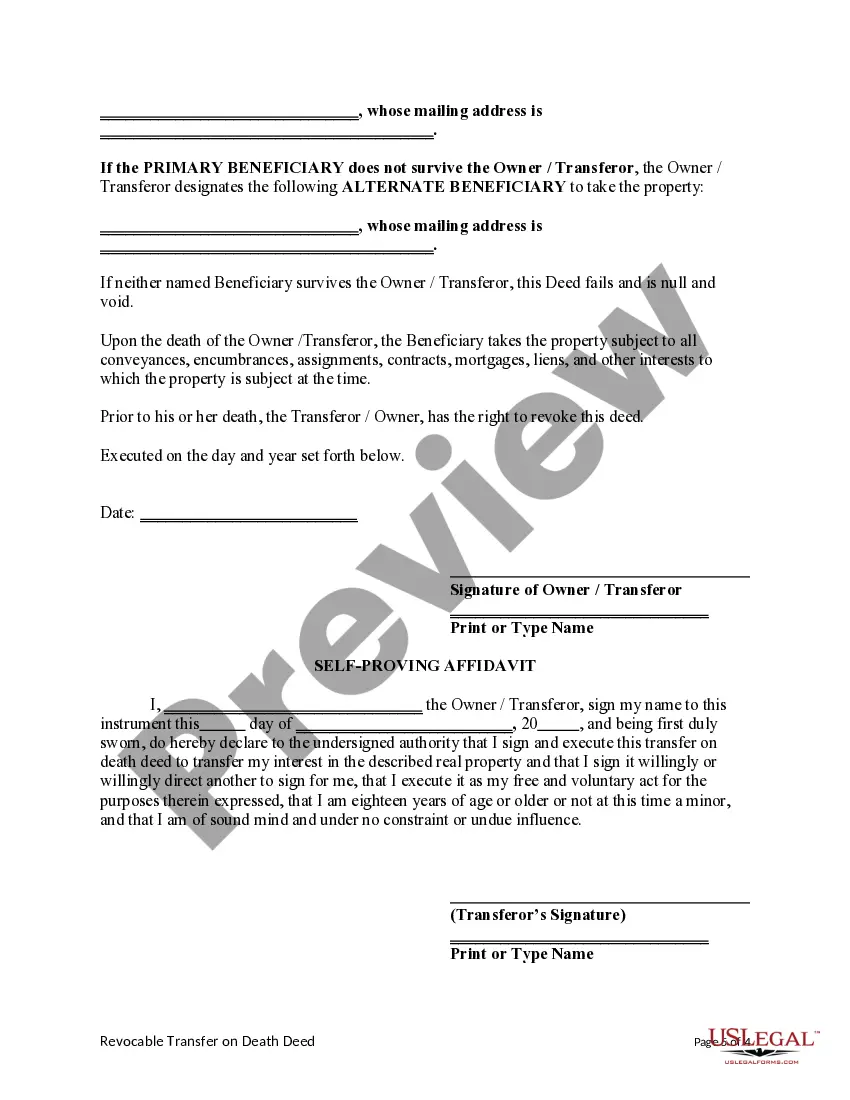

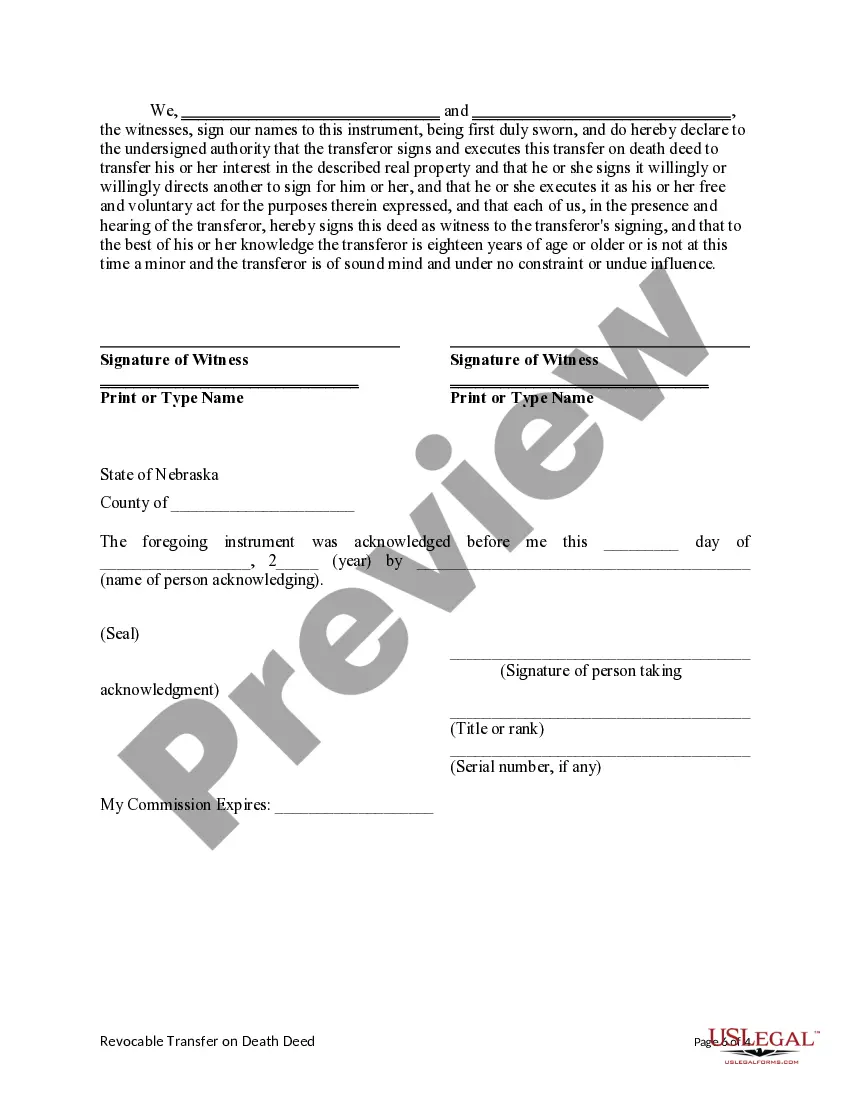

Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Individual with provision for Alternate Beneficiary

Description

How to fill out Nebraska Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Individual With Provision For Alternate Beneficiary?

Avoid pricey lawyers and find the Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Individual with provision for Alternate Beneficiary you need at a affordable price on the US Legal Forms website. Use our simple categories function to look for and obtain legal and tax documents. Go through their descriptions and preview them well before downloading. Moreover, US Legal Forms provides customers with step-by-step instructions on how to download and fill out each template.

US Legal Forms clients basically have to log in and get the particular form they need to their My Forms tab. Those, who haven’t got a subscription yet need to stick to the guidelines listed below:

- Ensure the Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Individual with provision for Alternate Beneficiary is eligible for use where you live.

- If available, look through the description and use the Preview option prior to downloading the sample.

- If you are sure the document meets your needs, click on Buy Now.

- In case the template is incorrect, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Simply click Download and find your form in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, you may fill out the Nebraska Transfer on Death Deed or TOD - Beneficiary Deed - Individual to Individual with provision for Alternate Beneficiary manually or by using an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

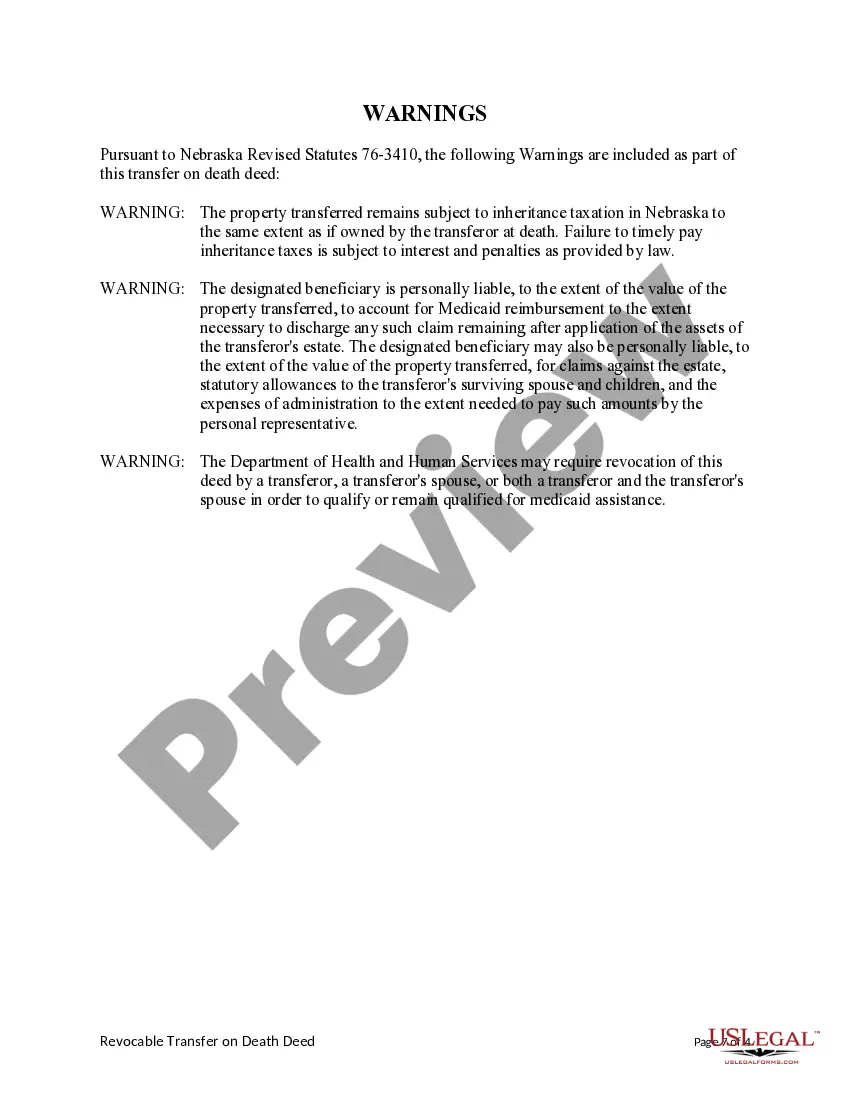

A revocable TOD deed does not avoid the owner's creditors. Creditors may seek collection against the designated beneficiaries as to secured and unsecured obligations of the original owner.A revocable TOD deed, if incorrect, cannot be resolved informally after the owner's death without tax consequences.

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

No a will does not override a deed. A will only acts on death. The deed must be signed during the life of the owner. The only assets that pass through the will are assets that are in the name of the decedent only.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.