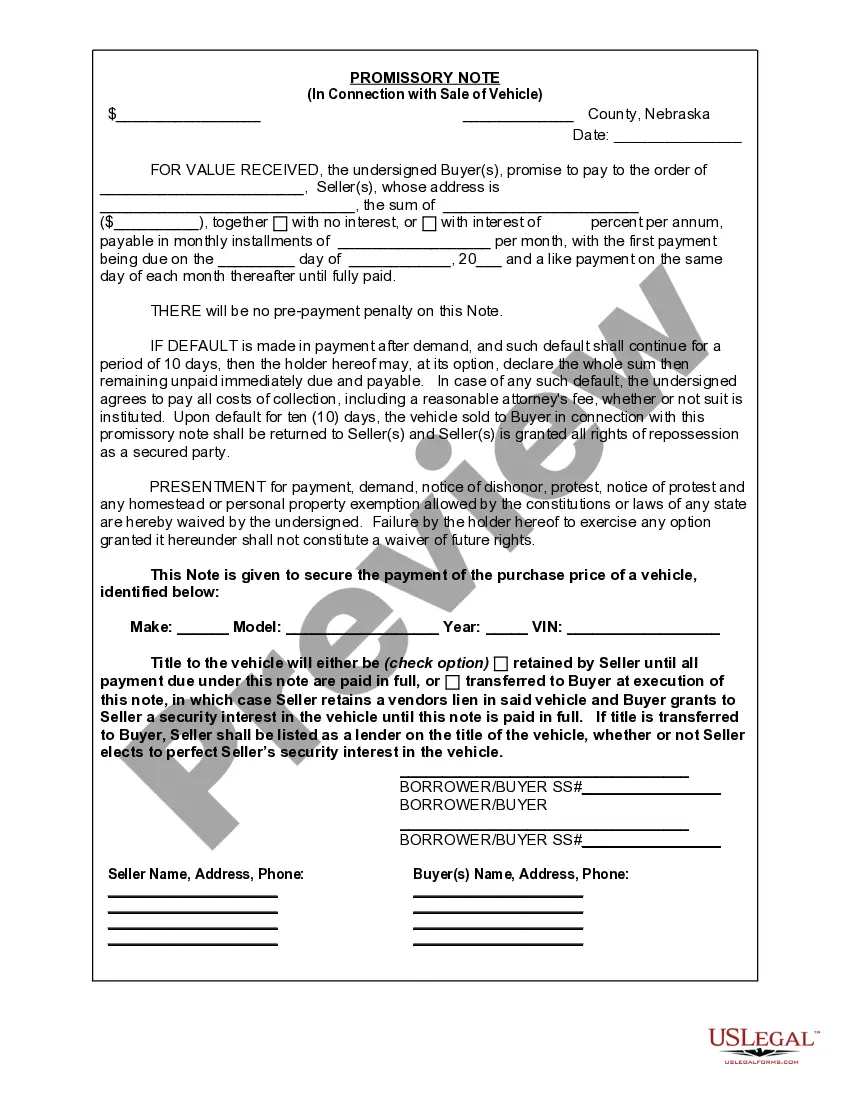

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Nebraska Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Nebraska Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Avoid expensive lawyers and find the Nebraska Promissory Note in Connection with Sale of Vehicle or Automobile you need at a affordable price on the US Legal Forms site. Use our simple groups functionality to look for and obtain legal and tax files. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms enables customers with step-by-step tips on how to download and complete every form.

US Legal Forms customers basically have to log in and download the specific document they need to their My Forms tab. Those, who have not got a subscription yet must stick to the guidelines below:

- Ensure the Nebraska Promissory Note in Connection with Sale of Vehicle or Automobile is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the templates.

- If you are sure the template meets your needs, click Buy Now.

- If the template is wrong, use the search field to find the right one.

- Next, create your account and choose a subscription plan.

- Pay out by credit card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, it is possible to complete the Nebraska Promissory Note in Connection with Sale of Vehicle or Automobile manually or by using an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

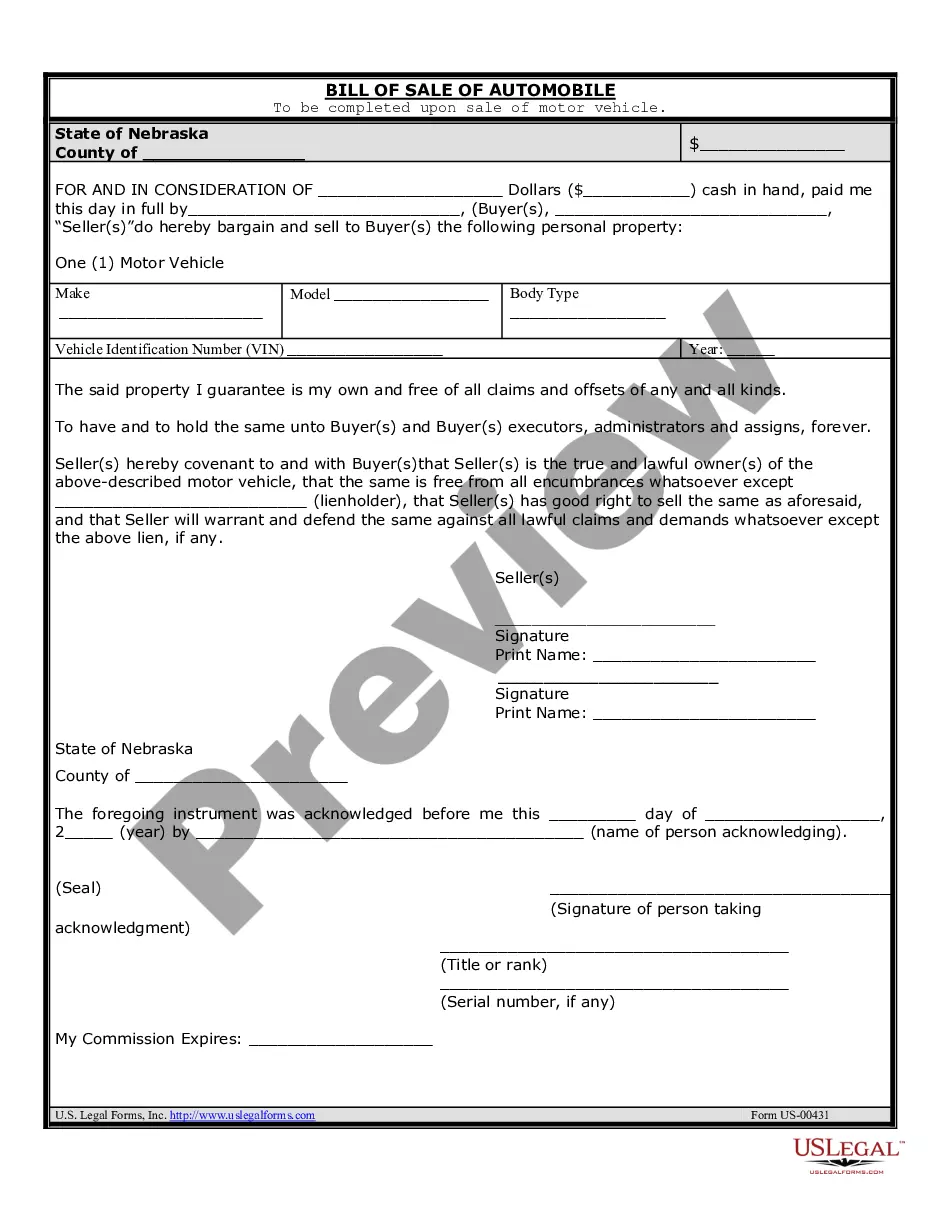

The information required on a bill of sale varies depending on the state. Generally, you must include the year, make, model, vehicle identification number and odometer reading or odometer disclosure statement. You will need to complete the seller section.Some states allow you to write "gift" instead of a sale price.

State of Nebraska. Department of Motor Vehicles. BILL OF SALE DATE OF SALE. (MO/DAY/YEAR) I, in consideration of the payment of the sum of $ Transferor (Seller) PLEASE PRINT. Transferor Information. Full Name. Address. Transferor's (Seller) Signature. Transferee's (Buyer) Signature.

Can a Bill of Sale Be Handwritten? A bill of sale is a legal document that verifies you have sold your car and provides basic information about the vehicle or any other item and the terms of the sale.As, with any legal written document a bill of sale can be handwritten.

Pay the loan off. Keep the giftee's financial circumstances in mind. Keep in mind the gift tax. Are you the car's owner? Create a Bill of Sale. Be sure to transfer the car's title. Make sure that your giftee has great car insurance. Selling a car online.

The date of the sale. A description of the car, including its: Year, make and model. The selling price of the car. If the car is a gift or partial gift, you should still create a bill of sale. Warranty information. The full names, addresses and signatures of the buyer and seller.

Writing the Bill of Sale On the bill of sale template, where the dollar amount is listed, write gift in the allotted space. You'll need to note the date of sale, the car's identification number, make, model and the number of miles on the odometer at the time of the transfer.

Nebraska requires a simple proof of identity and address and your driver's license will suffice. You will need proof of ownership of the vehicle and a completed application for a title. If you need help with how to fill out transfer of title form, you may contact your local Dept. of Motor Vehicle office.

Where it asks for sale price, you can simply write gift. Both parties will also need to sign the title to make it official, and some states require this to be done in front of a witness. If you own the vehicle outright but can't find the title, your local DMV can issue a replacement.

The good news? Gifting a vehicle means no sales tax. But the person receiving the gifted vehicle to may have to pay a federal gift tax. As of 2019, a gift tax payment is required if the fair market value of the vehicle is more than $15,000 for a single individual or $30,000 for a married couple.