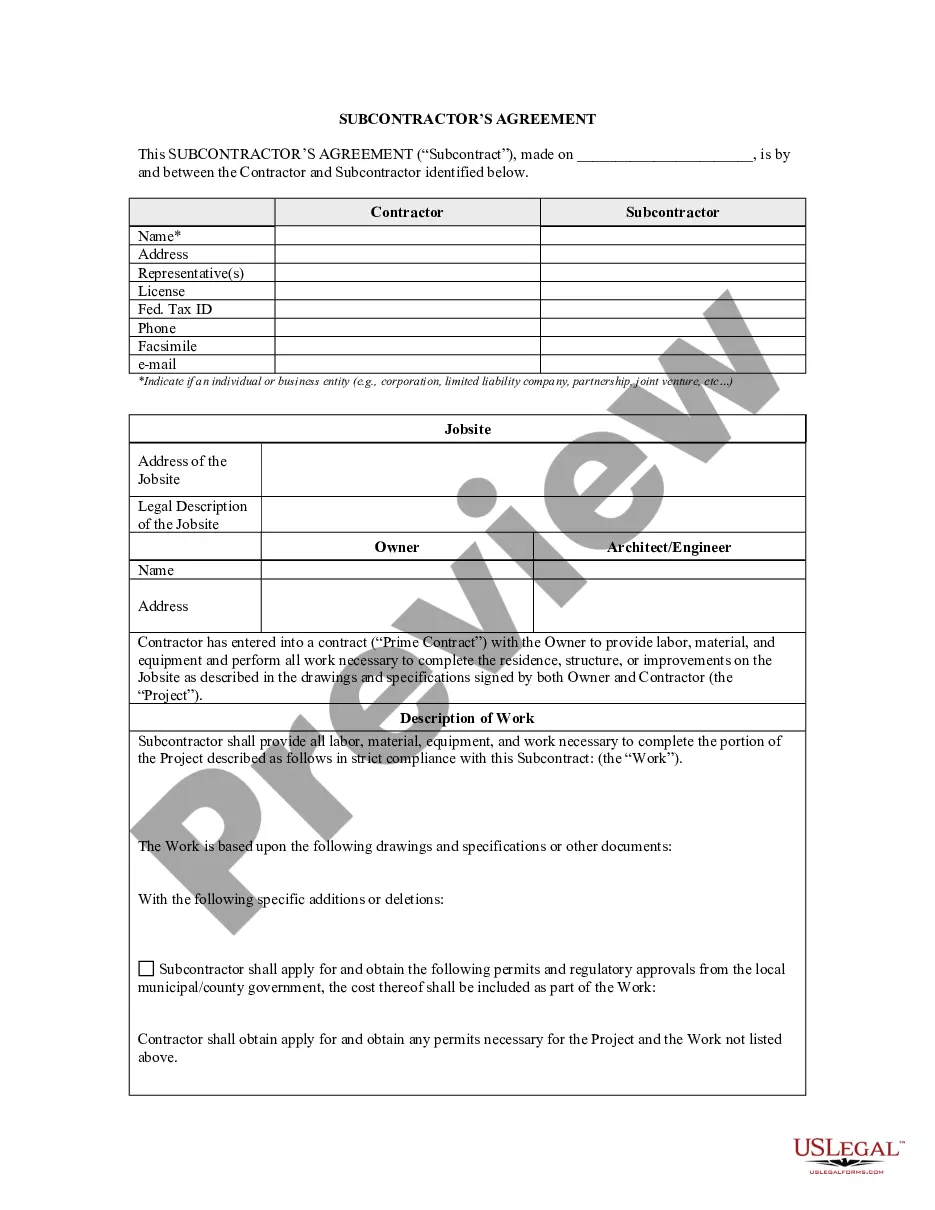

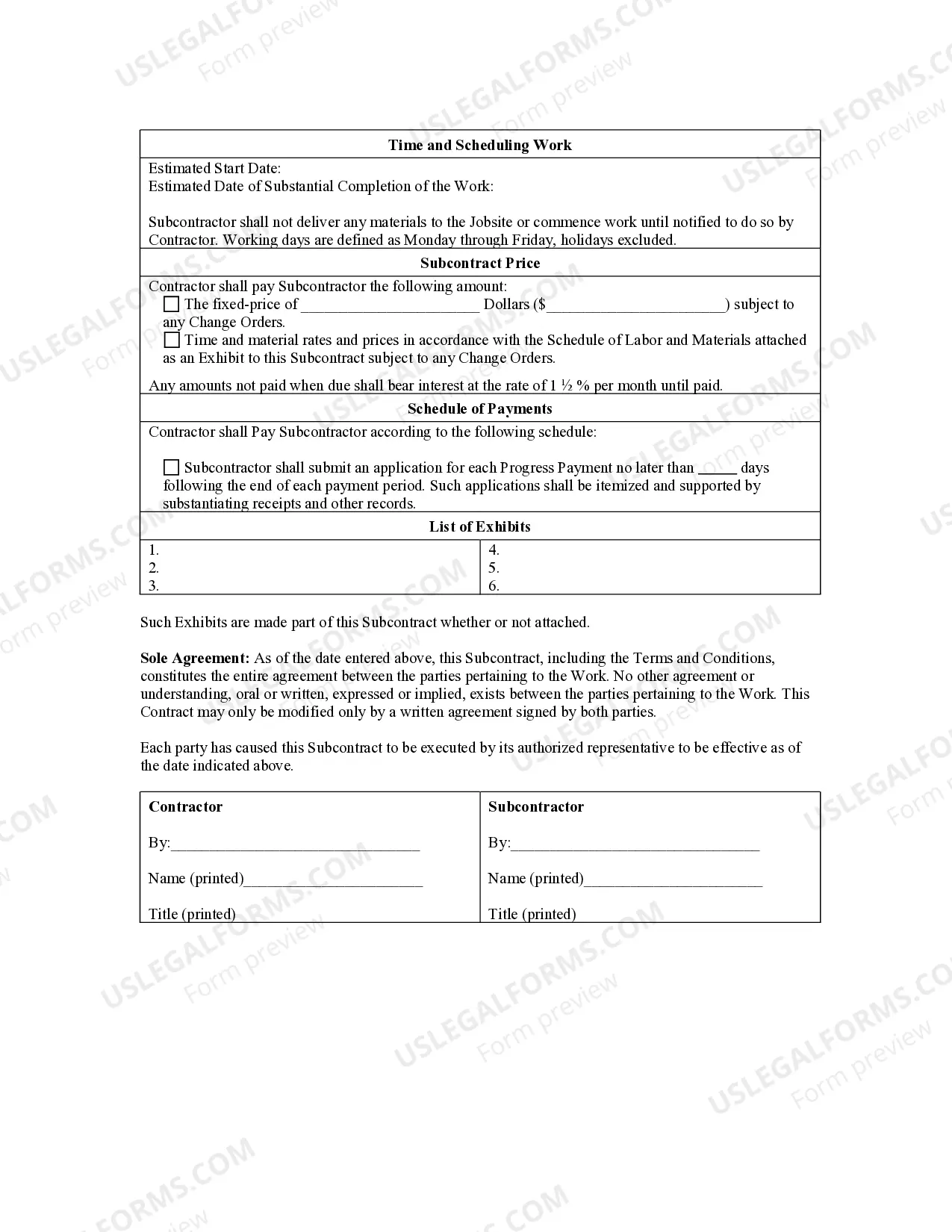

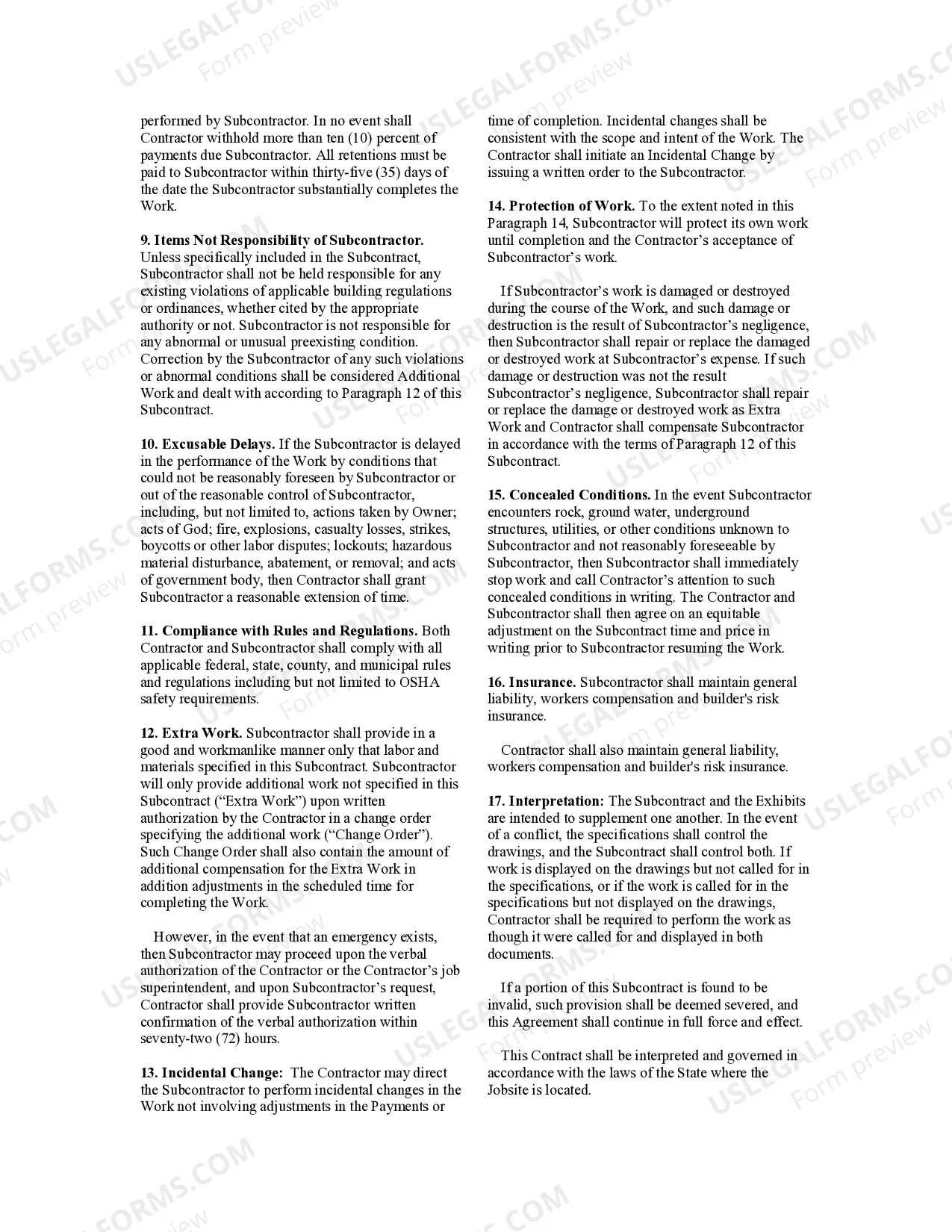

This state specific form addresses issues for subcontract work including: identifying the parties, identifying the job site, describing the work, scheduling the work, payment amount, payment schedule, change orders, contractor’s delay in commencing work, late payments, dispute resolution, excusable delay, concealed conditions, insurance, and contract interpretation.

Nebraska Subcontractor's Agreement

Description

How to fill out Nebraska Subcontractor's Agreement?

Avoid expensive lawyers and find the Nebraska Subcontractor's Agreement you want at a reasonable price on the US Legal Forms website. Use our simple categories functionality to find and download legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides users with step-by-step instructions on how to obtain and fill out every form.

US Legal Forms subscribers basically have to log in and download the specific document they need to their My Forms tab. Those, who haven’t got a subscription yet should follow the guidelines listed below:

- Ensure the Nebraska Subcontractor's Agreement is eligible for use where you live.

- If available, read the description and use the Preview option just before downloading the sample.

- If you are confident the template is right for you, click on Buy Now.

- In case the form is wrong, use the search field to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your gadget or print it out.

After downloading, it is possible to complete the Nebraska Subcontractor's Agreement manually or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Nebraska Contractor Registration Information The Nebraska Contractor Registration Act requires contractors and subcontractors doing business in Nebraska to register with the Nebraska Department of Labor. While the registration is a requirement, it does not ensure quality of work or protect against fraud.

On what labor charges must I collect tax?The labor charge is not subject to tax, provided it is separately stated on the invoice (an Option 1 contractor does not charge tax on contractor labor charges that are itemized separately). An Option 1 contractor is required to hold a Nebraska Sales Tax Permit.

Deliveries into another state are not subject to Nebraska sales tax. Services are generally taxed at the location where the service is provided to the customer.

What Nebraska requires of contractors is relatively little, compared to other states. There is no required exam, but you are required to register with Nebraska's Department of Labor (DOL) via their website, providing specific business and identity information.

A subcontractor will carry out duties on behalf of a contractor - who is responsible for their health, safety, and actions - and might be an individual or an organisation. However, the employees of a contractor are not considered subcontractors, they must be separate altogether.

Scope of Work. A subcontractor agreement should always specify the scope of work. Supply Chain. Defense & Indemnification. Insurance, Bonds, & Liens. Warranty. Arbitration. Conditional Payment.

Sales tax and surtax apply even when parts are provided at no charge. Labor Only for Repairs Charges for repairs of tangible personal property needing only labor or service are not subject to sales tax or surtax.

Five U.S. states (New Hampshire, Oregon, Montana, Alaska and Delaware) do not impose any general, statewide sales tax on goods or services. Of the 45 states remaining, four (Hawaii, South Dakota, New Mexico and West Virginia) tax services by default, with exceptions only for services specifically exempted in the law.

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.