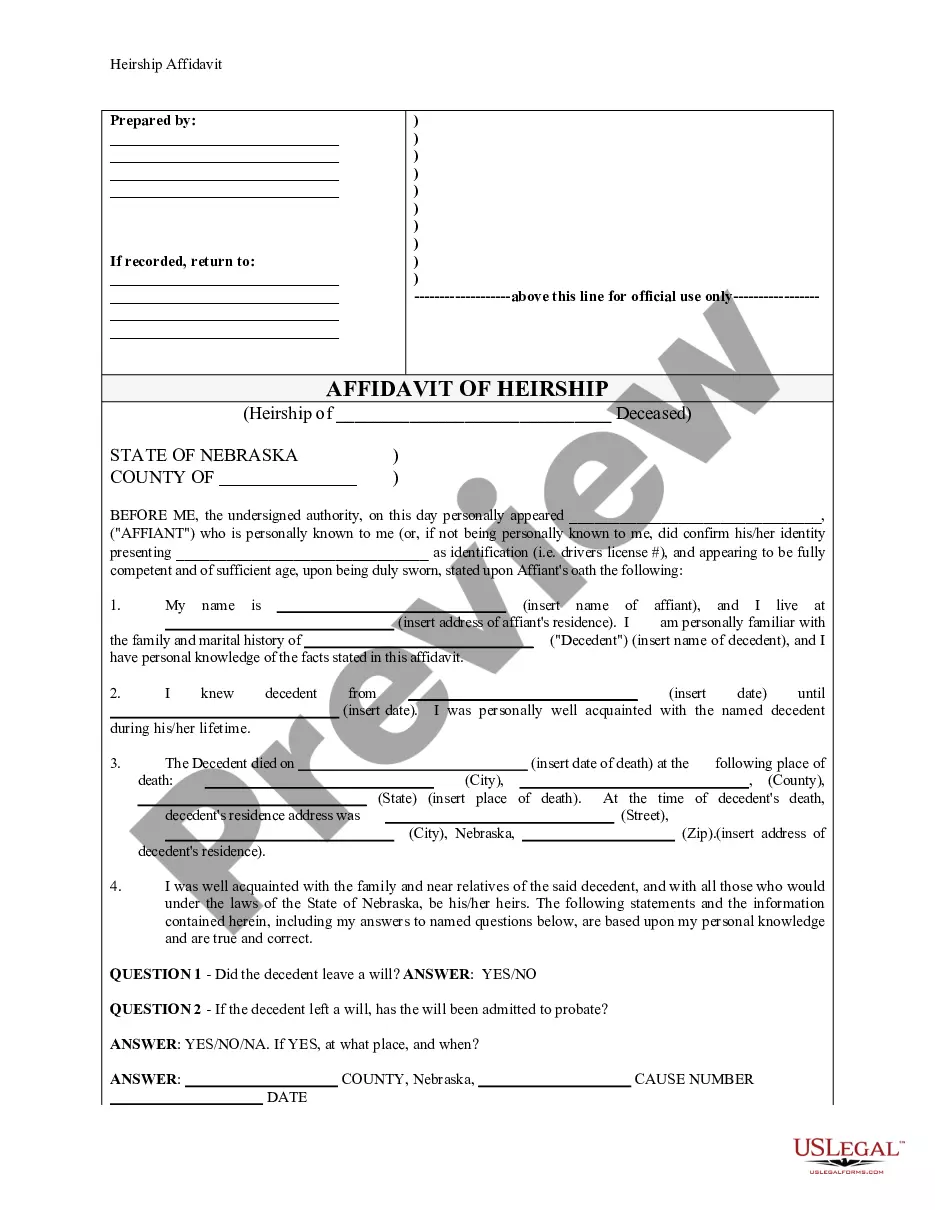

This Heirship Affidavit form is for a person to complete stating the heirs of a deceased person. The Heirship Affidavit is commonly used to establish ownership of personal and real property. It may be recorded in official land records, if necessary. Example of use: Person A dies without a will, leaves a son and no estate is opened. When the son sells the land, the son obtains an heir ship affidavit to record with the deed. The person executing the affidavit should normally not be an heir of the deceased, or other person interested in the estate.

Nebraska Heirship Affidavit - Descent

Description

How to fill out Nebraska Heirship Affidavit - Descent?

Avoid costly lawyers and find the Nebraska Heirship Affidavit - Descent you need at a affordable price on the US Legal Forms website. Use our simple categories function to look for and obtain legal and tax documents. Go through their descriptions and preview them before downloading. In addition, US Legal Forms provides customers with step-by-step tips on how to download and fill out each template.

US Legal Forms customers simply need to log in and download the specific document they need to their My Forms tab. Those, who haven’t got a subscription yet need to follow the guidelines below:

- Make sure the Nebraska Heirship Affidavit - Descent is eligible for use in your state.

- If available, look through the description and use the Preview option just before downloading the templates.

- If you are sure the template fits your needs, click on Buy Now.

- In case the form is wrong, use the search field to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you can fill out the Nebraska Heirship Affidavit - Descent by hand or with the help of an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

No, in Nebraska, you do not need to notarize your will to make it legal. However, Nebraska allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

Is Probate Required in Nebraska? Probate is necessary in Nebraska for estates. However, there are a few exceptions that allow the estate to pass to the heirs without going through the legal process.

Joint tenancy with right of survivorship. Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Tenancy by the entirety. Community property with right of survivorship.

Close relatives. Certain relatives of the deceased person are given a $40,000 exemption from the state inheritance tax. In other words, they don't owe any tax at all unless they inherit more than $40,000. This tax exemption applies to these family members of the deceased person: parents.

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

If you die without a will in Nebraska, your children will receive an intestate share of your property.For children to inherit from you under the laws of intestacy, the state of Nebraska must consider them your children, legally. For many families, this is not a confusing issue.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds (for example, in 2021 the federal estate tax exemption amount is $11.7 million for an individual), receipt of an inheritance does not result in taxable income for federal or state income tax

In Nebraska, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).