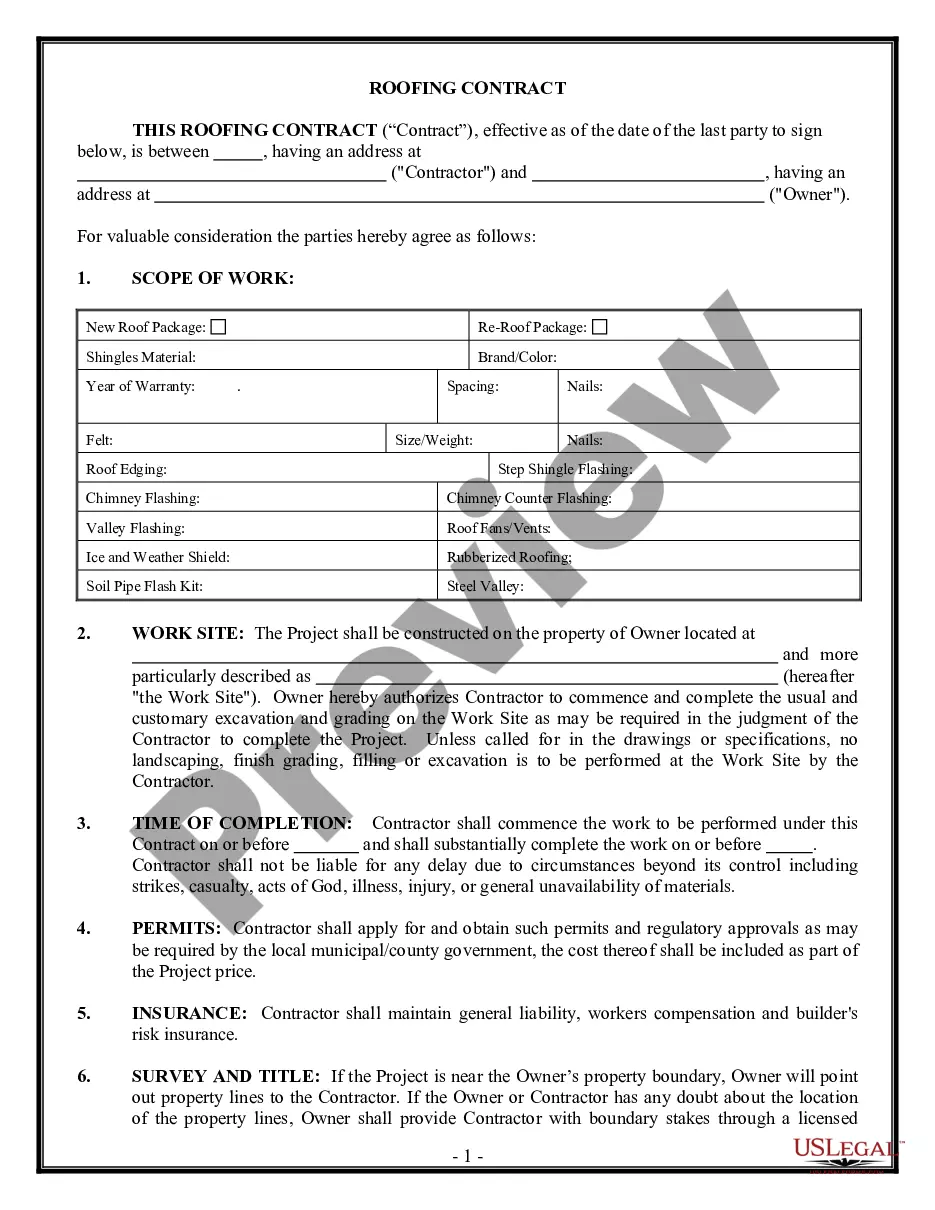

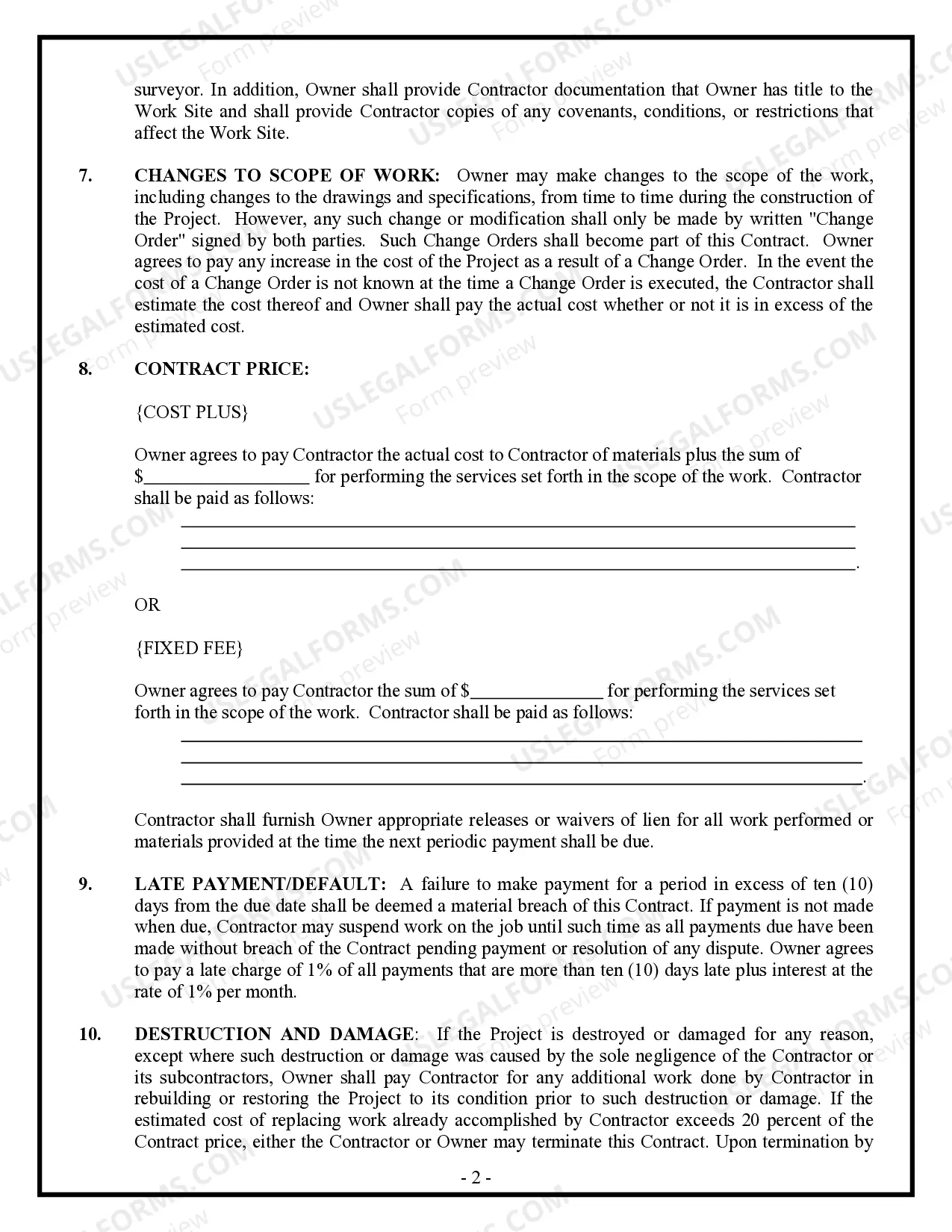

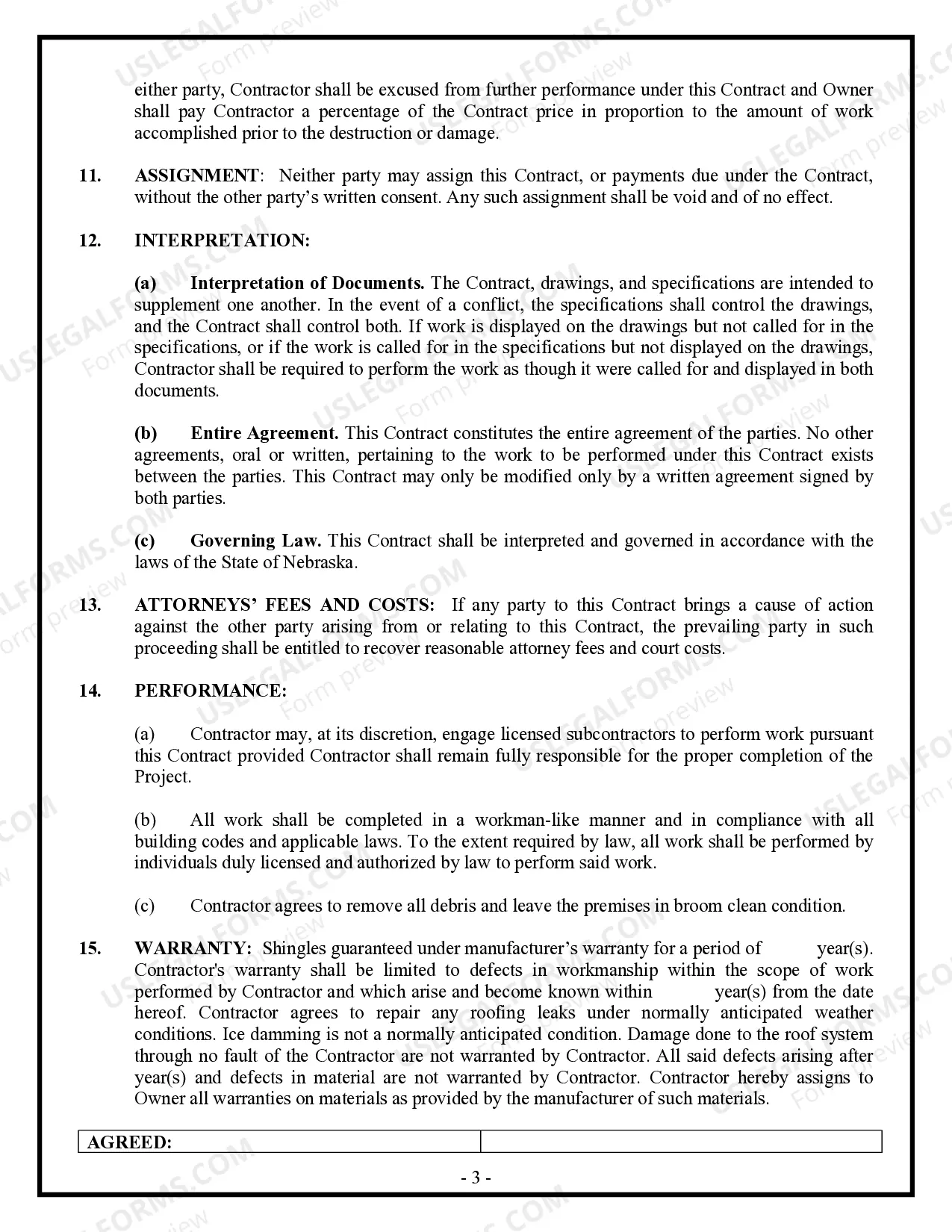

This form is designed for use between Roofing Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of Nebraska.

Nebraska Roofing Contract for Contractor

Description

How to fill out Nebraska Roofing Contract For Contractor?

Avoid expensive attorneys and find the Nebraska Roofing Contract for Contractor you want at a reasonable price on the US Legal Forms site. Use our simple groups functionality to look for and download legal and tax files. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to obtain and fill out each template.

US Legal Forms subscribers merely need to log in and get the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet must stick to the tips listed below:

- Make sure the Nebraska Roofing Contract for Contractor is eligible for use in your state.

- If available, read the description and make use of the Preview option prior to downloading the sample.

- If you’re sure the document suits you, click on Buy Now.

- In case the template is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

Right after downloading, you can complete the Nebraska Roofing Contract for Contractor by hand or an editing software. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

California's Home Solicitation Sales Act allows the buyer in almost any consumer transaction involving $25 or more, which takes place in the buyer's home or away from the seller's place of business, to cancel the transaction within three business days after signing the contract.

A roofing proposal sets the cost for a project that the contractor and building owner are bound to, like a contract. Most roofers will have set costs for materials and labor and will provide these costs in full, so you know exactly what to expect.

Nebraska Contractor Registration Information The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

Balance: Roofers work on roofs, which might have very steep pitches. Strength: Roofers need to be able to carry heavy materials, like bundles of shingles, up ladders and onto roofs. Stamina: Roofers spend most of their day on their feet outside, sometimes during intense heat or cold.

In short, it is a legally binding contract in which you agree to work with a roofing company to do all of your insurance-approved work.Per the name, it's contingent on the insurance claim being approved for the contract to hold together.

Your roofing contract must include the specifics of the project including details about materials to be used (their brand, type, color, and price), and start and end date of the project. The contract must also include details about the removal of the old roof and installing the replacement.

Step 1: Get Clear on the Scope of Work. Step 2: Measure the Roof. Step 3: Estimate Material Cost. Step 4: Estimate Labor Costs. Step 5: Calculate Your Overhead Costs. Step 6: Tally All Roofing Costs. Step 7: Add Your Markup for Desired Profits. Step 8: Bid the Roofing Job.

On what labor charges must I collect tax?The labor charge is not subject to tax, provided it is separately stated on the invoice (an Option 1 contractor does not charge tax on contractor labor charges that are itemized separately). An Option 1 contractor is required to hold a Nebraska Sales Tax Permit.

For sales made in homes, such as when a roofing contractor knocks on your door, inspects your roof, and you sign the contract, the homeowner has three days in which to cancel the contract with no reason. The representative must tell you about your right to cancel at the time of the sale with a full refund.