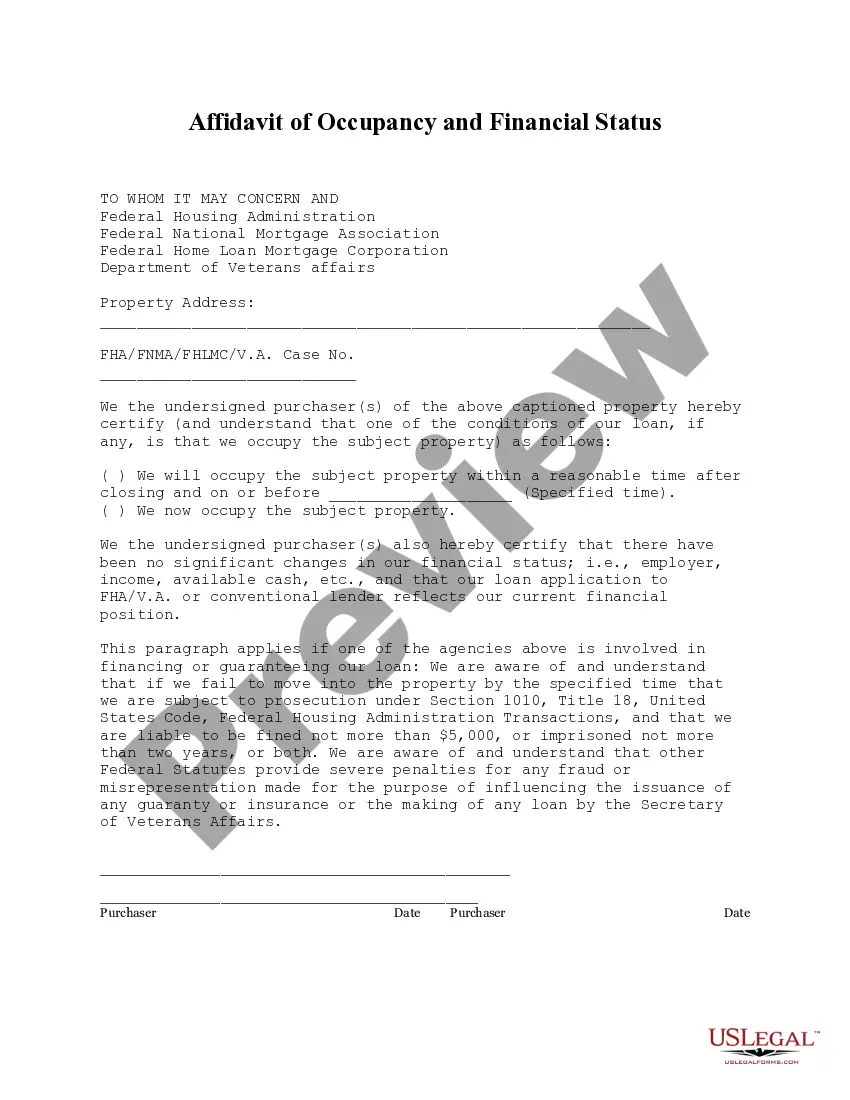

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

Nebraska Affidavit of Occupancy and Financial Status

Description

How to fill out Nebraska Affidavit Of Occupancy And Financial Status?

Avoid expensive lawyers and find the Nebraska Affidavit of Occupancy and Financial Status you need at a affordable price on the US Legal Forms site. Use our simple categories function to search for and download legal and tax files. Go through their descriptions and preview them just before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to download and complete each and every template.

US Legal Forms customers simply have to log in and obtain the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet should stick to the tips below:

- Ensure the Nebraska Affidavit of Occupancy and Financial Status is eligible for use in your state.

- If available, look through the description and use the Preview option just before downloading the templates.

- If you are sure the document meets your needs, click Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the document in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the form to your gadget or print it out.

Right after downloading, you are able to fill out the Nebraska Affidavit of Occupancy and Financial Status manually or by using an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

At your mortgage closing, you meet with various legal representatives to sign your mortgage and other documents, make any required payments and receive the keys to your new property.You give a certified or cashier's check to cover the down payment (if applicable), closing costs, prepaid interest, taxes and insurance.

Both buyers (if a married couple), or notarized power of attorney documentation permitting the present buyer to sign for the non-present one. Photo ID (passport or state-issued ID) List of your residences over the past 10 years. Sufficient payment to cover closing costs (usually a bank check or wire transfer)

If that date passes and the sale has not closed, either party can back out of the deal. For example, a buyer's penalty for missing the closing date might include paying a portion of the seller's mortgage to compensate the seller for keeping her property longer than planned.

Seller's real estate agentYour agent is tasked with facilitating the closing process and making sure that both parties have taken care of unfinished businesssometimes including pre-signing documentationbefore coming to the table at closing.