This form is a Warranty Deed where the grantor is a limited liability company and the grantee is also limited liability company. Grantor conveys and warrants the described property to the grantee. This deed complies with all state statutory laws.

Nebraska Warranty Deed - Limited Liability Company to Limited Liability Company

Description

How to fill out Nebraska Warranty Deed - Limited Liability Company To Limited Liability Company?

Avoid expensive lawyers and find the Nebraska Warranty Deed - Limited Liability Company to Limited Liability Company you want at a reasonable price on the US Legal Forms site. Use our simple categories functionality to find and obtain legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms enables customers with step-by-step instructions on how to obtain and fill out every single template.

US Legal Forms clients simply have to log in and get the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips listed below:

- Ensure the Nebraska Warranty Deed - Limited Liability Company to Limited Liability Company is eligible for use where you live.

- If available, read the description and use the Preview option well before downloading the sample.

- If you’re sure the document fits your needs, click Buy Now.

- If the form is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Choose to download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you are able to fill out the Nebraska Warranty Deed - Limited Liability Company to Limited Liability Company manually or with the help of an editing software. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

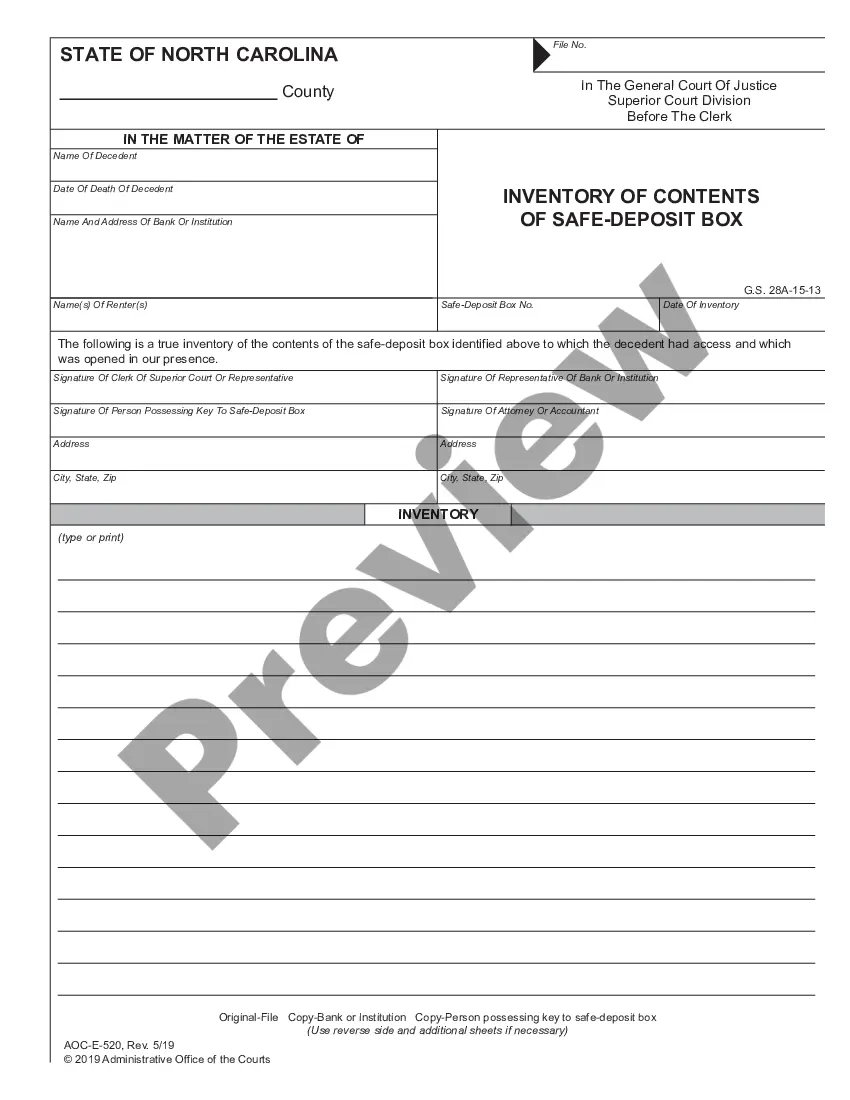

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

Let's start with the definition of a deed: DEED: A written instrument by which one party, the Grantor, conveys the title of ownership in property to another party, the Grantee. A Warranty Deed contains promises, called covenants, that the Grantor makes to the Grantee.

In a Limited Warranty Deed, the seller usually gives two warranties. The seller only warrants to the buyer that:This is a very limited warranty in comparison to the broad warranty in a General Warranty Deed where the seller warrants that the seller not only owns the property, but also all rights in the property.