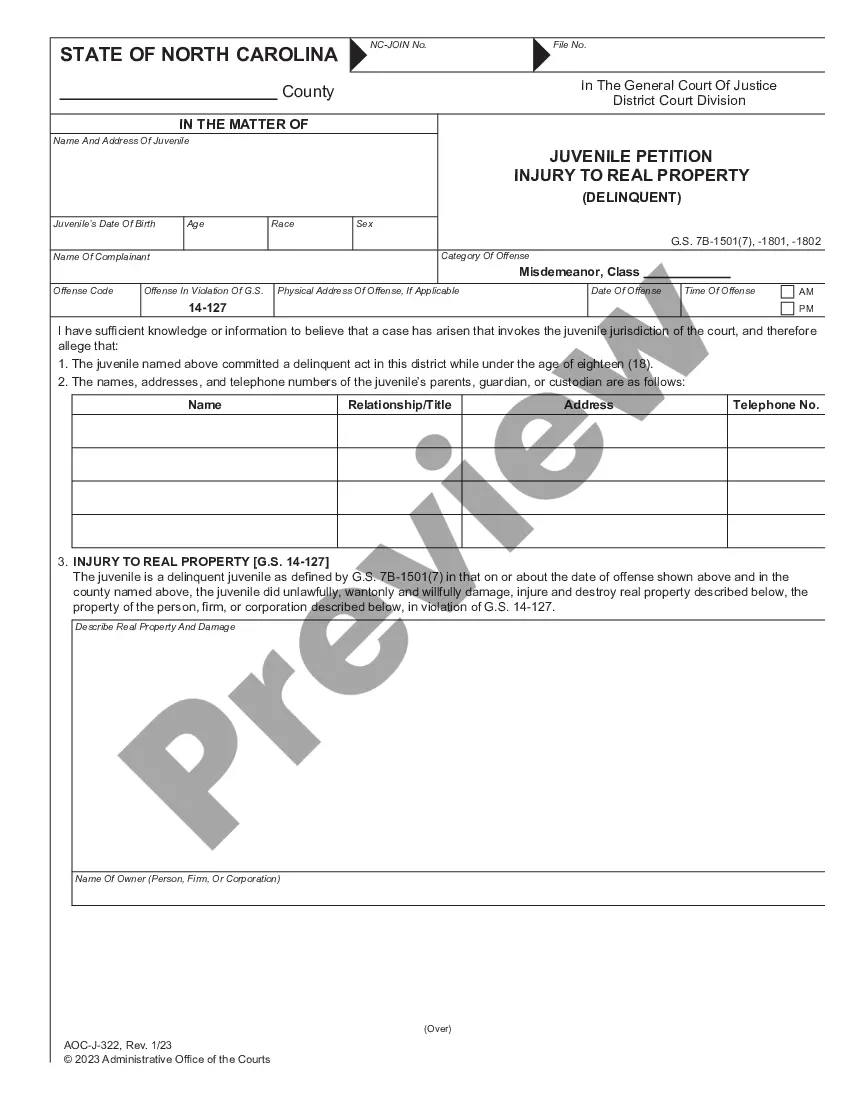

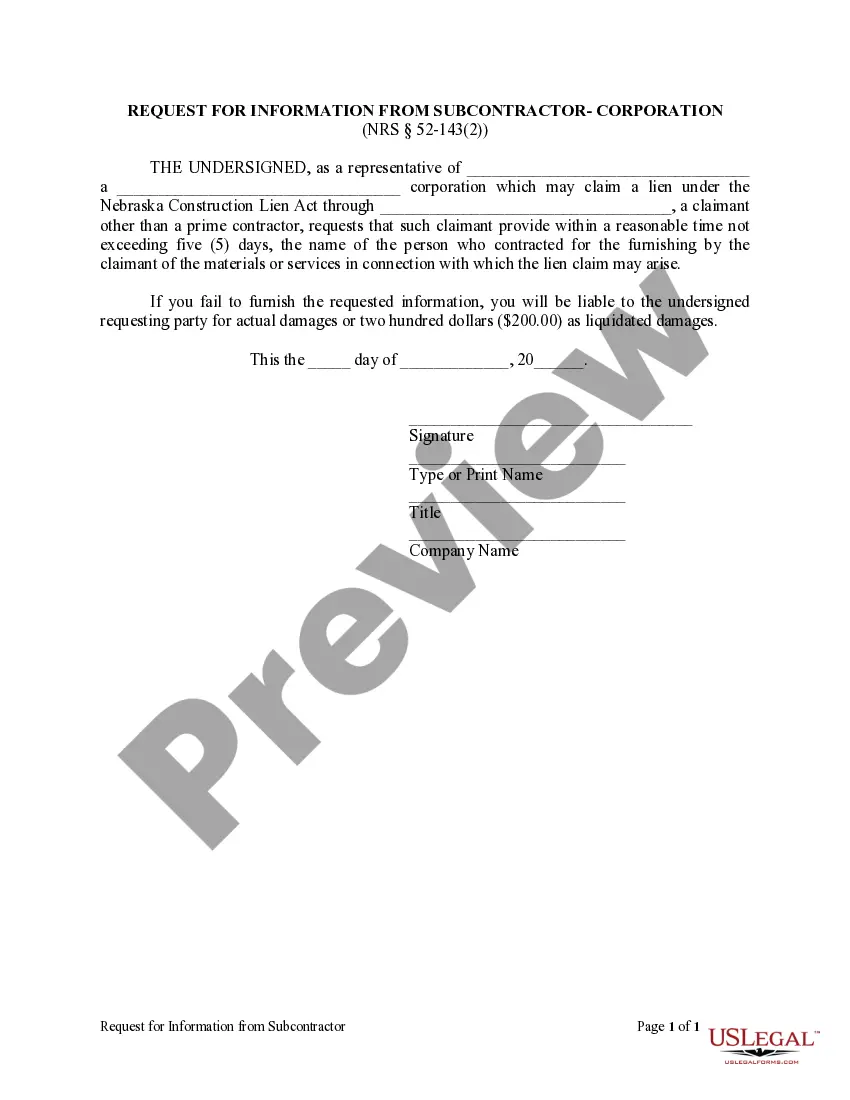

This Request for Information from Subcontractor form is for use by a corporation who may claim a lien under the Nebraska Construction Lien Act through a claimant other than a prime contractor, to request that such claimant provide within a reasonable time not exceeding five days, the name of the person who contracted for the furnishing by the claimant of the materials or services in connection with which the lien claim may arise.

Nebraska Request for Information from Subcontractor - Corporation

Description Nebraska Corporation Form

How to fill out Nebraska Request For Information From Subcontractor - Corporation?

Avoid expensive attorneys and find the Nebraska Request for Information from Subcontractor - Corporation or LLC you want at a affordable price on the US Legal Forms site. Use our simple groups functionality to find and download legal and tax forms. Read their descriptions and preview them just before downloading. In addition, US Legal Forms enables customers with step-by-step tips on how to download and complete every template.

US Legal Forms clients basically must log in and download the specific document they need to their My Forms tab. Those, who haven’t obtained a subscription yet should stick to the tips below:

- Make sure the Nebraska Request for Information from Subcontractor - Corporation or LLC is eligible for use in your state.

- If available, look through the description and make use of the Preview option just before downloading the templates.

- If you’re confident the template fits your needs, click on Buy Now.

- If the template is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Choose to download the document in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the form to your device or print it out.

After downloading, you can fill out the Nebraska Request for Information from Subcontractor - Corporation or LLC manually or with the help of an editing software program. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

File your Certificate of Organization with the Nebraska Secretary of State and wait for your LLC to be approved. You can file your LLC by mail or online. Filing your Nebraska LLC by mail costs $105 and approval takes 3-5 business days. Filing your Nebraska online costs $108 and approval takes 1-2 business days.

STEP 1: Name your Nebraska LLC. STEP 2: Choose a Nebraska Registered Agent. STEP 3: File the Nebraska LLC Certificate of Organization. STEP 4: Complete Nebraska LLC Publication Requirements. STEP 5: Create a Nebraska LLC Operating Agreement.

Minimum number. Corporations must have one or more directors. Residence requirements. Nebraska does not have a provision specifying where directors must reside. Age requirements. Inclusion in the Articles of Incorporation.

Choose a name for your LLC. File Articles of Organization. Choose a registered agent. Decide on member vs. manager management. Create an LLC operating agreement. Comply with other tax and regulatory requirements. File annual reports. Out of state LLC registration.

File your Certificate of Organization with the Nebraska Secretary of State and wait for your LLC to be approved. You can file your LLC by mail or online. Filing your Nebraska LLC by mail costs $105 and approval takes 3-5 business days. Filing your Nebraska online costs $108 and approval takes 1-2 business days.

Step 1: Create a Name For Your Nebraska Corporation. When naming your Nebraska Corporation, you will need to: Step 2: Choose a Nebraska Registered Agent. Step 3: Choose Your Nebraska Corporation's Initial Directors. Step 4: File the Articles of Incorporation.

No, you do not need an attorney to form an LLC. You can prepare the legal paperwork and file it yourself, or use a professional business formation service, such as .In all states, only one person is needed to form an LLC.

How much does it cost to form an LLC in Nebraska? The Nebraska Secretary of State charges $100 to file the Certificate of Organization, plus $5 per page. You can reserve your LLC name with the Nebraska Secretary of State for $15.

Choose a Business Name. Check Availability of Name. Register a DBA Name. Appoint Directors. File Your Articles of Incorporation. Write Your Corporate Bylaws. Draft a Shareholders' Agreement. Hold Initial Board of Directors Meeting.